Inside Blockchain Sports’ ATLA token staking Ponzi

Following news of Blockchain Sports’ ATLA token exit-scam on the equally dodgy MEXC crypto exchange, today we’re digging into the specifics of the fraudulent investment scheme.

Following news of Blockchain Sports’ ATLA token exit-scam on the equally dodgy MEXC crypto exchange, today we’re digging into the specifics of the fraudulent investment scheme.

Before we get to the latest ATLA exit-scam fraud, a quick recap on Blockchain Sports and how we got here.

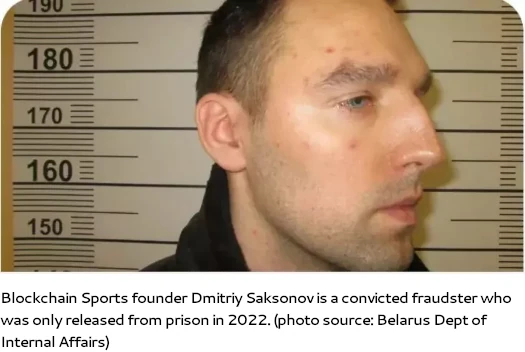

Blockchain Sports launched as a crypto Ponzi in mid to late 2023. The scheme is headed up by Dmitry Saksonov (aka Dima Saksonov).

Saksonov is an eastern European convicted fraudster now hiding out in Dubai.

Other names we can attach to Blockchain Sports are Artem Karapetyan (COO), Sergey Solousov, Dimitri Mikhalchuk, Vinay Ganga, Mohammad Alhnaity, Alexander Lorenz, Anatoli Javalenka and Vincent O’Grady (click to enlarge bios below).

Blockchain Sports’ initial marketing ruse was baloney about a “football academy” that would purportedly generate revenue. The first two iterations of Blockchain Sports were built around its SPORTS and FTBLL shit tokens.

After the first iterations of Blockchain Sports collapsed, they partnered up with serial fraudster Jeremy Roma.

Roma, a US national who splits his time between Dubai and California, was fresh off the late 2023 final collapse of his Daisy Global Ponzi scheme.

Roma’s involvement saw Blockchain Sports rebooted for a third time in or around February 2024. A new MLM division called “Limitless” was created.

This time around Blockchain Sports was an NFT “node position” Ponzi built around ATLA, another shit token.

Consumers, mostly Daisy Global victims hoping to recover their losses, were pitched on Blockchain Sports node positions costing up to 100,000 USDT.

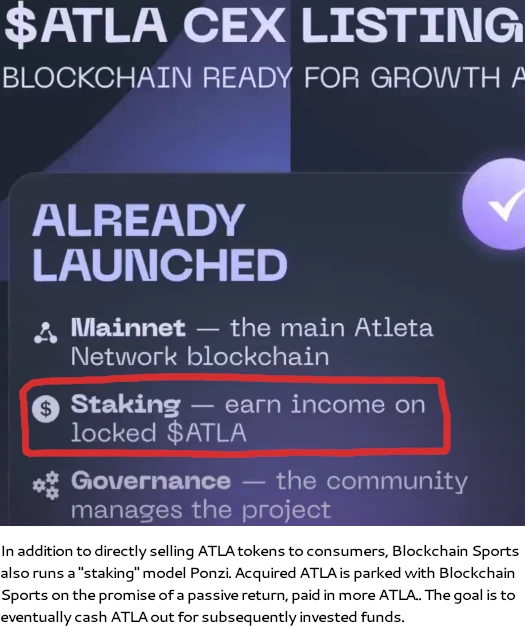

Node positions paid passive returns in ATLA, which could then be additionally staked for an even higher return (paid of course in ATLA tokens).

After the ATLA node investment position scheme flopped, Blockchain Sports began selling “drift pack” investment positions in late 2024.

Priced at up to 115,000 USDT, the ruse now was “drift pool” shares, purportedly tied to “AI racing” baloney.

Outside of raising eyebrows in Belarus, Blockchain Sports’ “drift pool” shares investment scheme also flopped.

Around mid 2025 Blockchain Sports rolled out its “public exchange” exit-scam. ATLA was to be dumped on the MEXC crypto exchange on August 17th.

Blockchain Sports and MEXC partnering up to defraud consumers wasn’t a surprise. MEXC fraud warnings have been issued by Japan, Ontario, Malaysia, Spain, Hong Kong, Quebec, British Columbia, Austria, the UK and Germany.

Presumably due to the ease with which he’s able to launder money through it, on a recent Blockchain Sports’ marketing webinar Jeremy Roma claimed MEXC was his “favourite exchnage”.

