BehindMLM’s State of the Scam 2025

On April 10th, 2024, BehindMLM turned fifteen. MLM news kept me from publishing this earlier but today we’re taking a look back on the past twelve months.

On April 10th, 2024, BehindMLM turned fifteen. MLM news kept me from publishing this earlier but today we’re taking a look back on the past twelve months.

Welcome to BehindMLM’s State of the Scam 2025.

MLM crypto scams

The decline of the MLM crypto scam niche, first observed around Q4 2023, continued throughout 2024.

All the crypto ruses are mostly dead (at least to the point nobody really believes them any more). “AI trading bots” is getting long in the tooth and there hasn’t been a “shiny new object” follow-up in a while.

The one exception has been the nonsensical Chinese “click a button” app Ponzis. Although “big hits” have been far and few between.

Increased regulatory response across Asia has thrown Chinese-run scam factories into mainstream discourse, but there’s still much to be done.

As for the scams themselves, we seem to have settled into low-effort app scams that come and go weekly. Not sure what the profit margin is there but evidently it’s enough for the crime gangs to persist.

Outside of the Chinese apps we haven’t seen any major MLM crypto frauds rise up over the last year. Bearing in mind the entire crypto “industry” is a musical chairs con game, I’d like to say that’s due to consumer awareness. It could just as easily be due to tightening of wallets though (or a combination of both).

Overall we’re in a pretty good place as far as MLM crypto scams failing to gain traction. But looking forward what concerns me is for how long?

Politics isn’t really something we get into here on BehindMLM and that’s because, in ideal conditions, politics has nothing to do with regulation of fraud. Administrations come and go, underlying law and enforcement remains the same.

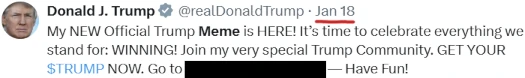

I can give you the precise date that all changed though: January 18th, 2025.

Yeah, obvious scam (wire fraud, securities fraud, potential money laundering, foreign corruption etc.), but what it means for regulation of MLM crypto fraud has yet to play out.

The intertwining of politics with crypto related financial fraud is problematic in that regulators charged with investigating and enforcing the law are also part of the government.

There’s an obviously broad inherent conflict of interest.

To that end we’ve seen the DOJ disband its crypto enforcement team on direct order of President Trump.

Established in 2022;

the National Cryptocurrency Enforcement Team (NCET) was established in February 2022 to address the challenge posed by the criminal misuse of cryptocurrencies and digital assets.

The team is comprised of attorneys from across the Department, including prosecutors with backgrounds in cryptocurrency, cybercrime, money laundering and forfeiture.

It’s probably not a coincidence NCET ramping up over the last few years corresponds with a general decline in MLM related crypto fraud based in the US.

Over at the SEC, its dropping crypto fraud related cases like hotcakes. Cases against Ripple Labs, Kraken and Coinbase have all been recently abandoned, thankfully none of which are MLM related.

Still, what does that say about existing MLM related fraud cases. Or worse still pending cases targeting MLM related crypto fraud over the past few years?

Generally speaking, much of the recent movement at the SEC has focused on cryptocurrency in a broad sense. That’s beyond the scope of this article and, if I’m being honest, not really relevant to MLM crypto.

Regulation of MLM crypto schemes ties into the identification of an investment contract (using the Howey Test). By their very nature all MLM crypto schemes offer investment contracts, requiring them to register with the SEC.

None of them do because, whatever the external revenue ruse is, none of them do what they claim to be doing. It’s always a marketing ruse, which having to file third-party audited with regulators becomes a lot more difficult to pull off.

What did catch my eye was a recent SEC “roundtable” on crypto trading.

Crypto trading is of course one of the most common MLM crypto fraud ruses (“we’re crypto trading!” marketing on the frontend, classic Ponzi on the backend).

The SEC’s Division of Corporate Finance appears to understand the importance of investment contracts with respect to crypto schemes – at least as it pertains to “crypto asset markets”.

Acting SEC Chairman Mark Uyeda’s statements however are a bit concerning. In published remarks following the roundtable, Uyeda lays the foundation for why crypto schemes should be exempt from current securities law.

Federal securities laws and regulations may present challenges for broker-dealers and national securities exchanges seeking to offer trading in tokenized securities.

