WeFi Review: WeChain WFI node investment fraud

WeFi operates in the cryptocurrency MLM niche.

WeFi operates in the cryptocurrency MLM niche.

WeFi’s website address (“wefi.co”), was registered in January 2024. The private registration was last updated on November 30th, 2024.

WeFi does not provide a corporate address on its website. Instead, in barely legible text, WeFi’s website lists associated shell companies registered in various jurisdictions:

- WeFi Payments Limited, a Canadian shell company claimed to be “a registered money services business”

- 3-102-939581 S.R.L., a Costa Rica shell company

- Nordpal Holding Limited, a Hong Kong shell company

WeFi is also associated with WeChain, which it claims is part of the “WeFi ecosystem”.

WeChain operates from the website domain “wechain.ai”, registered in May 2024. WeChain’s private domain registration was last updated on April 2nd, 2025.

In the footer of WeChain’s website, again in barely legible text, we find reference to:

- AppAtlas Technologies LLC, a St Vincent and Grenadines shell company

- InfiniCore Tech LLC, a Saint Kitts and Nevis shell company

All but one of WeFi’s shell companies is registered in a dodgy jurisdiction (i.e. little to no MLM related regulation). This raises a red flag for what should be obvious reasons.

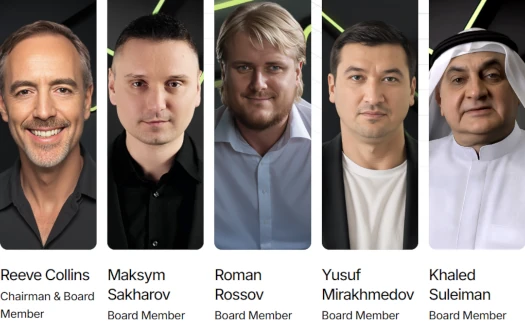

Heading up WeFi we have:

- Reeve Collins – Chairman and Board Member

- Maksym Sakharov – Board Member

- Roman Rossov – Board Member

- Yusuf Mirakhmedov – Board Member

- Khaled Suleiman – Board Member

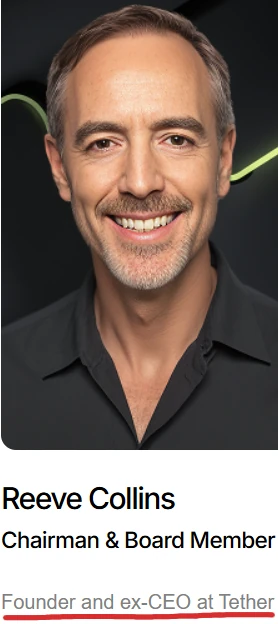

Reeve Collins cites himself as the founder and former CEO of Tether. Tether launched in 2014 and created and operates USDT, a cryptocurrency bearing the same name.

Collins and the other co-founders sold tether to the cryptocurrency exchange Bitfinex in 2015. Since then, USDT has grown to become the most common cryptocurrency BehindMLM comes across in MLM related fraud.

As of September 2025, Tether’s USDT marketcap sits at $170.04 billion. Up until 2019, Tether falsely claimed on its website that

Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USDT is always equivalent to 1 USD.

Following legal action from the CFTC (2017) New York Attorney General’s Office (2019), Tether changed its USD backed claim to:

Tether Tokens are 100% backed by Tether’s Reserves

In October 2021, Tether paid a $41.6 million fine for lying about USDT being backed by USD.

To date, it is unknown what “Tether’s Reserves” is made up of or, more importantly, whether it comes anywhere near to backing USDT’s current $170 billion market cap.

Tether has consistently refused to let a third-party auditor verify its backing. This lends itself to suspicion Tether is one of the largest consumer-level financial frauds in history.

To be clear, beyond co-founding Tether, Reeve Collins hasn’t had anything to do with Tether’s fraud since 2015. I only point this out because Collins’ personal brand marketing seems to rely heavily on his co-founding of Tether.

