Win on Wealth Review: 15% a month loan fraud Ponzi scheme

Win on Wealth provides no information on its website about who owns or runs the company.

Win on Wealth provides no information on its website about who owns or runs the company.

Win on Wealth’s website domain (“wow-winonwealth.com”), was privately registered on February 26th, 2022.

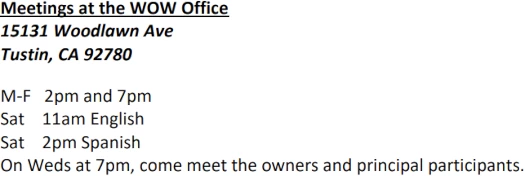

In the footer of Win on Wealth’s website a residential address in Tustin, California is provided.

This address corresponds to WOW Win On Wealth, a California Stock Corporation (C4847301).

Wow Win On Wealth was incorporated on February 11th, 2022. Trong Hoang Luu is listed as the registered agent for the company. Linh Thuy Le is listed as the incorporator.

Trong Hoang Luu is not a common name. I can’t confirm it’s the same person but I will note that a Trong Hoang Luu with ties to California has a permanent FINRA ban.

The ban, issued in 2002, prohibits Luu from “acting as a broker or otherwise associating with a broker-dealer firm.”

The ban is in connection to WMA Securities Inc., an insurance scam run by World Money Group Inc.

WMA Securities was incorporated in Georgia. Luu worked for the firm’s Anaheim, California branch.

In April 2022 World Money Group and WMA Securities were fined $200,000 for multiple violations of FINRA’s rules.

Luu copped his FINRA ban for ignoring requests for documentation by the National Association of Securities Dealers, as part of their investigation into WMA Securities.

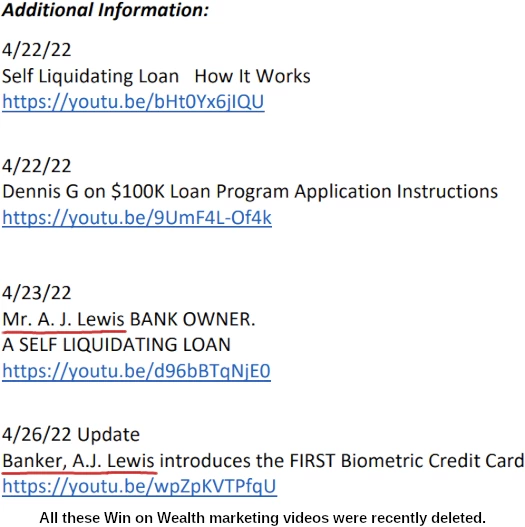

Another name I can tie to Wow Win on Wealth is someone going by AJ Lewis. AJ Lewis is Arthur J. Lewis, a resident of Homestead, Florida.

As above, Lewis is represented to be a banker. As I understand it he was hosting Win on Wealth marketing presentations circa April 2022.

Unfortunately the marketing videos featuring Lewis have since been deleted.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Win on Wealth’s Products

Win on Wealth has no retailable products or services.

Affiliates are only able to market Win on Wealth affiliate membership itself.

Win on Wealth’s Compensation Plan

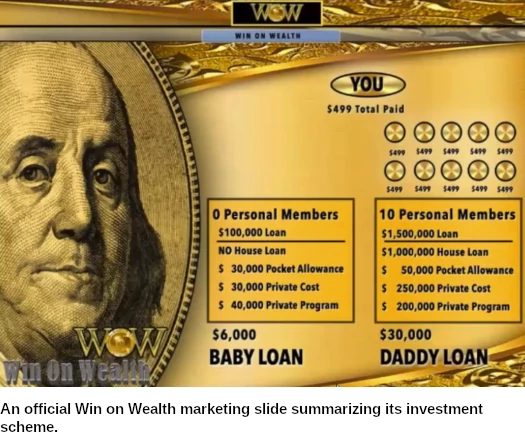

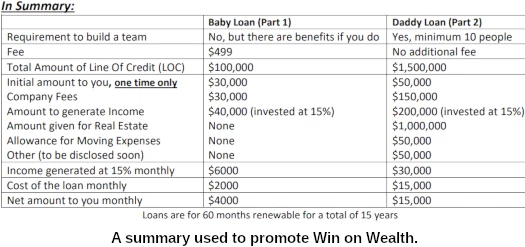

The investment side of Win on Wealth’s compensation plan is split into two parts.

The MLM side of the compensation plan pays on recruitment of Win on Wealth affiliate investors.

Win on Wealth Investment Scheme Part 1 (Baby Loan)

Win on Wealth refers to the first part of its investment scheme as acquisition of a “Baby Loan”.

Win on Wealth affiliates pay $400 for the company to set up a corporation for them.

A $100,000 loan is acquired through this corporation, which is broken up as follows:

$30,000 goes directly to you to use as you please (can be used to leverage in other ways you will learn to generate more wealth)

$30,000 goes to the company fees operating expenses and to fund other things like the compensation plan, etc

$40,000 is used to generate income for your corporation at 15% monthly which will generate $6000 per month.

From the $6000, you will pay back the loan at $2000 per month, which leaves you $4000 per month for 5 years!

In summary, Win on Wealth affiliates invest $400 on the promise of an immediate $30,000 ROI and then $4000 a month for 5 years.

Win on Wealth Investment Scheme Part 2 (Daddy Loan)

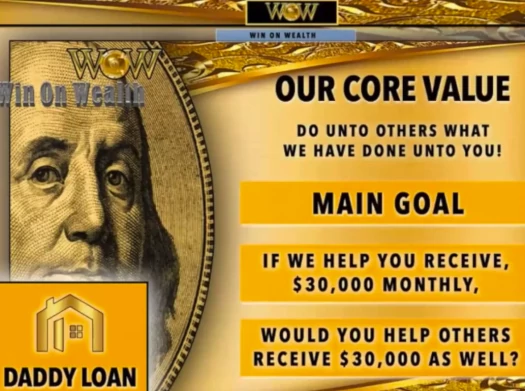

Win on Wealth refers to the second part of its investment scheme as acquisition of a “Daddy Loan”.

