FTC: MLM income disclosures are “confusing” & “ambiguous”

Following a review of seventy MLM income disclosures, FTC staff have concluded they are “confusing” and “ambiguous”.

Following a review of seventy MLM income disclosures, FTC staff have concluded they are “confusing” and “ambiguous”.

Specific issues with MLM income disclosure statements cited by the FTC include:

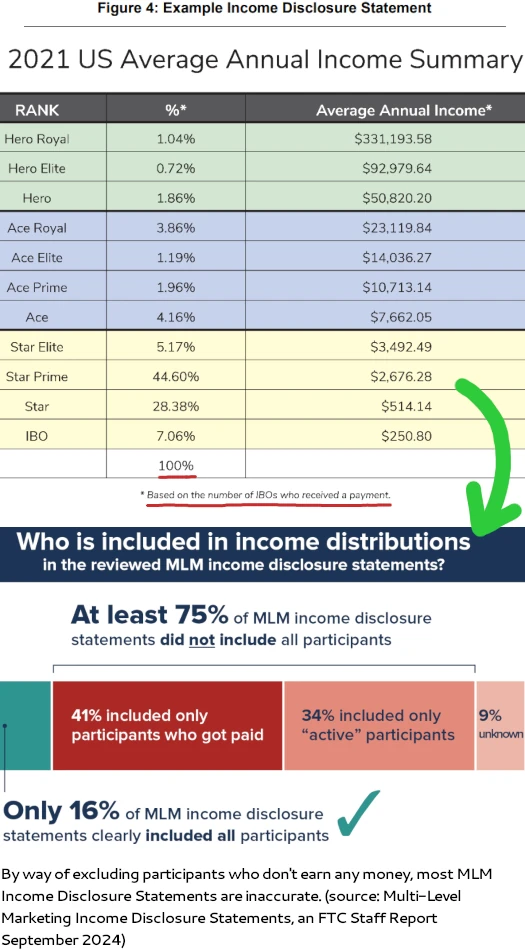

- exclusion of participants (affiliates or distributors) who “receive little or no income”;

- no accounting for expenses;

- unbalanced focus on high incomes earned by “small number of participants”;

- presentation of data is “potentially confusing or ambiguous”;

- important data that is presented is done so inconspicuously; and

- claims are often made without any clear supporting source

From the FTC’s executive summary;

Staff’s review of 70 disclosure statements shows that most:

(a) present income data that excludes participants who made little or no income and often do not clearly

explain the limitation;(b) do not account for expenses incurred by participants, and often do not clearly state the limitation, even though expenses can, and in some MLMs often do, outstrip income;

(c) emphasize high dollar amounts received by a relatively small number of participants;

(d) do not include information about the limited income that most participants receive, or provide it only inconspicuously;

and(e) present income data in potentially confusing or ambiguous ways.

Moreover, none of the reviewed income disclosure statements clearly explains what data is being presented to consumers.

They prominently state that they are sharing information about “income” and “earnings,” but do not conspicuously explain what the terms mean.

For example, do they include data about all types of income that could be earned, or just some? Are they net of any or all expenses?

The lack of clarity on this point is confirmed by the fact that many income disclosure statements define these terms—such as “income” and “earnings”—differently, or not at all.

Additionally, Commission staff’s analysis of data in the income disclosure statements, including the data hidden in fine print, shows that many participants in those MLMs received no payments from the MLMs, and the vast majority received $1,000 or less per year—that is, less than $84 per month, on average.

The FTC’s full ninety-five page report (most of which is appendices), is available on the regulator’s website.

My take on MLM Income Disclosure Statements is they typically don’t accurately present a complete picture. This is primarily because, as the FTC noted, participants who don’t earn income are typically excluded.

The argument for this is that people who don’t earn income aren’t participants. I disagree on the basis if you sign up for an MLM opportunity, you are a participant regardless of your financial outcome.

Excluding people who don’t make money bumps the average income per participant, which works in favor of MLM companies who do this. It’s misleading and why you typically won’t find Income Disclosure Statements cited in BehindMLM reviews.

The broader deceptive practices the FTC observed are a problem, but I feel secondary to the fundamental (in)accurateness of most MLM Income Disclosure Statements.

And even if the Income Disclosure Statements were accurate, a secondary problem is availability.

Staff reviewed the websites of each of the over six hundred MLMs known to staff. Only 79 made an income disclosure

statement publicly available.

While conclusions from the report are presented by the FTC, what exactly they intend to do with their findings isn’t.

All that’s mentioned is the report came about as part of the FTC’s internal investigation into “should commence a rulemaking to regulate earnings claims.”

On March 10, 2022, the Commission published an Advance Notice of Proposed Rulemaking (“ANPR”) regarding Deceptive or Unfair Earnings Claims.

The ANPR sought comment on whether the Commission should commence a rulemaking to regulate earnings claims.

The vast majority of comments received in response related to MLMs.

Personally I don’t think anything further will come of individual examples cited in the FTC’s study. Unless the FTC requires MLM companies to publish Income Disclosure Statements, enforcement action now will likely result in Income Disclosure Statements disappearing.

Pending any further reports, I suppose the next step is the FTC proposing what new regulation for deceptive or unfair earnings claims would look like.

No timeline but let’s hope whatever’s next doesn’t take another two and a half years.

While I agree companies could do more to be transparent in income disclosures, including in that count those that join and get paid nothing because they do nothing is like evaluating a diet plan which the person joining eats pizza and drinks beer all day saying it doesn’t work.

Although it would probably be different to nail down the actual statistics, most I believe would agree that over 90% in most MLM companies make little to nothing and many lose money. Some say as much as 97%.

Let’s say you wanted a second job to help with debts, and the job told you that after working all week, then month, only 3% get a paycheck, how excited would you be about that job? But in the MLM space they go from one to then next.

Sometimes it’s the company and others it’s the lack of work ethic of those joining with unreasonable expectations, but how to you accurately report in a disclaimer those that make nothing because they don’t follow best practices to promote whatever it is or do nothing at all?

This is an assumption and kills your entire argument.

The FTC mandating IDS’ be published and include participants who don’t earn anything would precisely counter deceptive income claims like you are implying:

“If you do something you’re guaranteed to get paid”. Guaranteed income representations of any kind are deceptive.