De Spend Review: DSG token staking node Ponzi

De Spend, also going by DeSpend, fails to provide ownership or executive information on its website.

De Spend, also going by DeSpend, fails to provide ownership or executive information on its website.

De Spend’s website domain (“despend.com”), was privately registered on August 28th, 2025.

Over on De Spend’s official English Telegram channel we find Chinese:

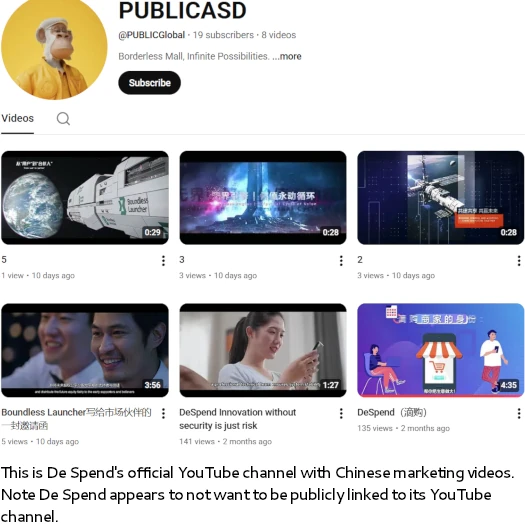

This ties into official De Spend marketing videos also being in Chinese:

This strongly suggests whoever is running De Spend has ties to China.

Despite the obvious ties to China, Chinese scammers behind De Spend falsely represent ties to the US:

This is the typical “register a US shell company with bogus details –> register shell company with FinCEN” legitimacy ruse scammers outside of the US use.

Any company can be voluntarily registered with FinCEN. FinCEN is not a financial regulator, registration of a company with FinCEN is meaningless with respect to MLM due-diligence.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

De Spend’s Products

De Spend has no retailable products or services.

Promoters are only able to market De Spend promoter membership itself.

De Spend’s Compensation Plan

Promoters purchase DSG tokens from De Spend with tether (USDT).

Once acquired, DSG tokens can be invested through three primary ways:

- staking – 568.991% annual ROI

- bonds – 90 days at 1,812.262% annual ROI, 180 days at 2631.93% annual ROI or 360 days at 3099.557% annual ROI

- node position – 100 to 20,000 USDT per position on the promise of an undisclosed variable ROI paid in DSG tokens

The MLM side of De Spend pays on recruitment of promoter investors.

ROI Match

De Spend pays a ROI Match via a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

De Spend caps payable unilevel team levels at ten.

The ROI Match is paid as a percentage of daily returns paid to promoters across these ten levels as follows:

- level 1 (personally recruited promoters) – 10% match

- level 2 – 5% match

- level 3 – 3% match

- level 4 – 2% match

- levels 5 to 7 – 1% match

- level 8 – 2% match

- level 9 – 3% match

- level 10 – 5% match

Note the ROI Match is paid in DSG tokens.

Node Investment Bonus Pools

De Spend takes 11% of company-wide investment and places it into four smaller node investment bonus pools:

- K13 invest 20,000 USDT and recruit 26 node investment promoters and generate 30 million USDT in downline investment = a share in a 1% pool

- K14 – invest 20,000 USDT and recruit 28 node investment promoters, have two K13 promoters in your downline = a share in a 2% pool

- K15 – invest 20,000 USDT and recruit 30 node investment promoters, have two K14 promoters in your downline = a share in a 3% pool

- K16 – invest 20,000 USDT and maintain 30 personally recruited node investment promoters, have two K15 promoters in your downline = a share in a 5% pool

Joining De Spend

De Spend promoter membership is free.

Full participation in the attached income opportunity requires a minimum 100 USDT investment (minimum staking amount unknown).

De Spend Conclusion

De Spend serves up a typical ecommerce word salad ruse:

De Spend is a modern WEB3 cross-border e-commerce platform and transaction value-added system that uses cross-border e-commerce and cryptocurrency social economic resources as a vehicle, with blockchain technology applications as the underlying business logic, and integrates e-commerce systems and financial systems as a comprehensive economic model for implementation.

The bottom line was if De Spend actually had anything to do with ecommerce, they’d be in profit and not running a three-tier illegal investment scheme.

While it offers up a meaningless FinCEN registration, what De Spend fails to provide is evidence it has registered its passive returns investment scheme with financial regulators in any jurisdiction.

This is verifiable securities fraud, and ties into De Spend being run by Chinese scammers hiding their identity.

As for DSG, it’s a simple BEP-20 shit token. BEP-20 tokens can be created in a few minutes at little to no cost.

As it stands, the only verifiable source of revenue entering De Spend is new investment.

Using new investment to pay returns would make De Spend a Ponzi scheme. Additionally, with nothing marketed or sold to retail customers, the MLM side of De Spend operates as a pyramid scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve De Spend of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.