To qualify for a Daddy Loan, Win on Wealth affiliates must recruit ten Baby Loan affiliates (details see above).

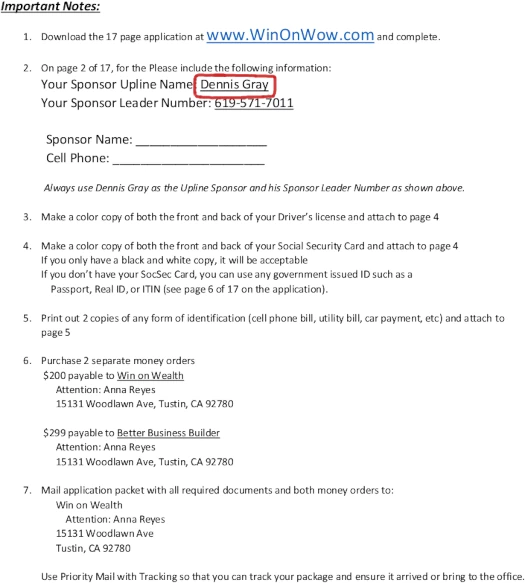

Presumably through the same set up corporation, Win on Wealth states the Daddy Loan consists of a “$1,500,000 line of credit”.

The $1.5 million line of credit is broken up as follows:

You will receive $50,000 upfront one time only.

$150,000 goes to the company for fees.

$200,000 is invested with a 15% return. This will generate $30,000 per month.

$15,000 will be paid to the loan, leaving you $15,000 each month for 5 years!

You are now left with $1,000,000 to use for Real Estate! There is also $50,000 given to you for moving expenses.

In summary; Win on Wealth affiliates acquire credit, receive $1,100,000 upfront and then $15,000 a month for five years.

MLM Commissions

Win on Wealth pays MLM commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Win on Wealth caps MLM commissions down twenty levels of recruitment.

Commissions are paid on invested funds down eighteen levels of recruitment as follows:

Part 1

- level 1 (personally recruited affiliates) – $400 per month

- level 2 – $200 per month

- levels 3 to 8 – $100 per month

- levels 9 to 18 – $80 per month

Part 2

- level 1 – $2000 per month

- level 2 – $1000 per month

- levels 3 to 8 – $500 per month

- levels 9 to 18 – $400 per month

Joining Win on Wealth

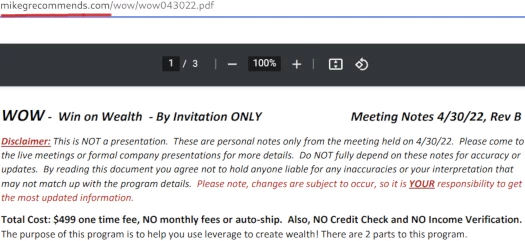

Win on Wealth affiliate membership costs $499.

Additional liabilities as a result of corporations set up for affiliates could total at least $1.6 million dollars.

Win on Wealth Conclusion

Given Win on Wealth don’t even reveal to affiliates how they generate 15% a month…

$200,000 is invested with a 15% return. This will generate $30,000 per month.

$40,000 is used to generate income for your corporation at 15% monthly which will generate $6000 per month.

…it should be obvious that any loans and credit obtained is done so under false pretenses.

The long and the short of it is if Win on Wealth’s 15% a month returns were legitimate, they’d just quietly earn from them themselves.

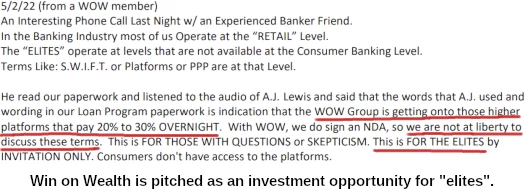

Instead you have nonsense about “the elites” to sucker people into loan, credit and investment fraud;

Win on Wealth commits loan and credit fraud by obtaining both under false pretenses.

The company will acquire a $100,000 Line of Credit for you- Easy Qualification with No Credit Check and No

Income Verification.Part 2 Loan is called the Daddy Loan with a $1,500,000 Line of Credit.

I can guarantee you there isn’t a lender or credit company out there putting this kind of money up for participation in what in all likelihood is a Ponzi scheme.

With nothing being marketed or sold to retail customers, the MLM side of Win on Wealth operates as a pyramid scheme.

Potential Win on Wealth affiliates are instructed to visit the company’s office in Tustin, California:

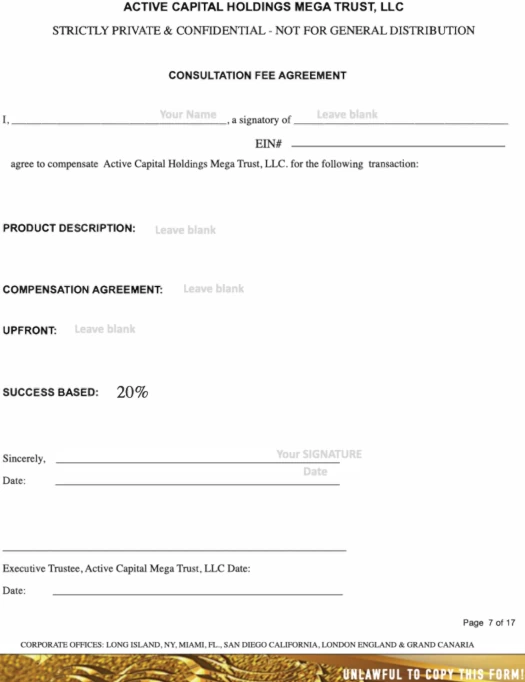

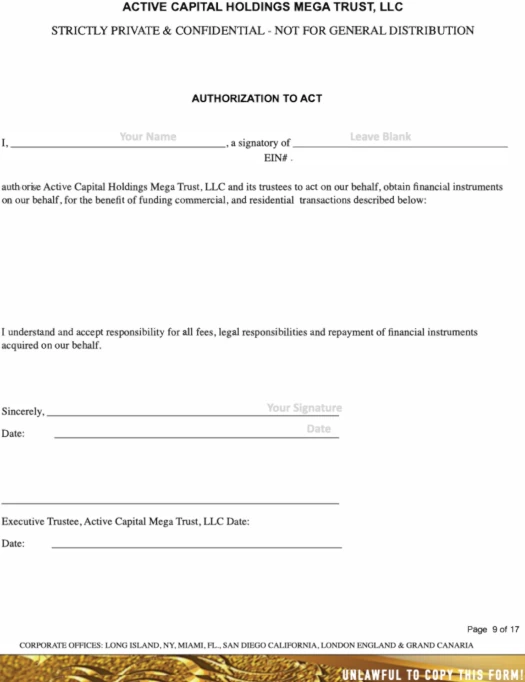

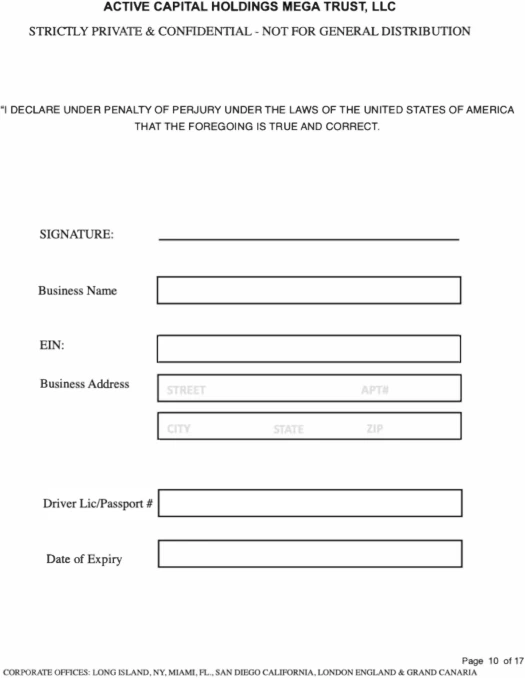

If they agree to sign up and participate, they’re then given a seventeen page form to fill out.

This form reveals Win on Wealth are using Active Capital Holdings Mega Trust LLC to set up shell companies to commit fraud through:

Active Capital Holdings Mega Trust LLC represents it has “corporate offices” in New York, Florida, California, the UK and Grand Canaria [sic].

Active Capital Holdings Mega Trust LLC however is very much run by US residents, as per referenced “laws of the United States of America”.

Further research reveals Active Capital Holdings LLC. Active Capital Holdings LLC is a Florida corporation, incorporated in 2019 by Arthur J. Lewis.

Page 11 of Win on Wealth’s affiliate form also attaches another name to the scheme; Anna Reyes.

I couldn’t find anything further on Reyes directly tied to Win on Wealth. The name appears otherwise too common to get a lucky hit on.

On the promotional side of Win on Wealth we have notorious serial scammer Michael “Mike G. Deal” Glaspie:

As well as “Jody” (Jodi?), “Tony”, “Charles”, Jack Riley and Dennis Gray.

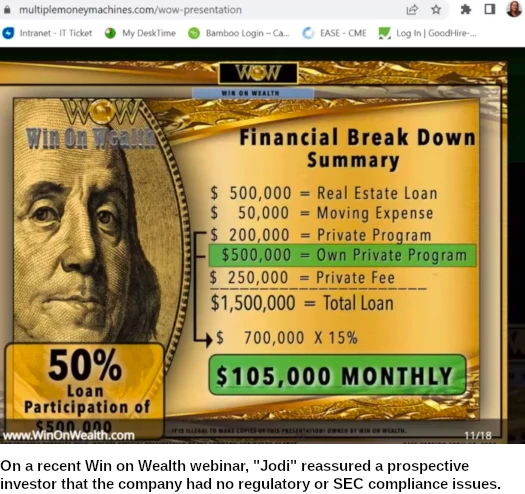

In addition to loan and credit fraud, Win on Wealth is also committing securities fraud.

However it’s obtained, Win on Wealth’s 15% a month passive investment scheme constitutes a securities offering.

Neither Win on Wealth, Active Capital Holdings Mega Trust LLC, Active Capital Holdings LLC, Arthur J. Lewis or Anna Reyes are registered with the SEC.

Despite committing securities fraud, on a recent Win on Wealth webinar “Jody” fielded a question about the SEC from a potential affiliate investor;

Q: Are there any regulatory issues or SEC concerns?

A: That’s what they don’t want. They don’t want to have us break the law or do things like that.

What they want to do, is they want to say, “Look”, y’know… what, it’s interesting but… any of you guys have heard about reverse mortgage?

It’s very similar to this. But in reverse mortgage they never give you the home. They keep the home.

But yet they give you the money up front and then they take your home and leverage against it and make money on it but they still never give you your house.

So all they’re doing is creating a mechanism to give you money and stay within the guidelines and protect themselves and you. In a sense.

Needless to say calling securities fraud a “reverse mortgage” doesn’t make it legal.

Suggesting Win on Wealth may have already collapsed, we note the domain “winonwealth.com”, which appears on Win on Wealth’s affiliate signup form, has been disabled:

We also note the domain “wow-winonwealth.com” advises the company is

TEMPORARILY NOT HAVING ANY BUSINESS PRESENTATIONS UNTIL FURTHER NOTICE!

AS OF JUNE 1, 2022, WE HAVE PAUSED ACCEPTING LOAN APPLICATIONS!

If Win on Wealth has collapsed, total victim numbers and funds lost is unclear. SimilarWeb pegs 96% of traffic to “wow-winonwealth.com” as originating from the US.

Update 19th December 2023 – Win on Wealth has collapsed.