To be clear, beyond co-founding Tether, Reeve Collins hasn’t had anything to do with Tether’s fraud since 2015. I only point this out because Collins’ personal brand marketing seems to rely heavily on his co-founding of Tether.

WeFi is no exception.

Association with USDT is probably not something I’d want on my resume, but I digress.

Khaled Suleiman’s LinkedIn profile places him in Switzerland. Suleiman has a finance history so I’m assuming this makes him WeFi’s money guy.

Maksym Sakharov and Roman Rossov appear to be random Ukrainian crypto bros who are now based out of Dubai.

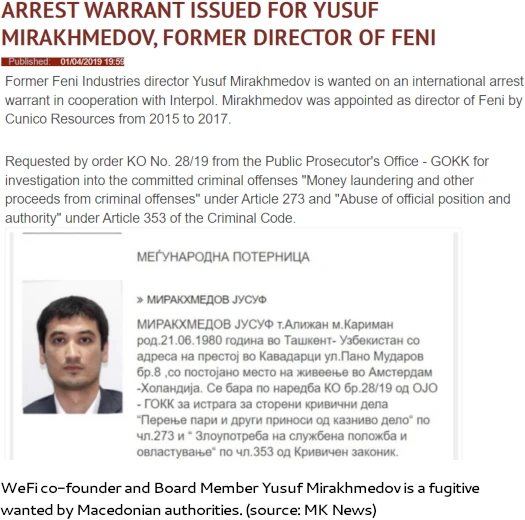

Yusuf Mirakhmedov, also based out of Dubai, is a wanted fugitive on the run from Macedonian authorities.

In 2015 Mirakhmedov (born in Uzbekistan as Јусуф Миракхмедов), was appointed Director of Ferronickel and CEO of Feni Industries. Both companies were then owned by Cunico Resources, which Mirakhmedov was also CEO of.

Around mid 2017, Macedonian authorities filed criminal charges against Mirakhmedov. Mirakhmedov was accused of misappropriating over $50 million.

The money, according to the investigators, was embezzled through organized crime by “Cunico Resource”, the company that also owns “Ferronickel” in Kosovo.

In October 2017, Macedonian authorities confirmed Mirakhmedov had fled Macedonia for Uzbekistan.

In 2019 it was confirmed Mirakhmedov was still wanted on an international arrest warrant.

Requested by order KO No. 28/19 from the Public Prosecutor’s Office – GOKK for investigation into the committed criminal offenses “Money laundering and other proceeds from criminal offenses” under Article 273 and “Abuse of official position and authority” under Article 353 of the Criminal Code.

In November 2017, the Financial Police Department filed a criminal complaint against Mirakhmedov, suspecting him of abuse of official position and authority.

Then, during the investigation, the Financial Police determined that Yusuf, the then director, illegally alienated reserves of ferronickel and other ore from the factory.

In December of the same year, the department filed a second criminal complaint against Mirakhmedov due to reasonable suspicion of abuse of official position and authority.

Mirakhmedov made an unfounded write-off of Feni’s untimely receivables, which is suspected of damaging the factory by 51,505,526 US dollars.

It appears at some point Mirakhmedov fled Uzbekistan for Dubai, where he reinvented himself as a crypto bro.

Update 22nd September 2025 – Another name we can tie to WeFi is John Sachtouras.

Sachtouras made a name for himself as part of corporate for the FutureNet Ponzi scheme.

As FutureNet was collapsing in 2019, Sachtouras launched Ascira around the same time.

Ascira was a run-of-the-mill discount travel MLM company charging $4999 for access.

Ascira appears to have collapsed in late 2024. Today Ascira’s website domain is for sale. /end update

As opposed to the various jurisdictions shell companies have been registered in, WeFi appears to be based out of and operated from Dubai.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to WeFi, read on for a full review.

WeFi’s Products

WeFi has no retailable products or services.

Promoters are only able to market WeFi promoter membership itself.

WeFi’s Compensation Plan

WeFi pays referral commissions when recruited downline promoters invest in ITO node positions.

