SEC probe WMI for possible securities violations

Back in August of this year, Wealth Masters International announced their future plans to initiate ‘some major corporate initiatives’. These initiatives would culminate in the eventual public floating of the company via an Initial Public Offering (IPO).

Back in August of this year, Wealth Masters International announced their future plans to initiate ‘some major corporate initiatives’. These initiatives would culminate in the eventual public floating of the company via an Initial Public Offering (IPO).

Whilst Wealth Masters didn’t give a set timeline or specify exactly what ‘corporate initiatives’ they would be implementing in the lead up to the IPO, it seems as if this announcement didn’t go unnoticed by the US Securities and Exchange Commission (SEC).

Underlying concerns the SEC have about WMI wanting to float the company, the SEC have since launched a full-blown investigation of their own into Wealth Masters’ business activities.

For those of you living outside of the US or unfamiliar with their purpose, the SEC

was established by the United States Congress in 1934 to regulate the stock market and prevent corporate abuses relating to the offering and sale of securities and corporate reporting.

The enforcement authority given by Congress allows the SEC to bring civil enforcement actions against individuals or companies alleged to have committed accounting fraud, provided false information, or engaged in insider trading or other violations of the securities law.

The SEC also works with criminal law enforcement agencies to prosecute individuals and companies alike for offenses which include a criminal violation.

Note something to be taken lightly and in regards to WMI, begs the obvious question of why, upon announcing they were going ahead with plans to launch an IPO, the SEC would launch an investigation into Wealth Masters.

