Monitor: FES “striving to do the right thing” on compliance

A new report from a court-appointed Monitor suggests Financial Education Services’ compliance efforts are heading in the right direction.

A new report from a court-appointed Monitor suggests Financial Education Services’ compliance efforts are heading in the right direction.

The FES Monitor filed his first report last November. In the report, which focused heavily on FES’ ongoing compliance efforts, the Monitor claimed “more can be done”.

In a second report filed on April 27th, the Monitor continues to track FES’ compliance efforts.

The Monitor believes the Monitored Entities have changed their corporate culture to “striving to do the right thing,” from the apparent pre-Complaint position of “having the right things nominally in place so we can point to those if someone challenges us.”

That said, the Monitor remains concerned that the Monitored Entities either do not fully embrace or comprehend what compliance entails.

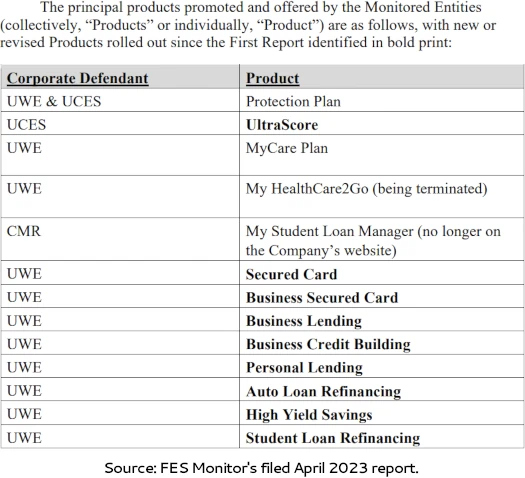

A primary example of this is FES’ newly introduced products.

The Company introduced new Fintech Products apparently without any advance awareness, comprehensive legal identification or review of potential regulatory issues.

It appears the Company began offering these Fintech Products to satisfy promptly agent needs in the marketplace in order to match offerings by competitors.

Nevertheless, the Company evidently never sought legal advice on the regulatory implications of these Fintech Products nor on how to ensure full regulatory compliance until shortly prior to announcing them publicly at the February 24-26 National Convention.

Simply matching competitors’ offerings is not sufficient without fully understanding either what competitors have done to comply with applicable laws and regulations or whether competitors are complying with applicable laws and regulations.

The Monitor views the inability of the Monitored Entities to recognize when legal consultation is prudent or even necessary as a significant shortcoming.

Other points of concern raised by the Monitor include:

- “the high concentration of compensation among a small number of agents”;

- an ongoing high percentage of internal consumption (presumably when weighed against retail sales volume);

- continued emphasis on recruitment of FES agents;

- FES’ “confusing and difficult to understand” compensation plan;

- FES sales calls potentially falling under Telemarketing Sales Rule law; and

- FES targeting African-Americans and Hispanics with deceptive marketing

The Monitor’s impression is that, at its most base level, the Monitored Entities are selling a “lifestyle” without explicitly saying so.

It is noteworthy that, from their inception, the Monitored Entities’ entire network of agents and customers and their target market of potential agents and customers are evidently middle to lower income individuals, over 95% of whom are African American or of Hispanic origin.

Yet, in the United States the vast majority of middle to lower income households are white. The Monitored Entities largely ignore this huge market both in geographic locations for events as well as messaging.

The audience and marketing message at UWE events (e.g., Super Saturdays and the National Convention) are remarkably consistent and tailored for either an African American or Hispanic origin audience rather than one that is white, Asian America, Indian American, and/or of Middle Eastern origin.

The Monitored Entities’ themes of financial literacy, financial success, owning one’s own business, and supporting one’s family are fairly universal American values across racial and ethnic lines.

But, the Monitored Entities clearly are narrowly focused in their approach in an apparent effort at selling a particular type of affluent lifestyle to those with low credit scores in specific racial and ethnic groups.

Thus far FES has been receptive to recommendations made by the Monitor.

The Monitor made 13 specific recommendations in the First Report (the “Recommendations”) for the Monitored Entities to implement as changes in their business operations in order to strengthen their compliance with applicable law.

The Monitored Entities apparently instituted a number of changes to their operations, policies and procedures based on the Recommendations.

