Elysium Network Review 2.0: €99 a month BTC commentary

BehindMLM’s initial Elysium Network review was published in May 2020.

BehindMLM’s initial Elysium Network review was published in May 2020.

Despite launching in 2019, Elysium Network presentations today still mark the company as a “brand new opportunity”.

At the request of a reader, today we’re revisiting Elysium Network for an updated review.

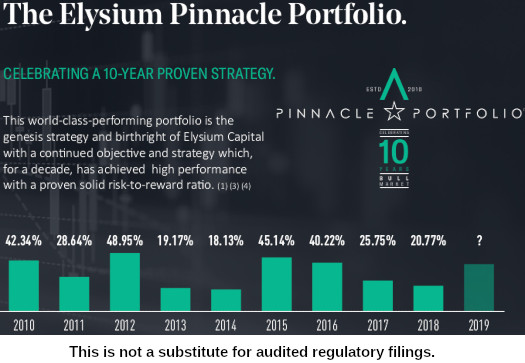

In May 2020 Elysium Network was committing securities fraud through Elysium Capital.

The investment scheme was called “Elysium Capital Pinnacle Portfolio”. You invested €500 EUR, did nothing and collected a return.

Neither Elysium Network, owner Fred Stege or any of his other shell companies were registered to offer securities in any jurisdiction.

This saw us label Elysium Network an unregistered securities offering.

Elysium Network’s securities fraud was conducted in partnership with Equiti Group, who Stege identified as a partner broker in August 2020.

Fast forward to May 2021 and Elysium Network shut down affiliate trading accounts without warning.

How much Elysium Network lost in the collapse is unclear.

Internal emails between Elysium Network affiliates reveal losses upwards of 70% of funds invested. There were supposedly only a few hundred Elysiun Network affiliate accounts set up at the time of collapse.

Upline Equity Network affiliates, who likely earned more than they lost in recruitment commissions, advised their victims to “just accept the loss and move on”.

For their part Elysium Capital sent out an email in mid June, advising “it is clear there was an issue that is not related to our systems.”

It’s clearly visible that the system tried to execute actions after 16:27:49 but that the orders were not executed.

These ‘dead’ moments cause a lot of drawdown as the EA cannot place the necessary hedges to secure the account and keep the equity under control.

These errors we got a lot from the Equiti account and not from the accounts of our other brokers. So there is definitely a general issue here.

As I understand it affiliates remain caught between Elysium Network and Equity Group blaming each other for their losses.

Stege, without any shame whatsoever, was quick to reboot Elysium Capital as a crypto trading opportunity.

And this is where things get murky.

In early June, about a week after the Equiti Group debacle, the Elysium Network and Elysium Capital websites went down.

Given the timing of the Equity Trading ruse collapse, we put this down to Stege initiating an exit-scam.

Access to Elysium Network was restored on June 10th. Elysium Capital’s website remains down.

Attempts to access Elysium Capital’s website return a period (.) placeholder.

As far as I know Stege has failed to provide any explanation.

In an attempt to suss out Elysium Network’s business model, I’m relying on a May 2021 presentation by Fred Stege.

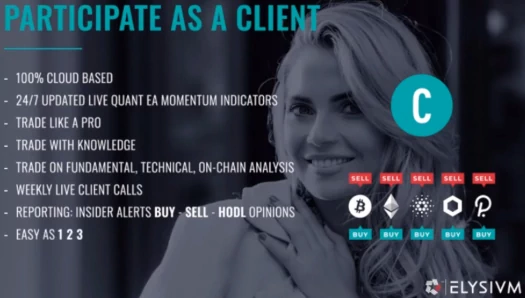

In the presentation Stege represents Equity affiliates and retail customers gain access to Elysium Insider.

Elysium Insider is purportedly a signals trading service. If there’s still an automated trading aspect Elysium Network, that’s not disclosed.

I figured seeing as its purportedly pitched at retail customers, Elysium Network’s website would provide information about Elysium Insider.

