Pool Funding Review: PFB token Ponzi scheme

Pool Funding fails to provide ownership or executive information on its website.

Pool Funding fails to provide ownership or executive information on its website.

Pool Funding’s website domain (“poolfunding.io”), was privately registered on September 11th, 2023.

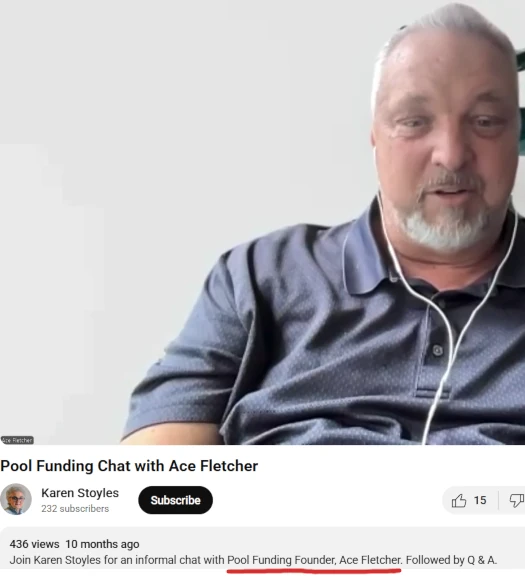

Update 26th July 2025 – As per a few reader comments below, marketing videos cite “Ace Fletcher” as Pool Funding’s founder.

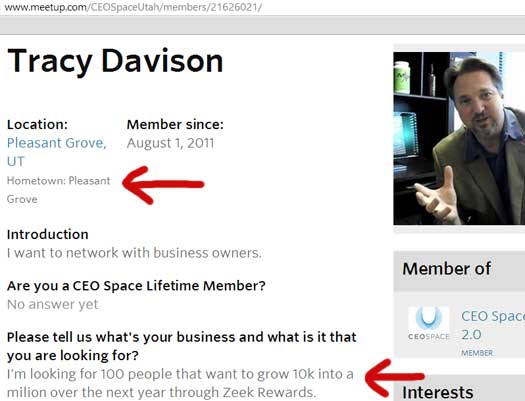

Ace Fletcher doesn’t exist. The man playing Fletcher is serial MLM Ponzi fraudster Tracy Davison.

Davison first appeared on BehindMLM’s radar back in 2024, as a top promoter of the Zeek Rewards Ponzi scheme.

As part of SEC proceedings against Zeek Rewards, Final Judgment was granted against Davison for $1.1 million in August 2017.

Davison, a then US resident, fled to the Philippines after Zeek Rewards collapsed. There Davison continued to defraud consumers through Penny Matrix and 60 Second Millionaire.

Pool Funding marks Davison’s first known transition to MLM crypto fraud. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Pool Funding’s Products

Pool Funding has no retailable products or services.

Affiliates are only able to market Pool Funding affiliate membership itself.

Pool Funding’s Compensation Plan

Pool Funding affiliates invest tether (USDT) into four pools; 1 USDT, 10 USDT, 100 USDT and 1000 USDT.

This is done on the promise of an undisclosed daily passive return.

While specific ROI rates aren’t disclosed, Pool Funding’s website states investors can “qualify” to “pull $30,000 a month out of our Pool of Funds”. This equates to $1000 a day in a 30-day calendar month.

While no commissions are paid on recruitment of Pool Funding affiliates, each affiliate must recruit two new affiliate investors to qualify for daily ROI payouts.

As I understand it this applies to each of Pool Funding’s four pools. Whether there are deeper recruitment requirements hidden is unclear.

Joining Pool Funding

Pool Funding affiliate membership is free.

Full participation in the attached income opportunity requires a 1111 USDT investment.

Pool Funding Conclusion

Pool Funding pitches itself as…

an innovative closed-loop financial system that harnesses the velocity of money, cycling resources within a 24-hour period

…which is fancy way of saying it’s a Ponzi scheme.

Pool Funding’s Ponzi scheme is simple in nature. New affiliates sign up, invest tether and that tether is stolen by the Pool Funding admin and earlier investors.

Recruitment requirements are in place, as without a constant stream of new suckers signing up to lose money, Pool Funding collapses.

It should be noted that Pool Funding runs its Ponzi scheme in PFB token. PFB is of course worthless outside of Pool Funding.

