Berry trading Ponzi collapses, IPO exit-scam & recovery fees

The Berry Ponzi scheme has collapsed.

The Berry Ponzi scheme has collapsed.

Withdrawals have been disabled, and investors are being fed multiple exit-scams.

Berry went by a few names; Blueberry, Berry Trading App, Fertile Soil Global (FS Global), Berry FS Global, Berry Exchange and, more recently, Berry Max.

Known website domains associated with Berry include:

- berry.im – privately registered in or around June 2022

- berry.band – privately registered on June 11th, 2022

- berry.tips – privately registered on June 11th, 2022

From what I’ve been able to put together, Berry affiliates invested cryptocurrency on the promise of passive returns.

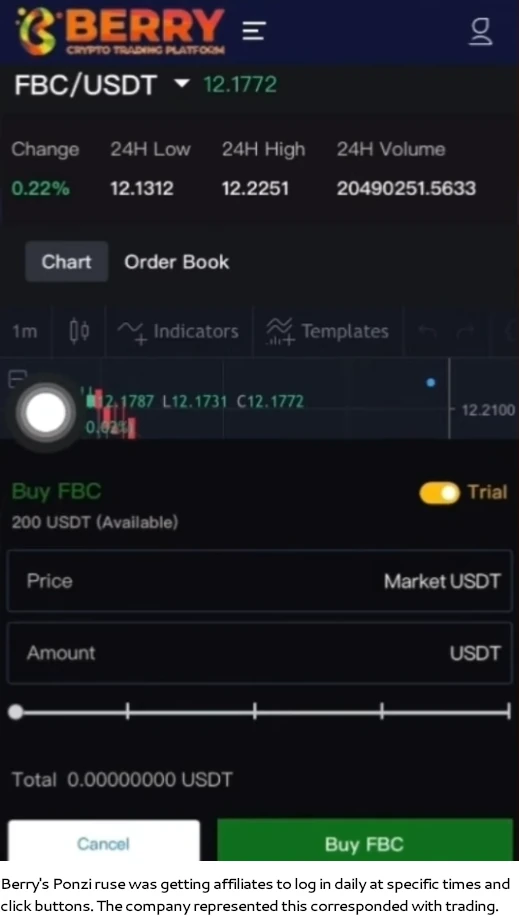

Berry had affiliates log in and click buttons, which corresponded with crypto trading.

In reality this was all an elaborate farce. Logging in to click buttons at specific times within Berry wasn’t attached to actual trading.

Berry had a commission structure tied to “VIP” tiers. This is similar to “click a button” Chinese Ponzi schemes.

Berry affiliates could also qualify for periodic bonuses, tied to either personal recruitment or how much they convinced others to invest.

Berry collapsed on or around May 2nd by disabling withdrawals.

In the lead up to Berry’s collapse, the Ponzi scheme launched FDPT tokens and an investment promo.

April 18th – 4D printing technology will open a special purchase session on April 24, 2023, and the project combining artificial intelligence and 4D printing will be launched soon!

April 19th – In order to give back to new and old users and become the mainstream of the world, the Exchange grandly launched the [5+5 Promotion Plan] a referral promotion program that means “Win-Win Activity” !

Activity Bonus Pool: 20,000,000 US dollars (closed when the amount have been given out)

Invite your new friends – work together to create profits and lighten hope!

On May 3rd, 24 hours after withdrawals were disabled, Berry trotted out an “acquisition” exit-scam:

The latest update for BERRY is full of positive news, indicating a bright future ahead!

We are thrilled to announce that the BERRY exchange has received an acquisition invitation from a globally renowned institution (world renowned institution).

This is a testament to the hard work and dedication of our team, as well as the trust and support of our users.

As the current new coins had attracted attention and popularity , the current valuation of the platform has increase 3.3 times of the original value.

The preliminary review of the acquisition will be conducted regarding the assets management , equity , assets circulations within the Berry Exchange.

Later that same day a 100% cashback on new investment (“recharging”) was also announced:

To show our gratitude for your support and attention, we are launching a 100% cash back ( rebate activity ) on your recharge within a specific time.

This was followed up with a BRY token launch on May 5th;

BERRY Token (BRY) is the platform token of BERRY Exchange, serving as the backbone of the entire BERRY ecosystem.

