Nimble Finance Review: Generic fintech ruse Ponzi

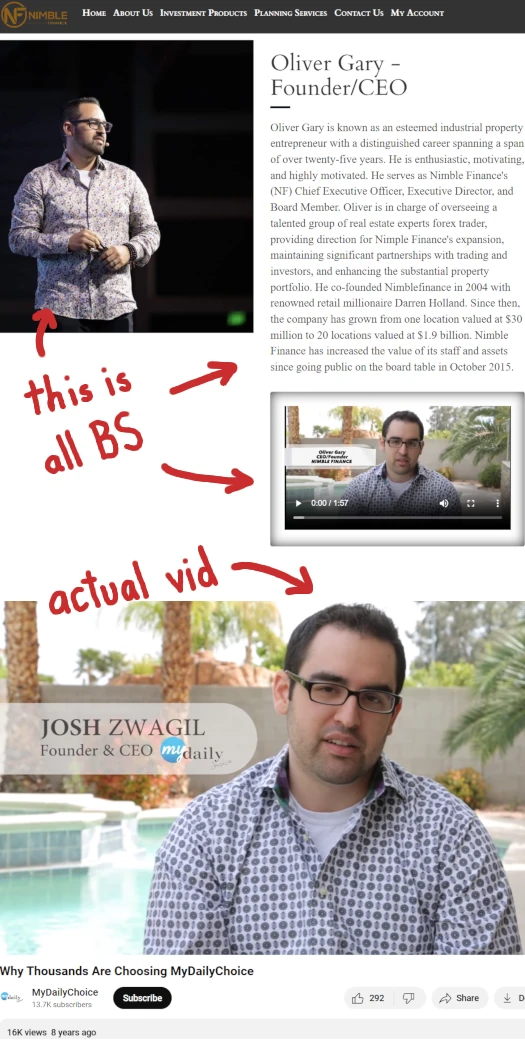

Nimble Finance outright provides false executive information on its website.

Nimble Finance outright provides false executive information on its website.

Characterized as founder, and CFO of Nimble Finance are My Daily Choice co-founders Josh and Jenna Zwagil.

Neither My Daily Choice, Josh or Jenna Zwagil have anything to do with Nimble Finance.

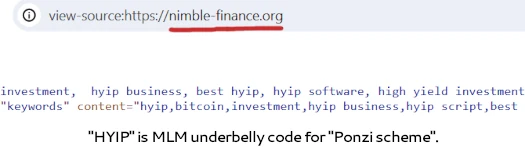

Nimble Finance’s website domain (“nimble-finance.org”), was registered with bogus details on October 15th, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Nimble Finance’s Products

Nimble Finance has no retailable products or services.

Affiliates are only able to market Nimble Finance affiliate membership itself.

Nimble Finance’s Compensation Plan

Nimble Finance affiliates invest funds on the promise of advertised returns:

- Builder Pack – invest $100 to $2999 and receive 2.9% a day for 3 days

- Director Pack – invest $3000 to $9999 and receive 9.5% a day for 7 days

- Executive Pack – invest $10,000 to $39,999 and receive 35.5% a day for 10 days

- Compensation Pack – invest $40,000 or more and receive 55.5% a day for 15 days

Nimble Finance pays referral commissions on invested funds down three levels of recruitment (unilevel):

- Builder Pack tier affiliates earn 10% on level 1 (personally recruited affiliates), 5% on level 2 and 3% on level 3

- Director Pack tier affiliates earn 15% on level 1, 10% on level 2 and 5% on level 3

- Executive Pack tier affiliates earn 25% on level 1, 15% on level 2 and 10% on level 3

- Compensation Pack tier affiliates earn 35% on level 1, 25% on level 2 and 15% on level 3

Joining Nimble Finance

Nimble Finance affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $100 investment.

Nimble Finance Conclusion

Nimble Finance is your typical generic finance template Ponzi scheme.

In addition to lying about the foundation of the company and who runs it, Nimble Finance’ website presents itself as a generic finance themed template.

The site is populated with copious amounts of generic finance jargon, accompanied by a plethora of stock and/or stolen images.

A look into the source-code of Nimble Finance’s website reveals it for what it is:

As a passive returns investment scheme, Nimble Finance is required to register itself with financial regulators. Nimble Finance fails to provide evidence it has registered with any financial regulators.

Thus, at a minimum, Nimble Finance is committing securities fraud.

As it stands the only verifiable source of revenue entering Nimble Finance is new investment.

Using new investment to pay ROI withdrawals would make Nimble Finance a Ponzi scheme. Additionally with nothing marketed or sold to retail customers, the MLM side of Nimble Finance operates as a pyramid scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Nimble Finance of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.