PrivaFund Review: Bogus trading returns Ponzi scheme

PrivaFund operates in the cryptocurrency MLM niche.

PrivaFund operates in the cryptocurrency MLM niche.

The company provides executive information on its website, however it’s pretty wonky.

The only name I was able to establish a digital footprint for outside of PrivaFund was Maurice Malherbe, and that’s a YouTube channel with no content created in 2013.

Everything else pertaining to Malherbe appears to be linked to PrivaFund and created in 2021.

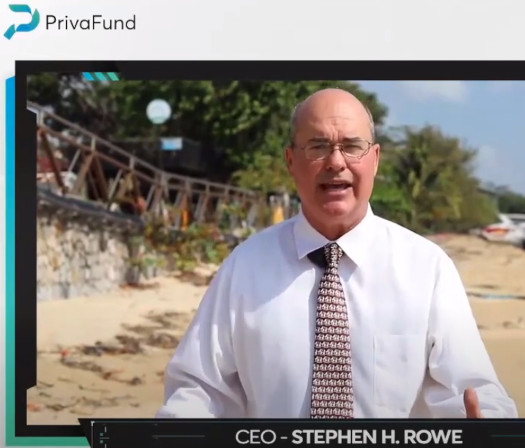

PrivaFund’s CEO “Stephen Hardy Rowe” has a lengthy backstory provided – none of it verifiable.

Video footage of Rowe strongly suggests he’s being played by an actor (seriously, who shoots a corporate video at a beach?).

Rowe (right) claims to be living in Thailand, which only strengthens the probability he’s an actor.

Rowe (right) claims to be living in Thailand, which only strengthens the probability he’s an actor.

In this video, you can clearly see the actor’s eyes darting between the camera and either a script or teleprompter placed just above the camera.

Other red flags include PrivaFund representing it has been around since 2019, and use of basic UK incorporation.

PrivaFund’s website domain was registered in December 2020. The company’s social media profiles were created in January 2021.

Conclusion: PrivaFund didn’t exist until a few months ago.

PrivaFund’s website is hosted in Germany. German is the default language provided for wire transfer instructions in PrivaFund’s backoffice:

Alexa currently ranks its top three sources of traffic to PrivaFund’s website as Australia (25.8%), Russia (18.7%) and the Ukraine (2%).

Not sure what’s going on in Australia but Russia appearing on that list is another red flag.

Finally in an attempt to appear legitimate, PrivaFund provides incorporation details for Privafonds Capital Management LTD. in the UK. Privaxchange OU is supposedly incorporated in Estonia.

PrivaFund’s UK incorporation looks bought off the shelf. The original incorporation for Future 101 is dated November 12th 2019, eleven months before PrivaFund existed.

After purchasing the incorporation, Stephen Harding Rowe was appointed sole Director with bogus filed details on December 14th.

Future 101 was renamed to Privafonds Capital Management on December 17th.

Both the UK and Estonia are scam-friendly jurisdictions, with Estonia being a particular favorite of crypto scammers.

Beyond acknowledging that basic incorporation is not a substitute for registering with financial regulators, UK and Estonia incorporation should be ignored for the purpose of due-diligence.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

PrivaFund’s Products

PrivaFund has no retailable products or services, with affiliates only able to market PrivaFund affiliate membership itself.

PrivaFund’s Compensation Plan

PrivaFund affiliates invest funds on the promise of a passive return.

PrivaFund do not specify investment amounts or audited financial reports detailing returns on their website.

PrivaFund Affiliate Ranks

There are eight affiliate ranks within PrivaFund’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Referendar – generate $5000 in downline investment

- Associate – generate $15,000 in downline investment

- Senior Associate – generate $50,000 in downline investment

- Counsel – generate $150,000 in downline investment

- Salary Partner – generate $350,000 in downline investment

- Partner – generate $500,000 in downline investment

- Executive Partner – generate $1,000,000 in downline investment

- Directing Partner – generate $3,000,000 in downline investment

ROI Commissions

PrivaFund pays ROI commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

PrivaFund caps payable unilevel team levels at eight.

ROI commissions are paid out as a percentage of returns paid to unilevel affiliates across these eight levels as follows:

- level 1 – 30%

- levels 2 and 3 – 15%

- levels 4 and 5 – 10%

- levels 6 to 8 – 5%

Company Pool Share Bonus

PrivaFund sets aside 5% of invested funds for the Company Pool Share Bonus.