Update 31st October 2025 – Win On Wealth co-founders Trong Hoang Luu and Linh Thuy Le have been indicted. The SEC has also filed parallel civil fraud charges.

Thanks for the info. I have been hit from all sides to join this WOW program and things didn’t add up.

As they say ” If it walks like a duck and sounds like a duck, it’s probably a duck”.

Keith

Looking at that address, I see a previous Troang Luu scheme appears to have existed there, JKT Financial Solutions of which he was the CEO (sic).

A number of other companies that he has been the agent for showed up in my search, upon locating the post office box in Garden Grove which seems to be his own mailing address.

Who actually owns the Woodlawn address?

Someone who was apparently comfortable letting Win on Wealth scammers hold events there daily.

Apparently the person who did this article is only speculating. Winonwealth is not a scam. They do have offices based in California.

MLM + securities fraud = scam.

Loan fraud = illegal.

Credit fraud = illegal.

No speculation, only facts.

Seems like Active Capital Holdings is pretty shady in and of itself, given the ongoing fiasco they are in in Las Vegas.

lasvegasadvisor.com/question/all-net-update/

Found another clue. The Better Business Builder in Tustin (possibly a branch of the Garden Grove address) lists both Troang Luu and Linh Le in their corporate documentation. The Facebook for this company indicates credit repair and “insurance” offerings, and we all (sort of) know how scam-riddled credit repair is.

Luu appears to be the owner/operator of yesmoneymoney dot com as well.

All of these facts are wrong. You guys don’t even know the truth.

Facts, by definition, are correct. Love the butthurt energy tho.

Martin… should I list the other WOW businesses tied to this one? The corporate filings are public record, you know.

I am not a member of WOW. I already know all these facts. These facts are totally irrelevant.

The reason why they stopped doing presentations is because they are going over contracts and compliance changes to tell the public that they want to do things the legit way.

Except that you probably are.

Except that they definitely are.

Ponzi go boom. It’s over. Going over contracts and implementing fake compliance changes (which are not connected to real compliance in any way because of the scheme’s illegality) won’t change the fact that WOW is a collapsed Ponzi.

Martin… changing things after the fact is not a defense from prosecution and lawsuits against what was done before.

Pretty much what’s already been said (<3 readers).

You can't undo securities fraud, which as I understand it Win on Wealth has been committing since at least January if not earlier.

KIR shut up. I’m not part of WOW. you guys don’t even know what your talking about.

This article is waste of garbage. Go write something that makes sense.

And with that I think we’re done entertaining Martin the very obvious Win on Wealth investor.

Best of luck with the scamming.

(“waste of garbage”, lolololol)

Very interesting, please keep me posted for the community’s safety.

Martin, have you searched for the parent company in all of the locations stated on the form?

Question #2 Why does the form go to a “Gmail account”?

Thank you for the information, I was thinking to join this company, not in CA, in other state.

I’ve been in a couple of it webinars, everything they shows seems simple but but with the information in this page, I think I going to put in hold the idea of joining.

If this is a scam it won’t last too long to be turning down, either by authorities or by the members itself.

Perhaps “Martin” is actually Trong Hoang Luu. Lol.

Guys, we need to give Martin a chance, I would like him to give a reasonable detailed comment, backed up with an explanation.

The writer of this article went to great lengths to explain each finding. Martin just stated you all don’t know what you are talking about.

Frankly everyone’s OPINION is irrelevant lets deal in the facts.

If someone has some more facts and/or full explanation of comment is disclosed, then we get somewhere (and it would be nice to know from what angle he is commenting from).

Martin has consistently demonstrated he has no facts beyond gUyZ tHeY hAvE aN oFfIcE!

Between that, failing to address securities fraud and the attempted astroturfing, Martin has been in the spambin for a while.

Guys have you ever visited their offices in CA. Have you met the owners in person to ask these horrible accusations.

Ask yourself this question, If they were committing Securities Fraud, wire fraud, credit card fraud with Billions of dollars at hand- then they would all be in jail by now.

I cannot describe the program in great lengths and great detail and explain to you the clear vision they have in actually helping out people.

^^ See, same old bullshit. None of that has anything to do with Win on Wealth committing securities fraud.

Regulation is reactionary. By that stupid logic nobody has committed an act of illegality until they’re caught. But why would they be caught if they haven’t committed an illegal act?

Stop making excuses for scammers.

You don’t need to. I already laid out Win on Wealth’s fraud above.

I knew in my gut something wasn’t right and not I have my prof and I was brought into by someone whom I thought was my friend.

Since I have not been in contact because I instincts were correct. I sent them my wait I sent someone my $499 what should I do now… anyone someone?

Ask whoever you sent your $499 to for your money back?

Ah right,so Ruja Ignatova definitely didn’t steal 4 Billion USD since she isn’t in Jail right?

indianexpress.com/article/explained/explained-who-is-cryptoqueen-ruja-ignatova-among-fbis-ten-most-wanted-8006401/

You were dropped on your head as a child too many times – it’s showing in your lack of logical reasoning

Can we listen directly from the owner?

You could, until Win on Wealth deleted A.J. Lewis’ webinars.

Nothing screams legitimacy like hiding the evidence.

These comments are quite enlightening.

Stumbled upon this when a friend forwarded me a text message asking them to join this wonderful “business”. Looking forward to updates.

Win On Wealth paused taking applications as of June 1, 2022, and announced on July 30th that it is processing an overwhelming number of applications received during May and June.

If you go to wow-winonwealth.com you can also read the corporate message they published also on July 30th.

Ponzi marketing kind of falls apart when you’re telling people you’re processing applications received during June, when you closed applications on June 1st.

This looks more like banking channel problems to me.

I went to a meeting many months ago. The place was JAMMED. It didn’t make sense to me or to my friend who came with me.

The guy, who invited the guy, who invited me, was pretty much a loser who has jumped on many get-rich-quick schemes before. Could a blind sow find an acorn?

