Crowd1 victims being funneled into Tag Markets fraud

![]() Crowd1 Ponzi victims are being funneled into an unregistered trading scheme run through Tag Markets.

Crowd1 Ponzi victims are being funneled into an unregistered trading scheme run through Tag Markets.

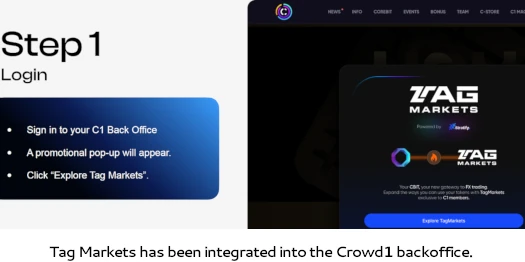

In communications sent out late last month, Director and higher ranked Crowd1 promoters have been advised they can register for Tag Markets through their Crowd1 back office.

This corresponds with official marketing material, instructing Crowd1 investors on how they can “join the Tag Markets opportunity”:

Investors are directed to a “promotional pop-up” in their Crowd1 backoffice, requiring them to push an “explore Tag Markets” button:

This redirects the Crowd1 investors to Tag Markets’ website, on which they have to create a Tag Markets account. This includes handing over personally identifiable information for purported KYC (we’ll go into why this is a significant risk later).

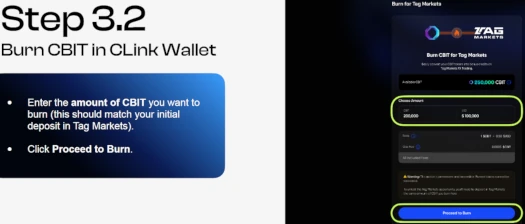

Once signed up, Crowd1 investors are then able to fund their Tag Markets accounts with new investment. Note each investment much be matched with “corebit” tokens (CBIT):

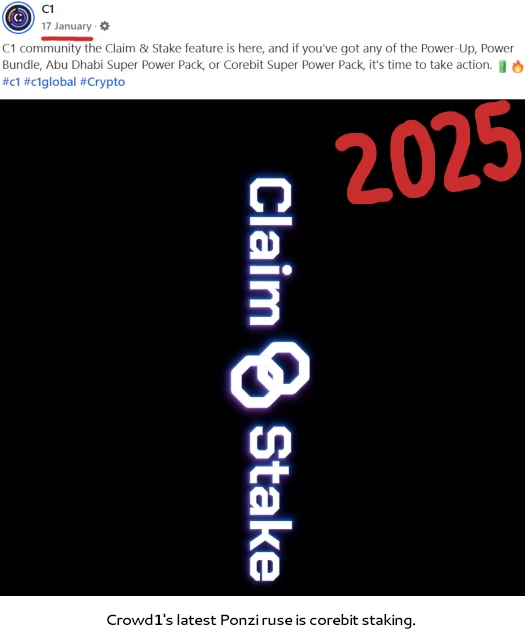

CBIT is part of a collapsed Ponzi staking scheme Crowd1 launched earlier this year:

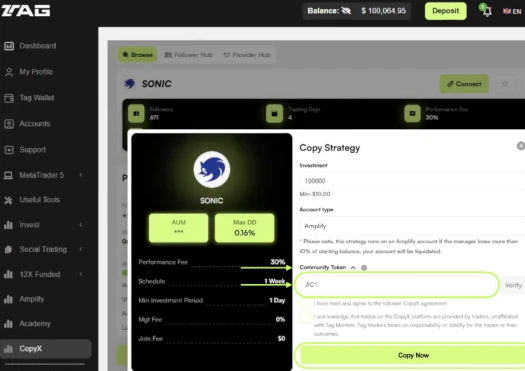

Funds are deposited into Tag Markets to participate in an unregistered “Sonic AI Copytrader” scheme:

As above, the Sonic AI scheme is being pitched as “passive income”.

