DAO1 launches Xova to solicit investment through

On the heels of MetaMask flagging DAO1 back in July, Xova has been launched.

On the heels of MetaMask flagging DAO1 back in July, Xova has been launched.

Xova operates from the website domain “xovawallet.com”, privately registered on August 22nd, 2025.

No ownership details are provided on Xova’s website. If we visit Xova’s Google Play Store app page however, we learn the app was developed by Swed Schield AG:

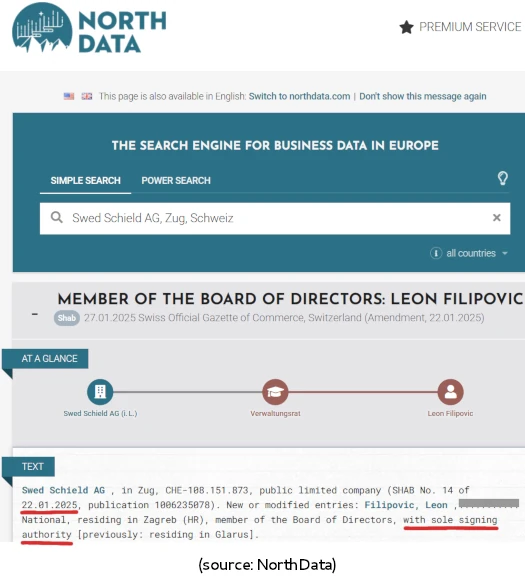

Swed Schield AG is a Swiss company that was registered in 2023. Leon Filipovic, cited as a resident of Zagreb, Croatia, was appointed Swed Schield’s sole Director in January 2025.

Filipovic (right) is a long-time business partner of Josip Heit’s. Filipovic’s name has popped up in connection with a string of shell companies, as well as companies directly tied to GSPartners.

Filipovic (right) is a long-time business partner of Josip Heit’s. Filipovic’s name has popped up in connection with a string of shell companies, as well as companies directly tied to GSPartners.

GSPartners is the predecessor of DAO1. The same fraudulent investment scheme GSPartners offered through its G999 token, DAO1 now offers through Apertum Foundation’s APTM token.

GSPartners, G999, DAO1 and Apertum Foundation are all owned and operated by Josip Heit. With Filipovic the sole Director of the shell company attached to Xova, it follows Heit is also behind Xova.

This tracks with DAO1 integration within Xova’s offered non-custodial crypto wallets.

So why does DAO1 need an internal wallet platform? And why isn’t the connection between Xova, DAO1 and Apertum Foundation openly disclosed?

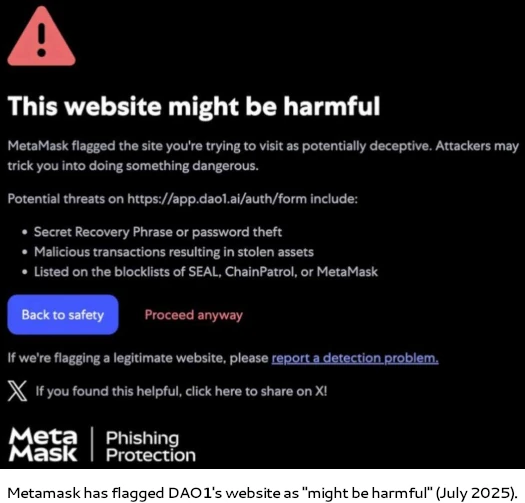

MetaMask flagged DAO1 as potentially deceptive:

At the time New Zealand, Australia and Texas (set aside in August), had all issued DAO1 and/or Apertum Foundation fraud warnings.

It’s unknown if other wallet platforms had flagged DAO1, but it was apparently evident the scheme risked other wallet platforms also blocking it.

And so Xova launched about a month ago. The first Xova marketing video went up on an Apertum Foundation associated YouTube channel on October 2nd, 2025.