The Company Pool Share Bonus is distributed to affiliates based on rank, split into eight smaller corresponding pools:

- Referedars receive a share in a 3% Company Pool Share Bonus pool

- Associates receive a share in a 5% Company Pool Share Bonus pool

- Senior Associates receive a share in an 8% Company Pool Share Bonus pool

- Counsels receive a share in an 11% Company Pool Share Bonus pool

- Salary Partners receive a share in a 14% Company Pool Share Bonus pool

- Partners receive a share in a 17% Company Pool Share Bonus pool

- Executive Partners receive a share in a 20% Company Pool Share Bonus pool

- Directing Partners receive a share in a 22% Company Pool Share Bonus pool

Rank Achievement Bonus

PrivaFund rewards affiliates for qualifying at the Referendar and higher ranks with the following one-time bonuses:

- qualify at Referendar (Portuguese?) and receive $100

- qualify at Associate and receive $1000

- qualify at Senior Associate and receive $5000

- qualify at Counsel and receive $10,000

- qualify at Salary Partner and receive $30,000

- qualify at Partner and receive $50,000

- qualify at Executive Partner and receive $80,000

- qualify at Directing Partner and receive $200,000

Joining PrivaFund

PrivaFund affiliate membership appears to be free. Any minimum investment requirements are not disclosed.

Conclusion

Dodgy executive profiles, UK incorporation, Russians… PrivaFund has the typical hallmarks of an MLM crypto Ponzi.

Even if we ignore all of that though (and you absolutely shouldn’t), PrivaFund fails the legitimacy test on account of it committing securities fraud.

PrivaFund represents it generates external revenue off the backs of anonymous traders.

New traders receive a basic funding for their trading API and are ranked with the algorithm. After the ranking more funds are distributed depending on performance.

Fully automated, smart fund distribution and over 50 traders are delivering the best profit average and optimal risk diversification for your portfolio.

Despite offering a passive investment opportunity, PrivaFund isn’t registered to offer securities in any jurisdiction.

When you operate legally, there’s no need for actor executives and basic incorporation in dodgy jurisdictions filed with bogus information.

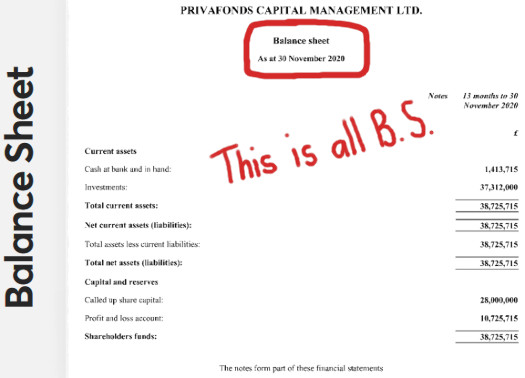

A great example of this is the bullshit “balance sheet” PrivaFund provides in their marketing material.

This is from their UK incorporation, which we’ve previously established is meaningless.

Take note of the 30th November 2020 filed date. This is before Future 101 was renamed PrivaFonds Capital Management LTD., so the entire filing is bogus.

Not that UK authorities care, they don’t verify any information submitted to them through Companies House.

The only reason MLM companies commit securities fraud is because they’re running Ponzi schemes.

In the absence of any verifiable external revenue, this is the case with PrivaFund.

As with all MLM Ponzi schemes, when affiliate recruitment dries up so too will new investment.

This will see PrivaFund unable to pay withdrawal requests, eventually leading to a collapse.

This appears to already be happening, following a recent “MXM” announcement on April 2nd.

Billed as a “new opportunity”, details aren’t provided but it sounds like a new way to milk existing PrivaFund investors for even more money.

Update 5th October 2021 – The YouTube video the first screenshot in this review was taken from has been marked private.

I did have the video linked but as a result have subsequently removed the link.

Update 22nd November 2023 – Austrian authorities have announced an investigation into suspected links between PrivaFund and EXW Wallet.

Who makes a corporate video on a beach? Beautiful Naiharn beach?

Well, someone who has lived on the tropical island of Phuket for 15 years, and wants everybody to know it.

Why no social media footprint ? Well, I do not have a network. Never had a network. The position is strategy, administration, motivation, and guidance.

Never had twitter, did not really use Facebook. Did not need to.

I can list the 15 real estate companies and resorts I have worked for in my 30 year career. Otherwise, be careful what you think you are saying.

Thank you

Hi “Stephen Rowe”, commenting from a US IP address in Washington. You could have at least used a VPN to stay in character.

So we have someone pretending to be someone pretending to be the CEO of a run of the mill MLM crypto Ponzi scheme. Nice.

Your manufactured Boris CEO backstory is meaningless.

Maybe you can come up with some bullshit excuse as to why PrivaFund is committing securities fraud? Thanks.

Im going to get my popcorn.

The scammers didn’t even bother to get those bullshit Estonian licenses for Privaxchange OÜ:

(teatmik.ee/en/personlegal/14409336-PrivaXchange-O%C3%9C)

As you can see, PrivaFund “AML & KYC Director” Martin Laur has another crypto investment scam called “2local.io”.

One of the videos featuring Rowe has been marked private.

Looks like PrivaFund’s collapse might be near.