Questra World collapses, suspends affiliate ROI withdrawals

For all intents and purposes, Questra World, Atlantic Global Asset Management and Five Winds are all the same company.

For all intents and purposes, Questra World, Atlantic Global Asset Management and Five Winds are all the same company.

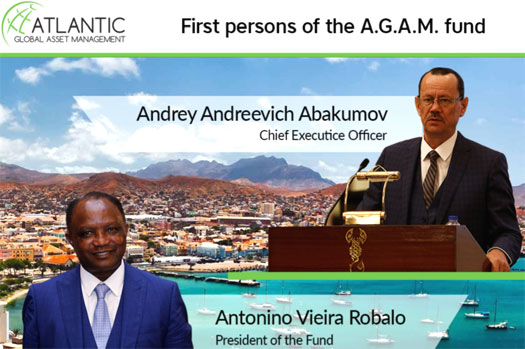

Atlantic Global Asset Management launched first and is/was headed up by CEO Andrey Andreevich Abakumov.

Atlantic Global Asset Management affiliates invested funds on the promise of a 300%-500% ROI in seven to eight months.

With new affiliate investment Atlantic Global Asset Management’s only source of revenue, it wasn’t long before Questra World was launched.

Questra World saw Atlantic Global Asset Management’s Russian roots take a backseat, with the company instead presented with Spanish management.

Heading up the facade is Jose Manuel Gilabert, who today continues to front the company.

Heading up the facade is Jose Manuel Gilabert, who today continues to front the company.

Through Questra World affiliates invested up to €500,000 EUR on the promise of a weekly ROI of up to 6.47%.

Having publicly shed its shady Russian roots, Questra World was arguably more succesful than Atlantic Global Asset Management.

Both companies operated in tandem though, with investors in one company commonly also invested in the other.

Eventually Questra World also started to collapse, which prompted the launch of Five Winds Asset Management.

Five Winds operates as a faceless company, although is quite obviously owned by Andrey Abakumov and his partners.

Five Winds operates as a faceless company, although is quite obviously owned by Andrey Abakumov and his partners.

Up until recently Questra World, Five Winds and Atlantic Global primarily targeted investors in Europe.

Regulatory warnings issued by Austria, Poland, Italy, Slovakia and Belgium however, have turned up the heat.

This has seen the company start to focus on Asia, with South Korea in particular emerging as a potential source of new victims.

Bogged down with investor ROI liabilities it can’t pay and regulatory problems in Europe, today the companies announced they were formally moving to Asia.

In true Ponzi fashion, Atlantic Global’s Russian management are in hiding.

Citing “health issues”, they failed to appear on a November 7th company webinar in Madrid, Spain.

Instead the webinar was fronted by Heung Sup Han, who introduced himself as the new owner of Atlantic Global.

Han is from Korea and through Asia Trade Group Limited, a shell company purportedly incorporated in Hong Kong, claims he’s now running the show.

Whether this means Atlantic Global’s Russian owners have sold up or are just operating from even further in the background is unclear.

In any event, the first order of business for any Ponzi scheme on the rocks looking to reboot is existing ROI liabilities.

Han’s solution is to suspend affiliate ROI withdrawals and investor support for three to six months.

The ruse behind this decision is Asia Trade Group Limited conducting “due diligence” on Atlantic Global.

This of course makes no sense, as due diligence of any legitimate company occurs prior to its sale and while it’s still operating.

Management and Asia Trade Group Limited (Hong Kong holding company).

Whereas Atlantic Global was tied to nonsense about an airline going public, Questra World to advertising and marketing and Five Winds to IPO investment, Asia Trade appears set to attach itself to an ICO.

Over the past two years launching an ICO has emerged as a “go to” model for Ponzi operators.

Details of Asia Trade’s ICO have yet to surface, with the company effectively buying itself at least six months to deal with investor losses.

If I might be so bold as to make a prediction, investors with losses across Atlantic Global, Questra World and Five Winds are probably going to be given pre-mined altcoin tokens.

Throw in the usual promises of Asia Trade’s altcoin being the next bitcoin and projected worth of a bajillion dollars, and that’s likely to be the next phase of the scam.

Nobody will address why Atlantic Global, Questra World and Five Winds failed, and round and round we go.

