Sean Robertson sues Blue Ocean Society owners

Sean Robertson, a purported trader who worked for Blue Ocean Society, has sued the Ponzi scheme’s owners.

Sean Robertson, a purported trader who worked for Blue Ocean Society, has sued the Ponzi scheme’s owners.

BehindMLM reviewed Blue Ocean Society earlier this year, noting Robertson’s involvement in the scam;

The unnamed partner Blue Ocean Society refers to is Sean J Robertson (aka Sean James Robertson). Robertson has reportedly cashed out and disappeared.

Robertson as an “unnamed partner” pertains to an official statement put out by Blue Ocean Society on January 23rd. We’ll circle back around to this later in the article.

Robertson filed a Statement of Claim (US equivalent is a Complaint) on August 8th, 2025. Robertson filed in the Adelaide registry of the Federal Circuit and Family Court of Australia.

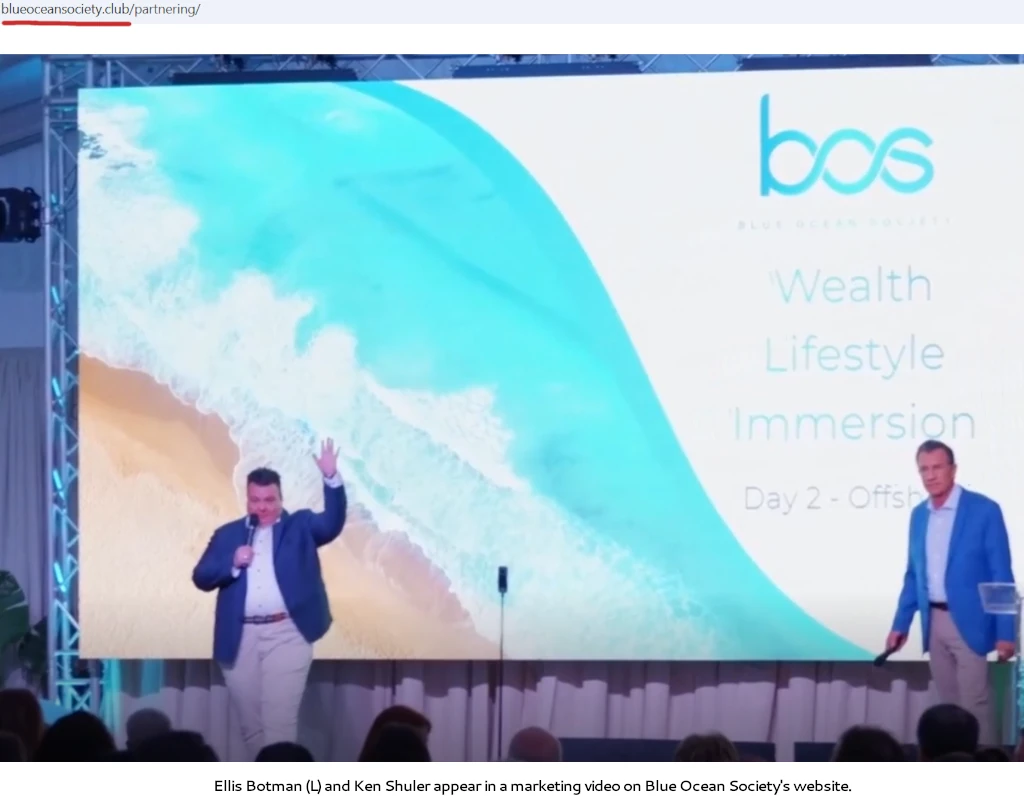

Robertson’s claim lists him as the Applicant. Blue Ocean Society co-owners Ellis Botman and Kenneth Shuler are listed Respondents.

In his claim, Robertson cites Blue Ocean Society as “an exclusive, invitation-only private wealth club” that

operated a number of managed investment schemes including but not limited to:

-an investment scheme known as “Raversus” with BOS promoting a return of 20% per annum;

-an investment scheme known as “Fully Funded Synergy” with BOS promoting a return of 16.67% per month;

-an investment scheme known as “Stratagem” promoting returns of 500% annually paid quarterly;

-an investment scheme known at “Tribe360i” with BOS guaranteeing 72% annual interest, paid quarterly plus potential performance bonuses of up to 600%;

-an investment scheme known as “SuperCo – PTI Initiative” with BOS promoting a return of between 300% to 500% in less than eight (8) months with capital contributions guaranteed;

-an investment scheme known as “PTI – Time Sensitive”;

-an investment scheme known as “South One” with BOS promoting a return of 8% per month (compounding);

-an investment scheme known as “Voice Life”;

-an investment scheme known as “Legacy Trading – 2 years” promoting 18% monthly returns for twenty-four (24) months;

-an investment scheme known as “Tap Reset” with BOS projecting returns of 300% to 500% over six (6) months;

