SEC confirms federal fraud investigation into NovaTech FX

The SEC has confirmed a federal investigation into the NovaTech FX Ponzi scheme.

The SEC has confirmed a federal investigation into the NovaTech FX Ponzi scheme.

Following non-compliance of investigative subpoenas served on Dap Dunbar and Corrie Sampson, the SEC obtained a court order enforcing compliance.

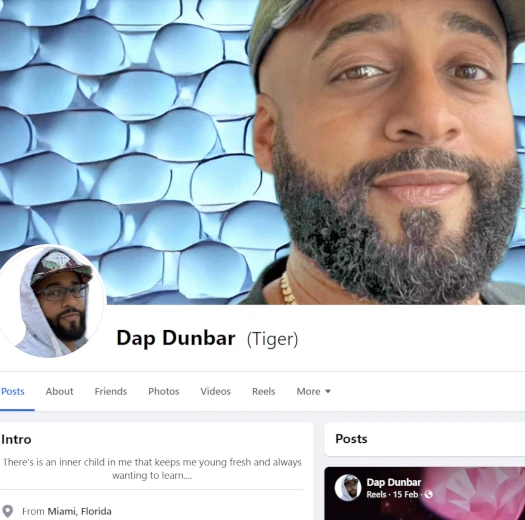

Dap Dunbar, aka Dapilinu Dunbar, refers to himself as “Mr Amazing” and “Tiger”.

On his FaceBook profile, Dunbar claims to be a Florida resident. Dunbar promoted NovaTech FX as “Team Diamond”.

On his FaceBook profile, Dunbar claims to be a Florida resident. Dunbar promoted NovaTech FX as “Team Diamond”.

The SEC claims Dunbar has “approximately 10,000 investors in his [NovaTech FX] downline”. Collectively, Dunbar’s victims invested “at least $50 million” in cryptocurrency.

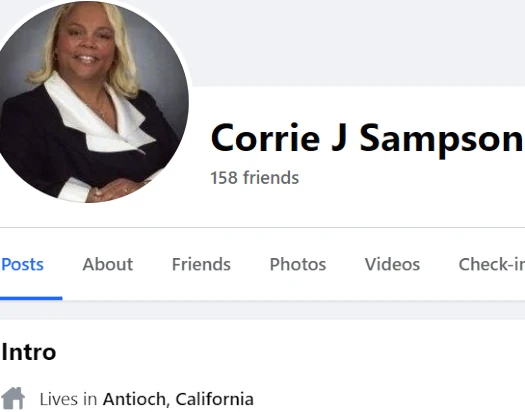

The SEC cites Corrie J. Sampson is cited as a co-founder of Team Diamond and appeared alongside Dunbar in marketing webinars.

As per her FaceBook profile, Sampson is a resident of California.

Quoting Sampson in NovaTech marketing material from January 2023, the SEC claims Team Diamond had ~50,000 investors who together invested “over $296 million”.

As top promoters of NovaTech FX, Dunbar and Sampson are believed to have personally stolen a significant amount of money. And that has caught the attention of the SEC.

The SEC is investigating whether certain persons, including Dunbar and Sampson, violated the federal securities laws in connection with the offers and sales of interests in NovaTech, a purported crypto asset investment program marketed to individual investors in the United States and worldwide.

As set forth in the SEC’s filing, NovaTech uses a multilevel marketing program to recruit investors into its program, and Dunbar and Sampson achieved the second highest and highest ranking, respectively, within the NovaTech multilevel marketing program.

The SEC issued subpoenas on Dunbar and Sampson in June 2023 and July 2023 respectively.

In addition to providing testimony before the SEC, the subpoenas seek information on

- “communications and documents … regarding NovaTech or AWS Mining”

- “social media posts regarding NovaTech, and … communications with prospective or current NovaTech investors, or with NovaTech’s principals, employees, or agents”

- “crypto asset wallet addresses, including wallet addresses from which Dunbar [and Sampson] received crypto assets from NovaTech, wallet addresses to which Dunbar [and Sampson] sent crypto assets to NovaTech, and wallets or accounts through which Dunbar [and Sampson] bought, sold, transferred, and/or traded crypto assets”

Dunbar confirmed to the SEC he had information relevant to the subpoenas at his appearance on August 21st, 2023.

As of December 13th, 2023 however;

Despite numerous attempts to secure compliance with the subpoenas, Dunbar failed to produce certain documents in his custody, possession, or control responsive to the subpoena and Sampson failed to produce any documents and to appear for testimony.

This prompted the SEC to request an order from the court, which was granted on February 13th;

The court granted the SEC’s application and ordered Dunbar and Sampson to produce documents responsive to the Commission’s subpoena and ordered Sampson to appear for testimony.

