Rino Markets Review: AI forex trading bot investment fraud

Rino Markets fails to provide ownership or executive information on its website.

Rino Markets fails to provide ownership or executive information on its website.

Rino Markets’ website domain (“rinomarkets.com”), was privately registered on May 25th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Rino Markets’ Products

Rino Markets has no retailable products or services.

Promoters are only able to market Rino Markets promoter membership itself.

Rino Markets’ Compensation Plan

Rino Markets promoters invest an undisclosed amount of money on the promise of “8-22% monthly returns”.

Rino Markets hides specifics of its MLM compensation plan from the public but doe state it uses a “Binary MLM (Multi-Level Marketing) system”.

A binary compensation structure places a promoter at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of promoters. Note there is no limit to how deep a binary team can grow.

From Rino Markets’ website

You earn commissions from both personal trading profits and from building your network.

From the above, Rino Markets pays a ROI match through its binary compensation plan.

Joining Rino Markets

Rino Markets promoter membership appears to be free.

Costs associated with full participation in Rino Markets’ MLM opportunity are not disclosed.

Rino Markets Conclusion

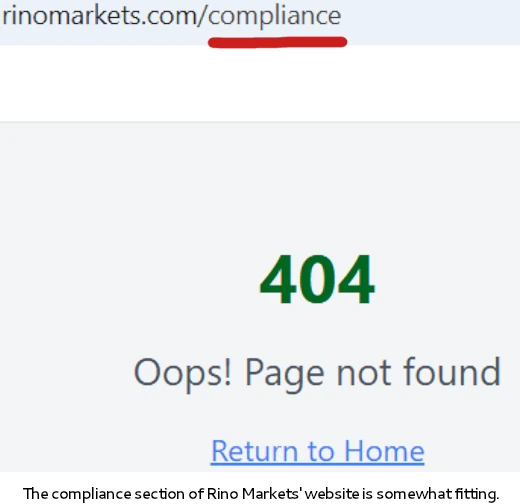

Rino Markets is a low-effort cash grab put together with automated AI web building services and an MLM backend from Indian developers.

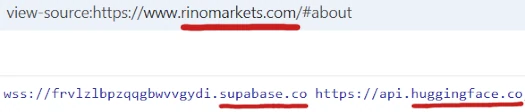

If we look at Rino Markets’ website source-code, we find references to SupaBase and HuggingFace:

Supabase ” allows developers to build secure, scalable applications without managing backend infrastructure.” HuggingFace pitches itself as “the most advanced platform to build AI with”.

Images on Rino Markets’ website also reveal ties to Lovable. Lovable claims it “turns your idea into a full web app in Minutes with our no‑code AI builder.”

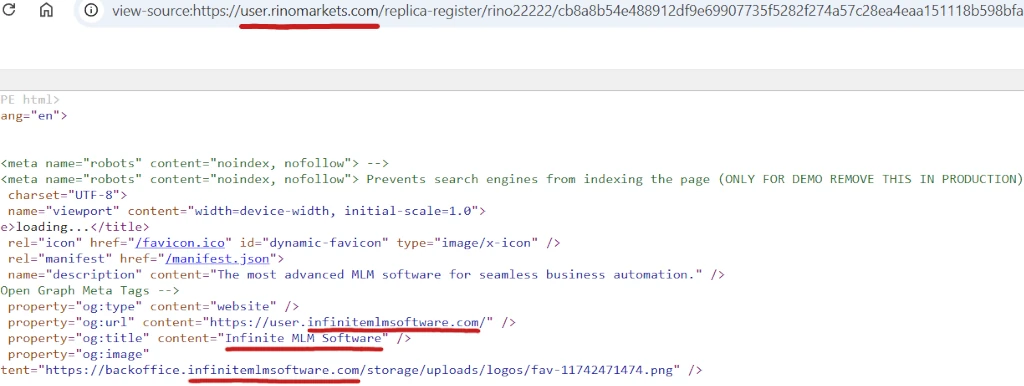

If we look at the source-code for Rino Markets’ backend, we find a reference to Infinite MLM Software (click to enlarge):

Infinite MLM Software is based out of India and pitches itself as “a digital system used to manage and automate the day-to-day operations of a multi-level marketing business.

Noting the heavy use of AI in Infinite MLM Software’s own social media marketing, it’s unclear whether Infinite MLM Software cobbled together Rino Markets’ website.

Either way, Rino Markets is illegally offering consumers access to an unregistered securities offering.

Rino Markets represents it generates external revenue via a typical AI trading bot ruse;

Experience superior trading performance through our revolutionary AI technology and comprehensive market analysis system.

No verifiable evidence of Rino Markets generating external revenue of any kind is provided.

Furthermore Rino Markets’ business model fails the Ponzi logic test. If Rino Markets actually had an AI trading bot legitimately generating 8% to 22% a month on a consistent basis, what does it need your money for?

On the regulatory front, Rino Markets’ passive returns investment scheme constitutes a securities offering in any country with a regulated financial market.

Rino Markets fails to provide evidence it has registered with financial regulators in any jurisdiction. This constitutes securities fraud.

As it stands, the only verifiable source of revenue entering Rino Markets is new investment. Using new investment to pay ROI withdrawals would make Rino Markets a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve Rino Markets of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

BAKO FAYSAL from the UK Was the owner. They scammed already. He was in PGI With RV Palafox

uk.linkedin.com/in/bako-faysal

George Hogland & Dane Koller from USA were BAKO’s partners.