LEO withholds commissions, Dan Andersson confirms Ponzi scheme

LEO owner and CEO Dan Andersson has announced existing commission balances are being held hostage, pending new investment from recruited affiliates.

LEO owner and CEO Dan Andersson has announced existing commission balances are being held hostage, pending new investment from recruited affiliates.

Andersson’s announcement was made in a “Special Global Associate Meeting”, held yesterday.

Last we heard Andersson was under criminal investigation in Pakistan. To that end authorities had forbidden him from fleeing the country.

In April the Pakistani SEC shut down a shell company related to LEO.

As far as we know Andersson (right) is still prohibited from leaving Pakistan, and the regulatory investigation into LEO continues.

As far as we know Andersson (right) is still prohibited from leaving Pakistan, and the regulatory investigation into LEO continues.

What with LEO’s latest incarnation being an MLM crypto Ponzi scheme, naturally this has been terrible for business.

Or as Andersson puts it, LEO now finds itself in an “almighty cash crunch”.

[22:51] Our balance sheet is very, very healthy. We have assets, we have properties, we have a balance sheet that is strong as anything.

We have some properties that are worth sort of four million pounds. We have claims on others that uh… let me not talk about that, it’s too painful.

But we have a balance sheet that’s very, very strong and very, very cool. That’s terrific.

But the business runs on liquid cash. And of course when the liquid cash dwindles, then you as a business leader have to do something about that.

Rather than come clean about his arrest and status in Pakistan, Andersson dances around the elephant in the room.

The closest he gets to acknowledging LEO’s legal problems, is stating the company has racked up “two million pounds of legal fees on different things”.

LEO began as a personal development pyramid scheme back in 2012. Like many MLM scams, the company pivoted into cryptocurrency in 2014.

This saw the introduction of LEO Coin, which has operated as a Ponzi scheme through an internal exchange since launch.

On or around August 2015 LEO Coin was listed publicly. At launch LEO Coin hovered around five cents.

From 2017 however it’s been in continuous decline, and now trades publicly at 2.2 cents.

Andersson refers to LEO’s sale of LEO Coin internally as a Digital Marketing Service (DMS).

In short LEO generates LEO Coin demand, solicits investment for the coins internally and pays commissions on affiliate investor recruitment.

This is your standard MLM crypto Ponzi model.

Trouble is, with Andersson stuck and new investment plummeting, LEO has (supposedly) run out of money to honor internal exchange withdrawals.

As part of his Special Global Associate Meeting announcement, Andersson inadvertently reveals LEO has been paying internal exchange withdrawal requests with invested funds.

[24:32] The DMS product has cost us dearly.

When we launched it, it was a fantastic opportunity. The crypto markets were full of opportunities that we were able to capitalize on.

But then that market, those markets contracted and very, very quickly we got to the stage where we had to kind of support the DMS payouts using our digital currency reserves.

We of course already knew LEO was operating as a Ponzi scheme (every MLM crypto internal exchange opportunity is), but there you have it from the horse’s mouth.

In response to LEO collapsing, Andersson announced all existing LEO affiliate commission liabilities have been suspended.

[32:11] The old liabilities, from things that you earned six months ago, nine months ago or last week, those commissions will be withdrawn against the commissions that you earn.

The algorithm will tell you how much you can withdraw. It means you can withdraw 100% of your new commissions plus 10% of your old ones.

The balances are there, but affiliates will only be able to claim out of new business – i.e. the recruitment of new LEO affiliate investors.

In an attempt to placate ripping off LEO affiliates, Andersson states he’s also asked LEO’s “senior executives to not take salary”.

In an attempt to encourage new investment, Andersson announced a reverse matching bonus was scrapped. Stricter qualification criteria for the regular matching bonus will also be introduced.

Defending the decisions, Andersson stated the bonuses were “a bit of bullshit” and that LEO “needs the cash flow”.

[34:56] If you have no intention to support LEO by standing up and fighting for LEO, then we have to make sure that we look after the people who are fighting.

Looking forward, unless a bunch of new gullible investors are found, LEO is over.

Not withstanding LEO’s and Andersson’s legal status in Pakistan, which Andersson has not addressed publicly.

By no longer propping up internal exchange LEO Coin withdrawals, Andersson states he expects the value to drop to the current 2.2 cent public value.

To give you an idea of how much that will gut LEO’s MLM opportunity, over the past 24 hours less than $4000 of LEO Coin was publicly traded.

LEO Coin is dead outside of LEO, and Andersson just killed it internally too.

Can’t say I blame him though, math is math and LEO can’t continue to pay out if there’s no new investment coming in.

In the meantime LEO’s existing investors are coming to terms with their losses.

