BFF Crowdfunding Review: 400% ROI Ponzi cycler

BFF Crowdfunding, aka BFF Global Network, fails to provide ownership or executive information on its website.

BFF Crowdfunding, aka BFF Global Network, fails to provide ownership or executive information on its website.

In fact as I write this, BFF Crowdfunding’s homepage is nothing more than an affiliate login form:

BFF Crowdfunding operates from the domain “bffcrowdfunding.com”, privately registered on June 11th, 2023.

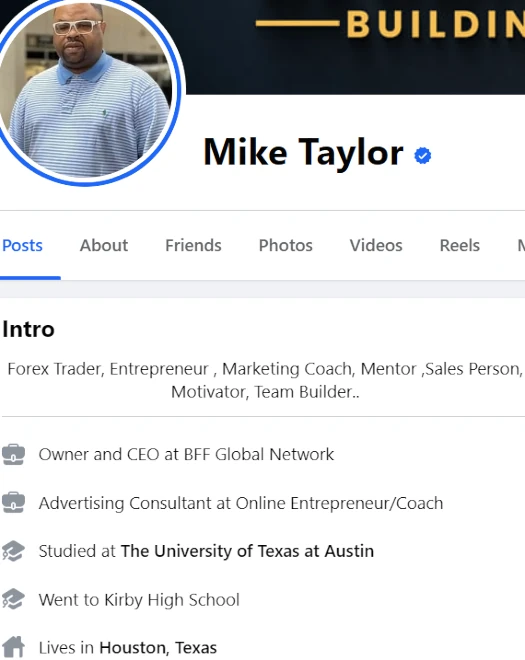

Further research reveals BFF Crowdfunding’s “BFF Global Network” FaceBook group. The group has one admin, Mike Taylor.

On his own FaceBook page Taylor, a resident of Texas, cites himself as owner and CEO of BFF Global Network.

On YouTube Taylor pitches himself as a “forex trader, online marketer, coach (and) mentor”.

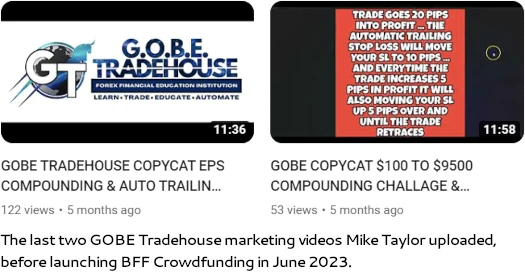

Prior to launching BFF Crowdfunding around three months ago, Taylor was promoting something called “Gobe Tradehouse” and GOBE Copycat”.

As you can see from Taylor’s YouTube marketing videos above, the pitch was turn $100 into $9500.

SimilarWeb tracked just ~3500 visits to Gobe Tradehouse’s website over August 2023. Whatever the scheme was it’s pretty much dead.

Going back even further, Taylor was a promoter of Tradera (collapsed) and Forsage (cash gifting Ponzi whose owners have been indicted).

Read on for a full review of BFF Crowdfunding’s MLM opportunity.

BFF Crowdfunding’s Products

BFF Crowdfunding has no retailable products or services.

Affiliates are only able to market BFF Crowdfunding affiliate membership itself.

Bundled with BFF Crowdfunding is an “affiliate marketing course” and “credit repair training course”.

BFF Crowdfunding’s Compensation Plan

BFF Crowdfunding affiliates invest funds into a cycler. This is done on the promise of a 400% ROI.

There are three investment tiers within BFF Crowdfunding; $125, $250 and $500.

BFF Crowdfunding pays out the advertised 400% ROI through a 2×3 matrix cycler.

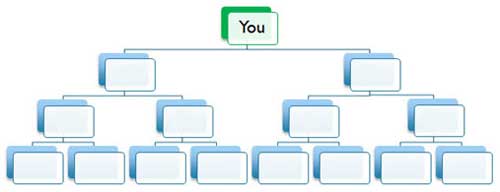

A 2×3 matrix places an affiliate at the top of a matrix with two positions directly under them:

These two positions form the first level of the matrix. The second level of the matrix is generated by splitting these first two positions into another two positions each (four positions).

Level three of the matrix is generated in the same manner and houses eight positions.