For example, national securities exchanges can only list registered securities and most tokenized securities in the market today are unregistered.

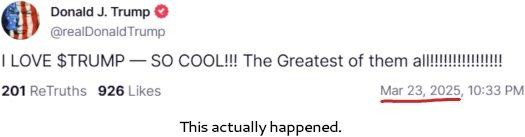

The reason they’re unregistered is because they’re scams that primarily facilitate fraud. We now have whole “memecoin” marketplaces set up to openly enable this – with as of yet no response from US authorities.

As of February 2025, 810,000 crypto wallets have lost over $2 billion to Trump Coin. Trump himself has pocketed around $100 million.

Again, we’re speaking in broader terms here. But the further crypto regulation strays from established US securities law, the greater the probability loopholes will emerge. And these loopholes will be exploited by bad actors.

Some of those bad actors will inevitably be MLM crypto scammers.

Combined with reduced enforcement (worldwide enforcement against crypto related fraud outside of the US is already abysmal), it’s a recipe for a return to the OneCoin era.

Strictly speaking as far as MLM crypto schemes go, existing laws are more than adequate. Existing civil and criminal laws address wire fraud, securities fraud, conspiracy to commit both and money laundering. Enforcement is ever the problem.

I hate to be all doom and gloom about this but, given everything else, it certainly feels like a Howey Test exemption for crypto schemes is on the cards.

That potentially puts BehindMLM in a precarious position. The underlying fraud is still there, but if legalized to the point of non-enforcement, civilian journalists such as myself can’t be the tip of the spear with nothing in the way of regulatory support behind us.

Best not to sound alarm bells over what hasn’t happened yet, but it’s certainly something I’m keeping in the back of my mind as the now daily circus of US “flood the zone with shit” style politics plays out.

I’ll continue to observe but it’s difficult at times to not just give in to outright pessimism. Correlation does not imply causation, but it’s getting real hard to not view developments as a means to facilitate financial fraud from the top down.

On a lighter note there’s been nothing from the CFTC. Assuming nothing has changed there with respect to MLM crypto regulation.

Also as an aside, if you’re wondering why there’s no “non-crypto MLM scam” section, pretty much every MLM scam is run in crypto these days. There’s no point.

The MLM industry in general

The contraction of the MLM industry has also continued over the past year.

Amid the inevitably MLM Ponzi and pyramid collapses, we’ve also seen Awakend, Tupperware, Epicure, Modere and Herbal Alchemy bite the bullet. There have also been a number of acquisitions and mergers.

A general recurring theme seems to be shifting consumer habits. Some of that is no doubt the cost of living crisis but also perhaps how consumers are buying goods – particularly the younger generations.

If you took the MLM industry as a whole, there’s probably some similarities between it and countries grappling with aging populations.

Still, we’re quite obviously far from bottoming out. BehindMLM’s pending MLM review list currently sits at around thirty companies. I haven’t gotten to emails over the past few days so there’s probably another five to ten additions waiting.

We’ll probably see more closures throughout the year but other than that I’m not expecting any significant developments. Moreso given the FTC is currently limping along with just two “loyal” Commissioners.

Legal proceedings have been initiated to challenge allegedly illegal conduct but who knows how long that’ll play out for.

All to the ongoing detriment of US consumers unfortunately. Speaking of which the Consumer Financial Protection Bureau and Foreign Corrupt Practices Act are also gone.

The latter in particular has been used to reign in foreign corruption by Avon, Nu Skin, HerbaLife and NewAge (alleged).

BehindMLM Housekeeping

I’m happy to report that the effects of the MLM industry downturn this past year weren’t as significant as the previous year. We’ve sort of reached a baseline with reader interest, spiking when something significant happens (Modere collapsing being a recent example).

The biggest challenge BehindMLM faced over the past year was getting Josip Heit’s GSB subpoena quashed in the New York Supreme Court.

Primarily due to a lack of supporting evidence and due process failure, we overturned the granted subpoena on appeal in May 2024.

As of April 2025, Heit’s regulatory legal troubles in the US continue to play out. Fruitlessly attacking journalists appears to have taken a backseat to (allegedly) trying to pull a fast one over US authorities.

Other than that it’s been a pretty straight-forward year. This let’s me get on with research and reporting on the MLM industry, which is after all what you’re all here for.