Should Dunbar and Sampson fail to comply with the subpoenas, they run the risk of being held in contempt of court. This can lead to the issuing of arrest warrants and temporary detainment pending compliance.

NovaTech FX was an MLM crypto Ponzi launched in 2019. The fraudulent investment scheme was run by serial Ponzi promoters Cynthia and Eddy Petion.

NovaTech FX collapsed in February 2023, after which the Petions went into hiding. Their current status and whereabouts remain unknown.

In filings related to the Dunbar and Sampson subpoenas, the SEC estimates NovaTech FX took in over $200 million from investors.

Between June 2019 and May 2023, NovaTech raised over $200 million in crypto assets from thousands of investors.

Given the scope of NovaTech FX and the majority of its investors being US residents, it’s highly likely any SEC enforcement action will be accompanied by criminal charges from the DOJ.

A criminal investigation into NovaTech FX however remains unconfirmed at this time. We will likely only be able to confirm pending unsealing of a filed indictment, or arrest of the Petions.

Of note is back in October 2022, Cynthia Petion endorsed Heather Bilange’s claim that the FBI had “audited and approved” NovaTech FX.

The SEC’s Texas office began investigating NovaTech FX in February 2023.

The SEC’s Investigation, to date, has revealed, among other things: NovaTech’s principals and founders include Cynthia Petion and Eddy Petion.

Before NovaTech, the Petions identified as high-ranking members of AWS Mining,7 which was subject to an Emergency Cease and Desist Order issued by the Texas State Securities Board (“TSSB”) on December 6, 2018.

In that Cease and Desist Order, the TSSB found that AWS Mining engaged in securities fraud in connection with cryptocurrency investment contracts that were marketed and sold to investors using a multilevel marketing scheme.

BehindMLM first reported on the SEC’s NovaTech FX investigation back in August 2023. Our source was EmpiresX’s Joshua Nicholas.

In addition to the SEC’s confirmed investigation, a civil RICO fraud lawsuit against NovaTech FX and the Petions was filed in New York on February 5th.

Pending further updates on the SEC’s NovaTech FX investigation, stay tuned.

Update 13th August 2024 – The SEC has sued NovaTech FX, alleging over $650 million in securities fraud.

Dap Dunbar and Corrie Sampson are named defendants in the SEC’s case.

Reminder: “hOw Do I gEt My MoNeY bAcK?” or anything close to it = spam-bin.

On a lighter note:

SEC: SEC, open up!

Dap Dumbass and Corrie Sampson: bUt We’Re NoT fInaNcIaL aDvIsOrS, tHiS iSn’T fInAnCiAl AdViCe!

Court: That’s nice. Now bend over scammers.

No wonder Eddy and Cynthia went quiet.

Wow, this guy, Dup Nunbar, was the one that was last to talk to us after the Petions stopped.

He sounded so spiritual, always talking like a real Christian man of God (there are many so called Christian men that would never know to talk that godly), he really deceived us, we believed what he was saying… but then he disappeared as well… and now I see this post… wow, he was lying all along…

These two were the biggest scumbags after Novatech’s collapse. They kept promoting and lied nonstop well after its collapse to siphon more money out of people, all the while talking about God.

Hope someone recorded those zoom meetings. Anyway, so glad these two scammers are being punished finally.

Hopefully the head of the snake is next, the Petions and Ricardo Roy.

I invest over $25000 in Novatechfx. there was still ongoing recruitment presentation after January 2023 knowing that the company was collapsing.

How likely will these scammers be forced to pay back our hard earned funds.

Disgorgement and restitution are typical claims in SEC filings.

You’re getting ahead of yourself though. First the SEC has to file a Complaint.

I was scammed by Cynthia and Eddie Petion.

I trusted a good friend! I was scammed! These are HORRIBLE PEOPLE!!!!!

Any possible ways to get our money back is appreciated and the government should hunt Cynthia and the husband Eddy petion down where ever they are hiding with peoples funds and should never go unpunished.

the petions are absolute scumbags the lowest form of life and to use the church and religion just makes it even worse.

i hope they get everything thats coming to them just evil people ruining honest hard working peoples lifes.

I just pray that all the hardworking people and myself get at least the money we paid into the scam back.

That’s not going to happen. Ponzi math guarantees at best you’ll get a percentage back.

That percentage shrinks the longer the Petions remain at large.

Oz,

The NY Attorney General has filed suit against the Petions.

coindesk.com/policy/2024/06/06/nyag-sues-2-crypto-pyramid-schemes-promoters-targeting-haitian-americans-in-1b-scam/

On my radar for today, thanks. Article up soon.