It will be used to support various functions within the platform, such as transaction fee, risk reserve fund, token-to-token exchanges, and as a means of participating in platform activities such as voting for new token listings and participating in pre-sales.

In order to meet the IPO listing requirements of the Nasdaq Global Market, the world’s second-largest securities trading market, BERRY Exchange must meet strict financial, capital, and joint management indicators.

To ensure the smooth progress of the merger, we have decided not to disclose the identity of the partner company at this stage. However, we will restore the withdrawal channel after the valuation is completed.

This is of course all baloney. It is very similar to QZ Asset Management’s recent exit-scam, minus the SEC filing filled with bogus information.

On May 12th, Berry informed users it was rebooting as Berry Max;

We are happy to announce Berry Exchange has reached a preliminary agreement with international institutions for Mergers and acquisitions , and now the exchange is officially fully upgraded !

Our official platform name has been re-branded to ‘Berry Max,’ which reflects our renewed commitment to providing top-notch trading services.

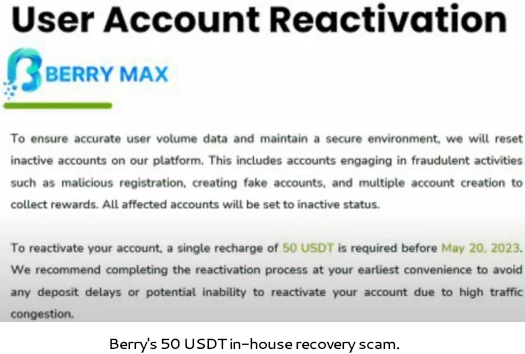

This was nothing more than an in-house recovery scam. Berry demanded 50 USDT from its investors, under the guise of “ensuring accurate user volume data”.

Berry affiliates who failed to pay up were threatened with account termination.

A new “loyalty program” was also announced, with the aim of screwing gullible investors out of an additional 500 USDT.

Berry’s loyalty program is scheduled to end on May 20th. That’ll probably be extended (the cashback reload scam was extended), after which Berry’s website will be taken down.

Basically it comes down to diminishing returns. Berry’s admins will continue to pump out new scams as long as enough gullible investors hand over more money – mostly because they think doing so will unlock withdrawal of money that doesn’t exist in their backoffices.

When that dries up, 404 website not found.

From what I’m seeing on social media it’s gradually being accepted that Berry was a Ponzi scheme. Certainly the recovery scams and IPO baloney have contributed to investors realizing they’ve been had.

As tracked by SimilarWeb, traffic to Berry’s primary .IM website climbed throughout early 2023. April 2023 peaked at 3.8 million visits, enough of a pot for Berry to pull the plug.

The majority of Berry website traffic originates from Africa; South Africa (36%), Botswana (16%), the UK (12%), Rwanda (11%) and US (8%).

The language used by Berry certainly has an Asian engrish feel to it. I feel like this might be an evolution of the basic “click a button” Ponzi schemes run by Chinese scammers, but I haven’t seen variations of Berry emerge.

Bit of a novel idea, getting affiliates to log in and click buttons at certains times to get them to think they’re trading – but ultimately still theatrics to hide a Ponzi scheme.

Other than the aforementioned scam updates and Berry’s website eventually disappearing, not anticipating any substantial updates on this one.

Update 24th May 2023 – Berry appears to have dropped its IPO nonsense and wrapped up the recovery fees exit-scam.

As of May 23rd, gullible investors Berry remaining are now being subject to a forced conversion to BRY token.

On May 23, 2023, all the unlocked assets held in BERRY MAX will be automatically converted to BRY.

BRY is worthless outside of Berry Trading, effectively making investors bagholders of a dead Ponzi token.

I don’t have a timeline but once the BRY dump exit-scam is complete, there’s no reason for Berry to keep the exit-scam ruse up. Expecting they’ll disappear over the next few weeks.

Update 31st May 2023 – After forced conversion to BRY token, Berry has now locked everyone’s tokens for 90 days.

The institution involved in the M&A requires all users to lock their BRY tokens for 90 days to ensure the stability of BRY’s value.

If we achieve a 50% increase in our platform’s performance for two consecutive months, we will unlock all the BRY tokens ahead of schedule.

The recovery scam hinges on gullible investors handing over more money. Usually this is done on an individual basis, Berry are doing it company-wide.