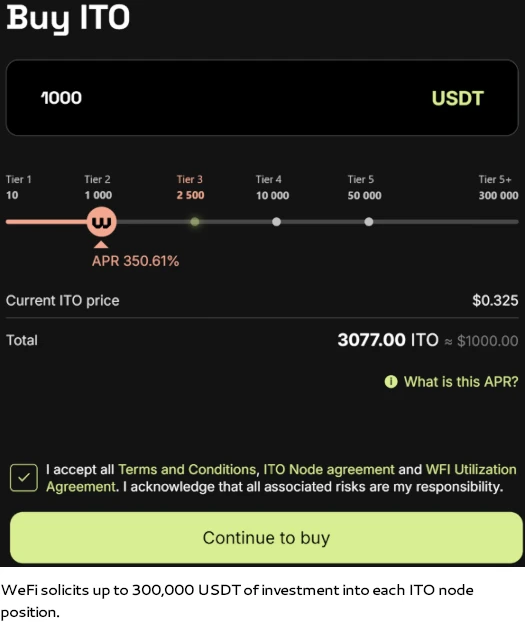

ITO node investment positions are purchased in tether (USDT).

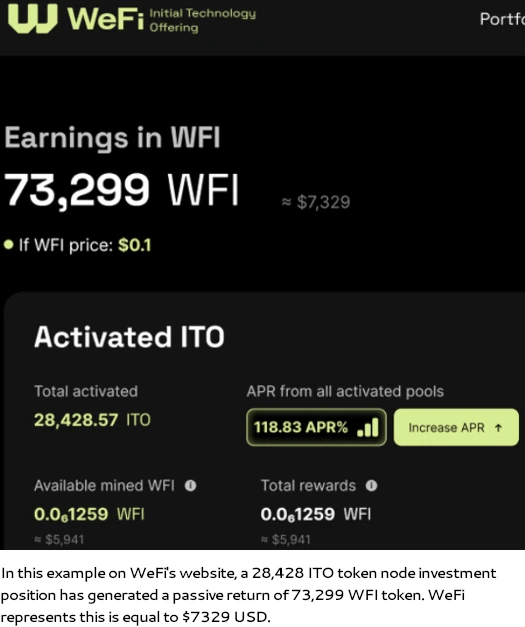

ITO node positions generate passive returns in WFI tokens. The more a WeFi promoter invests, the higher the WFI token return.

An marketing example provided by WeFi pitches consumers on a 350.61% annual ROI on a 1000 USDT ITO node investment.

It should be noted this is only tier 2. The slide above goes up to 300,000 USDT, although the corresponding annual return at that tier isn’t disclosed.

Once acquired through ITO node positions, WFI is then funneled into a staking investment scheme:

- earn 15% annually on WFI tokens invested for 180 days

- earn 20% annually on WFI tokens invested for 365 days

- earn 25% annually on WFI tokens invested for 730 days

WeFi pays referral commissions on WFI tokens invested into its staking scheme.

Referral commissions are paid down three levels of recruitment (unilevel):

- level 1 (personally recruited promoters) – 3%, unlocked with a 250 USDT ITO node position investment

- level 2 – 5%, unlocked with a 500 USDT ITO node position investment

- level 3 – 8%, unlocked with a 1000 USDT ITO node position investment

Note that WeFi pays referral commissions in WFI token, which are automatically entered into WeFi’s staking investment scheme for one year.

Joining WeFi

WeFi promoter membership is free.

Full participation in the attached income opportunity requires a minimum 250 USDT investment.

Full participation in WeFi’s attached MLM opportunity requires a minimum 1000 USDT investment.

WeFi Conclusion

The co-founder of tether, a bunch of Euro crypto bros hiding in Dubai, one of which is a wanted fugitive, a finance guy in Switzerland and shell companies out the wazoo… what could go wrong?

Putting all of that aside for a moment, WeFi is a simple “node” model investment scheme coupled with a staking Ponzi.

New WeFi promoters are recruited and invest USDT (ironic much?) into ITO node positions. The ITO node positions pay out a daily passive return in WeFi’s WFI token.

