Connect United Review: Node ruse MLM crypto Ponzi

Back in late 2021 BehindMLM published its WinWheel review.

Back in late 2021 BehindMLM published its WinWheel review.

WinWheel was essentially a reboot of the collapsed Algotech Ponzi scheme, fronted by several former top OneCoin Ponzi promoters.

WinWheel offered investors passive returns through node positions, tied to the company Connect.

This is a summary conclusion from BehindMLM’s WinWheel review;

To summarize, WinWheel is a Ponzi scheme with ties to Connect, an unknown blockchain company representing it is based out of the US.

Both companies are run by and/or promoted by serial-scammers, with business models appearing to be intentionally convoluted so as to confuse people.

WinWheel collapsed shortly after launch but Connect rebranded as Connect United and continued to defraud investors.

I made a note of this in BehindMLM’s WinWheel review. Recently though a reader reached out requesting a standalone Connect United review.

Having confirmed Connect United’s offering was MLM and not just a clone of WinWheel, today we’re publishing a separate Connect United review as requested.

Although it was very much created by an individual or individuals, Connect United fails to provide ownership or executive information on its website.

A visit to Connect United’s website redirects to an affiliate log in form:

Back in 2021 I noted Utah resident Stephen Michael Miller was the face of Connect.

As of May 2024, Miller’s LinkedIn profile cites him as COO of Connect since 2018 and President as of July 2020.

Before getting into MLM crypto fraud, Miller had a history in real-estate.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Connect United’s Products

Connect United has no retailable products or services.

Affiliates are only able to market Connect United affiliate membership itself.

Connect United’s Compensation Plan

Connect United affiliates invest in “win nodes” and “switch node” positions.

- a win node investment position costs $2000 annually

- a switch node investment position costs $8900 annually

This is done on the promise of a variable daily passive return.

Note that although Connect United’s compensation plan uses USD, the company warns “rewards are paid out in USD equivalent, NOT paid in USD”.

Connect United pays returns and commissions in its own WIN token.

The MLM side of Connect United pays on recruitment of affiliate investors.

Connect United Affiliate Ranks

There are four ranks within Connect United’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Droid – sign up as a Connect United and invest in a win node position

- BlockBot – recruit five affiliates who have invested in a win node position and have earned $10,000 in commissions over the past 12 months

- BlockBot5 – have a BlockBot or higher ranked affiliate in five separate recruitment legs

- BlockBot10 – have a BlockBot5 or higher ranked affiliate in five separate recruitment legs

- BlockBot20 – have a BlockBot10 or higher ranked affiliate in five separate recruitment legs

Referral Commissions

Connect United pays referral commissions on invested funds down two levels of recruitment (unilevel):

- 10% on level 1 (personally recruited affiliates)

- 5% on level 2

BlockBot and higher ranked affiliates receive a bonus 10% on level 1.

Joining Connect United

Connect United affiliate membership is free.

Full participation in the attached income opportunity requires a:

- $2000 win node investment or

- $8900 switch node investment

Note that these amounts are as quoted by Connect United in their marketing material. Live pricing however appears to be variable and based on whatever amount Connect United feels like charging.

Note that once quoted, Connect United advises investment costs are “locked in place for 30 minutes. ”

Connect United solicits investment in USD (credit cards), tether (USDT), USD Coin (USDC) and its own WIN token.

Connect United Conclusion

WinWheel’s simple investment scheme was buried in a pile of crypto jargon and pseudo-compliance. Connect United is pretty much the same.

Stripping away the crypto jargon and pseudo-compliance leaves us with a pretty basic investment scheme.

Connect United affiliates sign up, invest in “node positions” and receive a passive return. Commissions are paid on recruitment of investors who do the same.

Despite being based out of the US and primarily servicing US residents (as of April 2024 SimilarWeb tracked 84% of Connect United’s website originating from the US), neither Connect United or Stephen Miller are registered with the SEC.

Make no mistake, no amount of pseudo-compliance and crypto jargon changes the fact that, as per the Howey Test, Connect United’s node position investment scheme is a securities offering.

Connect United affiliates invest with the company (a common enterprise), on the expectation of profits (there is no other reason to invest), with said profits derived from the efforts of others (Connect United’s node returns are paid passively).

Failure to register with the SEC sees Connect United and Stephen Miller commit securities fraud.

On the money side of things, Connect United appears to be laundering funds through Switch Pay.