Following some personal challenges last year I’m in a bit of a better spot. As anyone who works online will tell you, balancing life with online work can be difficult. Even fifteen years in I’m still making adjustments.

I haven’t lost any drive but I’d be lying if the ongoing assault on non-immigration related law and order in the US wasn’t disheartening. Reflecting on that, I’m kind of torn between “what’s the point?” and “well, someone’s gotta do it”.

I don’t want to rehash what I’ve already written but I guess what I’m trying to say is I’m playing it by ear. Like you I don’t know day to day what’s going to happen, let alone how BehindMLM fits into changing legal and regulatory frameworks.

With BusinessForHome sold off a few months ago to an MLM company owner, I’m acutely aware of BehindMLM’s independent status more than ever. It’s a responsibility I’m at times not entirely comfortable with but also kind of the whole point.

Not to take anything away from the AntiMLM subreddit or various creators on YouTube.

The question of why there aren’t more “BehindMLMs” since we launched fifteen years ago inadvertently puts to bed a lot of the conspiracy theories scammers come up with.

Overall BehindMLM is in a good position to continue providing consumers with the latest on the MLM industry. Going into year fifteen we also now have a catalog of 10,469 articles and over 185,000 comments to assist with research.

Thanks for reading for another year!

Let me be the first to say “Thanks for all you do to warn and educate the masses.” It is a thankless job at times as well as frustrating and challenging trying to keep up with all of them. Yet you do a fantastic job on all fronts.

It is real simple why there aren’t any others in this space all these years: Your discipline, dedication, tenacity, fortitude, integrity, honesty, facing adversity head-on and genuine caring for people.

You deserve all the accolades for a job well done, and the appreciation of all who read your forum.

Looking forward to many, many more years of your success.

I wholeheartedly endorse Lynn’s words. I couldn’t have put it better myself.

First, thank you for your thoughtful ongoing work. This summary is very helpful. On a related note, I found it interesting that both Modere and Beautycounter failed under private equity management.

Not sure if you would want to promote this but we will have four 5th annual virtual conference on MLM and Consumer Harm.

We will have numerous speakers including: keynote speaker Samuel A.A. Levine, former Director of Consumer Protection, FTC; Bridget Read, auhtor of the forthcoming book Little Bosses Everywhere; TINA.org; State of Washington AG, and more.

Registration is here and free: tcnj.zoom.us/meeting/register/5tb_tRvVSv6Dc0N7e-P6Jw

Keep up the amazing work Oz – it is more important than ever that the activities of individuals such as Josip Heit and his gang are continued to be put in the spotlight.

I echo what Lynn wrote. Huge thanks.

Keep up the strong work, Oz!

Congratulations! Thank you very much for all your hard work.

Even more important than the big green tick against anything marked “crypto” just got, is this administration’s abandonment of the Foreign Corrupt Practices Act and the extraterritorial application of the Patriot Act unless it applies to terrorism.

The US will no longer claim jurisdiction when nobody else cares. Everyone in OneCoin and everything like it is breathing a lot easier.

(Ozedit: derail removed)

<3. Let's keep personal politics out of it. Who voted for who doesn't matter within the context of MLM regulation.

We're here now regardless and have to deal with the consequences.

You’re right.

If Ruja drops off the top ten most wanted we’ll revisit.

Dubai doesn’t even have to pretend to care any more.

No idea what you two were arguing about but it doesn’t appear to have anything to do with MLM.

BehindMLM isn’t the place for personal vendettas.

Oz, I appreciate that. Delta’s point was to blame MLM victims, suggesting their victimization is simply Darwinism at work. An incorrect and insulting analogy on multiple levels. Thanks for the important work you do

Yeah but htf did we get from an annual BehindMLM update to blaming MLM victims and Darwinism…?

I have a few opinions I’ll add. There’s certainly a drop in activity the industry. It’s purely market driven. With tangible items, instagram ads have flooded the market with high-quality, easy access products.

It was never going to be regulators, and their assortment of behavioral science experts, that curbed the industry. Lawsuits here and there were never effective. It was never “enough” to change behavior meaningfully.

As for the opportunity market, people looking to earn extra income can easily deliver sandwiches and earn a $100+ per month. Plus, there’s no shortage of high quality supplements, cosmetics, etc available online.