WFI tokens are then entered into a typical crypto staking Ponzi. Through said Ponzi, WeFi investors acquire passive returns in WFI token, all done in the hope of cashing out more than they initially invested in USDT.

WeFi’s ITO node investment scheme and WFI staking investment scheme are both securities offerings. This requires WeFi to register with financial regulators in every jurisdiction it solicits investment in.

As of August 2025, SimilarWeb was tracking ~130,000 monthly visits to WeFi’s website.

Top sources of WeFi website traffic are Vietnam (24%), Ecuador (21%), France (15%), Thailand (9%) and Germany (9%). Top sources of WeChain website traffic are Canada (54%), Brazil (29%), India (10%) and Thailand (7%).

WeFi fails to provide evidence it has registered with financial regulators in any jurisdiction.

WeFi also represents itself to be a bank:

Again, WeFi doesn’t appear to hold banking licenses in any jurisdiction.

And just in case you’re wondering what “ZK-KYC” is, it appears to tie into an awfully suspicious sounding “payment engine”;

WeChain’s ZK payment engine allows one user to prove to another that a statement is genuine without revealing excess information.

Our ZK payment engine paves the way for more privacy and security across bank transfers, payments, and peer-to-peer transactions.

Sounds like money laundering to me but hey, that’s probably the most minor red flag when it comes to WeFi.

For its part, WeFi appears to be aware it’s committing securities fraud and violating banking laws in the countries it’s promoted in.

This disclaimer is provided on WeFi’s website;

Please note that the promotion and/or distribution of our products and/or services outside Hong Kong may require a licence.

The content of our website is only addressed to Hong Kong residents, domiciled in Hong Kong.

If you are a resident domiciled outside Hong Kong and do not wish to visit our website, please close this page.

If you still want to visit our website, click Continue and in doing so, you confirm that you have read and understood the above and that you are accessing our website on your own initiative without active promotion or solicitation from WeFi.

Unfortunately for WeFi that’s not how securities and financial regulation works. WeFi is responsible for registering its securities offerings and obtaining banking licenses in the jurisdictions it operates in.

Why WeFi hasn’t registered its securities offerings and obtained banking licenses should be obvious.

As it stands, the only verifiable source of revenue entering WeFi is new investment.

Using new investment to pay WFI token withdrawals would make WeFi a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment inevitably dries up so too will new investment.

This will starve WeFi of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.

This one is not subtle, it screams FRAUD at a Nigel Tufnel volume level of eleven.

350.61% annual ROI just by sending your hard earned tether to some guys in a jurisdiction without an extradition treaty for financial crimes and who are also hiding their own financial transactions between bogus shell companies in dodgy tax havens.

What could possibly go wrong?

Love your work, Oz — you’ve outdone yourself again. That nugget about Mirakhmedov being a wanted fugitive is pure gold.

I’ve just bolted this into my own WEFI blog — because what’s a fake bank without a board member on the run for embezzling $50 million? Appreciate the update, mate!

Review updated to note John Sachtouras’ involvement in WeFi.

WeFi’s Chief Growth Officer is Agne Linge. I understand she was a former Binance employee.

The fact that someone with this background is joining the company suggests they’re committed to a sound business strategy. Could you please provide your analysis?

Sure. My analysis is whether Agne Linge worked at Binance has nothing to do with WeFi committing verifiable investment fraud.

Legitimacy via association isn’t a thing.

@Arnold: Bernie Madoff was once a chairman of the NASDAQ stock exchange (talk about credibility) before masterminding what became the largest Ponzi scheme in history!

The fact Agne Linge once worked at Binance has nothing to do with whether or not the company is legally operating!

Thank you Oz for all your work, it is so necessary. The addition of mr Sachtouras pushes this company over the edge into the purely, DO NOT TOUCH territory.

I am a former member of ASCIRA, when I first saw John he seemed like an exemplary man, he sold us the idea of financial freedom, he asked us to invest more and more, founding packages to go to Dubai that would come a flood of thousands of people and we would become rich.

my wife and I lost everything. here in Chicago, in Texas, and in many other places there are thousands of people in the same situation and both he and his assistant / lover Yuraima the Venezuelan accomplice of ASCIRA disappeared from one day to the next and now as if nothing had happened promoting that Ponzi scheme.