Switch Pay operates from the domain “switchpay.co”, only recently privately registered on February 20th, 2024.

Shell companies cites on Switch Pay’s website include Fortress Trust LLC, Ibanera LLC and Switch Reward Card DAO LLC. No specific information about these companies is provided.

In what is likely an attempt to hide Switch Pay’s association with Connect United and its fraudulent investment scheme, investments through Switch Pay are dressed up as NFT purchases:

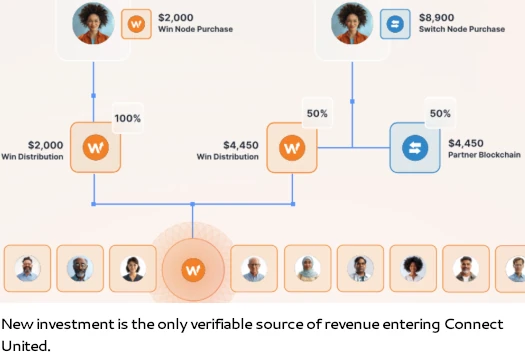

As it stands, the only verifiable source of revenue entering Connect United is new investment.

The proceeds from all transactions completed through Connect are distributed according to the Win Blockchain Distribution Algorithm.

The use of new investment to pay ROI withdrawals would make Connect United a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Connect United of ROI revenue, eventually prompting a collapse.

This is pretty accurate but I wanted to let you know that you are incorrect about the switch nodes.

The $8,900 is a one time fee (not annual) & technically they are no longer $8,900. After each 100 nodes that are sold the switch node price increases by $50.

Today, 1 switch node costs $9,050 & there are 23 left at that price until it increases to $9,100. The price never goes down, only goes up.

This will continue to increase until all 100,000 switch nodes are sold.

Yes, the Win nodes are annual but they never increase in price. They are always $2,000 & there is no 100,000 limit like there is with Switch nodes.

Once again, this is the only node that Connect sells that is annual. The rest work just like the Switch nodes & go up $50 after every 100 is sold with a max supply of 100,000 nodes for each (except for Win nodes which has no limit).

FYI, here is a full list of the other nodes that Connect sells & their current prices:

Grow ($4,700), Galvan ($5,000), Element ($6,400), Elevate ($2,500), Hyper ($1,300), Give ($2,600), Liberty ($3,600), Pixll ($3,500), Rev ($3,400), Rally ($3,700), iQue ($2,300)

Overall, you did a good job with this article. Keep up the good work!

Thanks for the clarification. I did make a note of the variable node pricing in the review.

The addition of (eleven!) additional node investment tiers suggests cash grab.

I’m usually good at sniffing out scams but I think Connect is legitimate. They have actual companies connected to their blockchain, and some of them are run by very successful people in banking and finance.

They also have a law firm overseeing things which has a former Attorney General and head of Homeland Security on-board. They have a detailed compliance program hosted by an attorney who describes why this company is not subject to Howey.

I think here you’re totally wrong OZ and you have to do a better research. Why don’t you contact their legal and compliance departement and ask them for the right information?

There’s no such thing as “not subject to Howey”. You can apply the Howey Test to anything and if it fits the criteria it’s an investment contract.

The right information is Connect United is offering consumers passive returns on investments. This is an investment contact as per the Howey Test and needs to be registered with the SEC.

You can put two and two together why Connect United isn’t registered with the SEC.

How typical.

Most Ponzis claim to have so-called “legal departments” or a law firm backing (most likely to scare off any Ponzi allegations online), but only a few of them hire actual lawyers and attorneys, and even then in 99% of cases these lawyers cannot prove that their Ponzi is not a Ponzi. Can’t see why it shouldn’t be the same here.

Oh, and as for the former Attorney General and head of Homeland Security, I can now see why they left those positions and ended up in a Ponzi. Brace youselves, as this will be a total legal disaster for you and your Ponzi.

if you create a free account and do the compliance training, you will see all about the howey test etc. I think a attorney like Daniel Payne knows more then Oz and Kir. (Ozedit: snip, see below)

I’ll make this easy for you; Your next comment will explain how Connect United securities offering doesn’t satisfy the prongs of the Howey Test. I’ve already provided evidence it does in the review.

Anything else from you will be marked as spam.

As for compliance, pretending your securities offering isn’t a securities offering isn’t compliance. BehindMLM is littered with the careers of lawyers who thought otherwise.

Well here’s the thing: what a certain attorney knows or doesn’t know is irrelevant.

