Cloud Token drops investment terminology, pseudo-compliance ahoy

As the most prominent app wallet Ponzi scheme on the market, it’s only a matter of time before Cloud Token attracts regulatory attention.

As the most prominent app wallet Ponzi scheme on the market, it’s only a matter of time before Cloud Token attracts regulatory attention.

Evidently fully aware of this, Cloud Token has begun to embrace pseudo-compliance.

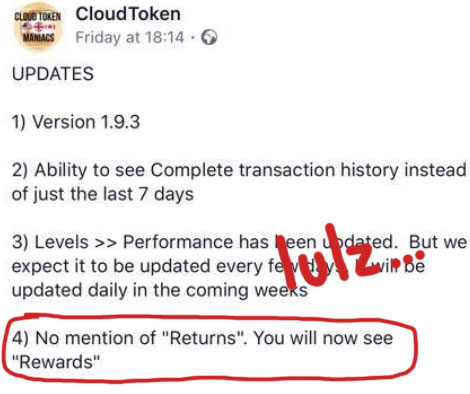

In it’s latest app update, Cloud Token advises it has removed any references to returns.

Instead, Cloud Token now refers to returns affiliates receive as “rewards”.

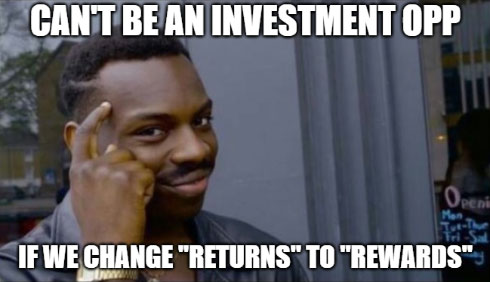

From a regulatory perspective, Cloud Token can call its returns whatever it chooses.

The mechanics of payment within Cloud Token sees affiliates invest $x in CTO points.

CTO points are parked with the company within their app, providing affiliates with additional CTO points.

Over time Cloud Token arbitrarily increases the internal CTO value, thus allowing affiliates to withdraw more than they’ve invested.

Reward, return… it is what it is – securities fraud.

This isn’t the first time Cloud Token has attempted to distance itself from its fraudulent business model.

Previously Cloud Token admin Ronald Ai and US promoter Faith Sloan claimed that because the company was investing funds invested into by affiliates, that affiliates themselves weren’t investing.

This convoluted logic fell apart upon consideration that affiliates were paid returns (a security exists when a return is derived via the efforts of a third-party).

At present Cloud Token is operated between Malaysia and Singapore. The company also has a notable presence in the US, headed up by a number of serial scammers.

As of yet the Bank of Malaysia, Monetary Authority of Singapore or the US SEC has taken any action against the scheme.

Given Cloud Token is now adopting Zeek Rewards’ and TelexFree’s greatest hits, regulatory action probably isn’t too far behind.

FAKE WALLET: And just like OneCoin, their mobile wallet is completely fake with no private keys to secure your coins on the blockchain as reviewed here: https://behindmlm.com/mlm-reviews/cloud-token-review-another-mobile-app-crypto-ponzi-scheme/#comment-412353

Hey great post, very informative. The people getting involved in this are in for a shock when their money turns up missing.

I’ve been getting an uncertain feeling about Cloud Token since I started paying mind to it thanks to someone I know who’s promoting it, they recently shared a video about it and personally it raises more red flags in my eyes.

I left a link to the video below, if you skip to about 27:08 you will hear them talk about their new business add on which screams scam to me.

Cloud Token video – (Ozedit: spam removed)

[27:08] of that video was some bullshit about a “reserve fund”. Ponzi smoke and mirrors.

Two updates, not really worth a new article.

Ronald Aai on Facebook today:

and

USDT are printed on demand by Bitfinex, who are under investigation by the New York AG.

Tether is supposed to be backed by USD but isn’t.

When it wants to pump BTC Bitfinex creates Tether out of thin air.

It then sells newly printed Tether for USD.

As revealed in the New York AG complaint, Bitfinex “borrows” this money to buy bitcoin, which drives the price up.

ag.ny.gov/press-release/attorney-general-james-announces-court-order-against-crypto-currency-company-under

What is probably at some point going to be confirmed by the New York AG is:

1. Bitfinex generates tether out of thin air.

2. Bitfinex sells newly generated tether for USD.

3. Bitfinex uses USD to buy bitcoin.

4. bitcoin price pumps.

5. Bitfinex sells off bitcoin for USD.

6. bitcoin price dumps.

7. Bitfinex generates more tether out of thin air.

8. Bitfinex uses USD obtained in (5.) to buy newly generated tether

9. (go to step 3)

The laundering happens through a series of “affiliated entities”. Bitfinex refers to it as a loan, so in effect is loaning USD from itself perpetually to drive bitcoin’s value up when they want.

Legalities aside, the problem is the more they do it the less actual USD is backing USDT.

From memory the New York case has already confirmed that USD allegedly backing tether is actually somewhere in the 70s% (not 100% as claimed).

Why Cloud Token wants in on this I don’t know.

I suppose there’s some bullshit going on in the backend that lets them keep more invested USD this way.

Also with USDT being unable to be cashed out to USD, probs an attempt to hide the money trail from the authorities as it were.

USDT has to be transferred into another coin before USD, which = one more layer of obfuscation.

As for the second quote, by confirming that Cloud Token pools investor funds to generate passive returns, Aai just satisfied the Howey Test.

They Howey Test is used to legally confirm the existence of an investment contract, with respect to securities regulation.

Tether is a different can of worms altogether, and is not really relevant to the CloudToken discussion.

If CloudToken claims to be priced on Tether, NOT USD, then it is MUCH MUCH MORE volatile than it previously claimed to be. Because Tether is a cryptocurrency… USD is a fiat currency.

This is not a matter of a typo… but an outright lie.

Quoth the Ronald;

Interesting information from Kevin Thompson that I think is relevant to CloudToken:

facebook.com/mlmlegal/posts/3053080374762820