R Network committing securities fraud thru “stock ownership”

![]() In a recent official R Network marketing video, a “common stock ownership” scheme was pitched to prospective affiliates.

In a recent official R Network marketing video, a “common stock ownership” scheme was pitched to prospective affiliates.

Neither R Network or their executives are registered with the SEC, meaning the offer constitutes securities fraud.

The marketing video in question is part of R Network’s current “90 day awareness campaign” promotion.

The video is hosted by R Network Master Distributor Jon Holbrook and Jeremy Jenkins, “the first person” Holbrook enrolled.

R Network first came to BehindMLM’s attention in April 2019. Back then Founder Richard Smith was pitching RevvCard, a debt card that, to the best of my knowledge, never launched.

RevvCard appears to have been quietly dropped and now R Network is marketing an ecommerce platform.

Affiliates pay $25 and then $50 a month on subscription. Commissions are paid when they recruit others who do the same via a 3×10 matrix.

Mixed in a free membership options, constituting R Network’s retail offering. Based on the tone of Holbrook’s and Jenkin’s presentation however, the money is in recruitment.

Around twenty-five minutes into the presentation Jenkins pulls up a slide detailing “common stock ownership”.

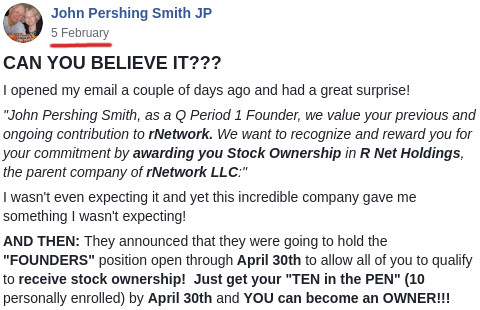

As per the screenshot above, R Network affiliates qualify for common stock ownership by recruiting ten affiliates by June 30th.

As explained by Jenkins, common stock ownership is offered on the representation R Network will be “going public in late 2020”.

[24:55] We are going public this year in 2020. And we’ve got a promotion going.

For all those who have personally enrolled ten people there is a stock package for you.

It’s a thousand shares and we’ve extended it because we want to make sure any(one) can participate.

If by the end of July you have enrolled ten people, you will get that stock package.

Putting aside whether R Network does or doesn’t go public by the end of 2020, if the company is awarding affiliates stock now that’s a public securities offering.

As I stated at the beginning of this article, neither R Network, R Net Holdings, founder Richard Smith or presenters Jon Holbrook or Jeremy Jenkins are registered with the SEC.

That means irrespective of anything else, R Network is committing securities fraud.

Jenkins mentions R Network’s stock ownership scheme has “been extended”, suggesting its been available for some time.

The video cited in this article was uploaded to Jeremy Jenkins’ YouTube channel on June 10th, 2020.

R Network is based out of Utah. Whether the SEC takes any action against the company remains to be seen.

Update 19th March 2021 – As of March 2021, R Network has effectively been merged into iX Global.

Update 24th March 2021 – Jeremy Jenkins has removed the YouTube video cited in this article from his channel.

Hey Oz, I wanted to personally thank you for keeping everyone on their toes in our industry. I really do appreciate the work you do in keeping people safe from the scams out there.

I have followed your site for many years now, ever since I got burned at TVI Express back in 2009 and I must say I have learned a ton about what to look for in a company to avoid the bad apples.

So to address your concern about my video with Richard and Jon, I admit, we should have been way more clear on how the offering works and used a disclaimer. I have since edited the video to remove the section on the promotion per your advice.

The way the promotion actually works is that if someone achieves the rank of Power10 by July 31st, they will be contacted by customer support and informed that they now will need to maintain their Power10 status for 11 of the next 12 months.

IF they do so, at that time they will be contacted by a representative of the parent company R Net Holdings (following the rules of the SEC) and allowed to purchase up to 1000 shares of stock at 1 cent each share. No stock is being issued right now and will of course only be made available after the IPO.

Moving forward, our official presentation will contain a disclaimer that we are not licensed brokers and we do not represent any specific security and that for details on the promotion they need to contact the support department.

Regarding the Revv Card, yes, the name has changed but the idea of the rNetwork Bank and getting paid on swipes from the rDebit Card is still very much happening.

There were some concerns behind the technology of the smart card that they are still working out, but the bank and debit card will still be happening later this year. For more details you can watch the CEO call from Trent Walker, starting at minute 18:30 here vimeo.com/420086509

Thanks again for helping us stay compliant! I am grateful.

Hi Jeremy, thanks for taking the time to respond.

If you’re using stock, virtual or otherwise, as a marketing incentive that’s still a securities offering.

Your MLM opportunity can’t have anything to do with stock (again a virtual offering at this stage or otherwise), unless you’ve registered the offering with the SEC.

Thanks for the update on RevvCard, I’ll check in if I find myself covering R Network again.

Please reference the official announcement from rNetwork Corporate dated May 26, 2020.

The following statements were prepared and approved by our SEC attorney. Any deviation from these statements is not official communication and should not be construed as such.

Please direct all legal inquiries to (removed)

Link to HTML email: conta.cc/3fmdSka

Original text in its entirety:

This, right there. Using virtual shares as a marketing tool pitched at the general public is a securities offering.

Whether the virtual shares need to be registered with the SEC or not is irrelevant. It is the act of using the shares as a marketing tool that constitutes a securities offering, not the shares themselves.

The virtual share offering is being made on the implication said shares will passively accumulate in value after purchase. This needs to be registered with the SEC.

Saying a securities offering isn’t a securities offering doesn’t change the fact it’s a securities offering.

@KW, did your SEC attorney explain that stock options are also a security? Offering unregistered options is an SEC violation.

I get that you may become public and trade in the Pink Sheets, but even though your shares are not regulated, you must still be in compliance with ALL SEC rules and guidelines, including their fraud and misrepresentation rules – which you are already violating.

Get a new SEC attorney, then ask if he knows a good criminal attorney. You are going to need one.