VidiLook disables investor accounts, adds KYC to exit-scam

VidiLook’s collapse has gone from bad to worse, following news over 10,000 investor accounts have been disabled.

VidiLook’s collapse has gone from bad to worse, following news over 10,000 investor accounts have been disabled.

KYC has also been implemented to keep disabled accounts inactive.

VidiLook collapsed on April 21st, following disabling of withdrawals. Owner Sam Lee’s initial ploy was acquiring VidiLook from himself.

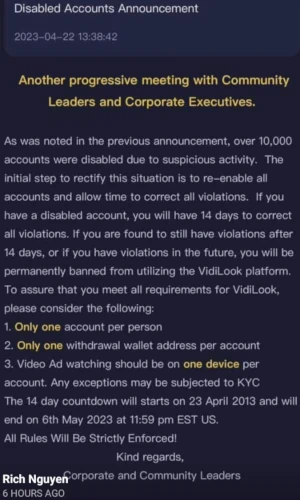

To that end an audit was announced, with an open ended timeframe. In an April 22nd announcement, VidiLook additionally informed investors it had disabled thousands of accounts.

Over 10,000 accounts have been disabled due to suspicious activity.

If you have a disabled account, you will have 14 days to correct all violations.

If you are found to still have violations after 14 days, or if you have violations in the future, you will be permanently banned from utilizing the VidiLook platform.

VidiLook’s claimed “violations” appear to pertain to investors having multiple accounts. This wasn’t a problem until VidiLook began running out of new investment to pay withdrawals.

VidiLook’s claimed “violations” appear to pertain to investors having multiple accounts. This wasn’t a problem until VidiLook began running out of new investment to pay withdrawals.

Also not a problem is KYC, which VidiLook has only now implemented for investors wanting to claim an “exception”.

Starting April 24th, VidiLook has given investors 14 days to either lose their accounts or provide KYC.

Handing over personal credentials presents its own problems, as VidiLook is run by Sam Lee and scammers in Dubai.

My take on VidiLook’s recent announcement is they’re hoping to cut out a chunk of withdrawals attached to disabled accounts. The intention is probably to reboot VidiLook at some point.

The problem for Sam Lee is disabling accounts doesn’t solve new investment not coming in fast enough to pay out. Like all Ponzi schemes, VidiLook is juggling an impossible mathematical equation that inevitably leads to collapse.

Pending any further developments on VidiLook’s collapse we’ll keep you posted.

The 14-day countdown to correct violations, or be permanently banned from utilizing the Vidilook platform, started 10 years ago, in “2013”. LOL

And, since last month, the US does not have EST (Eastern Standard Time). It is now EDT (Eastern Daylight Time).

Okay, silly question time… These “Multiple Accounts” would have cost $50-$1500 each! Will they return the money or use it to pay the people whose accounts are frozen?

And it’s ironic that they were only talking about controlling “Multiple Accounts” when it happened just last week on a Zoom meeting with SCAMLee, who probably provided the platform that runs ViDiLook. Didn’t he learn from the “Multiple Accounts” problem they had with HyperVerse?

I suspect some of the confiscated funds will be recycled to kick the can down the road.

That’s not going to last long though. Whether Lee just shuts it down or drags it out like the Hyper* remains to be seen.

So far we’ve got an open-ended audit ruse, so it’s looking like the latter.

Given the high percentage of US investors in the Hyper* Ponzis, I’d be surprised if Lee can do anything outside of recycled crypto Ponzis in Dubai.

I was looking to cover VidiLook 2.0 today. While the marketing it out, as I understand it they’re still making changes.

I think I’ll wait till mid-week to revisit and see if they’re done changing things on the fly.

From what I have seen, every investment tier except the entry $50 is screwed unless people recruit.

ROI payments across the board are still peanuts compared to pre-collapse. A refund has been offered but likely isn’t going to hold up given general sentiment is “give me back my money” among investors.

Don’t see this going on as is, so I expect we’ll see VidiLook 3.0 soon. No doubt Sam Lee will pretend he had nothing to do with VidiLook 2.0 either.

I changed everything, I still able to watch ads.

Dunno why you’d bother. This Ponzi collapsed months ago.

Sorry for your loss.