These people need to be brought to book if they can they just can play around with people’s lives that are battling.

There is some personal responsibility too though.

What I’m noticing with these Ponzi schemes is that obviously the time they last is getting shorter and shorter and shorter, which is brilliant!

Sometimes, you just wonder how many stupid people are left in the world who keep participating in these Ponzi schemes, hoping they’ve discovered gold. And then you get an email like this…

Well, let me tell you, there’s no legitimate investment platform if it involves crypto multilevel marketing and sounds too good to be true by guaranteeing unrealistic returns.

It’s a scam! “It’s not rocket science, it’s de Hek science”

1-6 months seems to be the “click to earn” lifespan.

Low input cost, short lifetime, reset and repeat.

FS Global facebook site was previously Bitclub Network, a previous scam. Then it was renamed to FS Global.

facebook.com/therealbitclubnetwork/about_profile_transparency

@Jacques

That explains a bit. Safe to assume all the top dogs in FS Global are serial Ponzi promoting scammers.

Berry was a little sloppy on this one using a registered business’s bank account in the name of Jinxa Distributors and standard bank.

Now they reviewed and changed their M.O. to a random person’s bank account.

This should be brought up with regulators and law enforcement agencies.

And what are African regulators and law enforcement going to do against Chinese scammers hiding in Hong Kong and Dubai?

South African authorities can’t even arrest the owners of MTI, a $1.7 billion Ponzi whose owners are still living openly in the country.

The best you can hope for is local promoters and ringleaders to be rounded up ala India.

I have a also been scammed by them so please inform me of any actions that gonna be taken against them.

This berry max has to be stoped they have hurt so many inocent people.

worse part of it changing bank accounts like it no bodys business that a big red flag.

how can they ask us for $50 on top of what we have in thousands of dollars and we can’t withdraw what nonsense. the hole world must know about them please help us.

We trusted Berry we invited the poor to invest their last money now they have to pay $50 to get access to withdraw their money.

how can you explain this to a disadvantage community. Berr disappointed the nation.

Simple. You invested into a Ponzi scheme and Chinese scammers don’t care about your nation.

This berry kill us they scam me alot of money.

Chinese scammers are getting your “leaders” to scam you.

Stop following Facebook groups and people referring you to the next thing, and tell your friends to stop too.

Waiting for d-day the 20th that’s when all accounts need to be reactivate by.

watch and see how thus date changes they will do anything to rob people if there money.

Berry has finished us, a lesson learnt the hard way.

I remember when someone called me and told me about berry, the way he told me that you can withdrawal any time.

I didn’t expect something like this. God have mercy on us.

The government of South Africa should stop Fs Global because it encourages robbbers.

ohh my money!!!I am crying.

Here are a couple of hints South Africans:

1. Stop believing you’re special

2. Stop falling for every scam

3. Learn from your mistakes

4. Stop voting for a political party that entrenches dishonesty

Why are you referring this to South Africans as if Berry was for South Africans everyone all the corners of world was scammed by Berry.

Mostly South Africans. Special breed of desperate.

We have been shucked.

A bit Darwinian evolution really, idiots lose their money because they are idiots.

Idiots need to get smarter if they want to stop losing their money.

If in anyway there is such an organization, FS Global must explain their involvement with these chinese crooks or else they must face the music.

Berry has extended the reactivation account time and loyalty program until 22nd and at the same time postponed the withdrawal date to 23rd! Why is that? Maybe, those are exit strategies

Yeah I saw that. Squeeze as much out of the dumdums left.

From an “understanding a scam mindset” perspective, if you’re still getting enough idiots paying the 50 USDT fee keep it going for as long as possible.

There is one Uncle Jason whose name is prominently associated with Berry and BerryMax . If this turns out to be a scam that people are fearing then this Jason should have a lot of questions to answer from Berry participants and Security agents.

I am surprised that people still hold periodic zoom meetings people with Indian accents (Not Chinese) promoting this knowing it to be a scam.. Perplexing..

Disable withdrawals then order affiliates to withdraw before disappearing:

Looks like the NASDAQ and IPO bullshit has been abandoned. Lololol.

My comment is about the activation of accounts, why was the deadline not month end cause some of us get money month end.