God is seeing Mr. John all the evil that you are doing.

They have recently put out a press release stating that ex-Visa executive Michael Batuev has joined WeFi as Global Head of Payments.

He will reportedly lead WeFi’s global payments strategy across all regions, starting with Europe and the Asia-Pacific region…

(Ozedit: link removed, see below)

This isn’t the place for marketing spam. Legitimacy via association isn’t a thing.

Rifet Nuhanovic (aka “Rifko”) from Recklinghausen, Germany, is an active Bytnex/Cryptex scammer. Since May 2024, he has uploaded 105 Bytnex/Cryptex videos to his YouTube channel.

Since October 31, 2025, Rifet “Rifko” Nuhanovic has also been promoting WeFi on YouTube.

postimg.cc/5Ymh3gFN

youtube.com/@RifkosInfokanal/videos

He is now also promoting WeFi on his personal website cryptex-online.de.

postimg.cc/GHqrb74g

cryptex-online.de/wefi-deobank

What is unusual is that this fraudster provides a complete imprint on his website cryptex-online.de.

postimg.cc/YvY5hd0w

cryptex-online.de/impressum

Rifet “Rifko” Nuhanovic, born in Yugoslavia, in a video from December 11, 2024.

postimg.cc/Xr96Cb3R

youtube.com/watch?v=PrzcMPHRnto

I first mentioned Rifet “Rifko” Nuhanovic in this comment.

https://behindmlm.com/mlm-reviews/cryptex-review-daily-roi-smart-contract-ponzi-scheme/#comment-491172

Bytnex/Cryptex scammer Rifet “Rifko” Nuhanovic from Recklinghausen, Germany, uploaded a new WeFi video to his YT channel an hour ago.

postimg.cc/64RJLXnm

youtube.com/watch?v=RkfRmr7ISqA

German serial fraudster Herbert Schmitz is looking for a new opportunity to defraud foolish and greedy people. Yesterday, he wrote on Facebook (as “Berts Sozial-Media”):

postimg.cc/7f988dxq

facebook.com/groups/795515335382743

On his website crypto-investment-team.de, he has created a new section for WeFi Bank with a very long text.

postimg.cc/sGhZt5F1

crypto-investment-team.de/we-fi-bank/

The funny thing is that this old crook links to one of his Facebook groups that is not accessible. 😀

postimg.cc/3kspFLPT

facebook.com/groups/859614176476395

German serial fraudster Herbert Schmitz responded quickly to my last comment. 😀 His link to crypto-investment-team.de/we-fi-bank now leads to the following error message:

postimg.cc/DSsYVQSY

The title WeFi Bank is now also missing from crypto-investment-team.de between “Core Races” and “Crypto Card.”

postimg.cc/dZwT1Y6y

Anyone wishing to register on wefi.co must confirm the following points.

postimg.cc/YjYZ2ywF

app.wefi.co/register?ref=(removed)

An official WeFi account has existed on Instagram since August 2024. SURPRISE! The location of the wefi_official account is Vietnam. One Ecosystem, WeFi… – Is Vietnam now becoming the Dubai of Asia?

postimg.cc/4mJDLkY1 + postimg.cc/kBQ58dks

instagram.com/wefi_official/

Addition to comments #13 and 14.

German serial fraudster Herbert Schmitz has removed his advertising for WeFi from his fraudulent website crypto-investment-team.de, but his criminal accomplice Ingolf R. Feger (aka “Ray Seger”) from Liechtenstein continues to promote WeFi.

