RBI: Banks want nothing to do with Speak Asia

For as long as I can remember, I’ve maintained that in the face of any criminal investigation or pending subsequent legal action against Speak Asia, any civil action in an attempt to recover money owed to panelists is a waste of time.

For as long as I can remember, I’ve maintained that in the face of any criminal investigation or pending subsequent legal action against Speak Asia, any civil action in an attempt to recover money owed to panelists is a waste of time.

Common sense dictates that if someone owes you money and they’re under criminal investigation and/or facing criminal legal action – any attempts you make to recover your money will take a back seat and not go anywhere until the criminal matter is resolved.

Such is the case with Speak Asia.

Courts aside, in order to pay panelists the money has to go through banking channels. The problem here is that currently it is common belief that the Reserve Bank of India (RBI) cautionary circulated to banks in India is to blame for this.

The general implication put forth is that if the RBI retract this cautionary, that the banks will play ball with Speak Asia and payments will start rolling out.

This of course makes no sense whatsoever because in the cautionary, the RBI never actually ordered any of the banks in India to not do business with Speak Asia. This was asserted by the RBI in a previous ‘right to information’ (RTI) document sent to Speak Asia panelist Swapnil Kumar back in October.

Ergo, the banks are acting entirely of their own volition.

In this original RTI document, the RBI also declined to provide a copy of this circular. This could be construed as the RBI hiding something, but as it is well-known that the Enforcement Directorate and Income Tax Department along with the Ministry of Corporate Affairs are gearing up to take Speak Asia to court in December over charges of money laundering and tax evasion, one can conclude that the confidential information in the RBI cautionary is related to these criminal investigations.

The RBI themselves have stated they never launched a criminal investigation into Speak Asia, so it make sense that they’d pass on their own findings to other agencies who were doing so. And until these other agencies investigations were concluded, naturally this information would remain confidential.

Regardless, what’s important to take away from the RBI’s original response to Kumar is that they themselves at no time instructed any bank not to do business with Speak Asia.

Not happy with this response, Swapnil Kumar again fired off a second RTI to the RBI which I believe was mailed by the end of October.

Sometime within the last few days Kumar got his second reply and in it, once again the RBI confirm that they have not instructed any bank to not do business with Speak Asia.

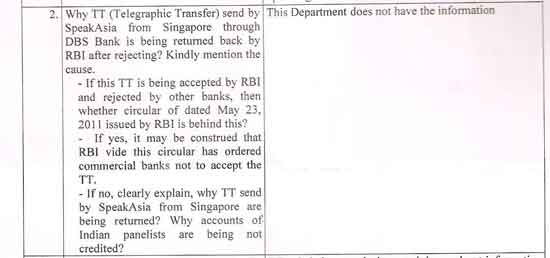

In his second RTI, Kumar specifically asked the RBI for an explanation regarding a rejected wire transfer of funds sent by Speak Asia from Singapore to DBS bank in India.

As you can see, to this query the RBI replied:

This department does not have the information.

And why would they? With the RBI already having explained that they did not instructed any bank to not do business with Speak Asia, it is clear that the banks are acting on their own accord.

The RBI cautionary no doubt mentioned that the RBI were looking into Speak Asia’s financials, along with the noting that Speak Asia was under investigation.

Or in the RBI’s own words;

We issued a confidential circular dated May 23, 2011 to all scheduled commercial banks to be more careful in opening and operating such accounts (of companies being suspected and investigated for being

‘money circulation schemes).

As neither the fact that Speak Asia is being criminally investigated, nor the RBI having formally announced the conclusion of its own investigation into Speak Asia has not changed, the logical train of thought is that the banks will thus continue to refuse to do business with Speak Asia until both matters are concluded.

The reasoning for this is simple and no doubt also explained in the RBI cautionary. If a bank is found to have enabled Speak Asia to conduct business in India, via means of using their banking channels, they are ultimately liable should the company be found to be guilty of a crime.