The ruse this time around was “ATLA would be dumped on MEXC, something something iNsTiTuTiOnAl InVeStOrs, we’re all gonna be rich!”

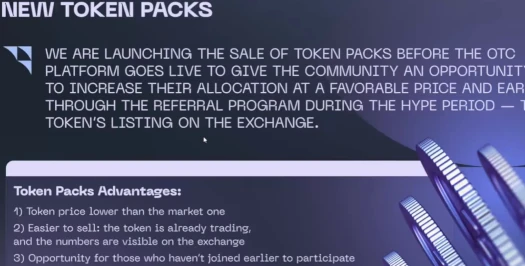

Naturally ATLA being dumped on MEXC brought with it a new round of investment fraud. In one final push to rinse gullible investors, Blockchain Sports rolled out new ATLA investment packages:

- Starter – invest 200 USDT and receive 1000 ATLA tokens (20 cents each)

- Booster – invest 975 USDT and receive 5000 ATLA tokens (19.5 cents each)

- Growth – invest 1900 USDT and receive 10,000 ATLA tokens (19 cents each)

- Pro – invest 3700 USDT and receive 20,000 ATLA tokens (18.5 cents each)

- Elite – invest 8750 USDT and receive 50,000 ATLA tokens (17.5 cents each)

- Whale – invest 24,750 USDT and receive 150,000 ATLA tokens (16.5 cents each)

- Titan – invest 75,000 USDT and receive 500,000 ATLA tokens (15 cents each)

10% of invested USDT is paid to Blockchain Sports investor recruiters. Another 10% is set aside for a “legends pool”, again rewarding those who recruit.

Blockchain Sports’ new token investment packs launched about a week prior to ATLA being dumped on MEXC.

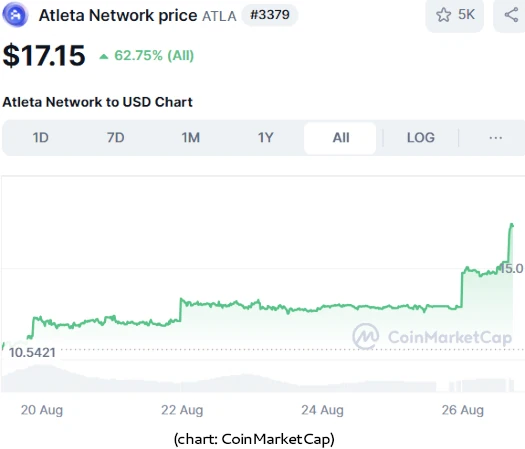

On August 17th, ATLA was dumped on MEXC and in the days that followed, recorded a peak of around $28 million daily trading volume.

CoinMarketCap began recording ATLA’s public trading value at $12.75 on August 19th. ATLA is currently sitting at $17.15.

On August 25th, Jeremy Roma appeared in a Limitless marketing video positively gushing about ATLA’s MEXC launch;

[0:44] Just last week the ATLA coin had its official listing on MEXC … and the price just skyrocketed outof the gate.

So what’s the problem here? Early Blockchain Sports investors are cashing their ATLA bags out, later investors who bought in at as low as 17 cents a token are cashing out – everybody’s getting rich!

Yeah, not quite.

If we zoom out for a moment, so to speak, the only funds entering Blockchain Sports is USDT from investors.

Sans whatever pittance has been paid out in commissions, invested USDT has been pilfered off by Roma, Saksonov and other Blockchain Sports insiders.

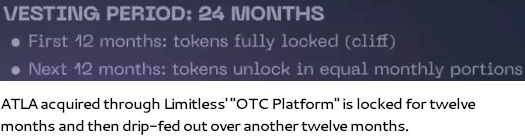

Here’s the rub, those who invested in ATLA prior to the MEXC dump, can’t actually cash out for at least twelve months.

Invested in ATLA tokens are locked for twelve months. The investment amount is then released in monthly increments over the next 48 months.

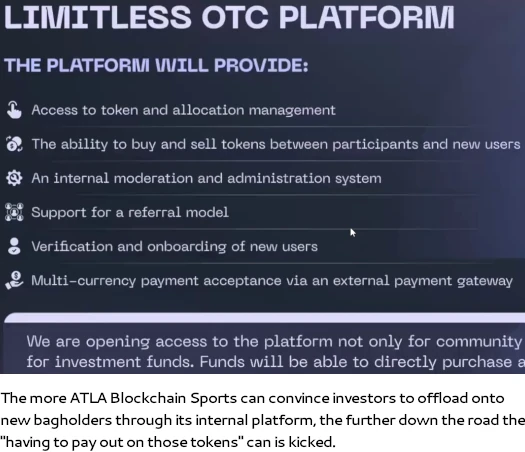

Other than participate in Blockchain Sports’ staking Ponzi scheme, the only thing ATLA investors can do is offload their bags internally through the “Limitless OTC Platform”.