There is a Heung Sup Han on G+ with profile created Feb 2015… and it’s the same person as he’s wearing the same glasses, same shirt, and same jacket with same hankie in the breastpocket. However, there’s no info. His followers do include a good number of Koreans.

The photo shown above appears to have been cut from an interview photo from denik.cz where it was quoted “Korean Merchatn Heung Sup Han loved Palava wine”.

NOLINKS://breclavsky.denik.cz/galerie/foto.html?mm=6626084-mikulov-heung-sup-han-jizni-korea-moravska-vina-obchod-dovoz

Rotten filthy scam. Good riddance!

swivel on that Claire Hartman James, now go and refund the suckers you signed up.

It’s a plan, both company will merged to the superior. so nothing to worry.

It’s a plan alright, a plan to screw Questra World affiliates out of even more money.

Definitely something to worry about if you’ve invested.

I’m invested it but right now all the funds are freeze due to new owner.

Superiorly SCREWED is what is taking place. Do people really fall for the DUE DILIGENCE after your take over a company?? Amazing if anyone actually believes that and then has the balls to tell others!!!

USI Tech will be next if it is not already…

It’s all about the offer and temptation not due diligence.

Can someone point me to the Internet link of the AsiaTrade Group Limited?

I cannot found any information’s about them.

The only matching name has a “Dead” status: offshoreleaks.icij.org/nodes/228865

Another one which may match, has a completely different logo: asiatradegroup.cn

And I cannot found any information’s about the relation between Mr Heung and a AsiaTrade.

Only that he is the owner of an import/export shop in Switzerland specialized in Videos goods, cosmetics, coffee and wines….

Dear sir, sir I am form india I want A.G.A.M company restart in November month otherwise very big problem face on working.

we are invest money in your company team is break in our side please start November month thanks

Asia Trade is a shell company, there’s likely no information available on it.

Hong Kong charges a fee for corporate information from memory.

If Agam buy doesn’t work, Mr. Heung can still sell Czech Wines as before:

theseoultimes.com/ST/?url=/ST/db/read.php?idx=13081

AGAM sham!

Link of asia trade: icris.cr.gov.hk/csci/search_company_name.do

@SubratPaul:

Thanks, but you to have register (and probably pay fees) to access this search engine.

If this company AsiaTrade really exist, it should be possible to found information’s just with a Browser.

But nothing like that here….

Some more information’s:

On 18th October 2017 the Asia Trade Group Ltd, a “deactivated” (not deleted) company, was “reactivated” by Mr. Heung Sup Han (3 weeks before the Questra/Agam conference) under the registration number CR2208240.

The new address of the company is the own address in Swizerland: Seestr.104, 8802 Kilchberg.

This is also the address of the “HAN ImEx & Consulting” specialized in Import/Export (Wine, Cosmetics, Coffee….).

I have found some more info on this guy, he has been dealing with rare wine for quite a long time in EU and this is an alternative investment.

Maybe in this sense, Asia Trade can invest into other projects like AGAM?

Btw, I wrote them an email and I figured out that due diligence can not guarantee that they will buy AGAM and they posted some information about negotiations with other projects. But good thing Han is interested in AGAM at least.

You do know this is all Ponzi smoke and mirrors right?

Han isn’t some saint who intends to make all of your Christmas ROI withdrawal dreams come true. He’s in it for himself, same as all the other Ponzi admins.

Mr. Han is exporting wine from Slovakia and he run for this the “HAN HS, sro” in Slovakia.

But the last financial results are not really great: Revenues for 2016: 0 Euro (!), Lost: 1089 Euro (!): finstat.sk/46168711

For this reason I cannot imagine that Mr. Han will be able to buy AGAM. Isnt it?

@Ponzo: If he still has €1 in his pocket then yes he can afford to buy AGAM.

When you have a company whose liabilities exceed its assets, and an investor buys it because they think they can turn it around, the company is generally sold for a nominal €1 – the real price the buyer is paying is the assumption of its debt burden.

Obviously this is a Ponzi scheme and the new owner isn’t there to turn it around but to milk it for a bit longer while the old owners make good their escape.

Apart from Tokay which is a sweet dessert wine and mainly comes from Hungary, neither Slovakia or the Czech Republic are noted for wines. In fact here in the UK I’ve never seen wines from those countries on sale. Wines from Hungary and Bulgaria are available but with the exception of Tokay they are cheap and nasty – great for cooking with or getting drunk cheaply if you’re desperate but no good for anything else.