As to why Xova doesn’t disclose common ownership between itself, DAO1 and Apertum Foundation on its website, this is likely due to DAO1 continuing to attract the attention of financial regulators:

- Germany issued a DAO1 and Apertum Foundation fraud warning on October 2nd

- Lithuania issued a DAO1 and Apertum Foundation fraud warning on October 30th

- Croatia has confirmed an ongoing money laundering investigation into Josip Heit

Xova is currently offered as an app through the Google Play Store, Chrome Web Store and Apple App Store.

Given the apparent obfuscation, it’s unclear whether the platforms are aware of Xova’s ties to DAO1, Apertum Foundation and Heit.

Google and Apple are of course US companies, and the DAO1 investment scheme, at least officially, isn’t available to North American residents.

This is a decision by owner Josip Heit, amid ongoing GSPartners fraud settlement negotiations with North American regulators still playing out.

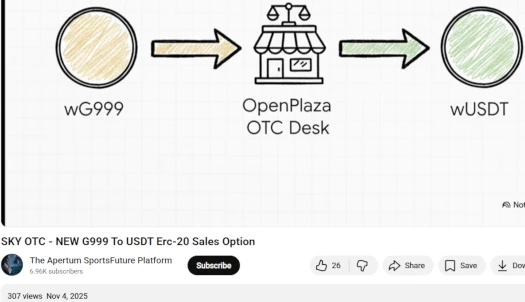

Earlier today Apertum Foundation published an AI robodubbed video to its “SportsFuture” channel, promising GSPartners G999 bagholders, the majority of whom are US and Canadian residents, a way to convert G999 to USDT.

Instead of just allowing G999 bagholders to finally cash out through DAO1, yet another new platform has been launched; OpenPlaza.

OpenPlaza’s website domain (“openplaza.io”), was privately registered on May 29th, 2025.

As represented in the previously cited Apertum Foundation marketing video, in order to cash out G999 bagholders must convert their tokens to WG999 through OpenPlaza.

WG999 is an Apertum Foundation token. Once the G999 –> WG999 conversion is done, WG999 must then be converted to WUSDT, yet another Apertum Foundation token.

Finally, WUSDT is exchanged for USDT – but it’s unclear who will be funding G999 bagholder withdrawals.

Seeing as Heit has reduced internal 24-hour APTM pump trading volume from $9.5 million to around $800,000 since August, it’s unlikely to be DAO1/Apertum Foundation itself.

No doubt somewhere along the line there’s going to be the expectation that WUSDT is rolled into DAO1’s fraudulent investment scheme.

Like DAO1, Open Plaza is purportedly blocking G999 cashing out by North American residents.

Obviously we know Josip Heit is running Open Plaza as yet another layer to the DAO1 fraudulent investment scheme, but blocking US residents is a bit odd considering Open Plaza’s “decentralized” marketing charade:

OpenPlaza is the premier NFT marketplace on the Apertum Blockchain, allowing users to create collections, mint and trade unique digital assets in a secure decentralized environment.

The same paradox has existed within DAO1 since launch in early 2025, so this is of course nothing new.

The bottom line is if any of this was legal, there’d be no need to block North American residents from DAO1 and anything else attached.

DAO1 and Apertum Foundation looking to resurrect G999 is likely due to a lack of new DAO1 investors tanking APTM’s public trading value.

The goal is to get G999 bagholders outside of the US to, ultimately, feed their monopoly money tokens into DAO1 and become APTM bagholders.

Whether Open Plaza temporarily pumps APTM from its current death spiral remains to be seen.

A private message was sent a few trusted members of an upline that gsp funds should be available by the end of the year.

I was not privy to how it was going to transpire but the wheels are in motion. Sounds like what you’re saying above could be the way it’s done.