At the end of the presentation I bet at least 100 people couldn’t wait to fork over the $499. That’s a cool $50K right then.

Additionally, they were doing 3 presentations a day with lots of people giving them checks.

What really disturbed me was they needed a front and back picture of your driver’s license and front and back of your Social Security card.

Nobody has a picture of my SS card front and back; there is a little stamped number on the back that is not anywhere to be found on the internet as I’ve never taken it out for anyone.

I was/am concerned that in addition to losing $499, the people who fell for it are ripe to have their identity stolen.

My friend wouldn’t listen though… we’ll see what happens to her.

So no more applications being accepted, no more meetings… I wonder if it already collapsed. Did anyone get a loan?

I have a family member who went into this. I didn’t my gut feeling didnt allow me to learn more.

However There’s several people I’ve come across that claim their program structure is nothing you’ve ever seen before & it’s so promising blah blah but I’m actually worried for my family member.

They are supposedly no longer taking applications for whatever reason.

All of them claim a revolutionary way to beat math.

First off, acknowledging all you discovered. Saw it all and still went forward because of risk/benefit ratio = low risk ($499) and extremely high benefit if only pays out one month ($34K).

I could care less if you’re right or wrong because of this ratio. Also, it’s $499 not $400 and since no one has been funded yet, nor have there been any legal problems, your accusations are all speculative.

Also, they’ve only stopped taking applications from CA.

Now, they’re processing other states. This is due to proper licensing for each state. My main concern was ID theft.

Then notbonly did Inget letter from my pension fund re: security breach of all our info but also got one from another company. So, there you go.

ID theft possible all the time. And, reason your DL & SS pics needed is one, to make sure you are a real person and State of CA also needs this info to set up our S Corp. Part of $499 …. $200 … goes to set it up and another $100 to fund Corp. = huge value right there since if Ibdid this it would cost me minimum of $800 for S Corp. So, time will tell all.

You’re a scammer looking to make a quick buck, got it.

The SEC’s Edgar database is public, you can search it yourself.

Time doesn’t legalize securities fraud. Sorry for your loss.

It’s not just about personal risk you selfish shit. That 34k is 68 other people’s money that you stole.

Selfish scammer confirmed,your parents must be proud.

For the slow people in the class,not being registered is illegal – that’s the definition of a legal problem. You not grasping that is a “you” problem.

Oh don’t worry,your personal details have been handed over to other fraudsters, you’ll be receiving many lovely opportunities in future too.

False equivalence

Pseudo-compliance baloney,you aren’t interested in anything they’re selling,just how much you can score stealing from others. At least be honest in your intentions.

Please keep me aware. I am concerned about identity theft.

There should definitely be some kind of compensation fund and support system for people who knowingly enter into obvious ponzis and are worried about identity theft. Yeah right.

Not sure if this is legit or a scam. I’ve known Dennis and Charles. Dennis set up a CA unincorporated Association for me so he appears legit.

Also as a member of WOW, mine was set up in late April via Jodi. I have received checked with SOS in CA and my corp name has been established for myself and other family members, so that must count for something.

Don’t like the delays or lack of info. Got into their backoffice on WOW’s website but really dosen’t tell much.

Oz …..aka ‘Mr. High & Mighty Know It All’ …. talk about knowing your facts …. WOW has absolutely nothing to do with selling securities.

Gee, think that’s why it’s not listed with SEC??

They are offering a Self Liquidating Loan … and because of the banking platforms affiliated with, Citi / BNY / Pershing to name few, they’re able to guarantee a 15% monthly return which pays for loan over 5 years.

Period. Not engaging with you or anybody else any further.

You not understanding what a “security” is is exactly why many adults should not be left in charge of their own money.

Go back to school and stop believing in unicorns.

It doesn’t. Securities fraud is no less illegal when committed through shell companies.

@Juana

You can call it whatever you want. MLM + passive investment scheme = securities offering.

Not being registered with the SEC and offering securities to US residents = securities fraud.

Sorry for your loss.

Hi I can’t find the source of who wrote this article (I’m on Mobile too) but unfortunately I have someone in my family who’s been reeled in, and I cant seem to make them see all the red flags.

Anyone a. Know anyone PERSONALLY who’s received a payment from them?

b. Know of any further updates? Thank you.

Win on Wealth appears to have collapsed a few months ago.

Also don’t fall into the trap of “stealing money = legitimate” trap. Regardless of whether Win on Wealth is paying or not, it’s still committing securities fraud.

MLM + securities fraud = Ponzi scheme.

What evidence do we have that shows that it collapsed already?

I heard that they are going to publish an update on September 2nd.

You guys believe numbers on a screen and don’t do any due diligence.

Since when is actual evidence relevant to you?

AntiMLM, excuse me, what?

Win on Wealth collapsed the moment they stopped taking signups, along with withdrawals.

OZ, Fair, the reason why I am looking for concrete evidence is because I am a journalist, and want to write a story on this, after getting dragged into it by a family member who claims to be receiving money from them…

Is there anyone I can talk to who would be willing to give me more info or be able to steer me a bit through this. Thank you.

Beyond Win on Wealth committing securities fraud (which you can verify), and not accepting new investors (which you can verify), and not paying out (which you can verify with your family member), what else is there to cover?

*I should add, that when I first heard about this, and the pitch, my mind instantly went to: this is money laundering or some scheme of that sort…

You literally can’t have “concrete evidence” till it’s liquidated or stopped by the cops,thats why these schemes can drag it out. Hopeful losers will hold out hope till the end of time.

What you can verify is their business is illegal.

I hear you, you’re basically saying, time will tell (once the loans are never distributed). However, this family member is being PAID, or so it seems, and has moved into a new place, and purchased a new sports car (through the “Business”)

what I guess I am trying to show is that that money will dry up, and all that will be left is an unreachable payment on a car and a home.

AntiMLM, so what do we do? report this to as many gov agencies until one of them decides to do something about it?