I could understand it if Mr. Han was importing Czech and Slovak lagers because those products have good reputations but Slovak wine? Nah, the only people that will buy them are the stupid and the gullible.

@Milliem

I’ve had very nice wine from Bulgaria, as well as Slovenia and Croatia. But Czech Republic and Slovakia are much further North so I wouldn’t be surprised if Slovakian wine was paint stripper.

Just felt I should stick up for Bulgarian wine.

@Ponzo

Hmm, then Manchester United Club with its -500 mln have no chance to survive.) A lot of companies have negative balance but still operate on the market. I assume Mr. Han has just started his activities on behalf of Asia Trade Group Ltd.

@Malthusian

I do agree with you, but there is no new owner anyway. Perhaps they will change their mind about the purchase of AGAM, who knows.. Depends on the outcome of the due diligence procedure.

That’s debt. Ponzo was quoting annual losses. If you don’t know the difference between a company’s losses and its debt this isn’t going to be a productive conversation.

Manchester United make £120m annual profit from gate receipts, TV money and merchandising. That £120m a year profit means they can easily afford to pay their £500m debt.

Where is the money to pay AGAM’s liabilities going to come from?

@David

You have probably overlooked these information’s:

On 18th October 2017 the Asia Trade Group Ltd, a “deactivated” (not deleted) company, was “reactivated” by Mr. Heung Sup Han (3 weeks before the Questra/Agam conference) under the registration number CR2208240.

The new address of the company is the own private address in Swizerland: Seestr.104, 8802 Kilchberg.

Means: Mr. Han (a one-man company) IS the Asia Trade Group Ltd.

@Ponzo

Could you, please, explain, what is the difference then? Perhaps, I missed something. Okay, there are many one-man companies, but that means actually nothing.

@David

Since you’re back (merry Christmas), maybe you could first answer my question on where the money to pay AGAM’s liabilities is going to come from.

And a second question, assuming that Han does actually have the money to pay AGAM’s Ponzi liabilities, why would he do so? How’s he going to get a return on that money?

This has nothing to do with due diligence. As has already been said, if due diligence was still going on, Han wouldn’t be the “new owner” yet. You don’t become the new owner of anything until *after* you’ve done due diligence.

The point of Ponzo’s posts is that there is no evidence that Han has any money which he could inject into AGAM to allow payments to investors to restart. And even if he did there is no reason he would.

You don’t take over a collapsed Ponzi scam to put money in, you take it over to squeeze a bit more out.

@ Ponzo

I think, the address Seestr. 104 in 8802 Kilchberg looks like an office building, not private:

share-your-photo.com/img/a199444052.png

Source: Google maps

A german blogger researched some more details on:

burrenblog.com/tag/asia-trade-group-limited/

@Malthusian

I do perfectly understand it, and there are banks that require 10% to get a 100% loan.

Agam could easily organize such a divorce… This is not their first year on the market.

Nevertheless, due diligence will sort everything out or at least Han shows up once again with other projects, then we can be sure he is serious.

By the way, Merry X-Mas and Happy New Year!

I have no idea what this is supposed to mean.

Han has appeared in company literature as the “new owner” and has appeared in a webinar as leader of the new company.

That means due diligence is over. It’s done. Han has done the due diligence, and decided he was happy to take over AGAM.

If Han is going to inject any money into AGAM so that payment of ROIs can restart (again, why would he?) the time for that is *now*.

The longer you let yourself be strung along by nonsense about “due diligence”, the more you will lose.

@Malthusian

AGAM is said to have certain assets (no one knows if that is true though, but they have said that) and European banks easily give the loan to such projects based on the assets the company possesses.

Regarding due diligence, it has just started, it cant be finished that quickly and its a normal practice.

It’s not being strung along, I’m just curious. Nevertheless, Han will be fine with other stuff, in case he decides not going for AGAM, I guess.

When Will questra world star’s working?

for all that have invested in this company we should all move on to the next opportunities.

i have been checking for updates on the company and there is nothing so far. so sad.

Questra World has already “worked” for those running it.

Investors such as yourself gave the admins money on the promise of impossible returns. The Ponzi scheme collapsed and the admins did a runner with your money.

