NewAge sold to Morinda founder John Wadsworth’s nephew

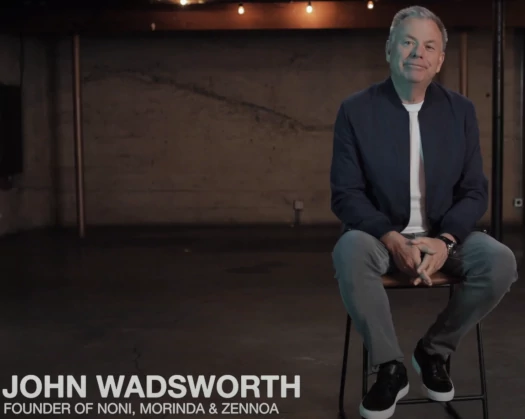

Approval has been granted to sell NewAge off to original Morinda co-founder John Wadsworth.

Approval has been granted to sell NewAge off to original Morinda co-founder John Wadsworth.

NewAge, who owns the MLM companies Noni by NewAge and Ariix, filed for Chapter 11 bankruptcy on August 30th.

That same day NewAge signed an Asset Purchase Agreement with DIP Financing LLC.

DIP Financing LLC is a Wyoming shell company with a PO Box address in Puerto Rico.

The sole named representative of DIP Financing LLC in the NewAge Asset Purchase Agreement is “John Wadsworth”.

I originally pegged this as John J. Wadsworth, one of Morinda’s original co-founders.

Morinda launched as Tahitian Noni International, dating all the way back to 1996. Non-MLM business operations date back even farther to 1993.

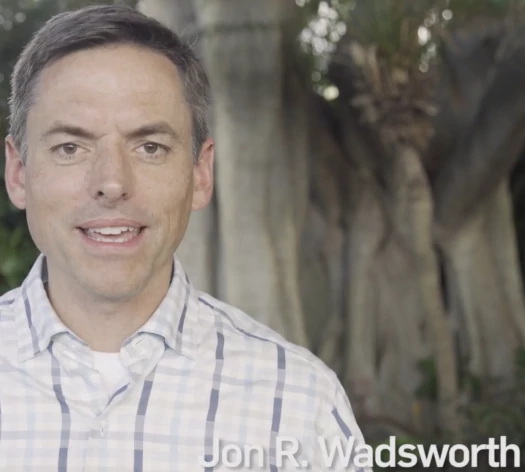

Turns out the “John Wadsworth” that signed the DIP Financing filing was John J. Wadsworth’s nephew, John R. Wadsworth.

This was disclosed in a September 20th filing, pursuant to an objection as to whether John R. Wadsworth had any hand in NewAge’s decline.

John R. Wadsworth identifies himself as a distributor for both Morinda and now NewAge.

Other than a part time summer job in 1997, while I was college student doing research work for Morinda, I have never been an insider, employee, officer, director or significant shareholder of NewAge, Inc.

I am a beneficial owner of less than 0.4% of the outstanding shares of NewAge, Inc.

John R. Wadsworth isn’t the only other Wadsworth tied to the business. John J. Wadsworth we’ve already covered above.

B. Joseph Wadsworth (“Brother”) is my brother and is an area president of NewAge for the North Asia Area.

BehindMLM reader “D”, who seems to be familiar with the Wadsworths, claims in the comments below that “Joseph is his brother and already runs NewAge Japan.”

While he’s obviously heavily involved in NewAge as a distributor, John R. Wadsworth maintains;

By comparison with my Uncle and Brother, I am not now, nor have I ever been an employee, officer or director of NewAge or its affiliates.

By comparison, I have always been a wholly independent sales agent/distributor of Morinda, both before and since it was acquired by (New Age).

John R. Wadsworth also asserts he “had nothing to do with the decline of the company”.

On the contrary, my sales of company products, as an independent sales agent/distributor, were growing.

John R. Wadsworth claims he became aware of NewAge’s financial issues through his brother, B. Joseph Wadsworth, on August 17th.

B. Joseph Wadsworth suggested his brother call Joe Ebb at Houlihan Lokey Capital, Inc., to discuss NewAge’s situation.

After speaking by phone with Houlihan on August 17, 2022, Houlihan requested I execute a non-disclosure agreement so they could share with me the same information they shared with any other potential acquirers, pursuant to the very same terms of confidentiality to which I agreed.

Other than suggesting I call Houlihan, no family member shared any information with me about NewAge’s challenges.

On August 20th, John R. Wadsworth set about forming DIP Financing LLP.

In addition to me, the other investors in DIP Financing LLC are neither current nor former insiders, employees, officers, directors or significant shareholders of NewAge, Inc.