In the old days when shelf space was a limiting factor for premium items, it’s no longer a factor. MLM filled the gap for years. Just-in-time shipping + instagram advertising (and all of the other social channels) changed it.

As for crypto scams, the current SEC has a significantly more sensible approach. Legitimate projects do exist and there’s going to be a framework to help consumers discern the good from bad.

Under the old SEC, every single project was presumed to be a security. Under the Howey Test, Bitcoin would’ve “passed” it in its infancy.

The scope of the SEC subpoenas and lawsuits were absurd. This is doubly true when keeping in mind the fact that the SEC pushed out zero guidance.

Solana is a security? That’s dumb. The crypto scams will continue to decline because, again, the market. Consumers have developed an immunity for the scams.

And for some consumers that want to yolo into Dubai-based scams, some are victims, some are willing participants and deserve the outcome.

ps, your work matters. It has for years. On the decision to continue or retire, good luck.

@Kevin Thompson

Ted Nuyten, who lives back in the Netherlands, wrote on Instagram on January 13, 2025:

What did he mean by that?

postimg.cc/zLWwB7vh

instagram.com/p/DExvBCvIuDD/

Hey Kevin, thanks for stopping by.

Re. crypto scams, I’d argue the framework exists. Existing securities and criminal law are adequate.

Enforcement? Yeah bit of a hot topic at the moment. If a sitting President ignores Supreme Court orders, who’s going to enforce the law?

We know who is supposed to be enforcing securities law against crypto scammers – but cases are far and few between. And cases that were filed are now dropped in favor of roundtables to discuss legitimization of fraud.

Very important to give perpetrators of fraud a say in what laws should and shouldn’t apply to them.

One issue specific to crypto is the false “crypto is unregulated” narrative went unchecked for so long. Should have been shut down around 2010, around the time scammers realized they could run Ponzi schemes through crypto.

So now we have hoards of investors who still think “crypto is unregulated” and push back on enforcement of regulations and laws that were always there.

I don’t argue that bitcoin in and of itself passes the Howey Test. The problem, and this has been the case since the first altcoin, is that just launching an altcoin isn’t profitable. This has gotten inevitably worse with the rise of shitcoins, aka “the emperor has no clothes” moment for crypto.

I don’t follow non-MLM crypto enforcement actions as closely as I do the MLM ones BehindMLM reports on. That said, you mentioned solana.

The SOL token itself? Couldn’t care less but, as I understand it, solana was created by Solana Labs – a centralized entity.

Over on Solana Labs’ website we find a staking Ponzi pitching retail investors on “returns/yield”: solana.com/staking

^^ That’s no different to the MLM node position investment schemes we’ve seen.

How does one become a Solana validator to profit off Solana Labs’ unregistered staking investment schemes? Why you have to invest in SOL and participate in the unregistered staking investment scheme of course (i.e. give money to Solana Labs).

So we have Solana Labs, owners of the solana cryptocurrency, running multiple unregistered investment schemes (staking, node positions).

You invest in SOL, you stake your SOL with Solana Labs, you get more SOL passively, you cash out other people’s money. That absolutely fails the Howey Test.

You invest in SOL, you get a node position on the promise of passive returns (fees + staking returns), you cash out other people’s money. That also absolutely fails the Howey Test.

And naturally a Ponzi has to spread infinitely to avoid collapse. To that end RIP Canadian retail investors – cointelegraph.com/news/spot-solana-etfs-launch-in-canada-this-week

The SEC and DOJ absolutely should be going after these fraudsters. Laws are being broken and nothing is happening.

I don’t know what the SEC specifically targeted in its other dropped lawsuits but I’m sure it’d take all of five seconds to identity unregistered investment schemes from each of the defendants.

But sure, let’s further legitimize fraud by giving crypto bros running fraudulent investment schemes certified actual exemptions from the law.

Solana is not a security. If the SEC could not prevail in court against Ripple, how in the world would anyone expect them to regulate effectively and consistently over other tokens? Using “existing frameworks” from the 1940s to discern whether a technology designed to evolve over time (decentralize) has failed.

Crypto, in general, achieved broad political support and the party responsible for hammering it got voted out. Democracy. There are absolutely scams in crypto.

There’s also important innovation that needs to be allowed to breathe i.e. stablecoins. The United States has a debt problem, stablecoins can help with the treasury market. And what rails do those run on? Ethereum, solana, etc.