Is this what you call helping people by holding our money, I took my child’s school fee to join berry and thinking that it would have been raised by this time now it’s needed I don’t now what to do cause am even a single parent not employed it’s difficult to raise money.

My is now not given food at school because of short school fee. why at least give back our joining fee and keep the one that we have raised, please be merciful have favour.

This issue affects me daily and am a person who is epileptic. You want to see people dieing Berry Max where is your help here.

Berry was a Ponzi scheme. The scammers behind it don’t care about you or your family.

They only care about your money, which you’ve transferred over. Harsh but this is the reality of investing in MLM crypto Ponzi schemes.

Article updated with latest BRY token exit-scam development.

Hi

So i have read through your findings and i want to give you a clear update on the current events at Berry MAX.

1. Withdrawals should have been open on 22 May and was moved to 23rd May . We submitted the withdrawals and last night they cancelled all withdrawals and have moved all our assets to the BRY token and then send out a communication at 22h30 south african tie.

2. This is done now according to them to give us another 30% ” Bonus appreciation : for being so “LOYAL”

3. I have a portfolio of over $700 000,00.( i didnt put that it – i am not that dumb and always start small and compound because thats what all these systems like , compound interest users

4. I have received a separate message from the inside that i would gladly share based on withdrawals and their strategy to prevent a guy like me that “earn” over $30000 a day on the tradings to only be able to withdraw $10000 a month.

This math doesnt make any sense to me..

Now at current they have send out signals with our funds frozen on the BRY token.

You have to deposit “real money to continue trading.

Why is isnt there any thing that we can do legally except for name and shame?

Thanks for the clarification. Berry collapsed when I wrote this article on May 16th.

Just waiting for the website to disappear now. All of the BS they’ve come up with since May 16th is just to further milk the saps left.

Because in most of the world the moment you hand over crypto to scammers it’s over.

Thanks for the updates, it’s all just part of the con. Do not pay anything else, you won’t be getting any money back.

You handed your money over to anonymous scammers overseas operating illegally, so there is little you can do except report them to authorities and not get caught in the same manner again.

I feel ashamed because l invested in Berry since last year but never withdraw not a cent.

these platform robbed me all my money, energy, time and data. God, Help us to expose these Scammers.

They Berry should be sentenced to prison. They should be exposed on their television station in South Africa as being scammers just as they were celebrated.

It is very sad that these people designed such an elaborate scam to hurt thousands of people. Not only did they design it once, but the andI had another scam trading platform just like Berry’s called Belam.

All of these scammers resources should be confiscated and liquidated and distributed to the victims of their scam.

Well the berry fsg managers are busy intimidating poor members who couldn’t withdraw even a cent while they the likes of pastor ngubo president of the Durban group or team angel, tabong a leader in the lion’s team and some others like Elizabeth mapasha, Lizzy gumede, bonga among others withdrew at will.

There is also a Christ embassy ministry pastor Swazi from mhlaleni who got promoted to be a berry manager because she had recruited many people, they even opened an office for her.

Unknown to her she was being used to lure innocent people to the scheme most of which never withdrew a cent.

She herself was being paid a salary of $800USD a month by berry for her role as manager, on top of that she could withdraw money successfully and even help chosen downliners to withdraw, she did however made donations to some charities in eswatini but now it’s all gone.

I wonder how she face church members she made to join the scheme since they have lost so much already…

I will be very glad if they can be exposed, and the some of the monies of us recovered, if that can happen.

How possible these scammers managed to scam so many countries and they is no country that can bring these scammers to justice?

that Chinese guy who came and spear on behalf of berry must be caught to explain well.

people must find their money which they invested into these scuummers.

What i don’t understand i you check Bry currency is already empty is just a number.

for withdrawal these guys really are dangerous they awalys come with plan ,the depositing is open why can’t they suspended it also as withdrawal if they are updating the system.

Something is not copying here. i think we have to find the person who introduced this berry thing i think he/she will clarify everything because whats happening now we have already lost our loved due to berry.

Once you accept Berry was nothing more than a Ponzi scheme everything makes sense.

The longer you remain in denial… well, good luck with that.

In Botswana in particular, the other similar one Ecoplexus is in the middle of a big investigation whereby ppl are getting paid back their investments via FNB Botswana.

Anybody know the difference in how Berry is operating vs Eco? So that they are also caught?