An attorney is not like a real-life Get Out of Jail Free card. An attorney is not the law. He only does his job as he’s getting paid by Stephen Michael Miller or whoever is actually pulling the strings to do so.

He might as well understand that the entity he’s reperesenting is a Ponzi, but he’s still getting paid to do his job, and that’s what he does. After all, even the convicted killers and terrorists have attorneys who defended them in courts and continue to provide legal assistance behind bars.

Does the fact of having an attorney mean these people did not commit what they did? Absolutely not. The same thing applies here.

The fact that Connect United claims to have lawyers and attorneys does not mean it’s not committing securities fraud and, as a result, does not operate as a Ponzi scheme.

I’m not a securities lawyer so I can’t argue the details here, but I did watch their compliance training and they make a case that it’s not subject to Howey.

Part of the reason, again according to my laymen’s analysis, is that the person involved has to do some work, which is to have your node hosted on your computer or in the cloud, which you pay for, so the potential income is not passive, it’s based on the success and utilization of the products and services being provided in their ecosystem.

If people aren’t using the companies in the ecosystem, no rewards are generated. You’re participating in the functioning of the infrastructure, so again it’s not passive.

That’s at least part of what I discerned which, according to their lawyer, keeps it from failing Howey.

Again, you can pick apart what I’m saying because I’m not a lawyer but they do make what appears to be a good case.

Setting up some node bs on a VPS doesn’t generate revenue. The ROI itself is passive.

In other words, claimed ROI revenue is passive and generated “by the efforts of others”.

This is of course all bullshit on Connect United’s part without audited financial reports filed with the SEC, but with respect to the Howey Test satisfies relevant prongs.

There’s nothing about “participating in the functioning of the infrastructure” in the Howey Test.

Sounds like Connect United’s lawyer is trying to justify securities fraud with mental gymnastics. Doesn’t work.

When I say “not subject to Howey” I mean it’s not going to be at odds with Howey, I believe the term is “fail” the Howey test.

I used the incorrect term but in essence, they don’t think they’ll have a problem with Howey, is that more clear?

They’re free to think whatever they want. Some people think the Moon is made of cheese. Does that mean that it is actually like that? Absolutely not.

Same thing here. A simple thought that Connect United will fail the Howey test and is therefore not a Ponzi scheme doesn’t necessarily align with the actual state of things.

Right now there are clear signs that Connect United’s operation does indeed resemble that of a Ponzi scheme, and their node investment part does satisfy the Howey Test’s prongs.

I didn’t know you were a blockchain expert. Apparently you are because you completely discard the idea of “some node”. Proof of action and proof of work are part of blockchain systems and depend on things like nodes to operate.

So perhaps you can enlighten us on (Ozedit: derails removed)

I think most people who are buying these nodes from Connect are hoping to get in early on the next Gala Games which Wright Thurston is a 50% owner of.

Gala Games’s original nodes came from the same people behind Connect. The 12+ nodes that Connect offers today are each from 3rd party companies hoping to utilize the blockchain technology the way that Gala Games has but for their own niche.

Is this a huge gamble for those buying these nodes today? 100% yes. But are they securities? I see no evidence of that.

As with Gala Games, none of these companies guarantee any ROI. It’s pretty straight forward. Your nodes get a portion of the daily rewards similar to how Bitcoin mining works.

What these rewards are worth is 100% up to the open market. That could be $0 or in Gala’s case today that is $0.04 per coin. No one has control over what the free market is willing to pay & there are no promises that these coins will ever be worth anything.

Also, nodes aren’t passive. You MUST keep them online in order to receive a NON dollar digital reward which for most of Connects nodes are currently worth $0.

This is how 99% of the blockchains operate. At some point the free market will see value in some of these blockchains which is what happened with Gala Games. But for many they won’t see the value in them which is why this is VERY risky.

But to claim that these are securities would then mean that all blockchains are securities which I have yet to see the SEC make that claim.

If it looks like a duck, walks like a duck and quacks like a duck, then it just may be a duck…

I have heard this before, powerful attorneys representing “serious companies”. uhmm

NOVAtech

GSPartners

OneCoin

Dubli

zeek rewards….. and more

In fact, Kevin Grimes,a VERY well known and respected attorney was sued for MALPRACTICE.

pasadenalaw.com/blog/2014/08/zeek-rewards-850-million-ponzi-scheme-legal-malpractice-lawsuits/

And One coin: reuters.com/legal/government/onecoin-legal-officer-gets-4-years-prison-crypto-scheme-2024-04-03/

Attorney names are not a “card get out of jail” thing.