These changes include:

- “updating and publicizing” company and Agent Standard Operating Procedures

- manual monitoring of high-earning Agents

- implementation of an “Integrated Solutions Certificate Program” (training and education on compliance, disciplinary policies, products and FES as a company)

- restructuring of service fee and monthly payments

- upgrades to FES’ capabilities to monitor Agents’ use of social media

- implementation of compliance training for FES compliance staff

- updates to “some” of FES’ marketing materials

- greater individualization of offered credit services

My take on all of this is that everything is undermined if FES has and continues to derive the majority of its sales revenue from recruited affiliates.

A lack of retail sales alone is enough to classify FES as a pyramid scheme – and that in turn should be enough to see the FTC prevail at trial.

The Monitor’s input on this specific point is as follows:

Agent interviews conducted by the Monitor Team suggest anecdotally that some legitimate demand exists for the Monitored Entities’ services.

Several agents the Monitor Team interviewed indicated that their association with the Monitored Entities began as customers in need of restoring their credit scores, or as both an agent and a customer, with a strong interest in the Products offered by the Monitored Entities.

These agents include Alfred Nickson, Josseny Cadestin, Johnnie Newsome, Lakeisha Marion, and Victoria Sparks. It is worth noting that most of these are some of the most highly compensated agents under the Compensation Plan.

To me this is wishy-washy. Of far more relevance would be an individual breakdown of the top earner’s downlines between retail and recruited Agent sales revenue.

This is what FES’ top Agents are being paid out on after all, and it’d be important to determine whether they are being primarily paid on recruitment or retail sales.

That this is being carefully tiptoed around suggests FES’ top Agents are still probably being paid out on recruitment. Whether these recruited affiliates have a “strong interest in the products” is neither here nor there.

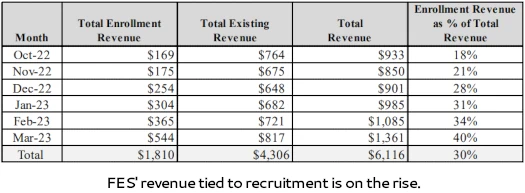

On that note, the Monitor provides the following data;

During the months of October, 2022 through March, 2023, on average, approximately 60% of Company’s total revenue was derived from sales to customers who are not also agents, with the remaining 40% of total revenue derived from sales to agents.

60% retail sales volume has room for improvement but is still a healthy margin over the defacto 51% threshold.

In the absence of retail sales volume requirements in FES’ compensation plan however, FES’ recruitment sales volume is on the rise:

If that trend continues, retail will eventually drop below 51%.

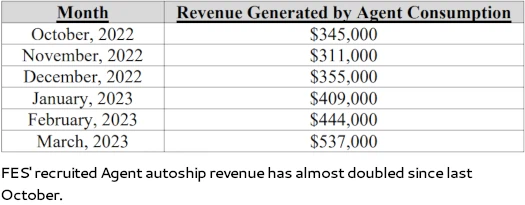

In addition to failing to implement required retail sales volume requirements, FES further incentivizes pyramid recruitment through mandatory autoship.

The Monitored Entities’ use of mandatory internal consumption, which creates a material percentage of revenue for the Monitored Entities and incentivizes agents to recruit other participants in order to have their monthly enrollment fees waived, is a concern for the Monitor.

This is traditionally known as “pay to play”.

“Pay to play” is a strong indicator an MLM company is operating as a pyramid scheme.

Another area of concern is FES’ churn rate.

Cancellation rates among customers and agents are relatively consistent, with approximately 60% of new customers and agents cancelling their participation with the business by the fourth month following enrollment.

High cancellation rates among customers and agents suggest an inferior Product offering and/or a non-viable business opportunity, raising questions regarding whether sales are reflective of genuine Product demand, as opposed to simply a cost of entering the business opportunity.

Tying into FES’ churn is “approximately 73% of agents earn(ing) zero commissions”.

Approximately 50% of commissions are paid to approximately 1% of the agents.

For those agents earning no commissions, when compulsory monthly Protection Plan payments are factored in, these agents would appear to lose money.

On the corporate finance side of things, FES’ overall financial position is in decline. Across the company’s three primary bank accounts, FES’ overall cash position has declined from ~$6.1 million last July, to ~$4.4 million as of March 2023.

From what I can tell, FES has completely abandoned its “Financial Education Services” branding to go with United Wealth Education (UWE). I assume this is an attempt to distance themselves from the FTC’s ongoing lawsuit.

The case docket reveals the FES defendants filed their answers to the FTC’s Complaint last month.

Pending a settlement between the parties, the case continues towards trial.