FES Monitor’s first report details compliance efforts

Financial Education Services’ court-appointed Monitor (formerly Receiver), has filed his first report.

Financial Education Services’ court-appointed Monitor (formerly Receiver), has filed his first report.

Overall FES has taken steps to address compliance, but top earners appear to still be flouting rules.

The FES Receivership was converted into a Monitorship following denial of a preliminary injunction back in July.

The FTC maintains FES is a $467 million dollar pyramid scheme, with the case scheduled for an October 2023 trial.

Till then FES has been given permission to operate under supervision of the Monitor.

The Monitor’s filed November 10th report focuses heavily on FES’ compliance efforts.

At the July 26, 2022 meeting with the Monitor and members of the Monitor Team, Mr. Naik reported the development of a “new compliance plan” for the Company that would be ready “this week.”

“Mr. Naik” refers to Parimal Naik, one of FES’ co-founders.

“Mr. Naik” refers to Parimal Naik, one of FES’ co-founders.

Documented compliance changes in the Monitor’s report include:

- new customers going through an “initial consultation” before any fees are paid

- FES’ Protection Plan capped at six months, ongoing subscription requires customers to opt-in

- full disclosure of “expected fees” during the initial six-month Protection Plan subscription period

- informing and emphasizing to customers that they are able to “cancel at any time”

Most of FES’ customers cancel their subscription “within two to three months of enrolling”.

FES refers to its distributors as “Agents”. To better monitor Agent compliance, FES has purchased FieldWatch.

FieldWatch automatically searches social media platforms, blogs, websites, news sites, and private online groups – using search terms provided by the Company – for non-compliant postings by the Monitored Entities’ agents.

The software then returns results based on the applicable search terms, which results are reviewed by the Company for incidents of non-compliance.

While FieldWatch can monitor live streams and posted videos, as of November 10th, 2022, FES hasn’t opted for that subscription tier.

This deficiency creates a potentially material gap in monitoring of agent activity.

While the cost of purchasing the upgraded search feature is not insignificant, the Company apparently deferred hiring additional personnel to bolster its online compliance monitoring in large part because of the efficiencies resulting from the FieldWatch technology.

Back in July Naik also represented to the court that he would “create a new five-person Compliance Department”.

The Monitor inquired as to the status of the Compliance Department in August, wherein only two staff names were provided.

FES does have a seven-person support team, however they are unable to act on compliance issues.

Assisting the Compliance Department is Javier Canales;

Mr. Canales apparently was referred to the Company by Kevin Thompson, an attorney who advises the Company on multi-level marketing legal compliance.

A member of the Monitor Team interviewed Mr. Canales. Mr. Canales is based in Las Vegas, Nevada. Mr. Canales states he has been involved in the multi-level marketing industry since approximately 2009, and has served in a legal compliance role in the multi-level marketing industry for approximately 10 to12 years.

However, Mr. Canales evidently has no formal training in legal compliance matters relating to the direct selling industry, but rather, has learned the role “on the job.”

The Monitor expresses concern over Canales’ lack of formal training. He goes on to state he’s “not confident” in FES’ Compliance Department being able to handle Credit Repair Organizations Act requirements (CROA).

The Monitor recommends FES put their Compliance Department, including Javier Canales

comprehensive and thorough compliance training provided by a knowledgeable attorney focusing on the requirements of CROA and applicable state laws and/or (b) formally incorporate outside legal counsel more frequently and on a regular basis to review specific CROA-related compliance matters.

FES has engaged two law firms, Greenspoon and Thompson Burton, but the Monitor believes “more can be done”.

The Monitored Entities’ failure to consistently utilize competent external compliance legal counsel in the past likely led to many of the issues the Company currently faces in connection with the litigation initiated by the FTC.

The Company should develop new and improved marketing materials, possibly with agent input, and in close collaboration with external compliance legal counsel, to ensure that all materials (including PowerPoint presentations) are reviewed and approved by external legal counsel with expertise in such matters.

Moving on to Agent compliance, the Monitor was advised by the Compliance Department that “presentations” were to be held ” in order to strengthen compliance as part of the Company’s culture.”

The Monitor is unable to confirm as of October 15, 2022 whether any such presentation has occurred.

Cited “Compliance Reports”, put together on a weekly basis, revealed a relative “low number of violations”.

Currently, FES Agents are allowed four offenses before they are terminated.

Indeed, while the Company has expressly prohibited agents from using marketing materials that have not been prepared by the Company, agents nevertheless frequently use their own self-developed marketing materials in violation of company policy.

In some instances the Compliance Reports indicate that the violations were corrected. In many instances, however, it is unclear whether the offending action was ultimately corrected.

One compliance blindspot is “in-person events” (PBRs) that Agents hold to sell FES and its products.

The Monitor Team requested a schedule of all PBRs currently being conducted by the Company or that the Company is aware of.

As of October 15, 2022, the Company has not reported any in-person events hosted by agents (i.e., PBR) to the Monitor Team.

Apparently agents do not report scheduled PBRs to the Company.

Another blind spot is following up on Field Agent reports.

In one example provided, a FES Agent was picked up by FieldWatch for a non-compliant social media post.

The Monitor Team verified that the offending post had been taken down, but found several other instances of non-compliance.

The above report shows (Agent) had a violation of “income claims,” which the Monitor Team was unable to find evidence of online.

But, based on Monitor Team’s review of social media, (Agent) did post photos with the following statements: “If your credit score starts with a 3, 4, 5, or 6 DM me,” “Your credit score has improved! +201,” with the comment, “This can be you the next in our program to do what you’ve been wanting to do, restore your credit.”