Email from “Marketing Team” dated November 24, 2025. The actual sender of this email is raymondconsultinggroup.com, a website owned by Ingolf R. Feger.

postimg.cc/4nzhP2yx

The email contains this address at the end.

postimg.cc/fJ7HXvYZ

Ingolf R. Feger‘s Reflink at WeFi can be seen in the following screenshot.

postimg.cc/YjYZ2ywF

And this is what the operator of the websites 5a-onlinebusiness.com and raymondconsultinggroup.com looks like! Very likeable, isn’t he?

postimg.cc/CZBWpqnH

WeFi World is an account on Facebook, created on November 4, 2025. The operator lists Aschaffenburg, Germany, as its location.

facebook.com/profile.php?id=61583012325845

Post dated November 22, 2025.

postimg.cc/vc5N4Hqj

facebook.com/photo?fbid=122105684043100410&set=a.122101099701100410

Jürgen Krüger from Essen, Germany, is an active Bytnex/Cryptex scammer. I have documented this here.

https://behindmlm.com/mlm-reviews/cryptex-review-daily-roi-smart-contract-ponzi-scheme/#comment-493956

Jürgen Krüger is now also an active WeFi scammer. On his YouTube channel with 155 subscribers, he has been promoting WeFi Deo Bank with 10 videos since October 6, 2025.

postimg.cc/JyJBBGV0

youtube.com/@JuergenKrueger/videos

The name Wolfgang Harger and his telephone number were also mentioned under a video dated October 10, 2025.

postimg.cc/GTbM5WJH

youtube.com/watch?v=nCDMZuaNNvU

On November 6, 2025, Jürgen Krüger privately registered the domain wefi-card.com. The registration again mentions a company called Stornofrei S.L., based in Palma de Mallorca (Spain).

postimg.cc/w14Ssjcd

ceginformacio.hu/cr10422312769_EN

On LinkedIn, Jürgen Krüger is no longer promoting Cryptex, but WeFi instead.

postimg.cc/LnT0XVND + postimg.cc/TLBkRy6m

linkedin.com/in/juergenkrueger45141/

As is typical for fraudsters, wefi-card.com does not include any legal notice, only an email address and a telephone number.

postimg.cc/Q9j7chJP

wefi-card.com/einladung-zum-meeting/

This 54-minute video featuring “Alex WeFi” was uploaded to the Globalleaders YouTube channel on November 25, 2025. The video was not listed!

postimg.cc/nX11vp7B

youtube.com/watch?v=XPvhGtbTmQc

The YT channel Globalleaders has been around since September 2021 and has 679 subscribers. The channel doesn’t have a single video listed!

postimg.cc/8jY793Sb

youtube.com/@globalleaders8115

PS: I found the link to this video in the Facebook group WeFi World (see comment #17).

Since November 24, 2025, German serial fraudster Thomas Adamec from Fürth has also been promoting the WeFi scam on YouTube with seven videos.

postimg.cc/bDG0x2Yd

youtube.com/@PassivesEinkommen819/videos

I last mentioned this lousy serial fraudster in this comment:

https://behindmlm.com/mlm-reviews/cryptex-review-daily-roi-smart-contract-ponzi-scheme/#comment-493833

postimg.cc/9wm2mJvp

I want to share my direct experience with Wefi.co because what they are doing raises very serious concerns.

Their site displays a Refund Policy link but the link does not open, so users cannot read any terms before depositing money.

After joining, I discovered that they impose a hidden lock for more than 5 years plus 180 days. This locking condition was never shown during registration or payment.

When I requested a refund, they refused and sent a scripted message saying farming cannot be stopped because it would affect their system stability.

This makes no sense because the entire setup is fully centralized and no external wallet connection was used. They have complete control over user funds, so claiming that they cannot stop or refund is not believable at all.

They continue trying to convince users to stay by talking about long term energy scarcity and possible future value, instead of addressing the main issue of undisclosed conditions and blocked withdrawals. They also avoid giving any timeline or real solution.

In simple words, the platform shows a non functional refund policy, hides critical locking terms, refuses refunds, holds user funds without consent and uses generic replies to avoid accountability.

This behavior clearly suggests misleading practices. People should be extremely cautious with Wefi.co because once the money goes in, they make it almost impossible to get it back.

Given WeFi is a fraudulent investment scheme, what about any of your experience surprised you?