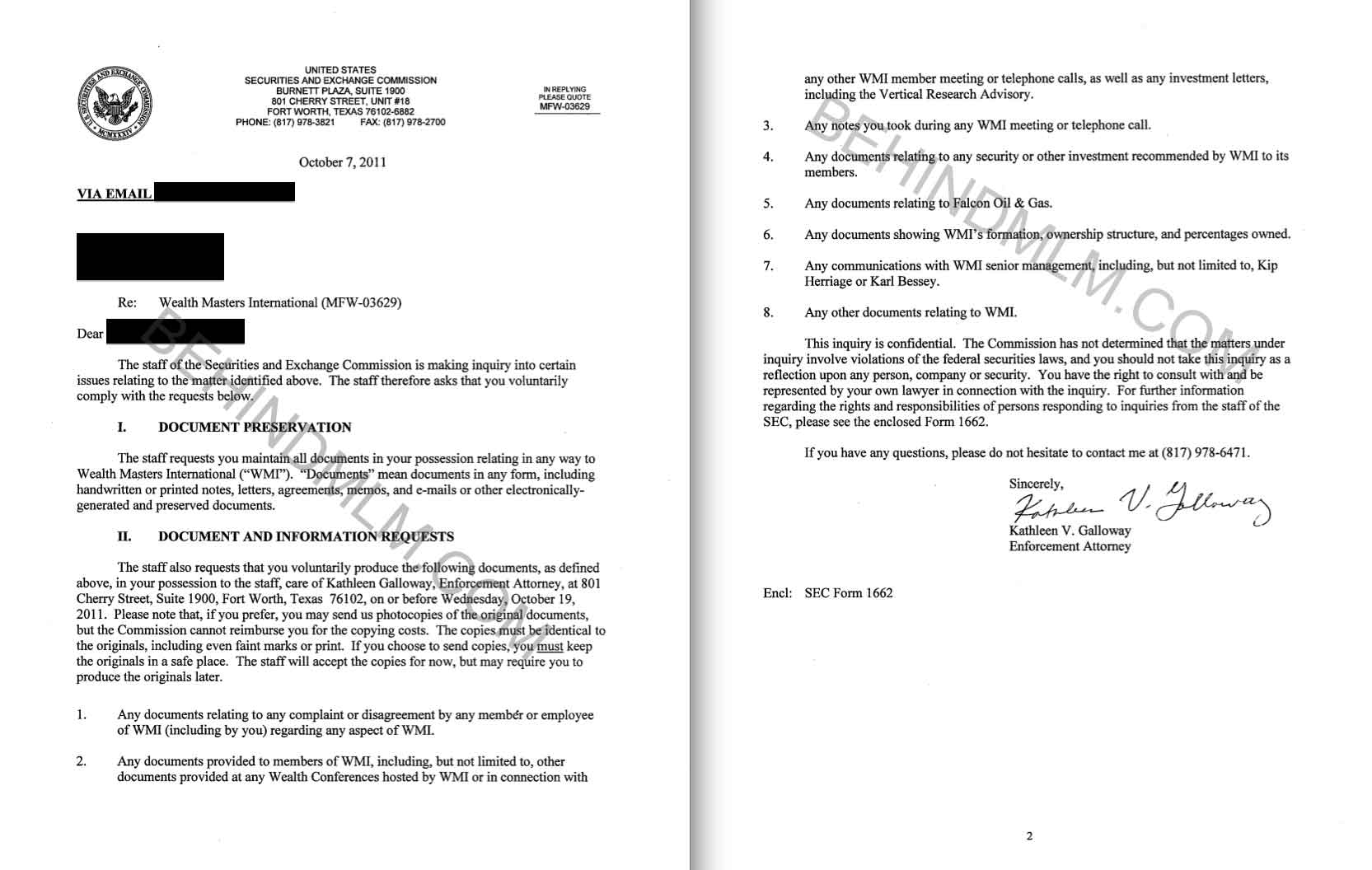

In correspondence sent out to WMI management under case number ‘MFW-03629’, the SEC has requested that staff ‘preserve’ all documents regarding WMI in their possession be maintained and available for future reference.

Additionally the SEC has also requested the surrendering of either originals or copies of any

- complaints or disagreement by any member or employee of WMI

- documents provided to members at any wealth conferences hosted by WMI, WMI member meetings or telephone calls and any investment letters, including the Vertical Research Advisory

- notes taken by staff during any WMI meeting or telephone call

- documents relating to any security or other investment recommended by WMI to its members

- documents relating to ‘Falcon Oil & Gas’

- documents showing WMI’s formation, ownership structure and percentages owned

- any communications with WMI senior management, including but not limited to Kip Herriage or Karl Bessey

- any other documents relating to WMI

In a nutshell, ‘give us everything you have on Wealth Masters’. In the correspondence sent out to an anonymous WMI employee or member, the SEC has given a deadline of October 19th, 2011 for the documents and correspondence requested to be surrendered.

Presumably, the recipient of the letter complied.

Unfortunately the specific nature of the investigation, or what violations specifically the SEC are looking for remain unknown at this stage.

It is noted that the SEC stress that

the Commission has not determined that the matters under enquiry involve violations of federal securities laws.

But obviously there’s suspicion enough for the SEC to essentially demand ‘any all documentation’ held by members or staff in relation to WMI be surrendered to them.

If I was to to take an educated guess, the specific inclusion and naming of ‘Falcon Oil and Gas’ appears to be somewhat of an irregularity in the SEC’s document request. WMI deal with a lot of companies and businesses in their day to day operations so it seems strange that the SEC have singled out and named this particular business.

According to the company itself,

Falcon Oil & Gas Ltd. is an international oil and gas exploration and production company, headquartered in Denver, Colorado, incorporated in British Columbia, Canada.

The company specializes in the business of unconventional and conventional oil and gas exploration and production and holds interests in prospective properties in Australia, Hungary, and South Africa.

The company is focused on discovering, acquiring, and maturing a globally diversified portfolio of drilling opportunities with a goal of maximizing shareholder value through strategic relationships.

Naturally, some of these ‘strategic relationships’ involve people or companies investing in Falcon Gas and Oil.

Not surprisingly, Falcon Oil and Gas has a developed a strong business relationship with Wealth Masters International and I believe are currently one of WMI’s ‘Alliance Partners’.

In March 2010 former CEO of Falcon Gas and Oil, Marc Bruner, went on tour with Wealth Masters’ CEO Kip Herriage to promote Wealth Masters in Canada.

Later that same month, Bruner took the stage at WMI’s m2 wealth conference held at Boca Raton, in Florida.

In November 2010, Bruner resigned as CEO of Falcon Oil and Gas. The company did not provide a specific reason for Bruner’s resignation.

