SureX Exchange Review: Multi-tier crypto investment fraud

SureX Exchange fails to provide ownership or executive information on its website.

SureX Exchange fails to provide ownership or executive information on its website.

SureX Exchange’s website domain (“surexchange.io”), was first registered in August 2022. The private registration was last updated on February 28th, 2023.

SureX Exchange’s social media profiles were created in October 2022, so this appears to be when the company launched.

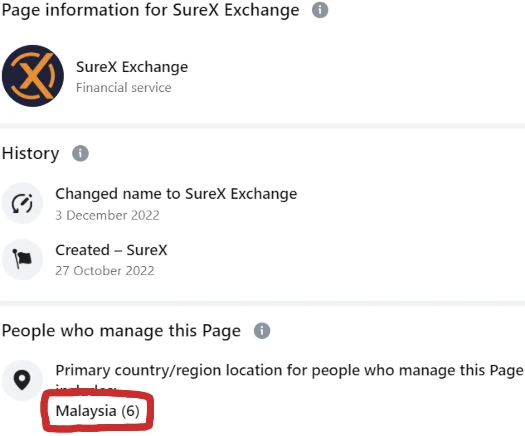

If we look at SureX Exchange’s FaceBook profile, we can see it is being operated from Malaysia:

A May 22nd post on SureX Exchange’s Instagram profile also reveals a staged charity event held in Malaysia:

SureX Exchange’s use of Chinese in its marketing suggests it is being run by individuals with ties to China from Malaysia.

This knowledge led me to Jacky Zhou, who is cited as SureX Exchange’s CEO:

Another SureX Exchange executive we can name is CMO Willie Tan:

Possibly due to language-barriers, I was unable to put together an MLM history on either Zhou or Tan.

Both Zhou and Tan are represented as being based out of Malaysia, which fits with SureX Exchange’s marketing.

Zhou is purportedly a Taiwanese national. This likewise fits with SureX Exchange’s use of Traditional Chinese.

Why Zhou and Tan aren’t featured on SureX Exchange’s website is unclear.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

SureX Exchange’ Products

SureX Exchange has no retailable products or services.

Affiliates are only able to market SureX Exchange affiliate membership itself.

SureX Exchange’s Compensation Plan

SureX Exchange offers affiliates three passive ROI models:

Staking

SureX Exchange affiliates invest tether on the promise of a passive monthly ROI:

- invest for 90 days and receive 0.4% a month

- invest for 180 days and receive 0.5% a month

- invest for 360 days and receive 0.6% a month

Follow Trade Fund

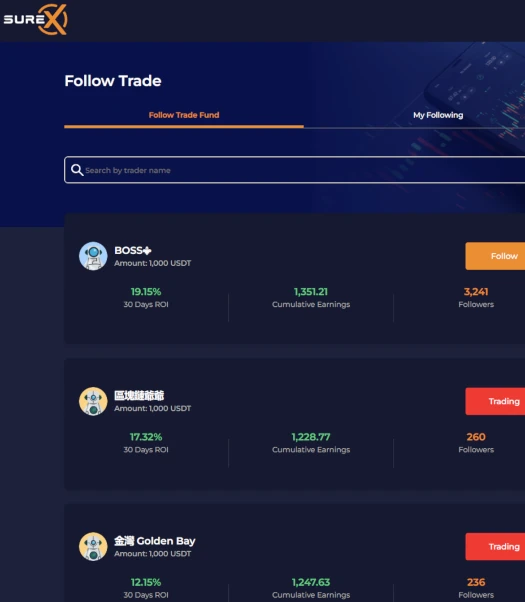

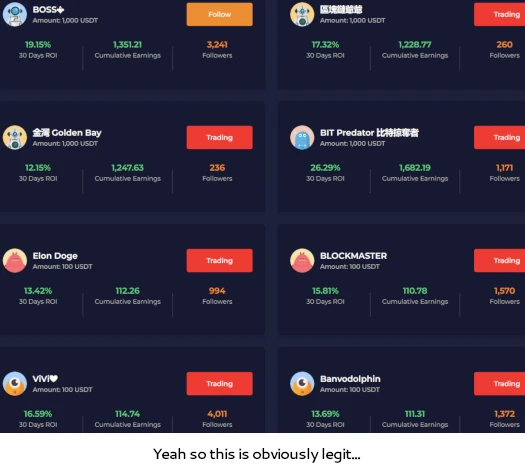

SureX Exchange also offers monthly investment plans set up as “Follow Trade Fund”:

Through its Follow Trade Fund, SureX Exchange affiliates invest 100 to 10,000 USDT on the promise of up to 21% a month.