That’s not the case. Elysium Insider does have its own website, on which it’s claimed

Elysium Insider provides independent and actionable research and analytics to our global subscribers to improve their investment and trading decisions. Everybody can do this!

One example of an Elysium Insider email dated late June has Stege not really knowing where bitcoin will go.

At the time BTC was at ~$34,000. Stege provided general advice for BTC going either way.

In another Elysium Insider tip email, dated July 13th, Stege provided general commentary;

Bitcoin is ranging sideways in the lower $30’000. – $34’000

$31’000 needs to be held. $34’500 needs to be broken to move to the upside around $38’000.

Today there is a Grayscale shares sell-off and that causes the downside pressure. If it absorbs well we might see a significant move to the upside later this week.

I’ve just bought a tiny bit today at $32,500.

But we could still go lower. Most likely we will find out this week. It’s still too early to touch Alt coins.

Stege doesn’t seem to be able to predict where BTC will go so much as provide commentary on what’s already happened.

All Stege reveals is Elysium Insider costs retail subscribers €99 EUR a month. That was a discounted introductory price in May, good for only a few weeks.

The full cost of an Elysium Insider retail subscription wasn’t disclosed.

Elysium Network’s website is still advertising “QUANT EA signal portfolios (“Trading bots”).”

Quant EA appears to be the outdated pre-crypto precursor of Elysium Insider.

Another oddity is Elysium Capital, as a Hong Kong shell company, being referenced on Elysium Network’s website.

Elysium Capital hasn’t existed since its website went down in early June.

If I had to guess, Elysium Network’s website hasn’t been updated for some time. This explains why there’s no information about Elysium Insider.

Elysium Network as an MLM opportunity focuses on selling Elysium Insider and recruiting affiliates.

Elysium affiliate membership is currently €499 and then €97 a month.

That provides you access to the Elysium Network backoffice, a social media marketing tool, Zoom clone and Elysium Insider.

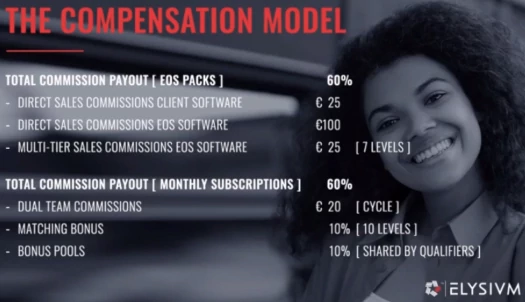

€25 EUR is paid out on recruitment of new Elysium Network affiliates and/or Elysium Insider retail subscription sales.

Another €25 EUR is paid out in residual commissions, down seven levels of recruitment (unilevel).

Monthly subscription fees paid by both affiliates and retail subscribers generates residual commissions via a binary team.

This is complimented by a 10% matching bonus and bonus pools.

This is pretty similar to what reviewed in 2020. Bearing in mind the euro amounts quoted are out of date, you’ll still get the gist of Elysium Network’s comp plan there.

On the regulatory front nothing has happened since the Estonian securities fraud warning issued in July 2020.

Prior to the warning, Stege was representing Elysium Network and Elysium Capital were Estonian shell companies.

After the Estonian fraud warning, Stege provided shell company addresses in Hong Kong and Sweden.

As opposed to Elysium Network being any less illegal, there’s likely been no new updates because there isn’t much going on.

As I write this Alexa ranks Elysium Network’s website at 5.4 million. For an MLM company that’s as good as dead.

Traffic to Elysium Insider’s website is so insignificant that it’s not measured.

Overall it’s clear the Elysium Network’s original business model collapsed. What’s now in its place is sloppy and not properly put together.

Not withstanding the Elysium Network website downtime or abandoning of Elysium Capital’s website altogether.

For now it seems Stege has recycled existing properties (affiliate membership tools), and is charging people €99 EUR a month for his thoughts on bitcoin’s day-to-day price movements after the fact.

Not as bad the securities fraud Elysium Network originally launched with but, at least in my opinion, not worth the price of admission.

Update 14th August 2021 – Equiti Group has disputed Fred Stege blaming them for Elysium Network affiliate losses.