It just seems as if many of the people involved in this, are waaaay over their heads.

Unless you’ve personally verified it, didn’t happen.

No new recruits = no money to pay out. They might have gotten in early and stolen a bunch of money, before Win on Wealth collapsed.

Who knows. What we do know is Win on Wealth stopped taking on new investors and paying out.

I can personally verify the house and car. Is there a way to contact you more directly?

I’m not saying your family member didn’t buy a house and car. I’m saying you haven’t confirmed the money paid for said house and car has anything to do with Win on Wealth.

And even if they got in early and stole a bunch of money before Win on Wealth collapsed, it’s still a Ponzi scheme.

Don’t fall into the “stealing money means it’s not a Ponzi” trap. Business models define Ponzi schemes. How much people steal through them is neither here nor there.

Got in early or took loans out because his “big payday is coming”.

Either way,if the former he’s a thief and liable.

Individual cases in Pyramid/Ponzi schemes only prove that some lucky bastards “can win”. Some by pure luck and coincidence, some thanks to their nasty plan and “know how”.

If you want to report about this case as journalist, you have to verify if it operates like Ponzi/pyramid. This cen be analysed by tracking the money in and out. Oz already did this analyse for you. There is no other money in than money from “partners”.

No matter in which phase the scam is (rocket up to the moon, some bastards get rich quick x first signs of stumbling and delayed withdrawals, selective withdrawals, kaboom and no withdrawals, communication radio silence, company dissolved).

The ending is always the same. Most of the money collected are “who knows where”, partners and investors has received “collective loss”, scam admins and hired faces escaped/disappeared. Very rarely some of them enjoy relax in prison.

P.S. You already have connection with author (Oz) here in comments.

Don expect more intimate connection. Oz operates in hot criminal area and can have a lot of enemies. He will not reveal his whereabouts and personal details for security reasons.

Journalist? Your call. Be smart.

Mr. Czech, thank you, and thank you Oz as well. I understand and respect your concern, my intention isnt to put you guys in the spotlight, I’m just caught up in this, and having knowledge in journalism, there is an ethical factor that is telling me to find out more.

YET also, talking to other professionals, as well as you all, it seems that cases like this always end up with these people screwing over people.

I perhaps came off as too naive, and for that I am embarrassed. Thanks again.

Hi Jam which family member is being paid through wow-winonwealth.

Nobody got funded through wow-winonwealth. My friend tried brought me to one of these webinars online and the pitch was absolutely confusing and immediately these people are hypnotized by the commissions.

It doesn’t make sense. Is there anyway to contact the CA attorneys office to do an investigation on this company.

It looks wow-winonwealth has updated their policies on the website. They stopped taking applications so that they can make these c-corporations are in compliance with state laws.

I don’t think this a ponzi scheme. They are using a method call ed fractionalized banking.

They all have invested their own money to make this project work where everyone wins. I don’t think they are out of business.

I believe they are trying to do things right. Their building and offices are there for everyone to find out their operation.

You can’t undo securities fraud. Unless Win on Wealth is registered with the SEC and filing audited financial reports, they’re committing securities fraud.

If you want to make claims about what Win on Wealth is doing with invested funds, please provided audited financial reports.

Failing which, MLM + securities fraud = Ponzi scheme.

The only way a corporation for a corporation to be reported to the SEC is its going to be put on the stock exchange and if shares are going to be traded.

C- Corporations that are being created by wow are not considered to be put on the stock market.

The securities are offered by Win on Wealth. Win on Wealth needs to register with the SEC.

How the securities offering is set up is irrelevant.

Your grasp of Securities laws and what Securities even are seem to be below that of a kindergartener.

I wouldn’t want to leave any financial decisions up to somebody so ill-informed, you need to participate less in scams and read a finance book or 2.

Antimlm- this is not about bashing someone. I’m not part of WOW-WINONWEALTH.

I’m just asking someone needs to investigate further about this company. I’m just speculating about the webinars that I’ve been invited to.

I think Oz has done his due diligence but however there seems to be a missing puzzle in all of this and I personally think that there needs to be an investigation done in person.

There’s no missing puzzle. Win on Wealth is committing securities fraud because it’s a Ponzi scheme.

The only thing missing is Win on Wealth’s SEC registration and legally required audited financial reports.

I never said you are part of it, what I quoted was your statement, that was factually incorrect.

How you got to that incorrect conclusion is irrelevant, as is your feelings.

It’s a scam, simply.

My pastor tried to get me involved in this months ago.

I looked over the application and there were tons of grammatical errors.

He seamed to be very excited about this and was busy singing members of the church up. I told him I believe this is a scam and he should be careful. Anyways, very sad.

SO MY SISTER GOT MY HUSBAND INTO THIS WOW ( BULLS**&!). I KNEW IT SEEMED FISHY. WHO THE HELL WILL GIVE YOU A MILLION DOLLARS TO BUY A HOME, YEAH OKAY!!

ANYHOW I TOLD MY SISTER THIS SH($ IS A PYRAMID SCHEME). (I THINK SHES VERY GULLIBLE) SO ANYWAY I KEEP ASKING HER FOR COPIES OF THE CONTRACT HUBBY FILLED OUT.

SHE KEEPS GIVING ME THE RUN AROUND. HUBBY SUPPOSED TO BE GETTING THE FUNDS BY 6/22/22. WILL SEE IF IT IT A SCHEME. ANYONE GOT THEIR FUNDS YET?

I’ve been looking into this. It could be a ponzi scheme. But they’re setting up S-Corps, because their “bank” said they are easier for the bank.

But S-Corps have requirements for annual or quarterly type reports, right? Who are the officers of the corporation- you need more than one, correct?

Banks typically don’t knowingly assist scammers with securities fraud. Whatever BS “the bank” has been told isn’t what Win on Wealth actually is.

How you set up securities fraud is irrelevant. But, as you’ve noted, might open up Win on Wealth and investors to additional fraud violations.