Liquidity Pools

SureX Exchange offers affiliates Liquidity Pool investment in two shit tokens.

SureX Exchange affiliates invest tether into SLT. SLT is an internal shitcoin SureX Exchange represents is pegged to tether.

Once invested in, SLT is added to an SLT Liquidity Pool. SureX Exchange pays a passive return on SLT invested.

SLT Liquidity Pool withdrawals attract a 10% withdrawal fee.

SureX Exchange affiliates can also invest tether in ST token.

ST token started with an internal 10 cent value. This is increased by $0.001 per every $100 million in tether dumped into the ST Liquidity Pool.

ST Liquidity Pool withdrawals are paid 90% in tether and 10% mandatory reinvestment.

Through its Liquidity Pools, SureX Exchange pitches an “expected” 300% passive annual ROI:

The MLM side of SureX Exchange pays on returns paid to recruited affiliate investors.

SureX Exchange Affiliate Ranks

There are five affiliate ranks within SureX Exchange’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- VIP 1- generate 50,000 USDT in downline investment

- VIP2 – generate 150,000 USDT in downline investment

- VIP3 – recruit three VIP2 or higher ranked affiliates

- VIP4 – recruit three VIP3 or higher ranked affiliates

- VIP5 – recruit three VIP4 or higher ranked affiliates

Residual Commissions

SureX Exchange pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

SureX Exchange caps payable unilevel team levels at ten.

Residual commissions are paid out as a percentage of passive returns paid to affiliates across these ten levels as follows:

- level 1 (personally recruited affiliates) – personally invest $100 to $900 and receive 10%, invest $1000 to $9900 and receive 20% or invest $10,000 or more and receive 50%

- levels 2 to 10 – 2%

Rank Achievement Bonus

SureX Exchange rewards ranked affiliates with a bonus on their residual commission rate:

- VIP1s receive a 2% bonus rate

- VIP2s receive a 4% bonus rate

- VIP3s receive a 6% bonus rate

- VIP4s receive an 8% bonus rate

- VIP5s receive a 10% bonus rate

Although not explicitly clarified, I believe these bonus rates only apply to returns paid to personally recruited affiliates.

Generation Bonus

SureX Exchange pays a Generation Bonus on up to five generations.

SureX Exchange defines a generation in a unilevel team leg when a VIP3 or higher ranked affiliate is found in the leg.

This affiliate caps off the first generation for that leg, with the second beginning immediately after.

If a second VIP3 or higher affiliate exists deeper in the leg, they cap off the second generation. The third generation for that leg then begins immediately under.

If no second VIP3 or higher affiliate exists deeper in the leg, the second generation for that leg runs the entire depth of the leg.

Note that generations are calculated independently in each unilevel team leg.

Using this generation structure, VIP3 and higher ranked SureX Exchange affiliates qualify for the Generation Bonus as follows:

- VIP3 ranked affiliates earn 2% on up to one generation per unilevel team leg

- VIP4 ranked affiliates earn 2% on the first generation, 1.5% on the second and 1% on the third

- VIP5 ranked affiliates earn 2% on the first generation, 1.5% on the second, 1% on the third and 0.5% on the fourth and fifth

As with the Rank Achievement Bonus, I believe these bonus rates only apply to returns paid to personally recruited affiliates.

President’s Club

SureX Exchange’s President’s Club is made up of the top 10 recruiters globally and top three recruiters in each country.

SureX Exchange sets aside 5% of company-wide invested cryptocurrency. This is used to fund the President’s Club, which pays out a “quarterly dividend”.

Travel, luxury car and luxury good bonuses are also referenced but no specifics are provided.

Joining SureX Exchange

SureX Exchange affiliate membership is free.