Nonetheless, the relationship between Falcon Gas and Oil and Wealth Masters has remained intact with WMI announcing just over a week ago that current CEO of Falcon Gas and Oil, Rob McCaulay would be giving a keynote presentation at the company’s upcoming m2 conference titled ‘Is this really the energy story of the century?‘

As an alliance partner of WMI, no doubt McCaulay will be attending the m2 conference, to be held in December at Maui, to drum up potential investors from within the WMI memberbase.

My guess?

The SEC suspect something is not quite right with the investment relationship (either directly or via encouraging the WMI memberbase to invest in Falcon) between WMI and Falcon Gas and Oil and have decided to formally investigate the two companies.

Again, this is only speculation but the inclusion of Falcon Gas and Oil and demands for documents regarding WMI’s investment recommendations by the SEC in their letter sticks out like a sore thumb.

WMI founders Kip Herriage and Karl Bessey claimed back in August that they ‘would never do anything simply because there was money to be made by doing it, and we would never violate our commitment to integrity’…

Evidently, pending the outcome of the SEC’s investigation into Wealth Masters, this might not be the case.

You can view the full letter sent out by the SEC below (click to enlarge);

Perhaps the SEC suspects a pump-and-dump scam coming from this “alliance” with WMI???

Interesting.

The people I know who are in WMI were recommended (by WMI) to buy Falcon Oil and Gas shares – which they did. They were told they could get them cheaper than the general public if they bought them the next day (through WMI)- limited time offer (read: sales pressure).

I looked Falcon Oil up and the share price WMI offered my friends was the same as the advertised share price online…so where was the discount? I don’t know.

Now I see there is a close relationship between WMI and Falcon Oil and Gas. This is looking decidedly shady.

Wondering about the accuracy of this site…is it legitimately accurate, or is it like a gossip column? Hmm? Anyone can write anything at any time.

@Eny — you’re welcome to verify the facts yourself. As you obviously didn’t… I recommend some action instead of words.

@Eny:

Accurate or gossip? You have to decide for yourself. Have a look at the copy of the document, or google the “SEC form 1662” that was enclosed in the document?

**** http://www.sec.gov/about/forms/sec1662.pdf

Other articles about WMI:

I have provided some information about WMI in Norway, and this also includes original documents from the Norwegian Gaming Board. For me it’s more like a ‘sharing of information’ than ‘gossip’. I prefer to use official sources and original documents (if available), and the information is usually publicly available on the internet.

It’s no secret that WMI was declared a pyramid scheme in Norway in late March 2011, and was forced to terminate their business there. WMI just prefers to treat it as a secret.

@Aussie

Sounds like my guess wasn’t too far off the mark then. I guess the SEC are investigating the nature of this investment advice and the business relationship between Falcon and WMI.

@Eny

Yeah, because I’ve got nothing better to do than doctor up SEC documents…

The SEC I imagine will not confirm or deny the case until they’ve concluded their investigation, but you’re welcome to contact WMI about it.

If you do, let us know how it goes…

Interestingly enough, Falcon And Gas’ former CEO Marc Bruner seems to have a bit of a history of fraud, amongst other things.

In two seperate court cases Bruner has been accused of

In both cases Bruner settled. Make of that what you will.

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_F/threadview?m=tm&bn=85040&tid=57&mid=57&tof=8&frt=2

It is my understanding that EX WMI employees are now being served notices from the SEC. Kip and Karl are in total denial of the investigation but let me assure you it is all very real. Kip Herriage has a history of lying so don’t listen to the BS coming out of his mouth.

Kip’s been standing on the WMI stage for YEARS saying he is unbiased and takes no money from his recommendations. That is a bold faced lie.

WMI have been encouraging members to invest in a company called Swarm. It was a $25K minimum buy in and supposedly the money bought shares in a Gold Mine located in Canada (promising huge returns). After searching high and low, I finally found Swarm Technologies Inc – on a FormD with the SEC (see Raw Filing in link).

http://www.formds.com/issuers/swarm-technologies-inc

Note Kip Herriage as an Executive/Director. The three other men all have their own ‘invention/idea’ to peddle to ‘investors’.

Richard J Wise (Inventor/patent holder of magnetic torque machinery for gold mining). Swarm’s business address is his home address (his house is currently for sale).