Such a posting presumably violates Company policy, but was not noted in the Company’s report.

Therefore, although the Company trains agents not to post client credit score increases and performed a review of (Agent’s) account, noting an “income claims” marketing violation, the agent also had other posts that violated Company policy that do not appear to be addressed or removed from such agent’s profile.

FES’ official company policy is to shut down an affiliate’s marketing website on a first offense (till the offense is remedied.

A supplied FieldWatch report for October 3rd reveals that, of the twelve violations cited, no Agents had their marketing website shut down.

A subsequent October 7th report reveals that websites weren’t disabled until Agents had received three or four offense warnings.

Again, Agents are supposed to be terminated upon receiving four compliance warnings.

The Monitor notes FES’ inaction “does not align with the action notes taken in response to marketing violations.”

A large part of the problem appears to be inaction with respect to FES’ top earners.

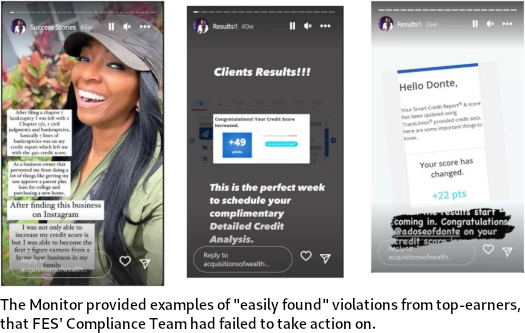

Social media posts from Alisa Barnes and Daniella Crevecoeur are provided as examples.

The following examples show non-compliant social media posts made by high-earning agents Alisa Barnes and Daniella Crevecoeur that the Monitor Team found.

Agent Alisa Barnes, posted on Instagram

“Client Results!!! Congratulations! Your Credit Score Increased. +49 points. This is the perfect week to schedule your complimentary Detailed Credit Analysis” and “When the results start coming in. Congratulations @adoseofdonte on your credit score increase”

Alisa Barnes is one of the Company’s most highly compensated agents, having earned approximately [redacted] in commissions per the 2021-2022 Commission Report.

Agent Daniella Crevecoeur posted items on Instagram showing credit score increases, with pictures stating “Your credit score has improved! +344”, “Your credit score has improved! +197”, “Your credit score has improved! +267”, “My score went up 178 points”, and “Your credit score has improved! +46”.

Given the absence on the Company’s violation report, such posts apparently were not flagged by FieldWatch or the Company’s compliance personnel.

Ms. Crevecoeur is also a high earning agent with about [redacted] in commissions per the 2021-2022 Commission Report.

Alfred Nickson, Morgan Hardman (Nickson’s wife) and Michal Bien-Aime Burgos, are also identified as FES top-earning Agents.

Based on easily found compliance violations from FES’ top earners, the Monitor recommends;

The Company should take special note of its higher earning agents to verify compliant practices. In this regard, the Company should consider targeting its FieldWatch searches to the Company’s top selling agents in order to see and correct potential compliance violations.

Despite the increased number of social media violations reported and the Company’s efforts to educate agents on compliance policies, the Monitor Team easily found non-compliant posts by certain high earning agents.

Finally, the Monitor raised concerns that FES’ Greenspoon attorney might be interfering with the Monitor’s duties.

Attorney Richard Epstein of Greenspoon addressed the August 6, 2022 Super Saturday Event from a legal standpoint, with an update on the FTC litigation, reassuring the audience that “no one should be alarmed, as this is typical and normal in the industry,” and that he and his firm had been involved in many such lawsuits with the FTC.

Mr. Epstein explained the Company had numerous positive improvements and changes coming to better follow the rules, regulations, and laws of the industry.

Mr. Epstein noted the Company is under a monitorship and said the following to the audience of agents:

“One thing I, you know, I will feel obliged to tell you is that some of you may get a call from Mr. Miles or his team.

The Company is under an obligation, willingly, to cooperate with Mr. Miles’ role as the Monitor.

We can ask you to do the same. But as you know, each of you are independent business people, and you can — you have to evaluate your own roles in this, but the Company is certainly cooperating and is as transparent as it can humanly be with Mr. Miles and his team, and we only ask you to be mindful, you know, that what it is you say and do reflects on the Company as well as you.”

While Epstein didn’t say anything incorrect, it does come across as a bit *winkwink, nudge nudge*.

The Monitor was concerned about these comments because, in the Monitor’s view, the only apparent reason to note that agents are “independent business people” in such context is to imply that agents need not cooperate with the Monitor since they are legally separate from the Monitored Entities.

Further, asking the agents “to be mindful” in connection with cooperating with the Monitor as to what they say to the Monitor appeared to be an effort to stifle full and candid disclosures by agents to the Monitor.

The Monitor shared such concerns with Mr. Epstein privately in person shortly after his remarks.

All up there has been an effort by FES to address compliance. Whether that justifies the court turning the business back over to its owners to potentially continue defrauding consumers, remains inconclusive.

Personally I think this is going to come down to FES not reining in its top-earners, and the Monitor having to continue pointing this out.

I suspect the reason top-earners are ignoring compliance, is because FES as an MLM business isn’t otherwise feasible.

This ties in with the Monitor’s previous report (as Receiver), expressing viability concerns with respect to FES operating legally.

It also of course brings home the FTC’s lawsuit, which let’s not forget accuses FES’ founders of running a near half-billion dollar pyramid scheme.

Stay tuned for further updates from the FES Monitor and case in general.

Hey Oz! Just started reading “The Missing Cryptoqueen”. Glad to see you and your website mentioned!

It’s a good read. Enjoy!