Full participation in the attached income opportunity requires investment in tether.

Note that while investment amounts are quoted in tether, SureX Exchange solicits investment in various cryptocurrencies.

SureX Exchange Conclusion

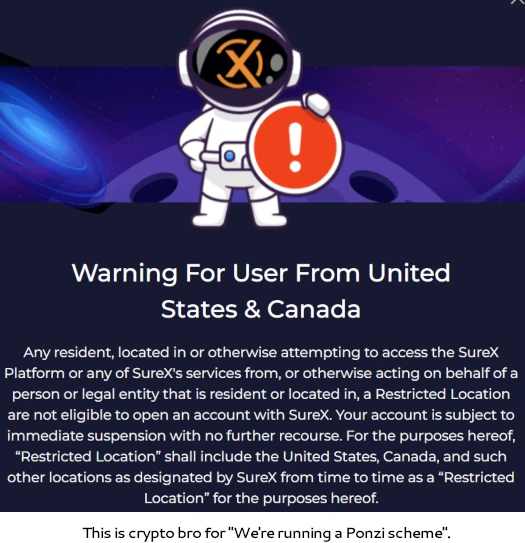

The first red flag SureX Exchange presents is through a visit to its website:

When an MLM company restricts the US and Canada, it practically confirms they are doing something illegal.

The reason MLM companies exclude the US and Canada is because they are the most active when it comes to securities regulation.

SureX Exchange’s business model, as presented, isn’t illegal in the US or Canada – provided the company registers with financial regulators and filed audited financial reports.

These reports are the only way to verify an MLM company is generated external revenue. And if they’re not available, that’s pretty much confirmation said MLM company isn’t doing what it claims to be.

Notwithstanding securities fraud is illegal the world over, not just in the US and Canada.

With respect to SureX Exchange, if it wasn’t obvious there is no external revenue. All that’s happening on the backend is newly invested funds are being recycled to pay earlier investor withdrawals.

Probably the weakest point of SureX Exchange’s charade is its Follow Trade Fund.

Of the 73 “traders” featured, not a single one of them is in the red.

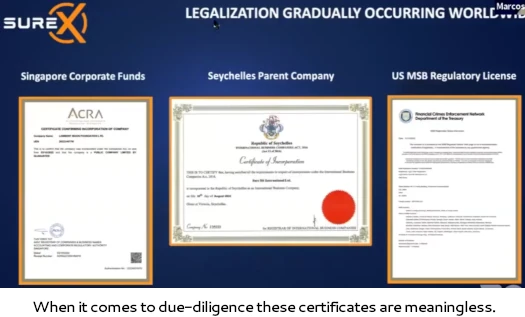

I should point out that instead of operating legally, SureX Exchange provides meaningless shell company and FINCEN cerfiticates.

These are not a substitute for registration with financial regulators. The FINCEN registration certificate is particularly amusing, given SureX Exchange is evidently terrified of the DOJ & SEC.

Jacky Zhou, who in SureX Exchange marketing is credited with “9 years trading experience” but in a marketing video claims he only got into trading during COVID-19 lockdowns, apparently sees himself as the next Changpeng Zhao.

Funnily enough, the SEC sued Zhao and his crypto exchange Binance earlier this month on a raft of civil fraud charges.

Although not confirmed, an indictment against Zhao is believed to be pending.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve SureX Exchange of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 12th November 2024 – Not sure exactly when it happened but SureX has collapsed.

As at the time of this update SureX’s original website domain redirects to “sure9.cc”, another domain which is currently for sale.

This is another platform the infamous Jan Gregory is promoting heavily on his social media.

I thought about mentioning Gregory but he’s not pretending to be an SureX Exchange executive this time around.

great article.

this is a scam company, the Zhou guy is a Malaysian Chinese who lost his job and joined this Co few years back. no experience in crypto.

they have 2 guys Naseer and Puvan act like ponzi recruiters and scammers one penang guy the other in KL. ask to invest and dissappear.

a lot of report on surex scamm and this guys and the so called cmo fakers.

officially dead SureX in Malaysia.

I’m guessing this happened a while back?

Made a note of SureX’s original website domain redirecting to another domain that’s marked for sale.