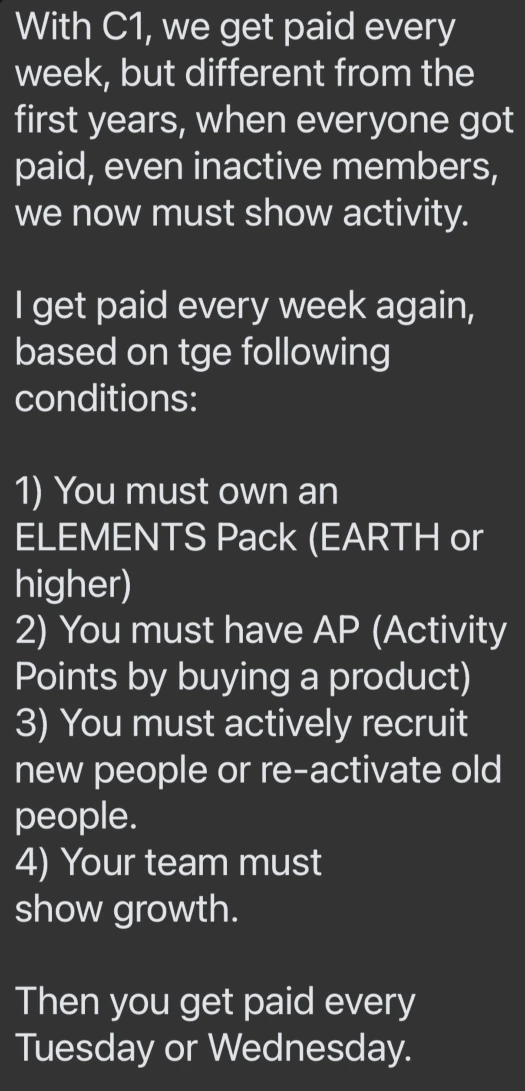

Catches not disclosed in Crowd1’s official marketing material include:

- investors must “own an Elements [Crowd1] Pack (Earth or higher)”;

- investors must meet Crowd1 “activity point” requirements (i.e. spend money within Crowd1); and

- investors must recruit new investors and/or convince their existing victims to reactive their accounts

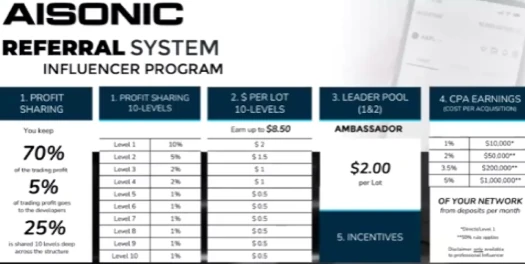

To financially incentivize recruitment of new Crowd1 victims, the Tag Markets scheme appears to have its own MLM compensation plan attached:

Crowd1 is an MLM Ponzi scheme run by by Jonas Eric Werner (right), a Swedish national hiding out in Dubai.

Crowd1 is an MLM Ponzi scheme run by by Jonas Eric Werner (right), a Swedish national hiding out in Dubai.

Launched in 2019, Crowd1 has gone through many reboots. The scam has also attracted the attention of regulators in multiple jurisdictions, prompting Werner to start using the name “C1”.

In May 2025, six of Werner’s Crowd1 accomplices were sentenced to prison by the Stockholm District Court. Werner himself disappeared off social media about a month before the sentences were handed down.

Tag Markets is a shady trading platform run by persons unknown. Tag Markets’ website domain is relatively new, having only been privately registered in March 2024.

On its website Tag Markets states it is ” owned and operated by T.M. Financials Ltd, a company incorporated in Mauritius”. This corresponds with two purported financial licenses, which outside of Mauritius itself are meaningless.

Tag Markets’ website also cites “Tag Markets Ltd”, a purported Saint Lucia shell company.

Tag Market only having ties to shell companies in two dodgy jurisdictions is an immediate reg flag. To that end Tag Markets has already attracted the attention of financial regulators.

Dutch authorities issued a T.M. Financials Ltd fraud warning in July 2025:

Tag Markets being integrated into Crowd1’s backoffice suggests Werner has struck a deal with the platform. This will likely see Werner paid a commission on new investment made into Tag Markets by Crowd1 investors.

Given withdrawals are tied to KYC, the shady nature of Tag Markets raises an identity theft risk for participating Crowd1 investors.