To date, the ED have announced plans to charge Speak Asia with money laundering, the IT department have confirmed Speak Asia and it’s management did not pay income tax, the MCA (through the SFIO) have announced they plan ‘to nail’ Speak Asia once their investigation is concluded mid-May and the EOW have announced that Speak Asia are ‘the biggest MLM fraud‘ they have ever investigated.

No doubt the banks are paying attention and will continue to reject any transaction attempts by Speak Asia into India. Simply put, there’s just too much liability on their part.

This liability remains even if the RBI cautionary is retracted, and as such there’s not much point calling for a retraction either.

Looking at the bigger picture, specifically the recently initiated mediation process between Speak Asia and its panelists moderated by former Chief Justice Ramesh Lahoti, once again I put forth that ultimately no conclusion from this matter can possibly result in payments being made to panelists.

This committee, referred to as the Lahoti Committee, was formed with the sole purpose of mediating a civil dispute between panelists and Speak Asia regarding non-payment of commissions owing.

Whilst the Lahoti Committee mediation process is ongoing, at its end ultimately panelists will either get paid or they won’t.

As it stands, with the banks refusing to do business with Speak (entirely of their own accord) – can anyone suggest how payment to panelists from Speak Asia is possible?

I mean it’s not like the Supreme Court can order a bank to do business with Speak Asia now is it. A court can hardly guarantee indemnity to a bank for servicing a client whilst criminal investigations are open and legal action are currently being prepared against the client.

That makes no sense at all.

The Lahoti Committee’s first meeting was last Monday on the 28th December. Despite sitting for four hours, as of yet no future date has been set for another meeting and even the details of the meeting itself have been kept out of the public sphere by all in attendance (including Speak Asia themselves).

One would think that should another meeting be required, a date could have easily been set on the Monday itself. But what if it isn’t?

Lahoti himself must know at this stage that any decision he makes is toothless until the banks are ready to conduct business with Speak Asia, and we know that’s not going to happen until the investigations into Speak Asia are concluded and the company is cleared of all criminal charges.

With no firm date possible for the above, could it be that Lahoti himself suggested so at the conclusion of Monday’s meeting? It would certainly explain why no future date has thus been set and also indirectly explain the deafening silence regarding what was discussed in the four-hour meeting.

Despite the constant dismissals and ridicule of the criminal action against Speak Asia by its members, ultimately they and the Lahoti Committee would appear to be at the mercy of their conclusions.

That said, why Speak Asia, its senior panelists and AISPA’s refusal to go public and relay this information to the company’s panelists remains a mystery.