Question:

Who founded ConnectUnited? The company is registered in WY as a DAO LLc.

If a company hides the founders names in this kind of business, something is wrong!

@Stop Scams

dUh BlOcKcHaIn isn’t a substitute for audited financial reports filed with regulators.

@Mike

In other words, they’re investing into Connect United (a common enterprise), in the hope of receiving a passive return derived from the efforts of others.

Welcome to the Howey Test.

The Howey Test prong pertains to ROI generation. Setting up some bullshit software on a VPS doesn’t generate ROI revenue. The ROI revenue is purportedly generated passively via the efforts of others.

Under securities law how you set up your passive returns investment scheme is irrelevant. All that matter is whether participants are investing on the reasonable expectation of passive returns derived via the efforts. This is Connect United’s entire “node position investment scheme” business model.

Finally;

1. But the blockchain isn’t securities = strawman argument nobody brought up.

2. Whether you consider securities fraud gambling is neither here nor there.

No, the only nodes that are from Connect are the Win nodes.

All other nodes are from 3rd party companies that are utilizing Blockchain Technology. Connect just offers them via their site as a Super affiliate but you can go directly to each of those companies & buy the nodes directly from them.

You’re going to have to do better then just making a blanket claim that Blockchain technology is automatically equal to being a security. (Ozedit: snip, see below)

Do you invest through Connect United as an affiliate or through said third-parties (on platforms completely unrelated or tracked by Connect United)?

Or better yet, are you paid Connect United MLM commissions on node investments with these so-called third-parties?

If so, then Connect United is making the securities offering. What you can or can’t do outside of Connect United with respect to the node investment positions is irrelevant with respect to Connect United’s securities offering

Never happened. First and last warning: You don’t get to make up a premise nobody said and build an argument around it.

Starting to become obvious you are clueless on securities law.

@Kir Apologies you’re replying to the derails. Better to just nip them in the bud.

If crypto bros want to argue whether cRyPtOcUrReNcY aNd BlOcKcHaIn Is A sEcUrItY they can do it somewhere else. As you pointed out in your replies, that’s not what is being discussed here.

Connect United’s node investment positions are unregistered securities offerings. The medium securities are offered through is irrelevant: There are no exemptions for cryptocurrency or blockchain related unregistered securities offerings in the Securities and Exchange Act.

@Mike

You’re doing everything you can to avoid addressing the above. I’ve already told you, anything that doesn’t address Connect United unregistered securities offering will be marked as spam.

I understand that, that’s totally fine with me.

You can skip Connect & go directly to the 3rd party. Personally, I am not a fan of the Win MLM nodes.

What you can or can’t do outside of Connect United with respect to the node investment positions is irrelevant with respect to Connect United’s own securities offering.

The nodes are not issued by Connect directly (except for the Win nodes). (Ozedit: snip, see below)

It’s an unregistered securities offering. Nobody said anything about an unregistered securities issuing.

So you can’t buy nodes in the USA without them being registered with the SEC? Is this your take?

My take is Connect United’s node investment scheme is a securities offering for reasons and explanations provided in the review.

Your review only mentions 2 nodes & it mistakenly claimed that Switch nodes cost $8,900 per year which is not true.

The review details Connect United’s node investment scheme. The other investment positions were brought up in the comments.

It should be noted Connect United hides details of its nodes investment scheme from consumers. Why should be obvious but is also in and of itself a violation of the Securities and Exchange Act.

As for investment costs, it was also noted Connect United makes up the pricing. Investment amounts were accurate at time of publication.

Any more straws to grasp? None of this addresses Connect United’s underlying node investment position securities fraud.

Now as far as the Win Nodes & the MLM aspect of that node specifically, perhaps you are right. MLM and Crypto is a bad combo. I can find common ground with you there.

Putting aside an MLM company with no retail offering is a pyramid scheme, the MLM side of Connect United isn’t the securities offering.

Be it Win Nodes or whatever nodes, Connect United offering consumers node investment positions on the expectation of a passive return, derived through the efforts of others, is what constitutes a securities offering.

You only earn a digital reward (not dollars) and only if your node is operating which you yourself have to setup & make sure is running. No one does this for you.

