Catly Ponzi scheme collapses, withdrawals disabled

The Catly Ponzi scheme has collapsed.

The Catly Ponzi scheme has collapsed.

In an announcement made a few hours ago, Catly informed investors it had disabled withdrawals.

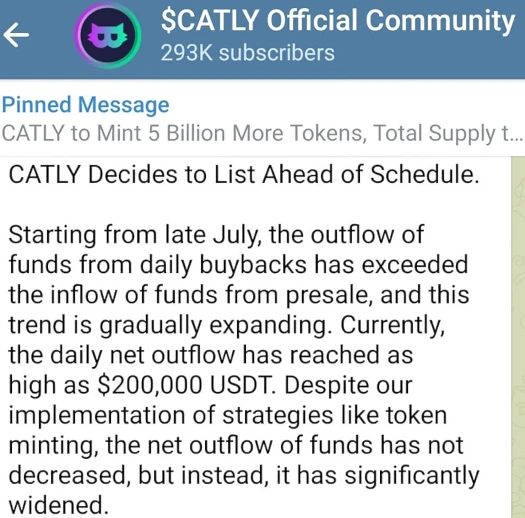

Somewhat refreshingly, Catly is honest about the reason for its collapse:

Starting from late July, the outflow of funds from daily buybacks has exceeded the inflow of funds from presale, and this trend is gradually expanding.

As happens in every Ponzi scheme, Catly withdrawals eventually exceeded new investment and that’s a wrap.

To ensure a successful listing of CATLY on exchanges, we have made the decision to halt the presale and buyback operations.

Catly’s exit-scam of choice is dumping its CATLY token on dodgy public exchanges and disappearing.

Here’s what’s next on our agenda:

1. Release the new CATLY token contract.

2. Distribute tokens to holders’ wallets.

3. List on encrypted exchanges.

There is of course no guarantee Catly will follow through with its stated exit-scam. They could just as easily skip the effort and disappear.

Signs this is likely include Catly disabling website support following its collapse. Catly’s social media profiles have also been deleted.

Catly launched a few months ago and is believed to be run by Chinese and/or Russian scammers.

Catly investors were lured in on the promise of a 3% a day ROI, offered through a typical “staking” Ponzi model.

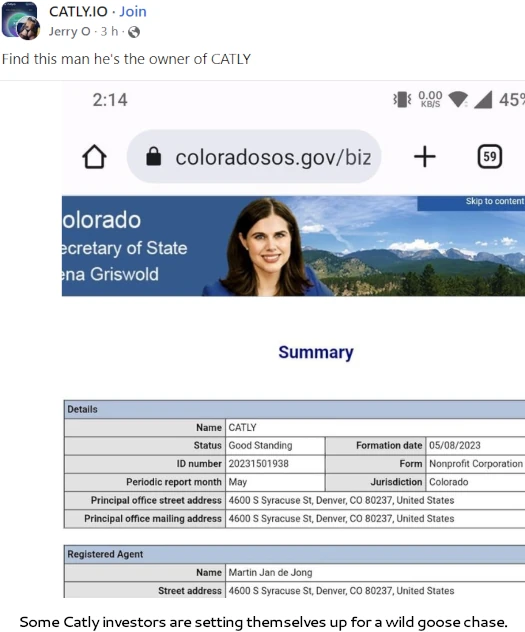

As part of its attempts to appear legitimate, Catly offered up investors a shell company certificate for Colorado.

Unfortunately the Ponzi scheme’s more gullible investors don’t realize this is a sham:

Even in the US (Colorado and Delaware are primary offenders), registering a shell company with bogus details is easy. Scammers pay a fee, fill in bogus details online and save a PDF certificate.

For this reason BehindMLM routinely cautions that shell company registration in any jurisdiction is meaningless. Shell company registration is not the same as registering with financial regulators.

I think he was professional scamer. Other way if he want to do good than he have many options for solutions.. buy price update or lunch coin ..

Or may be shear live isshu about catly. All people will solve her isshu ..

But he was a scamer.

Catly site not crushed still working. The reason why Catly disabled their Buyback mechanism (Ozedit: snip, see below)

…is because Ponzi go boom. Sorry for your loss.