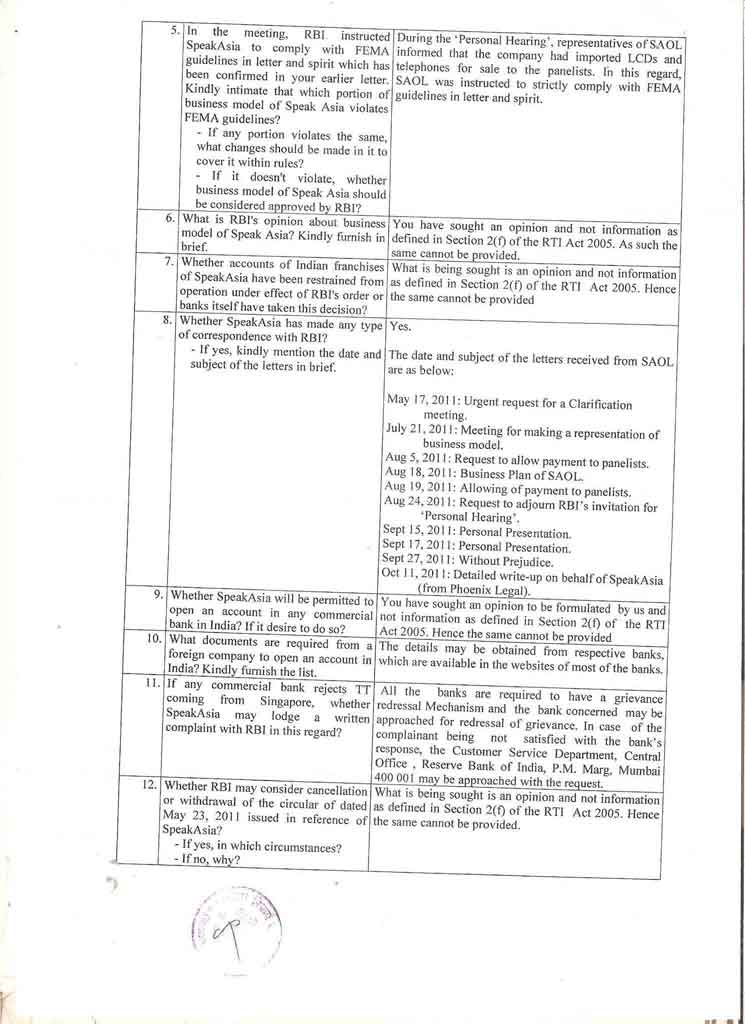

You can view the full November RBI response to Swapnil’s RTI below (click to enlarge):

Page 1

Page 2

Original RTI responses sourced from SpeakAsia MobiClub.

Dear OZ,

U very rightly said that RBI has not stopped the banking channelS, just cautioned the banks and very rightly as per his obligations towards the banks, as lot was coming on TV those days.

The RTI things is just a waste of time as nothing wld come frm it as nothing is der.

As for as criminal investigation is concerned it doesnt makes any sense in the wake of intervention of SC for amicable settlement of the dispute.

Now u talk abt money laundering or tax evasion and for one moment if we assume it is der….this is something which u also know can be settled any time.

Now the SC committee which u hv been talking abt is useless and toothless, can not change anything. Wat committee can do wld come out as it happens, pls dnt worry…

Wat i wanna say is that in this case watever info or conclusion u are drawing is based on the info u r getting frm the internet and seems like u r not applying ur brain. And it happens beacuse u r stuck on one thing i.e. banking channels cant happen so nothing will happen…but my dear friend dont forget nothing is permanent here…

and my dear friend u sld also know in cases like this the agencies wld never give complete info …that can never happen…and der wld always be incomplete info on internet and when u will use incomplete info for any research..u know wat will happen…….

So here only two things are worth discussing and they are whether SAOL really wanna pay or not……rest everything is irrelevant here…cos if u understand an iota of law..u sld understand wat i mean…

So pls apply ur brain whether the company is willing to pay or not…dont worry from where they wld pay….

We got confirmation from the RBI that they never instructed the banks to reject transactions by Speak Asia. Previously much hope was pinned that if the RBI retracted their cautionary, banks would do business with Speak Asia. The RBI’s clarification put this hope to rest.

Uh, as a business you can’t just ‘settle’ money laundering and tax evasion – these are crimes with consequences.

I’m not worried, just stating an analysis based on what we know. That is the banks don’t want anything to do with Speak Asia, so payments can not happen – regardless of what the Supreme Court decides or permits Speak Asia to do.

The internet isn’t investigating Speak Asia, the CID, EOW, MCA, SFIO, ED and IT departments are.

The internet didn’t book Speak Asia for money laundering, accuse it of evading paying tax and call it the biggest MLM fraud ever investigated in India, the ED, IT and EOW did respectively.

Of course not, but whilst the criminal matters/investigations are not concluded – as evidenced by banks rejecting Speak Asia’s transactions on their own accord – we can summarize panelists will not be getting payments anytime soon.

Despite participating in the SC action, Speak Asia of course already know the above as they are the ones having their transactions rejected. And if they had any legal recourse against the banks, they would have done something about it by now.

Conclusion: SC action is ultimately useless for now.

I’m pretty confident that’s what was discussed last Monday’s meeting and what Speak Asia, AISPA and the senior panelists have been advised by their lawyers not to inform the Speak Asia memberbase of.

Will is not enough, you need banks to pay. No banks, no pay.

