VBit Technologies Ponzi founder Danh Vo sued by SEC

The SEC has filed a civil fraud lawsuit against the founder of VBit Limited and Advanced Mining Group.

The SEC has filed a civil fraud lawsuit against the founder of VBit Limited and Advanced Mining Group.

The SEC’s lawsuit was filed on December 17th and names Danh C. Vo, aka Don Vo, as the primary defendant. Phuong D. Vo, My Tien Thi Nguyen and Diem T. Vo are named relief defendants.

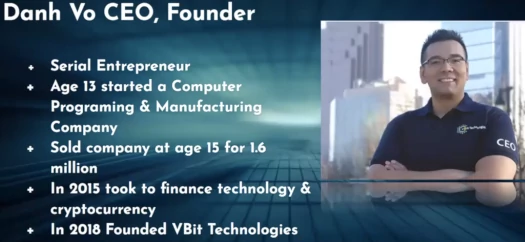

VBit Limited was an MLM crypto Ponzi launched by CEO Danh Vo in mid 2023.

Vbit Technologies, not to be confused with Vbit Limited scam, was a typical MLM crypto Ponzi launched in 2018.

VBit Technologies’ Ponzi ruse of choice was cryptocurrency mining. From a VBit Technologies fraud order issued by California’s DFPI in 2024;

VBit’s mining packages consisted of specialized Bitcoin mining hardware and “hosting” services, which enabled customers with little or no technical expertise in Bitcoin mining to rely on VBit’s mining specialists.

VBit Technologies collapsed in June 2022, at which time VBit Technologies pulled a “regulators!” exit-scam.

On or around June 2022, VBit informed its investors that it could no longer operate in the United States. VBit stated in an email that it “stopped all sales and withdrawals because of a potential pending settlement with the US SEC.”

Investors have been frozen out of their accounts and unable to withdraw their funds.

VBit Technologies’ SEC settlement exit-scam ruse was of course baloney. The SEC further alleges;

Vo falsely claimed in promotional materials that VBit was “[f]ully compliant and registered with every appropriate US government entity.”

Vo also falsely claimed to at least one in-person audience that VBit was “registered with the SEC.” VBit was not registered with the SEC.

Advanced Mining was launched as a VBit Technologies Ponzi reboot. It lasted a few weeks before pulling a “COVID-19!” exit-scam.

This of course was also baloney.

All up the SEC alleges Vo (right), through his VBit Limited and Advanced Mining Group scams, defrauded around 6400 consumers out of over $95.6 million.

All up the SEC alleges Vo (right), through his VBit Limited and Advanced Mining Group scams, defrauded around 6400 consumers out of over $95.6 million.

VBit Limited and Advanced Mining Group’s Ponzi ruse was bitcoin mining.

From the SEC’s filed lawsuit;

Vo claimed that VBit offered investors “a turnkey solution for average people to start making a passive income stream through Bitcoin mining without all the headaches of operating the machines.”

Vo offered and sold investment contracts to investors that purported to provide investors with passive profits from mining rigs that—though ostensibly purchased by investors from VBit—were entirely controlled and operated by VBit. While some investors received returns on their investments, others suffered substantial losses, and Vo misappropriated $48.5 million.

While bitcoin mining was the ruse sold to VBit Technologies investors, here’s what was going on inside the scam;

Since VBit did not create or maintain any records identifying which mining rigs were purportedly owned by which investors, there was no way for VBit to identify which mining rigs to ship to an investor whose termination request was granted.

VBit sold Hosting Agreements for more mining rigs than VBit was actually operating.

In 2020, VBit sold Hosting Agreements for 3,325 mining rigs but operated only 920 mining rigs.

In 2021, VBit sold Hosting Agreements for approximately 8,472 mining rigs but operated only 1,643 mining rigs.

By another metric, VBit sold a purported 8,472 mining rigs that were to generate a combined total of 846,700 terahash of daily power in 2021, but VBit in fact operated only 1,643 mining rigs that generated a combined total of 177,280 terahash of daily power that year.

Further, VBit did not have the funds available to back up the total balances reported on every investor’s online account.

This is because, for many of those investors, Vo misappropriated their invested funds (approximately $48.5 million) and never used their funds to acquire mining rigs or operate mining rigs to mine bitcoin on their behalf.