Update 30th October 2021 – As at the time of this update, the May 2021 Elysium presentation by Fred Stege has been deleted from YouTube.

I did have the presentation linked but have disabled the link due to the video’s deletion.

27:27 We want to build the largest crypto trading community around the globe. Why? Because it’s simple.

49:30 Discover the magic of residual – exponential income. – 49:55 “People know people that know people, all right, that know people that know people,…” – 50:35 “You can build that out to hundreds of people, thousands of people, hundreds of thousands of people and you get residual commission streams month after month after month on that entire group of people that you once started.”

So the retail product is €99 to hear Stege’s thoughts on bitcoin’s movements after the facts; the affiliate cost is one time €499 and then €97 a month to maintain the pyramid by hopefully convincing as many people as possible to cough up €99 a month?

Surely, building the largest crypto trading community around the globe can’t be that simple?

If it is simple Fred Stege seems to be having a hard time doing it. What does that make him?

Votes to rename him to Fred Stooge.

Eh? I thought Elysium Capital started delivering signals to the 3rd party institutional Pinnacle Fund in 2010?

Well, he’s got “an experienced, dedicated management team. Not everybody’s on these pictures, cause we got a lot of erm, a lot of developers, really important” (27:40 onwards)

Would those developers be the same developers that have been programming the trading bots since 2010? Who have by now apparently happened to switch their attention to actionable crypto signals?

The only person with some sort of programming credentials, a certain James Cao (linkedin.com/in/james-cao-0022581b3/?originalSubdomain=ca), was never mentioned and seems to have left Elysium in November 2020.

Some discrepancies there, looking at his CV at his current employer (upstack.co/team/cao).

Yeah I ain’t falling down Stege’s bullshit rabbithole 😀

Late 2019 is when Elysium Network surfaced.

After achieving huge success with a trading desk carefully hidden from view since 2010 (facebook.com/elysiumallstars/posts/294379881996374)

In July 2020, it was decided “to ‘upgrade-expand’ our operations already in Founder Launch. (This was planned for 2022/23)”

But…but…but…how did these institutional funds work with a trading desk with ten years of success if Stege only founded Elysium in 2019?

Pay attention, Herr D, Elysium built the software to enable retail clients to copy the trades of these external institutional funds. Which took them five years to develop before they opened to retail in 2020.

Elysium is (was?) also a prop desk which traded with their own money and which delivered robotic trading to institutional funds since 2010. Which explains why absolutely no trace of these funds or this prop desk can be found anywhere until August 2020.

From 2020 onwards, Elysium then acted as asset managers for retail clients. The clients’ money was in a segregated account, which meant that Elysium having power of attorney over customers’ portfolios wasn’t a securities offering.

They’re democratising wealth! Now hand over your money so you can escape dependency on traditional financial insitutions. Elysium Insider has a Representative Office in Sweden [on appointment], so there.

Jonas,

Almost everything you said is correct as much as I know – just one correction:

Elysium did not act as an asset manager because Elysium did not touch clients’ money used for trading. Those money were at the clients’ broker.

Elysium only provided signals (copied them automatically to clients’ broker). It was up to each signal client to decide what they intended to do with those signals.

(I may have fallen into the old “sarcasm not being obvious online” trap again?)

If Elysium wasn’t founded until 2019 (clearly visible from 27:27 until 28:27), how can they have been building software since 2015?

If Elysium wasn’t founded until 2019, how did their prop desk have a “10 year proven trackrecord” in 2020?

Any proof of them achieving 12956.19% in Aurum Digital or 1831.40% in Pinnacle by the end of March 2021? Unfortunately, they never published any figures after that until the alleged glitch of May 7, 2021. And now they don’t publish anything at all?

Oh please…

Customers had to give Elysium power of attorney to trade with their money. Elysium operated the trading bots on behalf of the clients through brokers Equiti and Multibank.

Check the LPOA customers had to sign with both Equiti and Multibank, both documents explicitly state Elysium Capital Limited was the asset manager. A textbook securities offering.