We got confirmation

Now it confirms that u r a team of people who are hired for the job but yesterday u categorically said with ur discussion with observer that

Who’s ‘these guys’? BehindMLM is a one man operation.

So frm where now ” WE ” has come ?????? when arrogance takes the front seat, intelligence takes the back seat …

And rest of your comments are arguments and that too without a base. This also shows that u do not know about indian laws at all.

@M_Norway

Basically you’ve a section of 1.2 million ponzi scheme participants who are upset their money was sent off to Singapore by Speak Asia. Company management has been in hiding for months now and there is no office to call and no staff to take their enquiries. Senior panelists (their uplines) only feed them biased positive news and whilst the association AISPA was keeping them informed, after their President was arrested, they too have now decided to abandon the free flow and exchange of information to best serve their own interests.

The end result is a bunch of civil action being launched as they feel this will get them somewhere.

@vikrant

We is the general public and readers of the blog, who have access to the same information I do when I publish it.

So you’ve got nothing further to contribute other then ‘nananan you’re wrong because I said you are’? Everything is explained clearly and consisely to you, but it’s like banging a head against a brickwall sometimes.

Thanks for playing. Any future comments nonsense about BehindMLM being paid agents will be sent straight to the spam bin.

Thanks Oz for clarifying the things. Hope you keep on doing the same job for other Indian scams such as RMP infotec , goldsukh etc..

Do you have any thing about myvideotalk on this blog.

Please throw some light on a new MLM venture http://www.globalwealthyclub.com as per as my information goes it is a fraud company involved with money laundering with no specific product in hand for the consumers.

Moreover, consumers have already started complaining against it.

Please throw some light.

Guys I’d ask that request for mlm company reviews be submitted via the contact form.

@ankur

Not at the moment.

Their compensation plan isn’t currently available but they do disclose that

If all you’re doing is sharing the opportunity with others to earn a commission and there’s no retail product sales, then yeah – it’s a scam.

@soapbox

your pile of RUBBISH is getting so big i’m afraid you’re going to bury yourself any day soon.

justice lahoti ,saol,panelists and the rbi have already shared a nice hot cup of tea around justice lahoti’s desk.they are trying to resolve their DIFFERENCES ‘amicably’.

after a few more meetings when they get to know each other well ,the problems regarding the banks will be resolved.one word from the rbi and the banks will line up neatly and welcome saol.

i mean, what do you think they’re talking about in the lahoti committee-the weather?

also,there will be more meetings.i know the date of the next meeting but will i tell-no no no.

and about the ED and SFIO etc -you got all that from the press din’t you?like the interpol and red corner notices news?like the 200 complaints received news?

right right,carry on .

@ Vikrant

“As for as criminal investigation is concerned it doesnt makes any sense in the wake of intervention of SC for amicable settlement of the dispute.”

I really wonder if people understand clearly that till now Supreme Court has heard only one of the parties..i.e. SAOL and/or the Panelists Association.. the Lahoti Committee was appointed so that the Esteemed Supreme Court can get a clear picture of what’s going on.

rather than dealing with lakhs of Panelists individually, it can deal with a special report compilled by Justice Lahoti..but even than it wont reach to any conclusion before hearing the Govt. Agencies..and the Criminal and the Civil investigations are entwined in such a way that no passing of Judgement is possible without completion of both the proceedings…Oz..Chang..What do you say on this?..

Also in today’s hearing the President of Aispa might get Bail..(Hope the CEO of SAOL – if he is indeed present in India-and the Secretary of Aispa are present)…and hoping that unlike the SAOL tradition everybody is visible at a later stage when required by Law..

Hmmmm again it is surprising that no update/video/letter from the Kumars and Kaurs sitting abroad for weeks now..say does anybody remember meeting/talking with them lately????

