Ranieri Assets Review: Generic fintech ruse Ponzi

Ranieri Assets fails to provide ownership or executive information on its website.

Ranieri Assets fails to provide ownership or executive information on its website.

Ranieri Assets’ website domain (“ranieriasset.com”), was first registered in 2015. The private domain registration was last updated on June 22nd, 2024.

Through the Wayback Machine we can see Ranieri Assets’ domain was for sale as of March 2022.

Ranieri Assets’ website as it appears today appears to have been uploaded in late 2023.

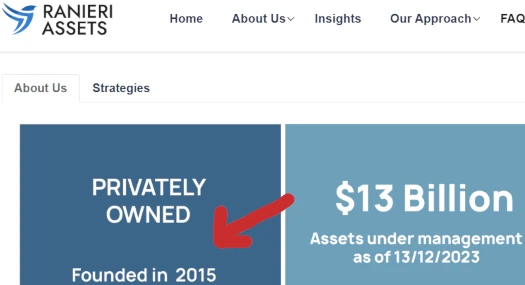

Despite existing for less than a year, on its website Ranieri Assets pretends it has been around since 2015.

Ranieri Assets provides two corporate addresses on its website, neither of which has anything to do with the company.

Ranieri’s provided Toronto, Canada address is owned by Davinci Virtual Office. Ranieri Assets’ Delaware address is random office space.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Ranieri Assets’ Products

Ranieri Assets has no retailable products or services.

Affiliates are only able to market Ranieri Assets affiliate membership itself.

Ranieri Assets’ Compensation Plan

Ranieri Assets affiliates invest $100 or $1500 minimums in cryptocurrency.

If $100 is invested withdrawals can’t be made for 9 months.

If $1500 is invested affiliates are able to make withdrawals on investments made for up to nine months.

Ranieri Assets hide ROI from consumers. Promoter marketing cites ROI rates of 21% to 42% a month.

Ranieri Assets pays referral commissions on invested cryptocurrency down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 12%

- level 2 – 6%

- level 3 – 3%

Joining Ranieri Assets

Ranieri Assets affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $100 investment.

Ranieri Assets solicits investment in various cryptocurrencies.

Ranieri Assets Conclusion

Ranieri Assets is your typical generic finance template Ponzi scheme.

In addition to lying about the foundation of the company, Ranieri Assets’ website presents itself as a generic finance themed template.

The site is populated with copious amounts of generic finance jargon, accompanied by a plethora of stock images.

The office building Ranieri Assets represents as its own is poorly photoshopped:

In Ranieri Assets’ website FAQ we find additional lies about investment insurance:

Does Ranieri assets insure the capital should unforeseen circumstances arise?

Yes, the capital is insured for 97.9%.

Which company is the insurance with?

Ranieri assets Insurance Board is owned by Ranieri but acts independently and also reports directly to the Delaware state department.

Ranieri Assets is insured… by itself. Riiiiiiiiiiiigh…..t.

Ranieri Assets’ claim about reporting to the Delaware State Department is also baloney. There is no such thing.

As a passive returns investment scheme, Ranieri Assets is required to register itself with financial regulators. Ranieri Assets fails to provide evidence it has registered with any financial regulators.

Thus, at a minimum, Ranieri Assets is committing securities fraud.

Ranieri Assets’ business model also fails the Ponzi logic test. As per the “founded lies” screenshot in the introduction of this review, Ranieri Assets also claims to be managing $13 billion in assets.

If Ranieri Assets was only playing around with half of its claimed managed assets, at 21% to 42% a month this still comes to $1.3 to $2.7 billion a month.

Why exactly does Ranieri Assets need your money again? And why are they wasting time soliciting $100 investments in cryptocurrency from randoms over the internet?

As it stands the only verifiable source of revenue entering Ranieri Assets is new investment.

Using new investment to pay ROI withdrawals would make Ranieri Assets a Ponzi scheme. Additionally with nothing marketed or sold to retail customers, the MLM side of Ranieri Assets operates as a pyramid scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Ranieri Assets of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.