Prepaid Legal Review: Legal insurance that sells itself?

The world over, the US is known as being the penultimate litigious society. It doesn’t matter how ridiculous or insignificant you think your claim is, if you can find a lawyer you have yourself a lawsuit.

The world over, the US is known as being the penultimate litigious society. It doesn’t matter how ridiculous or insignificant you think your claim is, if you can find a lawyer you have yourself a lawsuit.

Without a lawyer though, you’re not getting anywhere.

Meanwhile, on the other side of the fence, with people all over the country running around filing lawsuits like they’re candy – it’s not all that uncommon these days to find yourself, or your business on the receiving end of a lawsuit.

Frivolous or not, you’re still going to need representation or at the very least, some well-informed (and often costly enough on its own) legal advice.

Aiming to provide Americans with legal advice and make some money on the side with a MLM compensation plan is MLM company PrePaid Legal.

Read on for a full review of the PrePaid Legal business opportunity.

The Company

Way back in 1969 by Harland Stonecipher (yes, that’s apparently a real name) was in a car accident.

Frustrated at the lack of legal insurance options available at the time, Stonecipher (photo right) started up ‘The Sportsman’s Motor Club’ in 1972 offering members ‘legal expense reimbursement services‘.

The Sportsman’s Motor Club continued on for 11 years relying on a traditional sales model before adopting a MLM style business model and compensation plan in 1983. PrePaid Legal was born.

Twenty eight years later PrePaid Legal is still running as a MLM company offering prepaid Legal services in 48 US states with the company claiming to have 1.5 million customers and associates nation wide.

PrePaid Legal Products

As the name suggests, PrePaid Legal offers its clients access to various prepaid Legal cover plans.

These plans range from personal to family plans, business plans and even occupational specific plans (eg. commercial drivers).

Each plan covers specific things with a legal representative from paperwork reviews to court time, legal advice, IRS Audit support, court representation, will services and limited motor vehicle legal services.

PrePaid Legal’s plans (including identity theft protection at an additional charge) are only available in the US and due to complexities of laws varying from state to state, might not offer all services in all states. This needs to be checked up on depending on where you live.

PrePaid Legal’s plan sets you back around $26 a month but is slightly cheaper in some states.

There is also business plans available covering legal services that are more business orientated, ranging from about 75$-$125 a month (depending on your business size).

Again, for a more specific overview, you’ll need to check with PrePaid Legal to find out exactly what legal services are available in your state and for what price.

PrePaid Legal Membership Ranks

Within the PrePaid Legal compensation plan are 6 membership ranks starting off at Junior Associate.

Moving up, the other five PrePaid Legal membership options are as follows

Associate – There are two ways to qualify as an Associate, one is what is called a Fast Start Qualify and the other is not time limited.

To Fast Start Qualify, a Junior Associate must make 3 retail sales and either recruit 1 new Junior Associate to the business or make an additional 5 retail sales within 30 days of joining the company.

The other way to qualify as an Associate is to simply make 25 retail sales.

Senior Associate – 3 of your unilevel organisation legs must have an Associate in them, or you can make 50 retail sales.

Manager – 3 of your unilevel organisation legs must have a Senior Associate in them, or you can make 100 retail sales.

Director – 3 of your unilevel organisation legs must have a Manager in them.

Executive Director – 3 of your unilevel organisation legs must have a Director in them and you must have at least 75 retail sales (a maximum of 25 can come from any one leg).

The PrePaid Legal Compensation Plan

The PrePaid Legal compensation plan offers retail commissions upfront with a residual backend that pays you out a percentage of the membership fees paid monthly by those you sign up.

Additionally there’s also a generational residual commission paid out too.

Retail Commissions

Retail commissions in PrePaid Legal are a little odd in that they’re paid upfront as a yearly commission, on the assumption of course that your customer will maintain their PrePaid Legal membership for a year.

Retail commissions are paid out according to your membership rank and are as follows;

- Junior Associate – $50 (only $25 of your first five sales are paid in advance)

- Associate – $75

- Senior Associate – $100

- Manager – $125

- Director $150

- Executive Director $182.50

Cumulative Override Bonus

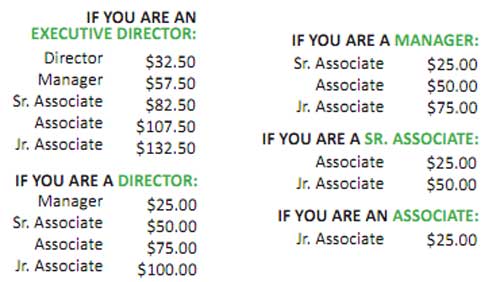

The Cumulative Override Bonus pays up to two generations deep and is paid out to the first member in your upline who is at a higher rank then you, each time you recruit someone.