Another thing I remembered when Phones were discussed here is that does anyone recon the amount of demur-rage that has piled up on the Import of the consignment of Rs 100 Crore lying in the Mumbai dockyards.. the cost of the goods now will shoot up to such an extent that……

Please stop using your common-non-sense and argue with factual data and clear logical reasons. Thanks

@mr y

why did the supreme court hear only saol?

nobody else ie the rbi ,mca , eow turned up.

why?because they had no charge against the company but were not cooperating with the company only because they were apprehensive about certain things.

so the supreme court said -sit together and thrash it out.

saol lawyers and aispa lawyers will soon figure out a way to stop the excesses of the mumbai eow,don’t worry.

the eow has confiscated saol’s first consignment of products.why will there be damages on the company?

@Andy

Agreed, I’m not even going to bother replying when the argument is ‘waaah the media are lying because I said so’.

I will respond to that though, if only to point out Ashok Bahirwani said it as fact without ever backing it up. Meanwhile the EOW have publicly stated that Speak Asia is ‘the biggest MLM Fraud they’ve ever investigated’ less than a month ago. Go figure.

Anju also seems to be under the impression that the EOW are the only ones investigating Speak Asia. Nevermind the SFIO report due mid December and the MCA announcing it expects ‘to nail’ Speak Asia by the end of the month. Oh and then there’s the small ED money laundering charge and IT tax evasion matters too.

Of course the media quoting the EOW are lying… but if Bahirwani merely mentions it… it’s gospel. Y’hit em with facts and they just run around screaming with their hands in their ears. The denial is quite comical at time.

As for the not turning up to the civil proceedings in the Supreme Court and Lahoti Committee, my interpretation of that is that civil action has nothing to do with them. The civil action takes a backseat to the criminal investigation, not the other way around.

That and should they turn up, perhaps it’d put them in a compromising position if Speak Asia were allowed to demand the current progress of the criminal investigation before it was finished. Who knows who Speak Asia would dissappear and send overseas to join Kaur and Kumar if they had access to the status of the investigation.

There’s just no point rocking up and all this nonsense about noticed issued to the authorities again and again will amount to nothing. Not till the investigations are done anyway.

@Mr Y

They were delivered to a pizza shop and then seized from memory. To date Speak Asia hasn’t explained to anyone why they had the goods delivered to a pizza shop. No doubt the paper work was dodgy which is why the goods were seized and when Speak Asia told the RBI they were importing goods, they warned them not to break FEMA guidelines.

Or maybe Speak Asia’s 60 page fake business model is in reality full of pizza recipes and this is yet another side of the business they claim always existed but they just forgot to inform anyone about it till after they were being investigated. So many lies, who knows.

@ Anju

Eow, Mca etc don’t work on apprehensions or hunches…they work on solid evidence and nothing else..The EOW guy..Rajvardhan has given definitive statements about the ongoings of the Co. Do you think that these Govt. Agencies and/or thier people will bullshit in front of the media just like that..Madamm..there is something called Accountability and Responsibility..

they will never ever blab off like “some people do” and say whatever comes to their minds just like that..even they are answerable to their Superiors..anyways there is no smoke without fire..Just wait and watch when they do come on..(it definitely is high time now that they get into their act)..Hence the Supreme Court is waiting and watching..(it off course has thousands of cases to look into apart from this)..

Anju..Anju..stop accusing the Eows of India ..its not going to lead you anywhere..They are just doing their Job..Decorating them with expletives is a just emotionally satisfying act of yours and nothing else..

OZ..Chang..any futher news about the Pal brothers..hope they are enjoying the show from the front seats..

And yeah..even though the Goods seized by Eow..some one will have to pay the charges if the goods are still lying in the Warehouses of the dockyards..hope they are in good condition after such a long time..after the conclusion of the case..