-an investment scheme known as “Vicksburg Prospect”;

-an investment scheme known as “Power Pulse”;

-an investment scheme known as “365” with BOS promoting a return of 1% per day or 265% per annum;

-an investment scheme known as “Gold Harbor” with BOS promoting an anticipated 100% return “per trading cycle”;

-an investment scheme known as “Santa Rally 2023” with BOS promoting returns of 100% for a one (1) month investment in the case of Santa Rally 2023;

-an investment scheme known as “DAV Opportunity” with BOS promising a minimum monthly return of 11.5%;

-an investment scheme known as “Rally3” with BOS promoting returns of 25% per month during a three (3) month period;

-an investment scheme known as “Rally5”;

-an investment scheme known as “Rally7” with BOS promoting returns of 25% per month during a three (3) year period;

-an investment scheme known as “Rally10” with BOS promoting returns of 25% per month during a three (3) month period;

-an investment scheme known as “Rally Hybrid” with BOS promoting returns of 25% per month during a three (3) month period;

-an investment scheme known as “Wow 1”;

-an investment scheme known as “Wow 4 Nevis”;

-an investment scheme known as “Royal Blue” with BOS promoting a minimum return of 110% with the expectation of “5 to 25x (multiplies)”; and

-an investment scheme known as “Mingo”

Although he doesn’t disclose so in his claim, Robertson ran Gold Harbor:

In fact, despite his direct involvement, it is only after the fact that Robertson, in his claim, acknowledges Blue Ocean Society’s securities fraud.

Each of the Schemes were unlawful within the meaning of Chapter 5C of the Corporations Act 2001 in that each of the Schemes were required to be registered with the Australian Securities and Investment Commission.

Each of the Schemes was required to have a Constitution … and none of them had such a Constitution;

Each of the Schemes was required to have a compliance plan … and none of them did so;

Each of the Schemes was required to be operated by a single responsible entity … and none of them did so; and

Each of the Schemes was required to product Product Disclosure Statements … in respect of each and every investment if offered to retail clients.

This is strange because Robertson cites himself as being “experienced in trading commodities, securities related products on listed stock exchanges”. Robertson also claims he was approached to “undertake Trading Activities for BOS … in or around 8 August 2022”.

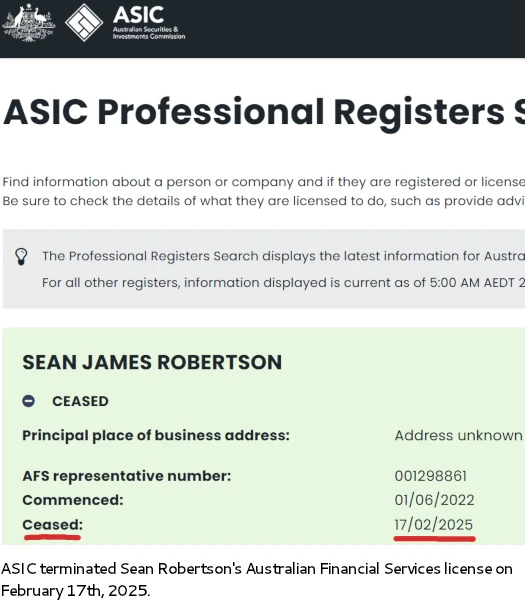

Robertson was clearly capable of identifying investment fraud; all one had to do was check Blue Ocean Society wasn’t registered with ASIC, and that no audited financial reports had been filed or shared with investors.

Yet apparently for three years Robertson failed to do any due-diligence. In fact, Robertson claims he only became aware of Blue Ocean Society’s fraud after “events following [his] engagement”.

Following the Engagement, [Robertson] commenced the Trading Activities under the Engagement.

[3 years pass]

In or around 25 February 2025, [Robertson] discovered that the [Botman and Shuler] were operating unlawful managed investment schemes.

The freezing of bank accounts operated by [Robertson] with authorised deposit taking institutions on account of his association with [Botman and Shuler], BOS and/or the Schemes throughout the Engagement;

Brokers refusing to deal with [Robertson] or otherwise closing brokerage accounts on account of his assocation with [Botman and Shuler], BOS and/or the Schemes through the Engagement;

Investors in the Schemes contacting [Robertson] or otherwise publishing articles:

-Describing the activities of [Botman and Shuler] as unlawful including as the perpetrators of a Ponzi scheme or series of Ponzi schemes; and/or

-Naming [Robertson] as involved in the Schemes or otherwise associated with [Botman, Shuler] and/or BOS in consequence of the Engagement.

Ah, so Robertson was fine with Blue Ocean Society’s investment fraud until it began to personally affect him.