Andersson appears to have little sympathy, telling affiliates upset about having commissions stolen;

[46:55] Honestly, if you want to be a freeloader, if you want to have something for nothing, you are very welcome to leave.

You are very welcome to be pissed off. You are very welcome to say goodbye and go off and find yourself a scam that you can run for six months.

One LEO affiliate investor who wrote in to us stated;

As a LEO member I am so stressed and afraid about company’s future.

Some of the leaders are talking about that he has to pay bribes in Pakistan to avoid being arrested that’s why he is spending company’s money and is not paying commission to us.

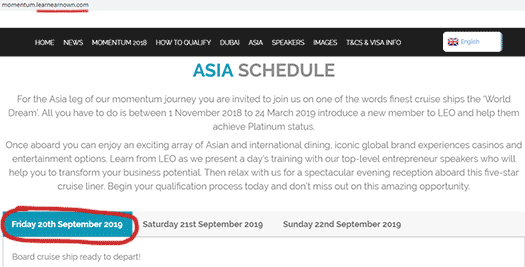

Other leaders are saying that he is planning to run away with company money and is going to reset the company next month during China cruise trip this is why he stopped commission payments.

We worked hard to earn this commission and he is spending it on himself.

Whether this “China cruise trip” plays out will be interesting to see.

At the time of publication LEO’s website lists Dan Andersson, Mihir Magudia, Andy Hanson, Waqas Suhail and Wendy Li as speakers for the event.

Stay tuned…

Update 25th September 2021 – As at the time of this update, Andersson’s “Special Global Associate Meeting announcement” video has been removed from YouTube.

As such I’ve removed the previously accessible link to the video.

Deja vu. I remember another leader of a trashy coin reported as saying to a hotel suite full of members in Las Vegas, “… if you are here to cash out, you do not understand this project and you should leave the room now”.

What part of “you took their money” don’t these guys get?

Greenwood of OL infamy found a Thai jail so tough that he did not bother to fight his extradition to NY.

Andersson will no doubt be thinking hard about someone American he conned so that he can do that after a couple of weeks locked up with Pakistan’s finest

Sir Dan Andersson did not come to Africa but Sir Mihir Magudia impressed all investors with his personality.

Mihir Magudia is director of Leo coin

leocoinfoundation.org/transparency.aspx

Mihir Magudia is director of Leo

learnearnown.com/leo/AboutLEO/OurTeam

Mihir Magudia is director of Digital Currency foundation

digitalcurrencyfoundation.io/AboutUs.aspx

Mihir Magudia is in United Kingdom parliament group:

publications.parliament.uk/pa/cm/cmallparty/180426/digital-currencies.htm

This should be enough proof that he is not a scam and doing great work in the United Kingdom.

Sir Mihir Magudia is not a scam.

Sir Dan Andersson is not a scam.

Leo coin is not a scam.

Nope. Legitimacy by association doesn’t work.

LEO is a Ponzi scheme and Dan Andersson is its scamming owner.

If Mihir Maguda is a Director of Leo he’s a scammer too, irrespective of anything else he might be doing.

So that’s what 10,000£ will buy. A couple of MPs and Lords to partake in an All-Party Parliamentary Group.

DCF manifesto: COMING SOON!

Interesting that they in January managed to use this to book a LEO leader meeting in the House of Commons under the guise of a Digital Currency Day, followed by a reception with (thirsty?) MPs attending.

Open your eyes!!

Anderson leocoin.

Norman ormeus.

Pasveer crowdbridge or wantage one.

Same actors…same game.

Once a scam-always a scam.

Andersson is an international con artist. On one hand he has bankrupted LEO company in the UK and on the other hand he is saying Leo has assets. He is lying either way.

You can hear in his trembling voice that he can see it coming. He will be soon caught and put in jail if not already. Stealing whatever is left over from Leo members is his last effort to accumulate money more for his old age when he comes out of jail after 10 years.

His business partner already blown whistle in 2016/2017 about him stealing money from Leo and Andersson removed him from Leo, but finally he unmasked Andersson ugly face though the UK court and justice system.

I also give credit to Andersson that after all this he is still pretending to be Mr nice.

Guess what all dictators were considered nice by their subjects at the time. Only after the dictators are thrown out of power people come out of under their spell.

But people like scam Mihir Magudia and his other followers will not be able to wash their hands that easily. They will also go to jail for their involvement in this scam with Andersson.

I attended two training seminars by Leo. Mr Andy Hansen was the trainer. Over half the time he preached about Mr Dan Anderson in a perfect ass licking way.

He promised that the next time Mr Dan Anderson will attend South Africa training seminar but now I know that why he could not travel to South Africa.

Quick search on Andy Hansen shows his scam in Aspire World in Australia.