@mr y

if the rbi and the mca and the income tax were investigating saol and had not completed the process, they would come and tell the supreme court that.they would say judge ,we’re not done ,more time please.

they would NOT ignore a supreme court order to appear before it.

they would not let the supreme court set up a committee to ‘resolve the matter amicably’.

the rbi would not come to the meeting on it’s own accord on the first date itself.remember, the rbi has had a few meetings with the company and the end result was they advised saol,[not threatened-as soapbox put’s it] to follow FEMA regulations.

if the company had violated any fema regulations the rbi would have appeared in the supreme court and said so .

what is going on in the supreme court is REAL and except for the mumbai eow ,in such a huge country nobody else is trying to hold back saol.

soapbox ,as he himself proclaims ,is merely a guy with a keyboard ,dependent on the few and far between newspaper reports available to him.then he feeds off on information provided by us and just twists it around to suit his ‘against saol’ stance.what does he really know?

besides delhi eow and chennai eow have cleared saol.

well this point is clearly mentioned in the writ filed by aispa in the mumbai high court.many of us have been mailed a copy of this writ.

don’t say it soapbox, let me say it for you-now our lawyers are lying to the high court and guess what, they’ll never get caught because judges are stupid.

There is no independent confirmation of this.

If SpeakAsia can tell RBI they sell cellphones, actually bought TV from China instead, and claim to use a business model that was never implemented, I would NOT be surprised if they presented something that is not completely factually true to the court.

After all, if they have been cleared, there must be some sort of document from EOW in those two places, yes? Some could have gotten it with a RTI, yes?

The fact that OTHER branch of EOW sees enough evidence to proceed with their case while these two “cleared” SAOL… something doesn’t fit, and I am NOT taking AISPA’s word for it. Their version doesn’t make sense.

I believe RMP Infotec is covered by Shyam Sundar over on corporatefraudswatch.blogspot.com. Just be warned, He and Mr. Brear has a… unique writing style. They do have good info.

Even if SAOL pays all their panelists, it does NOT absolve them of POSSIBLY being a ponzi scheme / pyramid scheme. That’s what the criminal investigation is for, NOT for cheating panelists.

SAOL would like you to think that if they pay off the panelists all problems will be solved. That will not be the case. As explained before, if a murder suspect gave a fortune to charity, investigators will deem that act irrelevant, as it has NO bearing on whether he is a murderer or not. Actual physical evidence, motive, and opportunity will determine whether he’s guilty or not, NOT whether he gave to charity.

Same here. SpeakAsia may or may not pay the panelists, but the investigation into whether SpeakAsia is a pyramid scheme or not has nothing to do with the payments any more.

Speakasia timeline

================

Just for info (Sorry if it is not related with the ongoing discussion)

1-Feb-2010

FAQ – Nothing

http://web.archive.org/web/20100203015055/http://speakasiaonline.com/faq.aspx

Compensation – The team rewards can earn you income up to $5520 per day – Wow!!!!!!

http://web.archive.org/web/20100201174004/http://speakasiaonline.com/compensation.aspx

——————————-

10-Nov-2010

The concept http://web.archive.org/web/20101110005050/http://www.speakasiaonline.com/theconcept.aspx

FAQ – Survey income and much more

http://web.archive.org/web/20101110004730/http://www.speakasiaonline.com/faq.aspx

Compensation – Total daily referral income of a panelist on one survey panel can be upto 5520 Reward Points (Team Bonus – 1 + Team Bonus – 2) = 400 Reward Points + 5120 Reward Points

http://web.archive.org/web/20101110004714/http://www.speakasiaonline.com/compensation.aspx1 Reward Point = US$ 1 only.

————————————–

14-May-2011

FAQ – Same as above

http://web.archive.org/web/20110514054632/http://speakasiaonline.com/faq.aspx

There are so many changes after May 2011 and in last week but I am unable to trace it 🙁

Carry on Anju.. Good work keep it up.

You mean keep saying things like ‘I know but I’m not telling’?

Do you mean how she ignore the parts she got wrong completely?

After all, if they have been cleared, there must be some sort of document from EOW in those two places, yes? Some could have gotten it with a RTI, yes? -chang

duh.of course there are documents.our lawyers aren’t crazy.these clearances have come very very recently and of course ,if somebody makes an rti inquiry, they will receive the response in due course.

SAOL would like you to think that if they pay off the panelists all problems will be solved. That will not be the case. -chang.

please chang don’t insult us like this.we are completely seized of the matter and know the difference between the company paying and the company winning.

AND please get this clear in your head,the lahoti committee is not ONLY for the purpose of payments.