It’s probably worth pointing out that, up until February 17th, 2025, about a week prior to Robertson claiming he became aware of Blue Ocean Society’s fraud, Robertson had his Australian Financial Services license cancelled by ASIC:

One might give Robertson the benefit of the doubt and take his “I knew nothing!” representation at face value, except, by his own admission, Robertson was “experienced in trading commodities, securities related products on listed stock exchanges”.

Circling back to the statement Blue Ocean Society put out in January 2022, referencing Robertson as an “unnamed partner”;

When we realized that our Island Partner—who was responsible for the Trading Islands—could no longer fulfill their obligations, we found ourselves in a difficult situation that, while completely out of BOS’s control, posed a serious risk to our members’ balances.

We understand how frustrating it can be to see sudden changes in your financial arrangements, and we empathize with any doubts or concerns you may have.

Earlier in 2024, we set out to secure external liquidity so that everyone’s withdrawal requests could be met while the Island Partner attempted to resolve things.

But as we arrived towards the end of the year, it became clear that the partner’s unprecedented challenges would drastically limit how much of the current Island Balances could actually be covered if we relied solely on that route.

We knew that wasn’t acceptable.

Leaving anyone empty-handed goes against everything BOS stands for. We made a decision to dissolve the relationship, and to move the reconciliation process with the Island Partner to the back-end so no member of BOS would be adversely affected by it.

Robertson was having troubles within Blue Ocean Society dating back to at least mid 2024. But uh yeah, Robertson had no idea Blue Ocean Society was committing securities fraud until February 2025.

I want to stress that Robertson’s involvement in Blue Ocean Society in no way absolves the liabilities of co-owners Ellis Botman and Shuler.

Both Botman and Shuler are serial fraudsters. Be it US authorities, Australian authorities or the countries working together, hopefully civil and/or criminal fraud charges are filed at some point.

What I take issue with is Robertson’s ridiculous representation that he unknowingly joined Blue Ocean Society as a trading insider, and knew nothing till February 2025.

Blue Ocean Society citing withdrawal issues specifically related to the unregistered investment schemes Robertson was in charge dating back to at least mid 2024, reveal that is clearly not the case.

Nevertheless, Robertson is suing Botman and Schuler for losses and damages.

From around 25 February 2025, and in consequence of the Applicant’s association with [Botman, Shuler], BOS and/or the Schemes through the Engagement:

-[Robertson] was unable to undertake the Trading Activities or otherwise was only able to engage in the Trading Activities on a limited basis; and

-[Robertson] received threats of violence directed at him and members of his family which required him to engage a security detail to protect him and members of his family from those threats.

In consequence of the matters pleaded … [Robertson] has suffered loss and damage as follows:

-lost profit from the Trading Activities; and

-the costs of and incidental to the security detail referred to.

In the premises, [Robertson] is entitled to compensation for the Loss and Damage … in an amount to be assessed.

Unfortunately, unless I’m missing something, details of active cases filed with the Federal Circuit and Family Court of Australia are only available to involved parties.

This means BehindMLM won’t be able to provide our usual level of coverage for MLM related legal action.

What we can share is Blue Ocean Society appears to have well and truly collapsed.

As of September 2025, SimilarWeb was tracking just ~7300 monthly visits to Blue Ocean Society’s website.

Top sources of Blue Ocean Society website traffic are the US (55%), Australia (32%) and Canada (13%).

ASIC issued a Blue Ocean Society securities fraud warning on August 18th, 2025.

Pending further action taken against Ellis Botman, Ken Shuler and insiders like Sean Robertson, Blue Ocean Society victim losses remain unknown.

You have to admit he has balls claiming even with all of his expertise, he couldn’t discern that he was up to his eyeballs in a massive Ponzi scheme.

Kind of like all the major pimps of OC claiming they had “checked out” OC and found nothing wrong. Then when their new suckers joining started drastically falling, lthey bailed.

Then they claimed they had been “Lied To” by the Crypto-Queen herself, Ruja. Never mind all the millions they stole, they were just duped like everyone else BS.

What I also find interesting is that if he was this great “trader” as he has claimed he is/was, his trades should have made more than enough money for these programs to succeed.

Guess he wasn’t this hot-shot trader after all. Funny how he never questioned the ridiculous claims of how much money the trades would return weren’t realistic. He truly believed these numbers were real? Of course not.

He is hoping the gullible will believe he was duped and fooled like his victims. He is no different that all the other Ponzi pimps and their claims.

He’s a victim my assets.

Ellis Botman, formerly known as “Lissy Botman” was a serial fraudster even before BOS. “She” fleeced investors of millions with the Multipreneurs brand which promised wealth & investment mentoring.

All she did was enrol people into Ponzi after Ponzi while charging exorbitant membership fees. She made a killing in commissions from these Ponzi’s while everyone else lost their money.

Both Botman & Ken must be held accountable.

Don’t think the case is going forward. Word has it Sean got paid off to shut up and go away.