Around $5 million of the $98.5 million Vo stole is confirmed to have been transferred to family members. The SEC claims Vo fled the US in November 2021, after learning of the SEC’s investigation.

From at least December 18, 2020 through at least November 18, 2021, Vo transferred approximately $48.5 million of the approximately $95.6 million raised from investors directly to his personal bank accounts.

From December 18, 2020 through mid-October 2021, Vo transferred approximately $32.7 million of misappropriated investor funds from his personal bank account to his personal account on a crypto asset trading platform, some of which he used to purchase bitcoin and other crypto assets.

Vo became aware of the SEC’s investigation on or about October 19, 2021.

Immediately after, between October 20, 2021 and November 18, 2021, Vo transferred approximately $15.7 million of investor funds from a VBit account to his personal bank account.

On November 19, 2021, Vo filed for divorce against his wife, Phuong D. Vo.

On or about November 20, 2021, Vo left the United States. Vo’s travel itinerary indicated that his final destination was Vietnam.

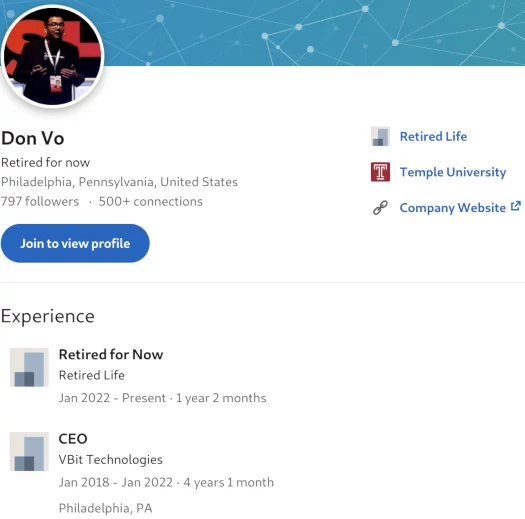

After fleeing the US, Vo updated his LinkedIn profile to reflect he was “retired for life”.

While Danh Vo is known to have fled the US, the SEC cites his family member beneficiaries as US residents;

Phuong D. Vo, age 39, is a resident of Philadelphia, Pennsylvania. She is Danh Vo’s ex-wife.

My Tien Thi Nguyen, age 58, is a resident of Cherry Hill, New Jersey. She is Danh Vo’s mother.

Danny H. Vo, age 30, is a resident of Philadelphia, Pennsylvania. He is Danh Vo’s brother.

Diem T. Vo, age 40, is a resident of Bellmawr, New Jersey. She is Danh Vo’s sister.

Specific to each family member, the SEC alleges;

Prior to October 2021, Vo gave his sister, Diem T. Vo, $300,000 of funds that he had misappropriated from VBit investors.

On November 2, 2021, Vo gave his brother, Danny H. Vo, $500,000 of funds that he had misappropriated from VBit investors.

On November 16, 2021, Vo initiated the process of transferring $1,000,000 of funds that he had misappropriated from VBit investors into a trust for his minor daughter, which was later established and funded in 2022.

On November 16, 2021, Vo gave his friend $300,000 of funds that he had misappropriated from VBit investors, which the friend subsequently transferred to Vo’s wife, Phuong D. Vo.

On November 17, 2021, Vo gave his mother, My Tien Thi Nguyen, $100,000 of funds that he had misappropriated from VBit investors.

Between November 16, 2021 and December 21, 2021, Vo gave his wife, Phuong D. Vo, an additional $1.8 million of funds that he had misappropriated from VBit investors.

None of these family members—Diem T. Vo, Danny H. Vo, Phuong D. Vo, or My Tien Thi Nguyen—provided services or consideration in exchange for these funds, but instead Vo provided the funds as gifts. They have no legitimate claim to these funds.

Identifying VBit Technologies’ MLM crypto mining investment scheme as an unregistered securities offering, the SEC has sued Vo for multiple violations of the Securities Exchange Act.

Additionally an injunction against Vo is sought, as well as disgorgement, prejudgment interest and a civil penalty. The SEC is also looking to claw back investor funds Vo transferred to his family members.

Stay tuned for updates as BehindMLM continues to track the SEC’s VBit Technologies fraud lawsuit.

Any chance that the investors will recoup any of their lost funds?

Depends how much is recovered and what the SEC does with that money. I.e. that’s a question for the SEC.