I’m not familiar with S-Corps so can’t comment on specifics outside of securities fraud.

Any update on this one? My friend, who got scammed in the Mike G deal, also put dough into this one. Twice burned?

Your friend might need to have control of their finances handed over to an adult.

Pretty much. I haven’t seen any updates.

WOW is back! I am watching a Zoom call from the California location. Should be fun to see how this plays out.

They are saying they had to put compliance and regulatory measures in place, including an insurance policy to serve as collateral for the business loan.

Everyone who has been onboarded will be funded this year – around 8k people it seems. They won’t take any new applications until those people are funded and operational.

Info to be posted on the website 6/5/23. I look forward to reading analysis of the new info. Thanks to you guys.

*heads over to SEC’s Edgar database…*

Win on Wealth is still not registered. So that’s a lie.

And 8000 bagholders you say? Good luck with that.

Where are all the 15% a month bajillionaires?

(Ozedit: derails removed)

I have a taped historical library of all the main events and promotional proceedings at WOW’s-ville since they came up the means of funding the operation someone’s clean (new) closely held corp by letting them borrow $100,000 for their corp biz.

What was announced to the thousands of “hangers on’ers” Saturday was the total elimination of the mlm ‘affiliate’ program as well as some of the planned features of the loan IN ORDER TO BE in compliance with banking securities laws.

So even though the loan program will still be just as beneficial as before, those who have stayed on (there has been an offer on the table for some time now that anyone who wanted to change their mind and cancel their application can do so in writing and receive their entire $499 upfront app cost back and keep or dissolve their corporation at their own discretion – June 30th is the deadline for cancelling their CA State corp and not being billed for the State renewal fee).

And? Legally required audited financial reports filed with the SEC or GTFO.

MLM isn’t illegal, securities fraud is. By definition securities fraud cannot be compliant with securities law.

Unless Win on Wealth is registered with the SEC it continues to commit securities fraud. It should also be noted already committed securities fraud cannot be undone.

Oz – yeah, this is going to be a massive trainwreck. I am trying to figure out what they did with all that money they are openly admitting they received – 8,000 x minimum $100 investment, up to $500 for many.

They said nothing about where that million+ went. If it took them this long to make whatever adjustments they claim they needed to make, it would take another 10 years to process all those applications.

And absent any real mechanism to secure 15% per month profit, there won’t be any money to support the Ponzi scheme since they won’t be taking new applications.

I’ve been looking at this company to see if they are legit. If they are committing fraud and illegal activities, why aren’t they shut down and why are the people in charge not in jail?

I’m pretty sure the law is smarter than everyone in this forum when it comes to financial crimes.

@Fred

See #24.

Yes Fred, you’re entirely right!

Nobody has been arrested or even charged with a crime because no law has been broken and there was no intent to do anything illegal.

When the company found out that, because of the way WOW wanted the program to be set up to work for everyone’s benefit, it couldn’t pay commissioned overrides on invested monies without being hassled by ambulance (or MLM) chasers, even though the entity that would have been paying commissions was technically the one who would have been loaning the corporate investor the money to invest.

So when they realized they were creating a situation that would have opened them up to POTENTIAL legal hassles with the financial system as it is set up to work and be controlled by the wealthy who want to stay in power (as many contributors to this thread have pointed out above), they put a freeze on the program in June of last year and offered everyone a 100% return of the cost of getting set up with a new Corporation in order to participate in a program that was going to have to be modified outside the scope of what was promised to the applicants.

(and that offer is still available to any WOW-Win On Wealth applicant for a Corporation and WOW membership in order to participate in a program that WOW has judiciously terminated)

“No intent to do anything illegal” is not a defense against securities fraud.

And securities fraud is very much breaking the law with respect to violations of the Securities and Exchange Act.

Securities and Exchange Act > sovereign citizen nutjobs

So insane. I was going through some old notes and found one where I made a video with speaking points to show my dad why it wasn’t a good idea to put money in this and it’s a sigh of relief that I was right.

Just doing a little bit of research really saved him and some other folks a mean headache. THANKS FOR YOUR HARD WORK!

Please allow me to jump in here. This WAS, IS and will always be a CON.

I will share with you that I have personally been contacted by three law inforcement agencies to date, not including 4 Attorney Generals offices in Florida, Texas, Nevada and California.

Arthur AJ Lewis, His partner in California, Lin Thuey Le and his Texas attorney are all being investigated for multiple counts of Fraud (Securities, Bank, International, etc.) in multiple business matters, that make WOW look like nothing more complicated to solve legally, than my 4 year old son’s math homework.

Investigators were present as would-be investors and WOW participants at more than 3 meeting held at the California, [removed] Woodlawn Avenue Tustin, CA 92780 Facility owned by Linh Thuey Le.

They are all going down in a well orchestrated, FBI round-up of individuals from the Texas Attorney, to Le and yes, of course, AJ himself, who has riddled multiple states with fraudulent bank/money deals and Ponzi Schemes.

I just wanted to share with you that we will never see our money returned, however, sleep well knowing the bastards are going DOWN.

IT IS ALREADY 14 MONTHS (1 YEAR and 2months) AFTER WE SENT THE APPLICATION AND $499 FOR THE LOC (LINE OF CREDIT) OF $100,000 TO RECEIVE $30,000 UP FRONT, AND THERE IS NOT EVEN THE C CORPORATION AND NO LETTER OF CREDIT EITHER.

I ASKED FOR REFUND AND THEY’RE RESPOND WAS THAT THEY DON’T FIND MY FILE.

JODI LEE PLEITEZ SENT ME ON AUGUST 2022 AN EMAIL CONFIRMING THE RECEIVED OF MY APPLICATION AND $400 MONEY ORDER, BUT SHE DIDN’T SEND ME A MEMBERSHIP #.

ANOTHER ONE OF THEIR MEMBER’S NAMED NELSON MANILA STATED THAT ALL OF THEM RECEIVED A CUT $$$ (PAYMENT) FOR RECRUITING PEOPLE.