When a BFF Crowdfunding affiliate invests $125, $250 or $500, they are placed at the top of a 2×3 matrix.

Positions in the matrix are filled when existing and newly recruited BFF Crowdfunding affiliates also purchase cycler positions.

The advertised 400% ROI is paid out as the eight positions at the bottom of each 2×3 matrix is filled:

- the $125 investment tier pays $62.50 per third level of the matrix filled

- the $250 investment tier pays $125 per third level of the matrix filled

- the $500 investment tier pays $250 per third level of the matrix filled, and generates a new $500 investment tier cycler position

The idea is to either buy-in or cycle up to the $500 investment tier, on which a new position is always awarded upon filling an existing $500 tier matrix.

Referral Commissions

BFF Crowdfunding affiliates receive a referral commission when personally recruited affiliates invest.

- recruit a $125 investment tier affiliate and receive $50

- recruit a $250 investment tier affiliate and receive $100

- recruit a $200 investment tier affiliate and receive $200

Joining BFF Crowdfunding

BFF Crowdfunding affiliate membership is tied to an initial $125, $250 or $500 investment.

BFF Conclusion

Whereas Gobe Tradehouse was a followup to Mike Taylor’s time in Tradera, BFF Crowdfunding is a continuation of Taylor’s scamming in Forsage.

As per a BFF Crowdfunding marketing video hosted by Taylor on September 30th;

At BFF we show you how to take a small investment and quadruple it in a small timeframe.

There’s not much between Forsage and BFF Crowdfunding, other than Forsage using smaller matrices, having only two tiers and operating exclusively in cryptocurrency.

While BFF Crowdfunding still appears to be on its first incarnation, note that Forsage was rebooted no less than six times over two years.

In addition to owner Lado Okhotnikov being indicted for running a $300 million Ponzi scheme, the SEC also filed civil fraud charges.

SimilarWeb tracked ~18,000 visits to BFF Crowdfunding’s website during August 2023. Of that traffic, 79% is attributed to US visitors.

In summary, former Forsage promoter Mike Taylor is running his own Forsage clone. And he’s doing so from within the US and is primarily targeting US residents.

Putting aside whether the SEC and DOJ go after Taylor as they did Okhotnikov, from a due-diligence perspective it’s important to know that in Ponzi cyclers it’s the admin who always steals the most money.

This occurs through preloaded admin positions (remember, at the $500 tier these positions cycle first and indefinitely), as well as an admin cut each time a regular affiliate cycles.

At BFF Crowdfunding’s $125 tier Taylor’s admin fee is $12.50 per cycle. At the $the $250 tier Taylor’s fee is $25. It’s assumed he takes a $50 cut at the $500 fee however the exact amount isn’t clarified.

In order for Taylor and early BFF Crowdfunding investors to make off like bandits, the majority of BFF Crowdfunding investors have to lose money.

This is basic Ponzi math.

BFF Crowdfunding’s inevitable collapse will occur when recruitment slows down. Being a Ponzi cycler, this will manifest by way of matrices within the cycler stalling (failing to fill up).

Once enough BFF Crowdfunding matrices stall, an irreversible collapse is triggered.

While I can’t speak as to if the SEC and DOJ will go after Taylor as they did Okhotnikov, a read through of BehindMLM’s Forsage coverage will give you a good idea of what the Ponzi cycler end-game looks like.

Update 20th April 2024 – BFF Crowdfunding has collapsed. At time of publication BFF Crowdfunding’s website is no longer accessible.

This thing must be all about WHO YOU KNOW. I joined months ago and still haven’t cycled through one board. Not ONE.

It says you don’t need to recruit. BS on that and how they pick and choose who is going to get paid

Math doesn’t care “who you know”. Math guarantees the majority of participants in Ponzi schemes lose money.

Congratulations, you’re in the majority. Sorry for your loss.

I actually got recruits and then blocked when I asked why are the boards aren’t moving for my recruits.

I heard business is going good so it doesn’t make any sense as to why the boards aren’t moving.

Someone has to be at the bottom of a cycler.

Unfortunately for the people you scammed, they’re at the bottom of the cycler.

I’ve posted this before on another infinite cycler scam,the details might differ but the basic math remains the same.