Oz your pen has incredible power. Since you mentioned the names of two crooks Dan Andersson and Mihir Magudia LEO removed ‘Our Team’ page from their website.

They have also removed all the bogus office addresses apart from the UK, Dubai and Hong Kong.

Mihir Magudia has been enjoying lifestyle and traveling around the world promoting LEO investment scam while Dan is awaiting his fate in Pakistan. Good for Mihir at least he is having fun.

An MLM company removing previously available information without an explanation is never a good sign.

A judgement in Pakistan has been published.

But it seems as if it only concerns Unaico – Leo is not mentioned:

(Ozedit: link removed, see below)

Thanks for that. I had to remove the link because the High Court website is a bit hokey. Managed to find the order though.

I skim read it and it ties into LEO, or at least explains some of what’s going on. Will have a report up soon.

Thanks to NAB for making sure that criminals like Dan Andersson doesn’t escape justice.

I invested in Unaico in 2012 and then Mr Andersson announced that he is closing Unaico in Pakistan.

I was so upset but then NAB recovered some of my money from Unaico.

Last month I was called by NAB for statement against Mr Andersson who was the main character behind Unaico.

Mr Kamran’s name was used to fulfil legal requirements of Pakistani national while setting up the company.

Officials told me that many leaders of Unaico including Mr Kamran is cooperating and helping NAB to uncover the truth because Mr Andersson says he only took Rs 98 million from public.

I am pleased that high court of Pakistan didn’t allow Mr Andersson to escape from Pakistan.

Xiu Hua Zhang say Dan Andeson promis he will come to china cruise in sep. Xiu Hua Zhang is my big leader and she say Dan Andeson make us all rich.

I think Dan Andeson is lier and Xiu Hua Zhang is lier.

They’re basically gambling on Pakistani prosecutors dropping the case.

Now the latest non-appearance is the GET event in Egypt for which ticket sales are being “refunded”.

Using the term quite wrongly because if tickets were “purchased” using the internal Online account then both transactions are not made with real money – just numbers in an account

Expect LEO to fail completely within a few months.

Mihir Magudia and Andy Hansen we’re going to Egypt with Dan Andersson for training in Feb. Instead they ended up in Dubai with ASCIRA and are now stealing LEO members to join this new company.

African LEO leaders are saying they are filing a police complaint against Mihir for fraud. Not sure if they will something out of it as Mihir will never set foot in South Africa.

Hi

Any latest news on LEO whether is still be running and what about our investments in South Africa.

Thanks

LEO is gone, along with your money. Such is the Ponzi life.

Sorry for your loss.

As a member of Leo is of course expecting to have some serious records from Dan Andersson how the members money been handled as well how he been able to withdraw the investments doone by members from the personal wallets?

I belive to anounce this behaviour on Instagram as to get more pressure on him as well open up the eyes on those who close to him as well authorities.

This is my personal suggestions but cant act without permission from thoose who involved.

Sincerely

Ingemar Johansson

Dan Andersson and friends stole your money through Leo, a Ponzi scheme.

I fail to see how posting anything on Instagram is going to change that.

Dan Anderson is still in Pakistani Jail. LEO has stolen lots of pakistani and south African people Money.

However LEO is finished and right now they running an other scam company with New Named “LBL” Learn Build Lead”. You can say it is “Learn before Looting” hahahaha.

The people who joined them will defiantly lose their amount again like LEO , Unico and Sitetalk. which is totally unrecoverable.

Dan Anderson used un-educated people to stolen public money in Pakistan Like Liaqat Magray, Shafiq Magray, Anjum Mukhtar, Saqib Nawaz Marwat, Atif Aziz, Muhammad Tariq and other few big scammers to collect money from Pakistani community.

Even these people dont have any education degree or expertise in cryptocurrency. they are totally illiterate in technical and piratical field but they can speak lie very well and motivated people through social mobilization in small groups of crowds by inviting people in Hotels to inspire and get them scammed.

People should avoid from these scammer now. otherwise they will be scammed again.

I was at one of the seminars and it was a total joke. I was wondering why majority of people did not speak English and they used a translator.

I have raised some of the questions on an open forum about this being a total lie and trying to scan people as well criminal investigation…not much was said besides that everything was a lie.

People were signing up with min of $10,000 CAD. I felt sorry everyone.

Is there any possibility that Leo can refund people their money?

Leo was a Ponzi scheme. Your money isn’t sitting in an account waiting to be refunded, it was stolen.

Sorry for your loss.

Dear all,

Salam Alaikum & Good Day to all LEO victims in Pakistan and elsewhere.

Can you please share the Registration number of LEO company in UK and their office address?

Looking forward to hearing soon.

best Regards

LEO was run out of Pakistan from memory. Anything incorporated in the UK was a BS shell company.