Rickey Dean Moneymaker (patents relating to vitamin/nutrient dispensing methods)

Fred Tissington (Cooking with Monkey / WorldofYum websites)

However, I am yet to find the Gold Mine connected to Swarm Technologies Inc. Here is a brief mention of it:

http://jayallyson.com/2011/06/best-investment-opportunities/

@ interesting: You are right, this is proof Kip benefits financially from his ‘recommendations’.

Well no wonder the SEC are investigating then.

Meanwhile I’m hearing reports all over the place that Herriage is sending out threatening emails to anybody who dares criticise him publicly…even if he just suspects he knows who it is.

@Aussie

As far as I could see, the filing was pretty new – 18. Nov. 2011. It seems like they have raised money for a new company.

I have had some discussions with WMI-members (former members?) in a gold/mining related forum some months ago. One of them was bragging about “his” gold mine in Canada.

He announced his plans for visiting “his” gold mine, but then suddenly he stopped visiting the forum (a couple of months ago). We haven’t heard from him since then. 🙂

It may be related to his predictions for gold, like “Gold will reach $1,850 before October 15, ABSOLUTELY SURE” and “$2,300 before the end of 2011”.

Sounds like a pump and dump in progress, doesn’t it?

Didn’t SEC just arrested “Rudy” Ruetigger for doing a pump and dump?

@M_Norway

Thanks for that info, it sounds like the same spiel. Would you mind sharing the gold/mining forum link? I’d like to have a read.

The people I know who invested $25K also claim they ‘own’ a 30th of the gold mine. This adds up to around the $ amount the FormD claimed to raise. I don’t know when they invested their $25K but I believe it to be recent and it was toward the company ‘Swarm’, so I am assuming this is where their money went for the “Gold Mine”.

The link I posted above from jayalyson indicates WMI flogging the Gold Mine opportunity back in June 2011. It reads of the same information given to the folks I know; new and amazing black sand magnetic extraction, heaps of gold already retrieved from the ‘test site’, the ‘real’ mining area/land riddled with gold yet to be started, massive returns on investment – guarenteed for the life of the mine!

Also curious is the small amount of investment raised. How far is less than $1Mil going to go? And if ‘Swarm’ only gave the offering in Oct/Nov (date of first sale 26/Oct/2011) what company were people investing in for the Gold Mine back in June?

While we’re on the topic of mining, a video from WMI member Ewan Robb. Robb claims to have joined WMI three years ago claims

Looks like the mining game has been going on for a while given that this would put us around early 2009.

In an online publication WMI makes these claims:

So, investing in silver were only available to WMI members?

Investments that are only available to members of a limited group of network marketers, it reminds me of the days of The 5 Percent Community when people shopped “shares” in a fictional exchange.

It is time to cite the WMI disclaimer:

Pay $20.000 to be introduced to investment experts? And even before knowing their names?

Publication source: http://issuu.com/lindaross888/docs/wealth_masters_document_for_prospective_members_se

I was at the WMI M2 conference with Marc Bruner and Kip… All I can say is that it is shadier that a Maple Tree on a hot summer day!!!

There was obviously a tight relationship between the two and you are going to say that the investor’s interest was the number on priority? I still have about 4,000 shares of crap….

My wife was heavily involved in WMI and all I can say is we were totally ripped off..I listened to hundreds of webinars and they constantly filled you with BS..

I met Kip once and didn’t like him or trust him from the beginning, I can smell rat right away. They were always pumping Falcon Oil ,Petro Hunter and others, Buy now or you will miss out, 1 time offer ect ect… I do own 40000 shares of Falcon but am down about 50g.

The M3 package is even worse …. investment my ass ,, all BS .. Dazzling Dentist , Making 7 movies ..they wanted 50000.00 for each to start ..

A Friend of mine invested in something they were promoting at a M2 event and it wasn’t even legit investment didnt even make it out the door that night.. They’re credit card was declined thank god…. I hope they are taking down hard…

The father and son Marc a Bruner and Marc e Bruner are scamming again same old pump and dump “unconventional oil and gas” story except this time the sec can’t touch them.

Petrohunter becomes Falcon Oil and Gas becomes Paltar Petroleum (paltar.com.au).

The only thing these guys are good at is personal enrichment and bullshit stories of buried wealth that only they can find with your cash. The Paltar Petroleum website even uses the same jargon as the petrohunter scam that netted them $100m.