A grey area could have arisen had Elysium merely sold the bots and then left it to the clients to adapt the bots themselves. That was demonstrably not the case here.

No. The signals were implemented automatically on the clients’ accounts.

A client may have been able to manually close a trade once Elysium (‘s bots) decided to open a trade, a client had no say in the opening of each individual trade. Which makes the setup discretionary asset management by Elysium. A textbook securities offering.

In that case, I stand corrected. I did not read those particular docs.

Regarding granting LPOA. I dont know if this falls under being security or not because on one hand trading is being done pretty much automatically, on the other hand it is up to everyone what they do with their money: whether granting someone LPOA or not.

If that could be considered a security, how does it differ from MAM where trader’s actions are copied to your account, trader takes a portion of profits and you have your portion of money? I don’t think participating in MAM is considered being engaged in security, does it?

Page 27 of the client registration tutorial.

Elysium Capital Ltd (and/or its subsidiaries) always claimed not to be “directly or indirectly involved in the offering of securities”.

Which is a lie regarding the indirectly involved part, customers sent their money to a 3rd party broker (i.e. not directly to Elysium); where Elysium used that money to trade on the forex market.

The next phrase (“clients can utilise oir trading bots at their own discretion at their preferred 3rd party brokerages”) is a lie as well.

Clients could only use these bots in a master account setup at the broker of Elysium’s choosing. If Elysium merely sold the bot and then left it to the client to operate it how and where they wanted, that would have been a different story.

But how would Elysium have made a 50% performance fee then? Why get a performance fee at all if they’re allegedly not trading?

Sure, though to avoid fraud and abuse, firms and individuals offering these services professionally need the correct licenses.

Companies claiming they’ve been around since 2010 and made 30% on average a year for instance.

This is different from having power of attorney over e.g. your spouse’s checking account or copying a friend who dabbles in forex trading as a hobby and with whom you make a deal.

In this case, size (of AUM) matters. You can copy a friend’s forex trades in an MAM setup without him needing a securities license.

If your friend becomes really good at forex trading, starts day-trading full time and attracts more copiers; at some point he will be considered a professional and would require regulation.

Elysium liked to compare themselves to eToro and claimed they didn’t need a license because the people being copied on there don’t need one either.

Unfortunately, Stege claimed to connect people to the trades of professional “MiFID-compliant” funds (Pinnacle and Aurum).

Who would need to disclose verifiable details to attract customers. Repeating myself, would you have any proof of the historical results or the mere existence of these desks?

Unfortunately, Stege also claimed to have Elysium’s very own Alpha Linea trading desk at the office in Malmö, headed by CIO Mattias Axel Larsson.

Repeating myself: no trace of (a license for) that desk can be found anywhere. Larsson’s website maxelia.ml has unfortunately expired.

No, you pay attention! (insert smiley)

The presentation clearly states (form 0:45 to 0:48) “incredible products – 11-year track record of success”. Which brings us to 2010 again. For a company allegedly founded in 2019.

Maybe we should understand “incredible” literally or at least in an etymological sense? As in “not credible anyone would be able to offer these kinds of results over 11 years”.

Regarding the MLM opportunity: the only product seems to be Stege’s crypto opinions (xoom and soho are still the unused excuse products), revenue seems to be generated by clients following his trading suggestions and the hope he was right?

A simple newsletter should suffice for that, no? If a subscriber considers Stege’s opinions to be worth that amount money a month, go ahead.

But what’s the added value of an mlm structure? Why not directly pay Stege €99 a month for his insights, instead of paying €499 and then €97 a month for the same product?

Blink and you’ll miss it, the presentaion now says “Incredible products – The foundation of your success.” The same clip is on the Network website.

Weird, why would Elysium try to remove all mention of their 11-year track record? That would convince a lot of people to be a part of the largest crypto trading community around the world!

I could swear I heard Stege tell prospective clients not to listen to anonymous trolls on the internet. Why does he keep changing his websites after reading behindmlm then?

The clip was uploaded by cryptoinsider.no; must be a very persistent introducing broker.