For example, if you are a Director and you recruited a new Junior Associate, the system would look to your upline for the first available senior ranked member. You would earn an override for bringing in a new Junior Associate and your upline would receive an Override Bonus too.

These bonuses are paid out on the same chart as follows;

To work out what your bonus is (or your uplines bonus), simply go to the relevant section of your rank and then either ‘Junior Associate’ if you are recruiting, or the membership rank of the member who recruited if you are the upline.

Using the previous example, being a Director you would earn a $100 override for bringing in a new Junior Associate.

Lets say your next ranked upline was an Executive Director, looking at the chart they’d also make a $32.50 commission (The $32.50 comes from the Executive Director section on the ‘Director’ line).

Note that at the Executive Director level it is possible to extend your membership rank by increasing the number of legs in your unilevel organisation that have Executive Directors in them.

There are 10 additional levels (‘Bronze Executive Director’ up to ‘Platinum 7 Executive Director’) and as you advance each level your Cumulative Override Bonus shrinks but your Retail Commission grows.

At the Executive Director Level, you earn $182.50 as an upfront retail commission and $32.50 in Cumulative Overrides.

At the Platinum 7 Executive Level (the highest) this is then $203.50 in upfront retail commissions and 50 cents in Cumulative Overrides.

Comparing these numbers does equal a negative $11 difference but this made up for by increasing the payout frequency of the Cumulative Override commission.

Instead of being paid out just once as an Executive Director, as you advance past this level you are paid out an additional Cumulative Override for each active Associate between you and the Associate making the sale.

The idea here is that by the time you advance beyond Executive Director, your unilevel organisation will be quite large and the additional Cumulative Overrides will make up the difference lost in the reduction of the payout itself.

Breakaway Bonus

The Breakaway Bonus is a commission paid out to Directors and Executive Directors up to seven generations deep.

Where’s a typical commission pays out on the downline, the Breakaway Bonus pays out following the upline.

Starting at the point of sale, a Breakaway point is the first Director or Executive Director found in the upline. The second Breakaway point is the next Director of Executive Director found working up, the third and forth follow on in the same manner until a total of seven qualified Directors or eight Executive Directors are found.

Each of these Breakaway points has a separate corresponding payout value, and they are as follows (Director/Executive Director payout);

- Breakaway 1 (the first upline Director or Executive Director found from the member who makes a sale) – $25/$32.50

- Breakaway 2 – $6/$10

- Breakaway 3 – $5/5$

- Breakaway 4 – $4/$3

- Breakaway 5 – $3/$1

- Breakaway 6 – $2/$1

- Breakaway 7 – $1/50c

- Breakaway 8 (Executive Director payout only) – 50c

Platinum Breakaway Bonus

The Platinum Breakaway Bonus operates in the same manner as the regular Breakaway Bonus, but pays out an additional $1 on 3 Breakaway points following the upline from the point of sale.

Note that the Platinum Breakaway Bonus is only available to Platinum Executive Directors and above.

2nd Year Membership Commissions

Note that the above commissions are only valid for the first year of membership of either Associates or retail customers you bring to PrePaid Legal.

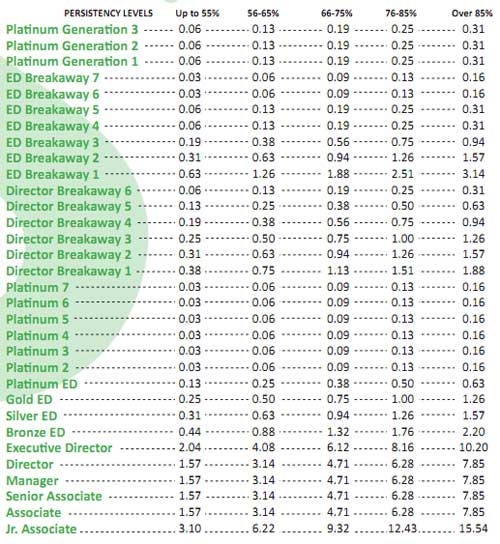

After the first year the same commissions as above are available to you, however the payout rates are determined by what PrePaid Legal call your ‘Persistency Level’

Simply put, your Persistance Level, is a percentage number of the amount of customers you bring into PrePaid Legal who stick with the company for over 12 months.

