DeFiNatics: Smart-contract Ponzi scheme in the making

![]() DeFiNatics is an upcoming smart-contract Ponzi scheme owned by Rick Katz.

DeFiNatics is an upcoming smart-contract Ponzi scheme owned by Rick Katz.

In his own words, DeFiNatics will launch a smart-contract affiliates can invest in.

According to Katz, speaking on an August 31st webinar, he copied DeFiNatics’ smart-contract “from a smart-contract that’s already working”.

DeFiNatics investment will be solicited in ethereum and made into a yet to be named ERC-20 token.

From there it’s the same old MLM crypto smart-contract Ponzi story.

[4:38] Jeremiah: So basically what you’re saying is, as a community, if we understand that once we get this thing going, once the contract launch(es), if we stick together as a community and understand, if we can hold this and compound it for … collectively, we can draw in, so to speak, outsiders into it which will grow it and the value will increase.

So we continue to make money, and then we could actually start siphoning some of those profits … without decreasing the value.

Is that what you’re saying?

Rick Katz: You know what’s amazing guys, is Jeremiah said all that and he’s absolutely correct.

Returns will be made in DeFiNatic’s token, eventually allowing affiliate investors to withdraw more than they invested.

[13:58] I would suggest you just hang on to your tokens and watch what happens but it’s up to you.

Because It already works. How the compounding works and the potential results of such.

Okay. Well you know what compounding is, you’re buying more. Right? You’re buying more.

So as you’re earning profits… listen, everybody knows what ethereum is right? You all know the value of that token right?

This whole program is designed to get you as much ethereum as you can possibly hold.

The compounding is gonna work like this: The smart-contract right, as… you have to call them tokens cuz that’s what they’re called, but they’re really like bonds. Like corporate bonds. Savings bonds. Right?

So you’re gonna earn interest with these. To compound, all you have to do is reinvest some or all of your earnings into buying more of these bonds.

[21:17] We eventually … will have an option to have automatic compounding.

Katz (right) implies new investors will sign up because the DeFiNatic token value will “go up and up and up”.

Katz (right) implies new investors will sign up because the DeFiNatic token value will “go up and up and up”.

[34:28] This thing will pay off for, y’know. The more people we get involved… it’s like, you don’t have to recruit anybody.

Just tell people, “Hey, they’re giving away free money.”

We may not even have to market this thing. People will see on the charts (and ask), “What is this token? Who are these DeFiNatics? What’s going on? It just keeps going up and up and up. Ohhh, I get it. I better get me a few of these coins. What? They’re $10,000 each?”

The ruse DeFiNatics will hide its Ponzi scheme behind is some undisclosed games platform.

Evidently some of the DeFiNatics crowd are familiar with MLM crypto Ponzi schemes.

At [7:28] two DeFiNatics affiliates ask Rich/Rick about “the functionality” of the shitcoin DeFiNatics will launch.

Here’s the non-answer they received:

[7:48] Functionality guys, ultimately we’re an economy.

So what is done in an economy? Everything. Buying, selling, trading, dada dada dada.

Whatever you can think of, ultimately that’s what we are.

Rich/Rick went on to equate DeFiNatics’ smart-contract to a “central bank”.

Although the fad has mostly died off, there is also an NFT component to DeFiNatics.

Those who invest early into DeFiNatic’s smart-contract have been promised NFTs.

When asked if the NFTs would be made by him, Rich/Rick replied;

[9:10] It’s going to represent our token.

Now how much value will it be? It depends on how much value the VIP access is.

Y’know, two years from now when we’re… y’know, our value is just through the sky … y’know this is a long-term thing guys. This is for our kids and grandkids.

DeFiNatics’ NFT platform is called “Ether Creatures”. It’s a “hybrid animal” clone NFT platform.

The hybrid animal NFT model is currently dominating what’s left of the niche.

[10:52] Ether Creatures dot com is owned by us. And we’re gonna have NFTs for that, where just (by) holding one of those NFTs you’ll win money.

Reading between the lines, and much like DeFiNatics’ smart-contract itself, it seems whatever value its NFTs have are pegged to new investment.

The MLM side of DeFiNatics was originally tied to a matrix-based pyramid scheme.

Katz explains this was abandoned after “CoinPayments … cut us off”.