Speak Asia have already lied in court, so what does that prove?

I asked from where this information came from, and all you did was tell me it’s been submitted in court. I don’t care where it’s been submitted – from where is Ashok Bahirwani getting this information. He’s just pulled it out of his arse and now you’re regurgitating it here.

I’m pretty sure criminal investigations aren’t subject to freedom of information requests, let alone when the subject of the investigation is still being investigated.

Well that’s interesting… wasn’t AISPA one and only goal to get payments in the hands of panelists? When did they start worrying about other matters?

And wasn’t the only basis of the civil PILs filed by AISPA and panelists that led to the Lahoti committee solely for the purpose of demanding payment?

If not, it would appear you’ve all sold the Speak Asia memberbase the idea that their payments were the sole reason the Lahoti Committee’s was instigated when this is not the case.

Furthermore, what else is being discussed then in the name of 1.2 million panelists without their input or consultation. Again, what a farce.

They’re panelists aren’t they?

What does AISPA as an entity have to do with the PIL, are they as an association owed money? I was under the impression they were included because they had a PIL that was aiming for the same goal, to get money for panelists.

Given that’s the goal of the criminal PIL, I’d have thought they’d get representation too. Otherwise why would a judge withdraw or suggest they withdraw the Rajmani PIL if they get no representation at the Laohti Commitee?

‘Yes, yes, withdraw your PIL and put your trust in people who will not communicate anything to you and are working towards their own unknown agendas’.

That makes no sense at all.

AISPA – filing public interest litigations and then deciding it’s not in the public’s best interest to be updated. You guys pretty much lost any credibility you had and became irrelevant when when Bahirwani decided he wasn’t going to discuss Speak Asia with panelists anymore.

@anju agarwal

Withdrawal of the PIL means the Supreme Court will NOT handle the case any further. They won’t ‘settle’ anything if the PIL is withdrawn or dismissed.

Normally, the Supreme Court would not have been involved at all at this stage, in most other countries. A Supreme Court is the last stage in a court system.

The Lahoti Committee doesn’t seem to ‘settle’ anything, either. As far as I can see the committee only writes reports.

I’m not familiar with the system in India, but in many countries minor civil cases can be handled by a single judge (outside court, or in a simplified court). ‘Minor’ usually means there are only 2 parties in the case, and they’re able to come to an agreement. They can’t ‘settle’ anything if the case involves some other parties. A committee will usually not ‘settle’ anything between parties, but it will usually recommend some sort of solutions.

I believe the Lahoti Committee will write a report, where they identify parties and facts in the case.

If the Lahoti Committee was ordered by the Supreme Court initially, then I’m pretty sure they will terminate their work if the PIL is withdrawn or dismissed.

yes,but saol being a respondent in this case filed it’s reply to the supreme court in which it prayed to be allowed to pay the panelists and prayed to be allowed to run it’s business.

saol explained it’s business model to the court and the court in turn asked the various agencies to come forth and give their views on these matters but of course no one turned up.

so on an exparte basis the supreme court formed a committee to resolve saol’s problems with these agencies.

comeon now,right from the start aispa has been supporting the company.aispa wants payments and wants the company to restart.

the goal of the criminal pil was to have saol investigated.

the pil is not by panelist.

the single fir [khosla] is by a panelist who chose to approach the eow for his payment.so the eow will get him his payment.

the rest of the panelists represented by aispa and the 225 panelists who individually filed a writ in the supreme court took the route of the judiciary to resolve the payment problem.

well, we don’t see anybody complaining so what are you complaining about?

melvyn’s bail plea will now be heard on monday the 5 th.havent got details yet.

Well that’s kinda silly. I can tell you right now what the problem is: Speak Asia is being criminally investigated. Nobody is going to turn up to any civil action until those investigations are complete.

I thought that was the goal of the FIR. Why then, if the RBI announced an investigation back in May is the PIL still going. Obviously it’s not just to do with getting the company investigated.