I REALLY THINK IT IS A FRAUDULENT ORGANIZATION “SCAMMERS” AND THE FBI SHOULD INVESTIGATE WOW-WINONWEALTH.

The FBI isn’t going to launch an investigation on their own. If you want Win on Wealth investigated you need to take the initiative and file a complaint with the FBI/SEC.

AnViPS #94

If you have your MO Receipt check to see if it was cashed. If it was, then send a Notice of cancellation to WOW along with a copy of Jodi’s letter and a copy of the receipt and give them 10 days to refund your money.

If they don’t reply, you can go to your local small claims court and upon winning your claim, you’ll have a legitimate PUBLIC record of their incompetancy, and I will recommend an attorney who, upon advertsing the formation of a class action suit and meeting all the requirements, handle the case at no upfront charge.

You’ll want to take action immediately while they still have most of the $4,500,000.00 they were advanced in the bank.

However, if your application was lost in the chaotic shuffle (and many were), there’s a good chance that the MO was lost along with it. So just have your issuing ‘bank’ cancel it and put your money back in your hands.

btw, AnViPS

WOW did not automatically issue WOW membership numbers just because you applied for the Corporate Loan program (and still doesn’t) unless you sign up for one on the web site.

The membership fee is $99. However, that fee was also part of the $499 that was submitted with your Corporate Loan Application.

So all you have to do is sign up for the membership and click on Paid with loan application to see if that part of your money got credited to that ‘division’ – if that works for you that could mean that since Jodi sent you the ‘no can find’ letter, they might have found it.

(of course that would be logical IF they have put some kind of system in place and are actually using it)

My son and I both joined WOW back in April, 2022 for $499 each.

Please keep me updated on their situation. Thank you.

I joined WOW in May of 2022. That was 15 months ago. I have received nothing from the company. Nothing.

There is no phone number to call. I have emailed a number of times and have not received an email response.

When I try to log on the the website it asks for my email and last 6 numbers of my social security number. The response is “no record found”.

THIS IS A SCAM. REPEAT, THIS IS A SCAM. DO NOT GIVE THEM MONEY.

I have an appointment with my attorney on the 28th of this month. I will follow up then.

I did buy into it last year. Due to a “longtime trusted: friend.

All my instincts were saying no.. alot of redflags.. but I trusted my friend at the time. Lost my 500.00. And I’m chronically ill without an income..

I do have a number of a man name john ‘jack’ Riley. I have lots of texts from him.. he has since stopped all contact..

my question is.. can I sue these people for fraud, breach of contract and identity theft, ot for the amount of the loan? What are my legal options?

All I wanted was to start a business from home so I can take care if myself while getting medical treatments..

Legal questions should be put to a lawyer. That said you’re likely to very quickly run up more in legal fees than the $500 you lost to Win on Wealth.

Win on Wealth was a Ponzi scheme run by US nationals that committed securities fraud in the US. Securities fraud in the US is regulated by the SEC.

If you want someone to be held accountable your best bet is providing whatever evidence you have to the SEC. A complaint can be filed on their website.

Rod Garrett, did you speak with your attorney yet? What did they say can be done?

I am sorry. Yes I did speak with my attorney. It took him less than one minute to advise me. Walk away. It would cost so much more in legal fees to get $499 back.

A class action case might work but would take unknown hours to determine the assets of WOW.

I/We wouldn’t find an attorney and if we did it could be years before we saw results.

I know this isn’t the answer anyone wanted and I’m sorry. I take solice in knowing I have “given” more than $499 to a few casinos in Las Vegas.

Bottom line: It could have been much worse. You can go to your local district attorney and also your regional FBI office to file a grievance. I wish you the best.

Oz,

now that WOW has ACTUALLY committed acts of a FRAUDULENT nature, and I lined up a legal team to hit them with a Class Action Suit, why are you not allowing my posts to the BehindMLM group to inform my fellow victims of such to be posted here?

1. Win on Wealth was a fraudulent investment scheme from launch. Securities fraud is illegal.

The Ponzi scheme inevitably collapsing doesn’t make it any less fraudulent – just that you’ve been forced to accept facts.

2. BehindMLM isn’t a platform to drum up support for class-actions. If you file anything we’ll cover it.

A LOT of my friends put in the $499 for this. My concern was not only the money but they required a passport or DL and your SS card.

I wonder if the people who bought in are now going to have identity fraud problems. Just wondering.

I went to a meeting in Tustin and the enthusiasm of people to throw $500 at sketchy people is amazing. Greed is a big motivator and apparently turns off the logic part of the brain.

Not only is this a scam; it is a poorly run one. It is amazing to me that anyone bought into this.

I know there are those that shout about them having an “office” but seeing their “office” just helps to prove the point that they are a scam.

For anyone who has not been there they run the scam out of a converted warehouse in Tustin. They even have the old loading docks and roll up doors for easy truck access into the main warehouse that they use as a waiting room.

Would “billionaire philanthropists”, as they purport where they get their money from, run an operation this run down and ghetto? NO! Of course not!

Don’t even get me started on the staff. They all look ghetto and unpresentable. They look and sound weird. They definitely could never get a job being a bank teller or something where looking professional is required.

Talking to some of them you learn they are all failed insurance agents. Now I hear they are selling IUL’s out of their office to help fund their Ponzi.

IUL’s are also a scam in case you were wondering. Do the research, heck do the math, you’ll see that its the payday loan of the middle class. And they are selling it to people who aren’t even in the middle class!

The poorer people who could use that money and would make more by just letting it sit in an index fund.

I feel bad for those of you that bought into this. I’m mad that I even wasted a trip there. I cant imagine how much worse I would have felt if I gave them even one cent of my money.

Anyone have any news on this scam crashing? I get an immense sense of schadenfreude from watching trainwrecks like this implode lol.

Review updated to note Win on Wealth has collapsed.