No idea what Ecoplexus is but Berry is a Chinese run Ponzi that targeted South Africa.

South African authorities can’t even police South African Ponzi schemes (MTI). Forget about Chinese run “click a button” Ponzis run out of Hong Kong, Singapore and Dubai.

Article updated on Berry’s exit-scam latest (tokens locked for 90 days).

I think we need to lay charges on this scams.

There is a new capitec account where they expect new people to deposit money into for BERRY.

I think if they dont release the funds after this 3rd month, we must open a case of fraud against them and take it to the newspapers.

Good day

I was a Berry max investor and now the whole Berry/ Berry max platform has gone dark please can you tell me what is going on with the platform, any contact details or how can us ,as investors get our money back.

A lot of people put the last little bit of money they had into this platform and I don’t want to see more people end up homeless or in poverty because of Berry Max, I want all the the investors money back.

Please can you assist me with right the wrong that Berry Max has done and bringing everyone involved to justice.

I sincerely hope that you can assist me with this or forward me any contact details you might have on anyone that was part of Berry max.

Like Mr Bae Lee, Ivan Koo. Mr John Pritchard (C.E.O. UK), Mrs Ashley Medaline ( financial analyst).

Please help get the people their money back

Kind regards

Eric Steyn

What is going on is you invested into a Ponzi scheme and your money is gone.

Sorry for your loss.

Can anybody please let me know where or how I can get hold of Ashley, she was the financial analyst, the one who created and sent out the signals for Berry and Berry Max, I’m urgently looking for her , also of anyone can tell me what the address is for BERRY MAX in the UK.

Please whatsapp me on (removed) it is of great urgency

“Ashley” doesn’t exist lil bro. And Berry Max has no ties to the UK. You got scammed.

I just saw that this Berry i.m is gone with the investor’s money their website page is no more. we need to bring this criminals into book.

You got scammed my man! Sorry ne.

The law must help us to get this Berry and F.S. Global, so they can refund all the investors.

We are depressed through this scam. Our health conditions are detoriating, we need our money before we die of stress.

It’s a scammer.

Good morning I’m RICARDO jossias deve I invested my money in FS global and berry since from February until now I didn’t get withdrawals website is gone no more Berry if I try to open.

I invested R7800 I don’t know what is going on this PLATFORM.

What’s going on is you invested into a Ponzi scheme and your money is gone. Sorry for your loss.

Yes is me i invested my money on berry and FS global platform.

So as all the conflus caused to fs global and berry to us south africans leaders what does them plan for all that?

They used lies of donation and charity to scam even the poor old womans who does have hunsbands they put millions of people in south africa in souffrance why?

Money. They wanted to steal your money.

This only reason people run and promote Ponzi schemes.

In the Democratic Republic of Congo, I’m going to fs global and Berry max gives me my money, they’ve been scamming all this time, they’re telling us they’re going to pay us.

We are frustrated.

Hello hello.

Am from Malawi, I invested money to berry and FS GLOBAL.

my money is gone website as well gone. Whatever they called fs global promises to pay us nothing happened.

Hello hello.

Am from Rwanda, I invested money to berry and FS GLOBAL.

my money is gone website as well gone. Whatever they called fs global promises to pay us nothing happened.

These comments are getting quite repetitive. I take it the Berry reload Ponzi collapsed (FS Global?), and Africa’s dumbest lost money again.

Coming on here after you invested into a Ponzi scheme and lost money to let us know isn’t constructive. I’ll be marking the spam accordingly.

This people are so heartless.South Africa it’s a playing ground for them. they should be stopped.

i invested 20k gone. they seemed so legit when I started with FS global. what a waist of time. but lesson learned.

How on Earth did an Ponzi app run by anonymous Chinese scammers seem “so legit” to you?

I was one of the people that were recruited in my neighborhood. i could tell that its a scam given when i asked the so called teacher about who are we trading with and where does the money come from.

she then told me we are trading against the system, so it made no sense that we are trading against a platform and making money from it.

so i decided that as soon as I reach 150usd I’m withdrawing 100usd so I’m left with just the 50usd to trade.

and I warned those that recruited me that guys this one is a scam lets pull out and they all told me that the will withdraw in January 2023 so I withdrew 100usd in December 2022 and by 1st of January no one of my team could withdraw.

No offense but this is peak “I’m a fucking idiot”.