John R. Wadsworth’s declaration goes on to mention some loan issues in China but I don’t think that’s relevant to NewAge being sold off.

Personally I think while John R. Wadsworth might have not included his family in DIP Financing LLC for the sake of legality, this is obviously a return of Morinda to the Wadsworth family as a whole.

Unfortunately, at least for now, who John R. Wadsworth’s DIP Financing LLP partners are hasn’t been disclosed. Nor do we know how much DIP Financing paid for NewAge.

In related filings, a September 28th Statements of Financial Affairs reveal that, throughout 2021, NewAge appears to have been kept afloat by a $3.2 million PPP Loan.

Of the loan amount, $2.8 million was forgiven.

Ariix’s financial affairs meanwhile look kinda suss. The company recorded $23.9 million in gross revenue in 2021, which plummeted to just $15,506 from January 2022 to August 2022.

While NewAge did upload a press-release to their website acknowledging its bankruptcy on August 30th, the company hasn’t otherwise made any public acknowledgement.

Throughout bankruptcy NewAge has remained active on social media, evidently discussing… more “important” issues.

I’m not expecting any further substantial updates but I’ll continue to monitor NewAge’s bankruptcy docket.

Update 29th October 2022 – As per an October 10th exhibit filing;

The purchase price for (NewAge’s) Assets is not less than $28 million.

Not 100% sure if that means NewAge was purchased for $28 million but assuming so.

Update 3rd March 2023 – NewAge has consolidated its MLM companies and rebranded as PartnerCo.

You’re getting your names confused. The purchaser is John R. Wadsworth. That is the nephew of John Wadsworth.

John R. is a Brand Partner at NewAge along with this partner Greg Tedrow. Together they have the largest organizations in Japan.

Are you sure it’s his nephew? The bankruptcy filing signatory was “John Wadsworth”.

I don’t doubt the family is on on the acquisition but I’m going by the filing.

The Wadsworths buying NewAge together would explain the shell company shenanigans.

Yes, I am 100% sure. You can read the court docket on this on Stretto.

D is correct. It is JR Wadsworth but John Wadsworth will have a role as Will cousin Joseph Wadsworth

It’s a family thing.

Thanks fellas.

I was going by the September 28th Statements of Financial Affairs, which only mentions John Wadsworth (as signatory for DIP Financing LLC).

What’s the specific filing that mentions John R. Wadsworth?

Joseph is his brother and already runs NewAge Japan. So yes, it’s a family affair. I can vouch that JR and Joseph are great guys.

Oz, you can read the clarification to the court from JR here:

cases.stretto.com/public/X198/11937/PLEADINGS/1193709202280000000031.pdf?fbclid=IwAR06y8qc9IzJBKGmbvqYqw-zE3t2Jox0kM5lEDwfj20z5UqXeUm9VsmKkTM

It explains the whole process and his relationship with his uncle and brother.

Thanks, will go over it and update.

Bankruptcy cases are easily the hardest ones to track. Ten million filings in every case and half of them are Tolkien novels.

Alrighty, I’ve updated the article. Thanks again for the input and clarification. John R. Wadsworth might want to include his initials in NewAge court filings :D.

One thought I had, as a result of John R. Wadsworth and his brother being tied to NewAge’s operations in Asia, is whether that extends to Ariix?

John J. Wadsworth featured in Ariix’s marketing material in 2021 (I only ran a quick search). I think it’s probable the Wadsworth’s knew what was going on over there (the pyramid scheme/bribery model).

accesswire.com/545630/New-Age-Launches-NoniCollagen-in-China-with-600000-in-Revenue-in-the-1st-3-Days

I went and looked up whether NewAge is operation in China and the above press-release is from 2019. My due-diligence senses are tingling…

Case No 22-10819

New Age sues old Chairman Ceo and area president.

Thanks. Article out soon.

Just a note on this. I’ve been slowly working through the 51 page Complaint over the past few days (in between all the other news).

I don’t if it’s just me but this is incredibly difficult to create an article around.

There’s a lot of repetition and pages and pages of paragraphs that jump all over the place.

Hoping to get it done today but I’m at page 24 as I write this and well into headache territory.

Tempted to say it’s a poorly written Complaint as I’m no stranger to covering legal docs.

Article updated with NewAge purchase price.

Via email:

Interesting chain of events, and everyone’s “happy”.

Via email (unverified):

The bulk ordering assessment here is reductive and incorrect.

“Incorporating the online business into the company” serves to protect the integrity of wholesale pricing, thereby protecting brand partner businesses from being raided by below-wholesale sellers.