As for your description of staking, nah. Staking yield, in that example, does not come from “new investors.” The NETWORK issues rewards to node operators. It’s referred to as an “issuance rate” i.e. inflation.

It’s akin to bitcoin mining rewards. Plus, it’s open-source code, anyone can run a validator (even people without SOL so long as they convince other SOL owners to delegate their tokens). I’m not a solana acolyte, but proof of stake protocols are important (when done correctly i.e. distributed governance).

I do still hold the view, and I haven’t wavered in years, that crypto + MLM is fraud. It’s very obvious that in America, this activity is nearly dead. The market works. Nature is healing.

I’m not here to argue over crypto broadly. I’m not even here to argue at all. The main point of my original comment is that activity is down and it was market driven. Obviously. The market will continue to work.

Crypto scams domestically are dying or dead. The volume flowing through pyramid schemes (define that as you like) is significantly down. Looking back, it was always going to be the market that moved the needle to protect consumers.

Not a description – it’s a definition.

What is the only reason one would invest tokens to participate in a staking scheme?

To passively receive more tokens. Why do you want more tokens?

To cash out other peoeple’s invested funds. It’s a closed-loop ecosystem with no external revenue source.

Ponzi schemes can be run through tulips, belly button fluff, crypto tokens or whatever. If the underlying flow of money is that of an investment scheme, that’s what it is.

Calling an investment scheme “staking” doesn’t change what it is. And it shouldn’t negate legal requirements as per existing securities law.

Also inflation? Lolwut? We’re talking about digital tokens. Push a button, fork it, start again. Best we don’t pretend the crypto space is subject to actual economic forces. It’s all bullshit controlled by a few nerds.

We’re 16 years in. Other than paying for drugs, kiddie porn etc., money laundering, tax evasion, unlicensed gambling and running fraudulent/unregistered investment schemes – what crypto use-cases are there?

I agree MLM crypto is dying but I do believe consumer awareness and active enforcement go hand in hand. Memecoin scams are still a thing (let’s be honest, all they did was rebrand shitcoin scams and give it a “humor” coat of paint to disarm people, making it easier to separate them from their money).

Why? Zero enforcement of the law.

Also I believe solana played a big role in all the memecoin scams. In the same way we go after illegal marketplace operators (Silk Road etc.), centralized blockchain owners should be held accountable for facilitating fraud.

I can agree to disagree on crypto in general but my criticism stems from over a decade covering MLM crypto. MLM crypto is after all just regular crypto scaled down with a comp plan.

FFS. Now the fucking idiots are going after Letitia James for alleged mortage fraud.

The SDNY is literally the most active arm of the DOJ when it comes to MLM fraud regulation (in particular investment fraud). And that’s on top of everything else they investigate.

Watch the fuckers put in some boot-licking puppet crony. Can’t have anyone investigating financial fraud in the US*.

*unless suspect has “wrong” political views or a history of investigating the “wrong” government officials

It’s quite the abortion of Justice that the Tax Fraud president now is pushing to have the AG investigating him to be prosecuted for Tax Fraud and fired.

The double standard is mind boggling.

New York went after Trump for real-estate related financial fraud tied to the Trump Organization:

en.wikipedia.org/wiki/New_York_business_fraud_lawsuit_against_the_Trump_Organization

Weaponization of the DOJ against perceived political dissenters. Move along, nothing to see here.

I said move along. Want to wake up in El Salvador?

Yup,every accusation is a confession, but for them to be found Guilty even it’s water off their backs. Rules for thee but not for meeeeeee.

well done, Oz.

Congrats on 15 years of great journalism and exposure.

I have read your report on MOSCA being a pyramid scheme or proxy; however, not once did you mention anything on how MOSCA uses Blockchain and the Smart Contract in its payout structure, was that done on purpose or was you just wasn’t aware about that.

I’ve been in MOSCA just a few weeks and I have and still is receiving bonuses, residual income and transactions fees so I believe you got your facts absolutely wrong.

Why would I mention irrelevant talking points that have nothing to do with MOSCA being an illegal pyramid scheme? You can’t “BUH MUH BLOCKCHAIN!” your way out of fraud.

Whether you’re personally stealing money through MOSCA is irrelevant to MOSCA being an illegal pyramid scheme. Sorry for your (victim’s) loss.