1. The Securities and Exchange Act doesn’t make an exemption for “digital reward”.

2. Why would anyone want “digital reward”? Because (insert crypto bullshit here), dollars come out the other end (Howey Test: “reasonable expectation of profits”).

That’s nice but as previously stated, setting up some bullshit software on a VPS doesn’t generate ROI revenue. Connect United’s node investment position ROI revenue is generated “via the efforts of others”.

Nodes are actually pretty critical. (Ozedit: snip, see below)

Whether nodes are critical or not is irrelevant to Connect United’s unregistered securities offering.

Besides, nobody investing in Connect United’s node investment positions gives a crap whether nodes are critical or not. They just want the passive return – that’s what they’re pitched on.

Furthermore, the Securities and Exchange Act doesn’t make an exemption for bUt I’m In It FoR tHe TeCh!

Not true. I’ve gotten to see how Gala Games which first started with the Connect team (Ozedit: derails removed)

Cool story bro. How “Gala Games first started with the Connect team” has nothing to do with Connect United’s node investment position unregistered securities offering.

The Securities and Exchange Act doesn’t make an exemption for crypto marketing spam.

If just shows that the Connect team has helped spawn at least one successful node network which clearly didn’t get accused of being a security. (Ozedit: snip, see below)

It’s not an unregistered securities offering because the SEC hasn’t sued us yet! <-- This is the ol' Yeah I stabbed that guy in the face but it’s not murder, I haven’t been caught yet! argument.

The SEC, among other things, enforces securities regulation as per the Securities and Exchange Act. The absence of an SEC lawsuit does not legalize an unregistered securities offering.

You can verify Connect United’s node investment scheme is a securities offering yourself by applying the Howey Test. Whether the SEC has sued Connect United or not is irrelevant to Connect United committing securities fraud.

It just means, legally speaking, Connect United hasn’t been held accountable (yet).

If the SEC filed suit against Connect United tomorrow, that doesn’t mean up until that point Connect United wasn’t offering unregistered securities to US residents. That has been going on since BehindMLM documented WinWheel in 2021.

You’re right Oz. A law passed in 1934 was absolutely referring to owning part of a blockchain protocol (Ozedit: snip, see below)

The Securities and Exchange Act is what the SEC uses to regulate securities.

The issue with Connect United’s MLM opportunity is the offering of unregistered securities to US residents. This is a violation of the Securities and Exchange Act and lends itself to Connect United running a Ponzi scheme.

If you want to discuss bLoCkChAiN pRoToCoLs or other irrelevant crypto bullshit do it somewhere else, thanks.

Connect United sold Green Nodes. (Ozedit: snip, see below)

Cool story bro. If “green nodes” saw Connect United solicit investment on the expectation of a passive return, derived via the efforts of others, then it’s part of the unregistered securities offering.

If not it’s irrelevant and has nothing to do with Connect United’s node investment position unregistered securities offering.

Oh goodie. If Connect United did and are still soliciting investment for “green nodes”, that gives the SEC an easy inroad.

sec.gov/litigation/litreleases/lr-25659

I pulled the case docket and, as of May 2024, the SEC’s case against Green United remains pending.

You can put two and two together as to why Connect United or the rest of its node investment securities offerings aren’t registered with the SEC.

It’s 100% relevant because we have a full view on what the SEC did to Green United which is a node that Connect United sold.

We don’t need a “hypothetical” analysis of what COULD happen, we already know what DID happen. (Ozedit: snip, see below)

What happened is the SEC sued Green United and the scammers behind it for securities fraud. And you’re telling me the same unregistered securities were/are being offered through Connect United.

Your honor, we see no point in continuing to watch defendants hang themselves. The prosecution rests its case.

No. Connect United only sold Green Nodes after they turned into “soft nodes”. It was the “hardware mining nodes” that Green United hosted & ran for their customers that was the securities issue since Green United did all the work. This is why the SEC went after them.

But since 2019 Green Nodes no longer work as hardware nodes. They’re soft nodes & the SEC vs Green United case ended in 2023 with clear understanding that Soft nodes aren’t an issue.

It was when they were “hardware nodes” and Green United hosted themselves that they became an issue.

Look I’m just going to start hitting the spam button. You’ve repeatedly demonstrated you lack basic comprehension ability.

Correct. In 2018 the soft nodes were not created yet.

This came in 2019 & since 2019 Green Nodes are mining GREEN on their own blockchain. The SEC had an issue with how Green Nodes were sold in 2018 as “hardware nodes” that Green United setup & hosted themselves.