OT Technology SE, Vaduz, Liechtenstein

Directors: Heit, Filipovic and Toma.

northdata.com/OT%20Technology%20SE,%20Vaduz,%20LI/_c6512723271090176

Per my sources in Dao1, Garth Richmond first made mention to them that he had been testing out the Xova wallet on 27 Sep. Based upon your reporting, I wonder if Xova had specifically been made for Apertum?

Garth Richmond is Bruce Hughes cousin so makes sense!

Makes some sense to me as well, I was told some members had seen the new platform and all the gsp stuff would be transferred over.

Regarding OpenPlaza — from what I’ve gathered, it was created by “Tekholms”, the same developer behind SKY, Velora etc. Tekholms appears to be an independent developer who has released dApps on other blockchains, mainly on Avalanche, based upon what he has said in the past.

I’m also of the view that Tekholms is the developer behind SportsFuture, which seems to be marketed by Harry Van Schaik and has had involvement from a few others, including Garth Richmond.

Interestingly, Tekholms may have left you a “love letter” on Nov 2 in the APTM Tokens Community group, saying:

“I would also like to add a little note for any ‘blog’ writers (IYKYK) who see this message… OpenPlaza is not a part of any past projects. It is purely an independent platform built by an independent developer who loves building on a decentralized blockchain.”

Unfortunately, any connection — real or assumed — with Josip Heit and co. is enough to put you under scrutiny, whether you like it or not.

Also – Calling Apertum “decentralized” is, however, questionable.

That said, it doesn’t take much digging to find that Tekholms’ real name appears to be Antonio Silva, based in Texas. Coincidentally, someone by that name appeared on a TSSB witness list back when the Apertum matter was still being argued.

I hadn’t realized that OpenPlaza had blocked access to U.S. and Canadian users, as their terms of service cite an opinion by the SEC. If this is the same Antonio Silva, I suspect he’s simply being cautious given how active the Texas State Securities Board has been.

@oz – Looks like your next piece might be about their new deal with Bitexlive. You could probably just copy-paste most of what you wrote when Auratus tried the same thing 🙂

More details should come out in tomorrow’s Global Call Nov 5 at 10 a.m. CET.

link – us06web.zoom.us/webinar/register/WN_a89kRUcMTbGtEocWWZzxdg

So, that Harry van Schaik (aka Harry AIMS aka Master Channel) grifter is probably the video generator behind SportsFuture; cranking out videos like crazy, just as he did with GSPartners… Except that he doesn’t put his face on the videos anymore, instead prompting AI stuff for “spreading the news”.

Remember how his old channel got him fame/mention in the Florida investigation. Seems he is trying to avoid it, but the US might just be able to ask the AI companies who is creating these videos anyway.

I see Bitexlive has been repurposed for APTM. There’s been so many layers of BS over the last year or so it’s difficult to keep track of it all.

Not so much “made for” as “made by”. This is all part of the same scheme, run by the same people.

Reporting on Heit’s Croatian money laundering investigation revealed a slew of shell companies. This is also how GSPartners was set up, with GSB at the top and umpteen spinoffs below.

Not surprisingly, DAO1 has been set up the same way with more spinoff companies popping up each month. And that’s just what we can publicly see because of marketing. Who knows how many shell companies there are on the backend.

Tekholms or Antonio Silva sounds like the Alex Cocindau equivalent for the DAO1/Apertum reboot. Same playbook, different names.

SimilarWeb’s October stats are up. DAO1’s website traffic plummeted another 52% to just ~37,400 visits a month.

Germany – 33% (active DAO1 fraud warning)

Dominican Republic – 25%

Australia – 19% (active DAO1 fraud warning)

US – 11% (DAO1 isn’t officially available because fraud)

UK – 10%

APTM hit another all time low on Nov 5th.

I live in hope that there’s still some good old-fashioned investigator out there with the guts to start chasing down these guys— like many of my scam-busting buddies.

He really is the scammer that keeps on giving, providing no shortage of content for our exposure work. There are far more tools available to scammers than there are to scam fighters.