Investview sues TPP over Apex and NDAU ROI guarantee

![]() Investview has filed suit against Total Protection Plus over a purported sham ROI guarantee for two unregistered investment schemes.

Investview has filed suit against Total Protection Plus over a purported sham ROI guarantee for two unregistered investment schemes.

Apex was a fraudulent investment scheme launched by Investview in 2020. Apex, run by serial fraudster and then Investview board member Jeremy Roma (right), collapsed in 2021.

Apex was a fraudulent investment scheme launched by Investview in 2020. Apex, run by serial fraudster and then Investview board member Jeremy Roma (right), collapsed in 2021.

Earlier this year, Investview settled Apex fraud allegations with the SEC for $375,000.

On May 14th, Investview filed a 10-Q Quarterly Report with the SEC, spanning January 1st through March 31st, 2025.

In the filing Investview disclosed litigation pertaining to what appears to be a scam within a scam.

Included in the Apex sale and leaseback program that was discontinued in 2021, was a “guaranteed assets buy-back product” underwritten, administered and managed by a third-party provider, Total Protection Plus (“TPP”).

TPP was a marketing tool, presented to Apex investors as a ROI guarantee.

[TPP] was intended to provide customers who participated in the Apex sale and leaseback program with a financial protection program (the “TPP Program”), under which customers, provided they complied with certain TPP required claims procedures, could elect to collect a cash payout in either a five-or-ten year interval after their initial purchase.

As part of their sales and marketing materials, TPP represented that they were a purported affiliate of a well-known global insurance brokerage firm that had sufficient capital resources, reserves and liquidity to support any payouts needed to satisfy their obligations under the TPP Program.

TPP was also offered to iGenius’ NDAU investors as a ROI guarantee;

Separately, iGenius members who purchased ndau through an Oneiro sponsored ndau distribution program, were also given the opportunity to participate in a TPP Program similar to the program offered to our Apex customers; which in this case was intended to provide customers who purchased ndau with a financial protection program under which such customers, provided they complied with certain TPP required claims procedures, could elect to collect a cash payout in either a five- or ten-year interval after their initial purchase.

Participation in this program was also in reliance on sales and marketing materials by which TPP represented that they were a purported affiliate of a well-known global insurance brokerage firm that had sufficient capital resources, reserves and liquidity to support any pay-outs needed to satisfy their obligations under the TPP Program.

Prior to terminating the distribution of ndau in August 2023, we distributed over $16.6 million in ndau to our members purportedly supported by the TPP Program.

As in the same case as had been done with respect to the Apex customers, TPP was paid substantial premiums for the program, and those premiums were included in the purchase price for the ndau program, at no additional cost to the customer.

Investview claims it has paid TPP “over $6 million” in licensing fees.

During the fourth calendar quarter of 2021, we suspended any further offering of the TPP Program in connection with the sale of ndau after TPP was unable to comply with our vendor compliance protocols, having cited certain offshore confidentiality entitlements by which it was unwilling to provide evidence of its financial support arrangements.

That suspension has remained in place as we have been unable to further validate the continued integrity of the TPP Program and the vendor’s ability to honor its commitments to our members; despite the payment of over $6 million to TPP to secure the benefits of the TPP Program.

Perhaps not surprisingly, consumers who invested in Investview’s Apex and NDAU schemes are being ghosted by TPP.

Our level of concern over the viability of the TPP Program has recently increased materially as we have come to learn that:

(i) certain of our customers have been unable to reach TPP in order to process claims for their 5-year promised returns;

(ii) certain customers have informed us that the TPP website has been inoperative and customers have been unable to process their claims; and

(iii) an email communication purportedly from TPP, or an affiliate thereof, has been received by certain of customers in which the sender asserts that the obligations of TPP under the TPP Program were (unbeknownst to us and our customers) purportedly dependent on the financial wherewithal of another heretofore undisclosed TPP affiliate, that the email claims now has no ability to satisfy the commitments originally made by TPP.

In other words, “thanks for your $6 million. Bye now!”

In an effort to hold TPP accountable for losses incurred through Investview’s Apex and NDAU investment schemes (both of which were/are not registered with the SEC), Investview claims

on March 28, 2025, we commenced an action against Total Protection Plus, UIU Holdings LLC, Jason R. Anderson, Jacob S. Anderson, and Schad E. Brannon (collectively, “TPP”), in the Court of Chancery of the State of Delaware captioned Investview et al., v. UIU Holdings, LLC et al., seeking to, among other things, compel TPP to fulfill the commitments that were made to the Company’s customers under the TPP Program.

Delaware case information and court filings are purportedly public. When I went looking for “Investview et al., v. UIU Holdings, LLC” however, nothing came up.

I’m not saying Investview didn’t file a lawsuit, just that for whatever reason I can’t gain access to case information.

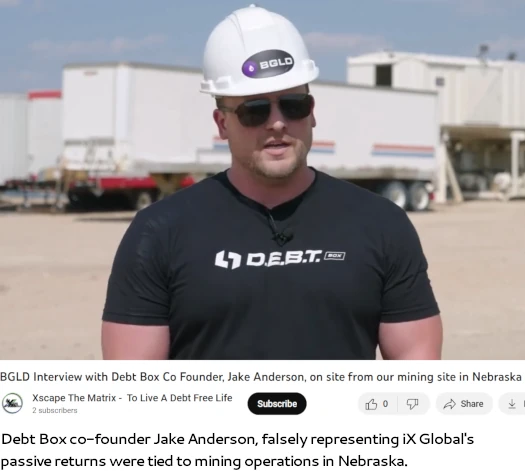

As to TPP’s owners; Jason R. Anderson, Jacob S. Anderson and Schad E. Brannon, these names will be familiar to long-time readers as the fraudsters behind Debt Box.

Similar to how TPP was a marketing tool attached to Investview’s Apex and NDAU schemes, Debt Box was a marketing tool for Joe Martinez’s collapsed iX Global Ponzi scheme.

Specifically, iX Global was marketed to consumers on the premise external revenue generated through Debt Box was funding ROI revenue.

The SEC filed suit against iX Global, Debt Box, Jason R. Anderson, Jacob S. Anderson and Schad Brannon in 2023.

The SEC alleged Debt Box’s external revenue ruses were baloney, and that iX Global’s investment scheme constituted securities fraud. Consumers were alleged to have been defrauded out of at least $110 million.

What should have been straight-forward fraud proceedings was unfortunately bungled by SEC attorneys handling the case.

With the underlying securities fraud unprosecuted, as of June 2025 a refiled SEC lawsuit on the matter remains pending.

In June 2024 the Andersons and Brannon turned up in Dubai, as part of a bizarre kidnapping exit-scam ruse. $400 million in claimed stolen investor funds remain unaccounted for.

It’s unclear whether, beyond the “over $6 million” Investview paid TPP in licensing fees, whether TPP misappropriated Apex and NDAU investor funds.

Pending further action by the SEC and/or DOJ, stay tuned for updates in subsequent Investview SEC filings.

An iGenius trifecta from Oz. It’s a very good day indeed!

What’s clear to me is the so called TPP insurance was a central argument to convince gullible investors to buy NDAU through Igenius. It was then presented as a “no risker” by Igenius’s members.

“Ndau will go up trust me bro, and if it doesn’t you can still get your initial money back after 10 years, Igenius is part of investview it’s a listed company audited by the SEC on a regular basis what could go wrong?”

Investview is now pretending to have been duped lol. Even Annette Raynor (former Investview COO) made a website “as a customer” to encourage the complaints being addressed to TPP. How convenient.