You’re failing to comprehend the evolution of where these nodes started (as hardware) to where ends are now (as decentralized software nodes).

If the SEC had a problem with the current Soft Nodes this would have came out between the 2019-2023 timeframe that the SEC went after Green United. You’re about 5 years behind with this article on Connect United & all I’ve done is help you get caught up.

Where the bullshit node software is/was hosted is irrelevant to the investment opportunity being an unregistered security.

From the SEC’s March 2023 Complaint;

Arguing securities fraud with crypto bros is like shooting fish in a drained soda can.

I said you were right already. In 2018 Green Nodes didn’t mine GREEN.

But since 2019 they have been & now after 4 years of the SEC going after Green United, the case is settled (Ozedit: snip, see below)

Are you daft? The SEC filed suit against Green United in March 2023. As of May 2024, the case is ongoing.

sec.gov/litigation/litreleases/lr-25659

I think I’ve been patient enough, spam-binned. Best of luck with the securities fraud.

I have lost over $7000 on the Connect Green Nodes scam!

Connectunited is atypical bait and switch and Ponzi. The company baited customers my selling nodes to generate passive income.

Most of the nodes that were sold are values less that a penny and are going down in price.

Switched to requiring Win Nodes to participate in MLM commissions. They are constantly asking for additional funds.

They justify their position by telling customers to join the MLM side and sell more nodes to participate in earnings and get commissions.

Bottom Line most of the coins that were mined are worth less thaN 1 PENNY. Members that purchased nodes are left millions of worthless coins.

Example elementunited is now valued at .0002 ha ha. A wopping $1.600 lost.

The coin is going down in value. They also distribute rewards…. not clear on the value.

Bottom Line Bad investment Scam Alert!!! alert… Watch for new Bait and Switch Tactics.

Win Node and Rewards Review: Disappointing Returns and Lack of Long-Term Value

I purchased a Win Node in 2023 for $2,000, expecting it to generate meaningful rewards over time. Over the course of a year, I accumulated around 130,000 rewards from mining. However, the reality of its value today is incredibly disappointing.

Massive Loss in Value

Despite holding the node for a year, the current estimated value of my rewards is just $150—a staggering 92.5% loss from my initial investment.

This drastic decline raises serious concerns about the sustainability of the project and whether these nodes hold any real long-term value.

Rewards Are Now Being Given Away

What’s even more frustrating is that rewards, which were once earned through investment and mining, are now being given away.

This significantly dilutes their worth and makes it difficult to justify any further investment.

If something that took time and money to accumulate is now essentially free, why would anyone purchase a node today knowing it’s highly likely to lose value?

Lack of Investor Protection and Transparency

While I understand that digital rewards and blockchain assets are subject to market fluctuations, the way this has played out feels like a rug pull.

The project offers no safeguards for early adopters who invested in good faith. The lack of clear communication or a plan to maintain value makes it hard to trust the future of Win Nodes.

Final Verdict: Not Worth the Risk

With such a significant drop in value, no real incentives for new investors, and the dilution of rewards, Win Nodes do not seem like a worthwhile investment.

If you’re considering buying one, be aware that there are no guarantees, and the risk of further devaluation is high.

⭐ Final Rating: 1/5 – Would not recommend investing in Win Nodes unless major changes are made to restore value.

Restore value? Connect United is an MLM Ponzi scheme. It’s only purpose is to transfer your value (money) to its owners and top recruiters.

The node BS is just a new ruse to sell you the same scam Charles Ponzi was pushing back in the 1930s.

It’s clear again. The system is constantly changing and it is being made complicated.

The most important thing is that you have to keep hoping for years that your nodes will ever be worth anything.

Fairly new to connectunited, blockchain world jarjon, crypto, multi-level marketing (mlm), etc., I urge anyone already registered or is contemplating registering with connectunited to do your research or Google Search ‘connectunited negative reviews’ due diligence.

My husband and I stand juxtaposed from each other because he has bought into the hyped promises of acquiring $100,000 by December 2025 should their coin increase in value by new users joining and/or purchasing multiple nodes.

I appreciate the candid and thought-provoking comments leveraged via BehindMLM.com website that gave me a counter position to get my husband to rethink placing any more money in connectunited.

This mlm organization uses former GALA success owners and other glittering and successful personalities to lure blockchain, crypto ignorant individuals to blindly inv3st lots of money.