For example, if out of your first 10 people you either recruited as Associates or sold PrePaid Legal to as retail customers 5 of them continued to pay their membership years beyond their first year, you would have a Persistency Level of 50%.

This would then go up or down accordingly as each 12 month period came up for review on customers or Associates you’d brought to PrePaid Legal.

The more people you have paying membership beyond their first twelve months, the higher your Persistency Level will be.

As an associate yourself, your commission on these members is paid out as follows (depending on your persistency level);

Note that in the above chart, the ‘Platinum Generation’ bonus is the ‘Platinum Breakaway Bonus’ I refer to above in my compensation plan explanation.

$17 Legal Plan Note: The above information is relevant to PrePaid Legal’s $26 legal plan coverage. Additionally PrePaid Legal offers another $17 legal plan which comes with its own compensation plan figures.

The components of the $17 legal plan compensation plan are the same so they can be applied as is to the $17 compensation plan. Note however that the commissions figures are different.

Joining PrePaid Legal

Those wishing to join PrePaid Legal as a Junior Associate are looking at a one time fee of $249.

Conclusion

The biggest challenge I see with the PrePaid Legal business opportunity is the unpredictable nature of legal matters, and uncertainty of covering costs that you might be hit with in the process of engaging said matters.

PrePaid Legal comes across as being sold as something you might need should legal action come your way, or you find yourself in a position to launch it yourself. Kind of the same way medical insurance is sold (‘you probably won’t need it, but just incase…’).

The problem then is that looking at the legal services PrePaid Legal offers, it seems most of them are procedural (capped by the hour, or a certain amount of forms, telephone calls etc.)

You’re being sold car insurance, but in reality only being given roadside assistance. Enough to get you home… but after that (unless you pay extra), you’re on your own.

As such, I get the impression that selling PrePaid Legal to people mightn’t be as easy as it sounds. Surely someone fed up with paying ongoing legal bills would they themselves search for a cheaper alternative?

And if you’re there at the right time… then sure, you might get the sale but far more realistically, like any insurance, you’re going to be attempting to convince your lead they need your service.

Unlike health insurance however, where you know your health is going to fail sooner or later, legal services are definitely a gamble for most people.

And for those it isn’t, those that for one reason or another find themselves in the legal arena consistently, surely they’d be better off retaining the services of a personal lawyer than relying on PrePaid Legal’s mostly casual offerings?

And that’s not a criticism of the company, I mean for $26 or so a month it actually doesn’t sound too bad. What you’re essentially counting on however is the cost of the limited service you’re going to get coming in at less than the cost of specialised legal service to handle a matter as it arises.

When weighing up the cost of PrePaid Legal over the years this could be way over, taking into account of course the ongoing costs after you’ve exhausted your limited PrePaid Legal coverage.

Get over that marketing minefield however and you might just be able to build yourself a profitable home based business.

Compensation plan I don’t see any major problems other than the peculiarity of paying out members an initial upfront yearly commission.

This in itself isn’t so bad but it’s hedged against the risk of the customer (or Associate) cancelling their membership before the 12 month period you’re being paid an advanced commission on.

No doubt from the company’s viewpoint this acts as a strong incentive to keep people paying memberships (hell, they even publicly grade you on this!), but from an Associate’s perspective, the ever looming chargebacks spell potential disaster.

You’re obviously going to spend some of the commissions you earn with PrePaid Legal and if you’re using them to live on, pay bills, send your kids to school or whatever, what happens when people quit and the company demands its money back?

You’ve already spent it so what do you do?

Answer: You go into debt if you can’t cover your losses and then find yourself playing the dangerous game of relying on the PrePaid Legal to get you out of debt… taking the even bigger gamble more people won’t end their subscriptions along the way and drive you even further into debt with commission repayments.

Not a nice situation to be in, but a very real danger with the way the PrePaid Legal compensation plan retail commissions are set up.

That major worry aside, the only thing I think that needs to be mentioned is that while there are recruitment requirements built into the upper end (you can’t become a Director without having recruited 3 Associates) of the compensation plan, they aren’t mandatory (Director level excluded) and there’s plenty of retail commission options.

Additionally to advance beyond the Director level, retail sales are actually tied into the promotion too – meaning you have to sell PrePaid Legal’s service if you want to advance.