This gentleman started out as sparsmartere.no, became becomemoneywise.com and then yourfinancialconfidence.com. All of those are offline now, odd.

Mr Eriksen from cryptoinsider.no keeps adapting his website; until yesterday he gave you an introduction link to elysiuminsider.io/auth/register.

The “introduction price for a couple of days only of €99” Stege mentions around 40:40 of the presentation has now been changed to a more pyramid-friendly €149 (who’s going to become an affiliate for €499 if the difference in price for non-affiliates is at €2/month?).

They didn’t get round to changing the disclaimer yet, copy-pasted from Elysium Capital. I’d like to see whether I agree with the terms and conditions, unfortunately clicking on them doesn’t do anything.

It’s this type of small details which stops a company from becoming the largest crypto trading community around the globe.

Odd, then what went wrong for “Mick” on scamwarning.org/elysium-capital-review-elysiumcapitalio-is-a-suspicious-forex-mlm-company/?

That might be the same person as “M Baxter” on trustpilot.com/review/elysiumcapital.io

Odd how the Elysium network site still claims “Participants have full control over entries and exits” or “Clients can at all times manually intervene in their open positions”.

That site now leads to a dead link from wix.com.

But he is still flogging the dead horse by promoting the company with what is at least his fifth website at becomeanelysian.com.

Well, the largest crypto trading community around the globe has to start somewhere.

Cited May 2021 Fred Stege presentation has been deleted from YouTube.

That’s unfortunate; why force potential participants in the largest crypto trading community around the globe to get their information form anonymous trolls like me? Wouldn’t it be much better to listen to his master’s voice?

Mr Eriksen may have gotten a call from compliance officer Shalini Persson, if she still works at Elysium? Her alleged time at Elysium doesn’t merit any mention on her cv, odd.

Stege has always been adamant about how Introducing Brokers shouldn’t build their own websites. If only one could ask CRM, but Scott Lindahl stopped working at Elysium on May 31 (facebook.com/scott.lindahl72/posts/10156736075136218).

Mattias A. Larsson lost his middle initial and part of his last name on LinkedIn, and now even linkedin.com/company/maxelia/ “no longer exists”. His alleged time at Elysium doesn’t merit any mention on his cv, odd.

Oh well, becomeanelysian.com/post/bitcoin-updates tells us

If only there were something like a datestamped overview of what Stege predicted about the market? That would surely convince lots of people to become part of the community?

Now this becomeanelysian.com website has disappeared as well?!

How would one go about becoming an Elysian these days or joining the largest crypto trading community to be around the globe?

At the moment, it looks like a lot of subscription fees and quite a bit of money to spend on disappearing domain names.

Has the MLM part of Elysium Network stopped operating? On the Network page, clicking “join” will lead you to a landing page telling you to contact them. Clicking “join” on the Insider page will lead you to a registration page.

€149 for a monthly subscription, €1639 for an annual subscription (one month free!) to Elysium Insider with no extra products.

I’ve sent an email to the network support, asking if one still gets €125 to introduce customers to them, so you’d only have to introduce 14 people to get your annual subscription’s worth. I also asked what the benefit would be for customers to come through an introducer instead of going directly to Elysium. Awaiting the answer with bated breath!

It lead me to office.elysiumnetwork.io/user/register; where I could get a yearly subscription for €1,428.95 to become a “brand partner/reseller”.

Then I’d only have to introduce 12 people to get investment and still get access to the “advanced Elysium R%A website”. Definitely no pyramid selling going on here.

Stege hasn’t given his Monday “Business Opportunity Webinar” and his Wednesday “Fast-track Webinar” since December 2021.

He still blesses 25-35 people with his Friday Markets Closing calls, where one gets to hear that Bitcoin is volatile, it could go lower but it could go higher, but ranging sideways is always an option.

Huh, so it does. Once there, I can click on any option, but the order total stays at €0,00.

The “Xoom” voip software is no longer offered either, I seem to gather? Would have loved to resell that to my whole network and to retail clients, but alas.

Oh well, Rome wasn’t built in a day either; they’ve still got until 2029 to become the company of the decade.