Whoever is running Pool Funding can turn off USDT withdrawals without notice. When this inevitably happens, the majority of Pool Funding affiliates will be left bagholding yet another worthless Ponzi shit token.

hey pal,

too bad you don’t know what you are talking about. the founder is on every night to show you any and all proof you need.

I receive usdt every day and deposit in my bank each week!

if its a scam its a poorly thought out one. i started with $200 to fund my account, the rest has been my income. over $1600 and counting in the $10 pool.

i send my $10 directly to the blockchain then to my sponsor! no central controller like a ponzi.

the pfb is used to pull money from the market and share it with the members. not investing in his crypto.

go to the founder before spewing lies!

1. The review states Pool Funding hides ownership and executive information on its website, which is true. What happens in shady private groups is irrelevant.

2. Feel free to pass on “proof” Pool Funding has registered with financial regulators and filed audited financial reports, proving it isn’t committing securities fraud.

Whether you got in early and started stealing money is irrelevant to Pool Funding being a Ponzi scheme in which the majority of people you’re stealing from will lose money.

A Ponzi scheme is such by way of new investment being used to pay existing investors. How that is set up is irrelevant.

SimilarWeb shows Pool Funding was dead until recruitment picked up in the US last month. I take it you’re part of that new recruitment drive.

Sorry for your loss.

This Admin should be ashamed for stating unfounded lies about businesses they haven’t properly investigated.

Pool Funding is decentralized, that by itself makes it impossible to be Ponzi.

There is no central pot funds to be able to manipulate payout, so not a Ponzi.

All monies are sent from member to member in secure wallets, again no way a Ponzi, the owner can’t take funds from anyone.

There’s plenty more reasons, but these reasons alone are enough to hopefully this Admin to make a retraction.

Smarten up and do your research first.

Alan

^^ A Ponzi scheme is such because it pays ROI withdrawals with subsequently invested funds.

Whether a Ponzi scheme is decentralized or not (decentralized Ponzi schemes don’t set themselves up), is irrelevant.

It’s always the dumbasses running around telling everyone else to “smarten up”.

This protocol has paid out more than it has taken in… Wouldn’t that deem it, not a ponzi?

The $PFB token price is over 180k.

This protocol has helped thousands already and is just getting started.

Lil bro thinks his pRoToCoL Ponzi can beat math. Guessing you just got recruited.

Pool Funding website is so low SimilarWeb doesn’t track it anymore. PFB might as well be $1 bajillion if there’s no new money to steal.

Those bags be heavy yo. Sorry for your loss.

Very interesting style of communication. I haven’t lost anything with Pool Funding… and holding/selling the token has made my bag very heavy, you’re right about one thing on this thread.

Less than a few hundred website visits a month. Lil bro is standing alone in a bar with the house lights on. Everyone else has gone home to fuck.

The saddest bagholder is the bagholder of a dead Ponzi in denial. Sorry for your loss.

Terrible analogy… The site requires daily activity. Your website activity trackers are off, to say the least. (Ozedit: alternative reality fantasies removed)

…so close.

Anyway, this isn’t the place to shill for greater fools. G’bye and again, sorry for your loss.

I do enjoy it when dumbasses insist their Ponzi Scheme is not a Ponzi Scheme. Then are shocked when the inevitable collapse happens.

This is the minute I knew something was wrong with this program. personal account $30 a day the two recruits at $30 a day (30×2=$60).

Total payout daily = $60. Add two more recruits daily payout = $90. Total money taken in = $150 daily with total paid out at that point $90 daily.

Ace puts $60 in (PBF) which is his pocket. It just multiplies from here with Ace keeping 40% of the money circulating.

This is a hybrid version adding a crypto coin to the Ponzi known as Gifting.

Token value is tanking and is showing the beginning of the draining of liquidity of 100k by Ace and very soon the pool funding will stop paying.

I’m surprised you guys haven’t figured out who Bitcoin Ace really is:

https://behindmlm.com/companies/60-second-millionaire-review-ex-zeek-pimp-flees-to-philippines/

Hey Rick,

What is your proof that this is the same guy?

I know someone involved in poolfunding.io and would like to be able to warn him, if indeed it is a scam. Certainly seems suspicious to me.

Poolfunding founder Ace Fletcher. Real name, Tracy Davison. Any poolfunding guys in here, Google him, does he look familiar?? A big fish in a zeek rewards Ponzi.

Review updated to note Tracy Davison is running Pool Funding as “Ace Fletcher”.