ExaCoin Review: EXA points “lending” daily ROI Ponzi scheme

![]() ExaCoin provide no information on their website about who owns or runs the business.

ExaCoin provide no information on their website about who owns or runs the business.

The ExaCoin website domain (“exacoin.co”) was privately registered on October 23rd, 2017.

At the time of publication Alexa estimate that Vietnam is the largest source of traffic to the ExaCoin website (27%).

This suggests that whoever is running ExaCoin is likely based out of Vietnam.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

ExaCoin Products

ExaCoin has no retailable products or services, with affiliates only able to market ExaCoin affiliate membership itself.

The ExaCoin Compensation Plan

ExaCoin affiliates invest in EXA points on the promise of an advertised daily ROI:

- invest $100 to $1000 and receive a 48% ROI after 179 days

- invest $1010 to $5000 and receive a 0.1 daily ROI for 149 days plus bonus 48%

- invest $5010 to $10,000 and receive a 0.2% daily ROI for 119 days plus bonus 48%

- invest $10,010 to $50,000 and receive a 0.3% daily ROI for 99 days plus bonus 48%

- invest $50,010 to $100,000 and receive a 0.35% daily ROI for 79 days plus bonus 48%

- invest $100,010 or more and receive a 0.4% daily ROI for 59 days plus bonus 48%

A single-level referral commission of 5% is paid on funds invested by personally recruited affiliates.

ExaCoin also pay residual “lending rewards” through a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

ExaCoin cap payable unilevel levels at seven, with commissions paid out as a percentage of funds invested across these seven levels:

- 8% on level 1 (personally recruited affiliates)

- 3% on level 2

- 1% on levels 3 and 4

- 0.5% on level 5

- 0.3% on level 6 and

- 0.2% on level 7

Whether ExaCoin pay lending rewards as EXA points or a percentage of funds paid for parked EXA points is unclear.

Joining ExaCoin

ExaCoin affiliate membership is free, however free affiliates can only earn referral commissions.

Full participation in the ExaCoin income opportunity requires a minimum $100 investment.

Conclusion

In addition to being an obvious Ponzi scheme, perhaps the most troubling aspect of ExaCoin is that it might be a proxy for Chinese scammers skirting the country’s recent ICO ban.

After Vietnam China is the second largest source of traffic to the ExaCoin website.

Either Chinese scammers are running the company through Vietnam, or ExaCoin has managed to solicit an unusually high amount of Chinese investment.

That investment is illegal and given the highly public nature of China’s ICO ban, a pretty big liability should Chinese authorities intervene.

On top of that you have the obvious Ponzi fraud, common to all altcoin ICO “lending” schemes.

ExaCoin affiliates invest real money in exchange for worthless EXA points.

EXA points are currently not publicly tradeable and have no purpose outside of ExaCoin itself.

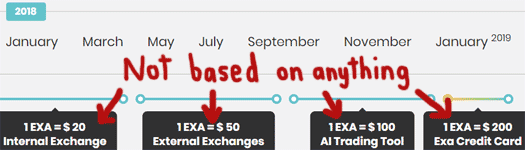

Within ExaCoin EXA is being invested in solely on the promise of projected returns. That includes the daily ROI paid out as compensation and baseless projections EXA points will rise in value.

The ruse behind ExaCoin’s ROI revenue is the usual cryptocurrency trading cliché;

Exa is a platform providing analyses and exploits of 1,300 cryptocurrencies in the market to find the best times and the best prices for the best trading decisions.

Naturally ExaCoin provide no evidence of cryptocurrency trading taking place, much the less any external revenue used to fund affiliate ROI payouts.

The only verifiable source of revenue entering ExaCoin is new affiliate investment. Using new investment to pay existing affiliates a daily ROI makes ExaCoin a Ponzi scheme.

And not even a “good” one at that. If you look at ExaCoin’s daily ROI percentage payout, each tier falls short of initially invested funds.

This suggests reinvestment is mandatory if a profitable return is to be realized.

In turn that balloons out the time ExaCoin’s anonymous owner(s) have to cut and run, as even at the highest investment tier two terms comes to 118 days (just shy of four months).

The exit strategy for ICO “lending” Ponzi admins is pretty straight forward.

ExaCoin’s admins are flogging off EXA points for 90 cents to $1.30 each throughout December.

If they attract enough investors, the ExaCoin admins buy an altcoin script, convince a few dodgy exchanges to list it (based on “look how much money was invested!”), get listed, use that to profess legitimacy and then pay out funds invested until the minimum reserve is reached.

ExaCoin will then abruptly stop paying out and the anonymous admin(s) make off with what’s left.

Gullible ExaCoin affiliates who invested on baloney promises of riches are meanwhile left with an altcoin whose value fast approaches zero.

And that’s on top of most affiliates losing money on the ROI side of things, because that’s how a Ponzi scheme “works”.

This has played out time and time again in the MLM underbelly “lending” Ponzi niche. ExaCoin won’t be any different.

I do hear what you’re saying… the same thing literally everyone always says about lending platforms. Yes they could be scams. But then again so could any fiat based anything.

Everything you point out is also based on nothing, no facts, just conjecture and skepticism right?

For as many lending platforms as there are, there have only been a few full on scams that I know of. maybe there is more out there that I don’t know about?

And they did have an ICO? ANd I would imagine brought in capital through it? As far as lending platforms go, they seem to be the most open about their concept of using a trading bot. If they brought money in through the ICO, and are trading, then that is where the money is coming from.

Yes anything could be a scam but, to conclude that something is a scam with little or no evidence is as much of a scam as the company you’re calming is a scam.

this statemetn: Gullible ExaCoin affiliates who invested on baloney promises of riches are meanwhile left with an altcoin whose value fast approaches zero.

And that’s on top of most affiliates losing money on the ROI side of things, because that’s how a Ponzi scheme “works”.

This has played out time and time again in the MLM underbelly “lending” Ponzi niche. ExaCoin won’t be any different.

shows how biased you are but, I would be interested in hearing more about the other programs this has played out “time and time again”

What’s your point?

False, it’s a fact that ExaCoin hasn’t proved external ROI revenue is being used to pay affiliates.

It’s also a fact that ExaCoin has no registered its securities offering with a securities regulator in any jurisdiction it operates in.

Doing so would require them to disclose evidence of external ROI revenue, which they can’t because there is none.

This means they’re recycling newly invested funds to pay off existing investors, making ExaCoin a Ponzi scheme.

To date I have not seen a single MLM ICO lending opportunity that has provided evidence of external revenue being used to pay affiliates.

“and are trading”. You’re almost correct.

With no evidence of trading all the money invested during the ICO is making up lending ROI payments. That’s Ponzi fraud.

If the facts are biased towards every ICO lending being a Ponzi scheme, that’s reflective of the ICO lending business model.

There are plenty of ICO lending scams that have already collapsed. Run a search on ico lending scam on BehindMLM, restrict the timeline to 2017 and look up how they’re going now.

The typical half year maturity period means the collapse happens in slow motion, but the ICO lending Ponzi niche is beyond saturated now. We’re going to see a ton of collapses in 2018.