Notwithstanding total loss of money invested into Tag Markets, which is in addition to funds already lost across the many Crowd1 Ponzi reboots.

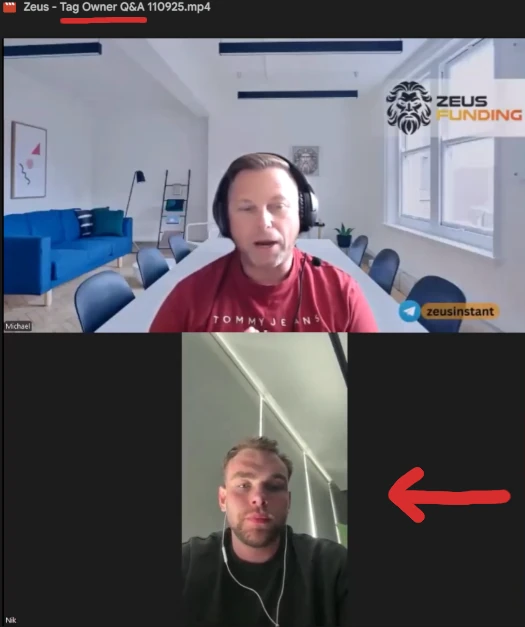

Update 24th October 2025 – Niklas Freihofer (as Nik) has begun appearing on marketing webinars as owner of Tag Markets:

“Michael” above Freihofer is Michael Eder. Eder is co-founder of Zeus Funding, another Tag Markets fraudulent investment scheme.

CashFX victims are also being funneled to TAG Markets to earn passive income from their copy trading program.

The owner of TAG Markets is Niklas Freihofer: youtube.com/watch?v=SdtFSfPzIEM&t=14s and youtube.com/watch?v=2XCGTsw7V1I

The address of TAG Markets and their broker-dealer licence in Mauritius were also used by Pure North Markets Ltd which surrendered that licence in March 2024:

fscmauritius.org/media/170534/public-notice-pure-north-markets-ltd-gb21026474-surrender-of-licence.pdf

Do we have anything definitive tying Freihofer to Tag Markets? The first video isn’t about Tag Markets. The second is AI-generated slop (recovery scam style).

I can see Freihofer nuked his Instagram account, that’s a red flag. On FaceBook he cites himself as a former Eaconomy promoter (account also nuked back to 2020).

The address doesn’t mean much as it’s a shell company address. These are commonly shared across multiple shell companies.

That and obviously neither Tag Markets or Freihofer have any actual ties to Mauritius. Freihofer appears to be yet another Euro scammer hiding in Dubai. This does fit with Jonas Werner being the same.

Dagcoin is also being funneled to Tag market.

According to CashFX members who have joined the TAG Markets platform, Nik Freihofer has appeared in private calls and has been introduced as the owner of TAG Markets.

According to their website, Tagmarkets.com is owned and operated by T.M. Financials Ltd, a company incorporated in Mauritius, under company number C185265 and regulated by the Financial Services Commission of Mauritius as an Investment Dealer, License number GB21026474. This is the same license number as for Pure North Markets Ltd. (in addition to the same address).

So either there is a connection between the two, or TAG Markets just copied the license number from another company that had surrendered its license.

On their website, TAG Markets has a whole section trumpeting its FSC license. “Licensed by the TSC for Your Security and Peace of Mind”.

Thanks. Only because I’m not familiar with Pure North Markets (or any of Freihofer’s previous scams), I’ll hold off updating till we get something more concrete.

Figure it’ll probably come out in the wash if enough Crowd1 victims start asking questions.

And someone also shared this with me: fintelegram.com/whistleblower-request-krypto-payment-operator-ubankxx-and-its-mlm-fraud-schemes/

And here’s a woman named Susan Turner warning people in a post on Medium on June 20th 2024 about Nik Freihofer… Exposing Niklas Freihofer : The Fraudster Deceiving Investors Worldwide

medium.com/@susanturner5642122/exposing-niklas-freihofer-the-fraudster-deceiving-investors-worldwide-173fd180dc0d

Article updated to note Niklas Freihofer has begun appearing on marketing webinars as owner of Tag Markets.