Once again though, ATLA acquired through the OTC Platform is locked for 12 months and then released monthly over the next 12 months. So good luck with that.

But Oz, what about the millions in daily ATLA trading volume?

Jeremy Roma explained the importance of creating daily trading volume on an August 13th Blockchain Sports webinar;

[44:13] It’s so important that every single, it doesn’t matter if its ten dollars, a hundred dollars. Every single one of us, go onto this exchange and purchase the ATLA coin.

And for those that understand trading, to even go into the trading arena … that amplifies the volume, right?

[44:49] It’s a powerful thing that we can do. We ran some numbers, I ran some numbers last night looking at what kind of volume can be created just from the trading community. And it’s massive if this becomes a highly traded coin.

Like we’ve seen junk coins do enourmous volume, and they’re total junk coins – they’re not even real projects. But the trading community starts to get behind those coins and next thing you know there’s billions of dollars being traded on these assets that are worthless.

That’s all very well but, owing to massive Daisy Global Ponzi losses, interest in Blockchain Sports is practically non-existent.

As of July 2024, SimilarWeb was only tracking ~2900 monthly visits to Blockchain Sports’ website. 56% of Blockchain Sports’ website traffic originates from Belarus, 29% from the US and 15% from Germany.

Traffic was too low to Limitless’ website (the MLM side of things), for SimilarWeb to measure. This tracks with the only people still following Blockchain Sports being Daisy Global investors who Roma continues to string along.

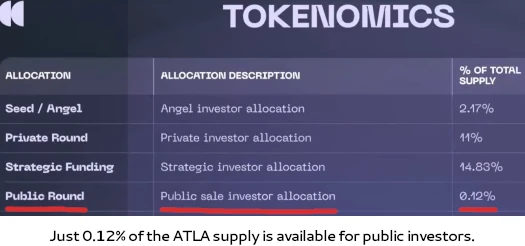

Now is also probably a good time to point out that only 0.12% of ATLA is allocated to public investors.

That leaves 99.88% of the ATLA supply in the hands of Blockchain Sports insiders (Roma and friends).

Guess what they’ve been up to?

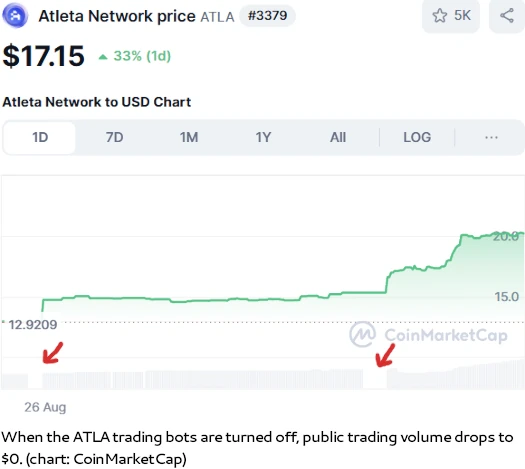

For those that haven’t cottoned on yet, the less actual public trading a crypocurrency has the easier it is to manipulate the value.

With ATLA we have a captive group of bagholders literally unable to cash out. Roma and friends can pump ATLA’s public trading value to anything (theoretically at some point trading fees will make the charade financially unviable).

In fact if you look at CoinMarketCap’s trading chart over the last 24 hours, you can see periods where the trading bots (i.e. wash trading) were turned off:

During these periods, ATLA trading volume plummets to $0.

The goal is to present ATLA’s completely manipulated public trading value to get new investors on board. By the time they realize they’ve been scammed; twelve months, twenty-four months or whatever it is later, come up with a new marketing ruse to continue to defraud consumers.

That’s pretty much what has been happening under various names since Roma launched Daisy Global back in 2020.

Pending authorities stepping in to put a stop to this mess, how long the Blockchain Sports Ponzi limps along for remains to be seen.

At no more than a few thousand monthly website visits we’re probably close to scraping the bottom of the barrel, but perhaps just not quite there yet.

Thanks for covering this. One of my friends tried to recruit me into this shitshow earlier this year. Now he’s all hyped up about how much money he’ll make.

I only told him to at least withdraw as much as he put in ASAP. I feel sorry for him but it was already impossible to argue with him back then.

I’ll check back here later for updates. Keep up the good work!