Given that the money trail (via Seven Rings International) extends across India, Singapore, the British Virgin Islands, Holland, Brazil, Italy and who knows where else – what exactly do you think the Lahoti Committe is going to achieve?

Cresdibility and complaining aren’t the same thing, look them up.

Thanks for the update, wonder why.

Unfortunately, all these are speculations on your part, based on the assumption that SAOL lawyers do not lie.

And we all know what ASS U ME means, right?

kuntal/ankur, kindly dont bring myvideotalk into this. Soapbox will waste no time in tearing it down with the scam angle. This will ensure they get the hits required for his survival.

Myvideotalk is an honourable company, doing network marketing business the right way. Soapbox will do his best to tarnish the image. Please keep off from this dangerous zone

Viniben : could not understand if this was a comment in favour of OZ or MVT.

And how much of this website have you read to cause you to form this VERY DISTORTED opinion, that BehindMLM only talks bad? Or is that a dare for Oz to review that company? 🙂

@viniben

Uh, I don’t make companies scams – they do that on their own.

Good to see its confirmed. The senior panelists on Speak Asia powers were running around trying to convince everybody it hadn’t been confirmed he was arrested (despite the fact they took him in on Thursday I think it was).

Obviously this arrest is a result of the information gleaned from Crasto’s interrogation over the last week. I imagine now the EOW will interrogate Ashish Dandekar and then cross check the info with Crasto.

I wonder if their provided information will lead to more arrests?

Either way, the noose is tightening.

Manoj Kumar brought Speak Asia to India under this name, it was some education based scam from memory. I looked into it when researching information for the ‘Who is really running Speak Asia?‘ article.

AISPA Secretary Ashok Bahirwani has put out an update 3rd Dec with some interesting tidbits.

With Speak Asia’s $3000 deposits to President Melwin Crasto on hold, apparently money is running out to defend AISPA’s interests. So Ashok is begging ‘family members of Speakasians to please send in more monetary support by way of cheques‘.

They obviously don’t want bank deposits or anything traceable as bank accounts linked to Speak Asia would no doubt turn up other

$3000 payments from Speak Asiairregularities.Speaking of the Crasto arrest,

Yeah… because being paid kickbacks by the biggest MLM fraud in the history of India requires courage and subsequently being arrested for your involvement is obviously an ‘unjust’ act. What a crock!

And Bahirwani also has a go at the legal proceedings;

What happened to ‘respecting our honorary judicial system and process’ etc. etc. when he thought Speak Asia were just going to waltz into court, lie and be allowed to restart operations ASAP??

No doubt we’ll continue to hear how biased and ‘stacked’ the legal system is as the Speak Asia scam continues to implode from within as it gets wrung through the legal system.

Also Ashok has finally announced when the next Lahoti meeting is;

He doesn’t mention a specific day, but apparently it’s happening this coming week. Interesting is Bahirwani’s choice of words, ‘intervention.

What aspect of the Lahoti Committee are AISPA hoping to intervene on? Are they unhappy with Lahoti’s response thus far and discussion at the Committee?

Perhaps this is why Speak Asia, the senior panelists and AISPA have been silent on the progress of the committee…. they don’t like how it’s going and feel the need to ‘intervene‘.

Should be another interesting week, Monday is the Rajmani criminal PIL and next court appearance for Crasto and the Lahoti Committee is set to meet again… although we probably won’t hear anything at all about it unless the company can spin anything positive out of the discussion. They couldn’t do it last time so I imagine they’ll just continue to keep us all in the dark about it whilst Seven Rings International further and further distance themselves from the mess.

Who needs a bank account in India to pay panelists when u can pay by PayPal and the money will come directly into one’s bank account in India?

The question is to whether it is paying. No. They only want to restart their business in India as they were doing earlier. So go ahead and do business and pay by PayPal. What is stopping them?

Pay custom duty and demurrage to customs via PayPal for all your Chinese/Yug products. For their TV channel pay by PayPal. Monies from India can be remitted to you through another international payment method by your franchisees as PayPal can no longer be used by Indian citizens for making payments.