As of August 1st, DeFiNatics was paying a 10% referral commission on ethereum invested by personally recruited affiliates. Whether that’s since changed is unclear.

BehindMLM is putting this article together because Katz states that anyone in DeFiNatics who earned through the matrix “will still get their matrix commissions”.

In the August webinar Katz represents that the smart-contract is still undergoing modification prior to launch.

[1:13] Right now I’m waiting for the smart-contract to get finished.

DeFiNatics’ public-facing website provides a link to the “CFR” Facebook group.

The group began as Crypto Fund Raiser and was launched in April 2017. Currently the group has 2600 members.

Katz admins the CFR Facebook group with Lori A. Petrosino and Trisha Barnes.

Katz admins the CFR Facebook group with Lori A. Petrosino and Trisha Barnes.

Trisha Barnes markets herself as an IBO at Cerule.

Lori Petrosino has recently been promoting the HyperFund and Daisy AI Ponzi schemes on social media.

Make no mistake, Rick Katz knows he’s running a Ponzi scheme. He states he would “like to keep (DeFiNatics) low-key and underground”.

[2:22] I think everybody now knows for the sake of this working, we have to keep a low profile as much as possible.

Just tell people one on one privately, secretly. Go into a Telegram chat room even and talk.

Don’t let Facebook and big brother see everything you’re doing.

We shouldn’t be doing this in our Facebook group, that’s why I’m trying to get everyone on Telegram.

To that end DeFiNatics’ homepage advertises a company Telegram group:

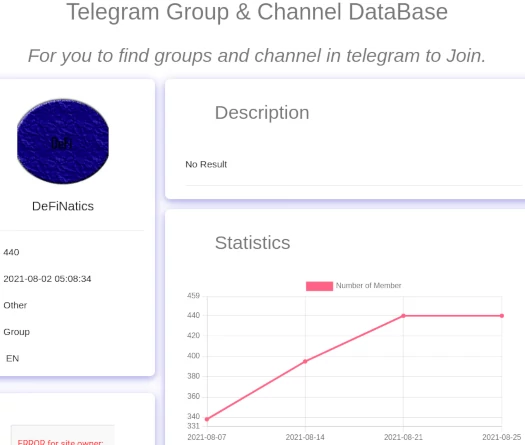

DeFiNatics’ Telegram group was created on August 2nd:

As at the end of August it had 440 members.

Presumably Katz believes, should regulators investigate DeFiNatics, the use of Telegram will make it easier to delete incriminating evidence.

Katz believes he’s entitled to run Ponzi schemes because “there are problems with the financial system” and “the government steals all the money”.

As of August 1st, DeFiNatics’ smart-contract was purportedly still being finalized. I couldn’t find any subsequent public updates.

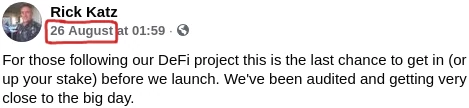

On August 26th Katz represented DeFiNatics was launching soon:

After DeFiNatics’ smart-contract Ponzi has launched, Katz intends to launch an in house crypto exchange.

He believes this will generate “another ten million worth of investment” into DeFiNatics.

DeFiNatics’ tokens are capped at just over 300,000. Katz claims they “will each be worth thousands of dollars”.

[18:25] Most of the value in the smart-contract is going to be decentralized.

Nobody can shut that down. Unless… I don’t know if the government has ways to shut down decentralized exchanges.

In Katz’s own words, DeFiNatics’ smart-contract is

[20:56] is passive income. Click here, click there, OK you’re done for the day go fishing.

Is that passive or is that like hard work or what? (laughs)

The passive nature of DeFinatics’ smart-contract Ponzi scheme makes it a securities offering.

This would fall under the regulatory jurisdiction of the SEC.

According to his Facebook profile, Rick Katz is based out of California. Trisha Barnes and Lori Petrosino are also believed to be US residents.

Update 6th May 2022 – Doesn’t look like there’s much going at DeFiNatics.

The cited August Rick Katz webinar has been deleted sometime in the past week. I did have a link to it but due to the deletion had disabled it.

Outside of that traffic to DeFiNatics website is non-existent (it’s still a “coming soon” landing page). The NFT game Ether Creatures is still “in development”.