Working as intended.

What is happening now with the 12 weeks waiting period after it was announced that Questra have new owners….. are we loosing our money.

You’ve already lost your money. You just pointlessly gave the Questra World Ponzi admins an extra twelve weeks to cover their tracks.

@Nicola Diener:

Nope, the waiting period for this due diligence is 6 months (24 weeks).Probably the longest in the World.

Confirmed by AsiaTrade itself: asiadevelopment.com/blog/hello-world/

I swear, this is better than watching the ‘Jerry Springer Show’.

Good and detailed review! Not sure about Asia Trade.

I´ve had a trust in Han way before this thing showed up. Many of his businesses brought me and my family a big wealth.

I am supporting the idea of Due Diligence since at the end Asia Trade rejected the idea of buying them. The thing with the ownership is messed up a bit and rumors are different.

I am just following my logic and experience I´ve had with Han. Best of luck!

Hi, all investors of Agam and questra why nobody is raising your voice against the long silence from them.

It is minimum responsibility of the company to give information on exact process going on which are running with the investor’s money. It is very sad about the unworthiness of the company.

I sincerely request you all let us find the way to bring them down and must see them to be punished by law for deceiving the common people. Please raise the voice and search the way to reach the burglars.

I think AGAM is scammed because no body give the reply from the AGAM website now what we do if the AGAM not give authority to withdrawal???????

kindly anybody can explained or told about AGAM policy it can be running position or not??????

Sure. AGAM and Questra World are a Ponzi scheme. You’re not supposed to be able to withdraw your money after a scam has collapsed.

It’s mean we have lost our All money.

I would like to agree with some of the comments mentioned above. Asia Trade is a responsible company, very professional.

Due diligence is an official and registered procedure. It is known that Asia Trade did not buy AGAM at the end, but for some reason, the light is still shining on them as if they are the same as agam or questra.

If you give tips to a taxi driver but then he crashes during his way back home doesn’t make you guilty of this situation.

What’s the point of speculating on asia trade- don’t know, but I know they are professional and there is no doubt they will keep moving forward to search better business opportunities. But i never had any doubt in them.

What had happened is not right! Asia Trade dumped AGAM after due diligence and that leaves all of the investors ‘hanging’ without any ideas how to pursue..

As an investor what will be the next option?

Seeing as this is a Russia/Ukraine Ponzi scheme, you don’t really have an option.

Your money is gone and your local authorities are hardly going to chase up where it went cross-border into Russia.

Kazakhstan might recover something but unless you live there you’re probably not going to see any of it (and even then).

No doubt – Questra has collapsed about an year ago (followed by a failed attempt to reboot with Lianora/Five Winds in Europe).

But there is a “funny” side of collapses like this (providing you are not a deceived “investor”). Let’s have a fun with this video message from the current (alleged) CEO of Questra:

facebook.com/questraworldengland/videos/943455585802737

2 minutes of bullshit excuses (“I understand you investors are scared, angry and disappointed now, but still there is a hope we get out of the shitty situation… and you know, I am a good man!”)

Broken English (from the CEO of international company!), no real information, stand-up footage in the streets with a lot of noise around, recorded on mobile (video shot in vertical orientation!). Very professional. 😉

Looks like multi milion EUR company is running out of the money to rent an office, a professional recording equipment and put their CEO in the kind of business suite.

Bottom line: according to some sources, former CEO Jose Manuel Gilabert resigned and this tragic clown were appointed to this CEO position (to face the anger).

Uh, so the new CEO of Questra World is Euro Neo?

Video is week. Needs more fact spots.

And Gilabert didn’t resign, he ran off with the money he stole as shit came crashing down.

🙂 Call it whatever you like. Of course, Questra fan sites and facebook groups call it in other way (diplomatic).

Well one thing though one year on why is the AGAM QW Lianora Five Winds site still up and operational and support still do answer messages?

The so-called Ponzi guys behind this supposedly scam should have closed up shop just like Biznet did. Why keep the websites open?

To keep hope alive.

Hopeful gullible investors don’t complain to regulators.

Oh.. a big source of revenue for any company that has gone scam are the funds they receive once the general MLM’ers/ Affiliatire Marketers now it is a scam…. but the general public who dont think twice about checking Google… make deposits…