Marketing PrePaid Legal isn’t without its challenges but with the right mindset and extensive company history, they’re obviously doing something right.

So long as you pre-plan for commission chargebacks and are aware of the marketing challenges you face (educate yourself thoroughly on the limitations of PrePaid Legal’s provided services), you should have a pretty decent crack with the business.

Good luck!

Prepaid Legal was in a ton of legal trouble, sued by members in early 2000’s in various states.

http://www.forbes.com/forbes/2002/0708/050.html

It is also in heavy competition with the non-MLM legal insurance companies:

http://www.aplsi.org/legal/legal_service_new.cfm

They are heavily lambasted in Canada

http://www.canlaw.com/caveat/prepaidlegal.htm

And finally, some shady stock deals by the stockholders… and other red flags:

http://www.sequenceinc.com/fraudfiles/2009/02/pre-paid-legal-services-inc/

Wow, under the sheets sounds like a bit of a mess!

@Oz — yeah, the part about company doing stock buyback while the owners sell their shares looks pretty darn shady.

It really *could* be said that the company is using membership revenue to buy back stock to drive up the prices to stockholders can cash out at a profit. It’s legal thus far, but it’s shady as heck.

I went to a “presentation” on this “opportunity” about a year ago. A few red flags I witnessed;

1) They were all about joining so you could sell- sure, they mentioned the joy of having a lawyer “on call” and being that lawyers “biggest client” (the distinction between an individual biggest client and being part of a group that’s the biggest client doesn’t exist for pre-paid legal), but when they tried the hard sell, it was all about getting into the “opportunity”.

2) The starring speaker for the night said, at one point “Pre-paid legal has such confidence in their stock, they’ve been buying a lot of it themselves for a few years!” A company buying lots of it’s own stock is not a sign of confidence.

3) After the hard sell was finished, I asked for a copy of the contract I’d be signing. The guy went away and came back with a brochure. I left. They were having people sign the contract at a table in the back of the room, and they weren’t exactly encouraging them to read it, if you know what I mean.

The whole thing was highly energized- they really tried to get people worked up, and to disconnect from the rational part of their brains. I was especially turned off because I went as a potential customer of the “services”, not realizing that they really aren’t separate from the “opportunity”.

I’d recommend finding a good attorney and giving him a retainer before doing this- at least you could fire the attorney and request your retainer back, if necessary.

Thanks for sharing that Grover, sounds like one of those corny meetings you see in movies from the 80s!

Unbelievable, I just went to one of those ”meetings” and am currently deciding if this is something that I should get into. The money is great but what about the backend of things?

@Him

How can you say the money is great without having joined and worked the business? I hope they didn’t guarantee you an income…?

Let me give you some perspective as PPL member since 2000. Sold it for a few years starting in 2004 because I had used it a number of times, it worked and it had saved me money.

Sold it mostly to small business owners who already use attorneys and saw it as a saving them money and in group benefits where employees say it as benefit for estate work, teenagers getting in trouble, tickets, tax advice and the like.

Not actively selling it now because involved in some other business ventures that enjoy doing more, but still getting several hundred dollars a month in residuals from active members. I still call my provider law firm for issues personal or business today.

All those suits were dismissed or settled. Most of it amounted to sales people over-promising when they knew better or members who joined not listening or not reading the contract and expecting to get the same kind of service a wealthy client does with a law firm on a million dollar retainer.

Seriously, your joking right ? Have you actually tried to get an individual family plan from those competitors.

Some are ONLY available as employee benefits of large companies (Metlife requires the company to have more than 500 employees and ARAG requires a group to have more than 5,000 employee to be eligible to offer the legal plan) and they lock you in for a year.

Others require you belong to a particular union. Others are only available in certain states or regions. Generally, the prices are in the same price range. None offer small business legal plans.

The national ones on that list don’t have same quality control system and are soliciting online all the time for attorneys to join them and take a discount.

Really? what a joke… This is a competitor site that only exists to generate leads for lawyers. Referral sites like this will say just about anything to get impressionable potential customers to take the action they want them to.

Like any company, PPL gets legitimate criticism, but this site you refer to is not without controversy with it’s questionable sources, biased opinions is definitely not it.

Apparently it was an attractive enough company to be bought out for 2/3 of a billion in 2011. Services are the same but the management and name have changed. How that will work out is anyone’s guess.

Will continues to use the attorney’s as long as it’s around because it does offer value.

I think you missed the point of the service completely. People who have medical problems often don’t get care because they don’t have insurance. In a similar light, those who do not have access to lawyers typically lose legal battles, whether it’s with a landlord, a local business, a car accident, speeding ticket, employer taking advantage of them, or whatever.

With a Legal Service Plan, one can have access to a lawyer to get a consult in any legal matter. Every one of those items above are issues that I have personally experienced or helped someone with through via their Legal Shield (formerly Pre Paid Legal) plan.

Not to mention, the percentage of people who do not have a Last Will. It’s also included in the plan at no additional cost for the primary member ($20 for a spouse). That alone is worth the cost of the plan because they even update your Will every year, as circumstances change and dictate that you should review it at least annually.

As far as the strength of the company, they went from being a solid publicly traded company to being purchased by a private equity firm. They are solid and I am both a happy customer and an Associate who gets joy out of helping to protect families and businesses.

I think you might be overselling the “access to a lawyer” thing just a bit. If you’re engaging in a “legal battle” I think you’ll find yourself maxing out your plan coverage pretty quick.

And drawing comparisons between medical and legal problems is a bit rich. Like the probability of an individual getting into a legal battle and requiring medical assistance are even remotely comparable… please.

If you get sued….how many hours of an attorneys time can YOU buy at around $175 an hour?

I have over 260 banked hours that if I am sued in civil court or named as a respondent that I can use every year… God forbid.

I have had the legal services plan since 1999. In that time I have gone months or maybe even years without needing them. I am a landlord with 65 rental properties. I ran into a tenant that…. without the council of my PPL attorney, I don’t know what I would have done.

I spent over 6 hours on the phone….over a period of about 2 weeks….with the attorney. factor in the cost per hour of the avg attorney in NC ($175) and I saved hundreds of dollars….and had peace of mind knowing I was doing the correct things.

I also purchased a mobile home park and the seller could not produce titles as stated in the contract….the advice of my PPL attorney saved me over 100K on the price….my cost for the advice…$0…other than my membership fee.

I keep the membership, and now that my sons are over the age that they can be on mine, they have their own also….why? 1 reason…if you get into an automobile accident and someone is killed…even a passenger in your car…and you are charged with manslaughter, negligent homicide, or vehicular homicide….your auto insurance WILL NOT COVER YOUR ATTORNEY FEES.

Those are all criminal charges, and NO auto ins co. covers them… but PPL does, you will be represented by the best they have in court… a manslaughter charge here in NC starts at around a 10k retainer to defend against with a private attorney.

You can pay $300 an hour for a great attorney in your town (state) who can probably only practice 1 type of law 9 to 5 mon- fri….or you can pay $300 a year for 24 hr a day 365 access for emergencies to a network of attorneys nationwide that cover any area of the law you can think of.

Yes I do market the membership….no that NOT not why I am commenting….yes there have been some awful people connected with selling this and they lied to people…just to make a sale.

As an MLM I personally do not like a stair step breakaway pay plan…..but you can truly go out and sell just by yourself and make $500 a month without a Herculean effort. $500 a month would stop a lot of bankruptcy filings.

Yes you will get some chargebacks….no it will not kill your business…no business keeps 100% of their customers….not one, sell some more memberships.

Anyone can do their due diligence on this company…they are an open book…

I am at the Director status with them and the rank is for life…as long as I have a membership in place…or market a few here and there….

If I want to sell a plan and make a couple of hundred bucks…I do just that…15 minutes tops….write good business and it will stay on the books….market it to people who would rather spend the $26 on beer and cigs, and they will cancel in 3 months, just about guaranteed.

Sorry to run on but the bottom line is…they are a good company….they survived short seller attacks… Harland sold the company for around $650,000,000.00. The new owners do not play….do the business correctly or go elsewhere. It is now Legal Shield.

I enjoy your website and always check to see what scams are on your radar, you are almost always spot on..if more people would just use the common sense that they were born with they could see through the B.S. most of these folks are slinging. Keep up the good work!

Glad to hear it’s working out for you then Graham.

Just one question, “banked hours” = unused hours that have rolled over annually?

I love this company! They never touch your earned status.Ive been DIRECTOR since 1985 and I’ve seen other ML companies make many changes to their agents status over time, wrongfully.

I have used them in my REAL ESTATE BUSINESS many many times over the years. You can trust this Company. 38 years and counting.