MyCOM Review: Failed ecom platform turns to crypto fraud

Owing to MyCOM intentionally omitting details of their MLM opportunity in their marketing, this isn’t a typical BehindMLM review.

Owing to MyCOM intentionally omitting details of their MLM opportunity in their marketing, this isn’t a typical BehindMLM review.

Hiding information is a common occurrence across the various facets of parent company Tesora Financial’s operations, which made putting together this review a headache.

On that basis alone I’d recommend avoiding MyCOM and Tesora Financial. MLM companies only go to these lengths to hide information when they’re up to no good.

If you want to know what exactly MyCOM and Tesora Financial are up to, read on.

MyCOM is headed up by founder and CEO Jaime Villagomez.

Villagomez is also founder and CEO of Tesora Financial Group (dba Tesora International) and all its attached shell companies.

Villagomez runs MyCOM and Tesora Financial Group from Utah in the US.

MyCOM launched in 2017 as an ecommerce platform MLM company.

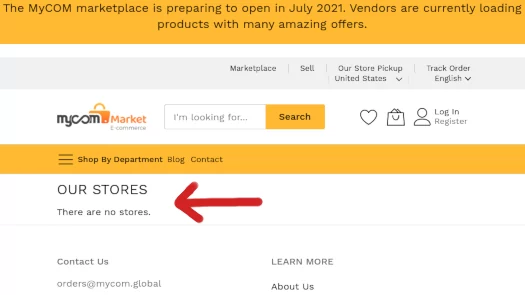

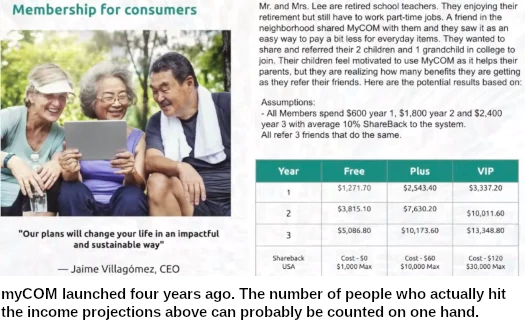

Four years later, here’s how that’s going:

MyCOM’s marketplace is a failure on every measurable metric. Thus it’s not surprising Tesora Financial and Villagomez have jumped on the crypto bandwagon.

Before we get into that though I want to go over what MyCOM is pitched as.

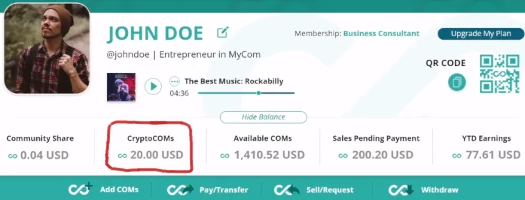

Essentially you’re looking at the usual closed ecommerce portal with cashback. As opposed to actual cashback, affiliates, customers and businesses are paid in COMS – which Villagomez stresses “isn’t a cryptocurrency”.

That’s disingenuous though, because at some point there does appear to have been a crypto component to COM points:

That distinction aside, COMS might as well be an in house MyCOM cryptocurrency.

Retail customers receive COMS when they purchase products on MyCOM’s empty marketplace. They can’t cash them out.

Retail merchants are paid in COMS, which they can cash out.

Whether MyCOM affiliates can cash out COMS isn’t specified, which likely means they can (hush hush).

Oh and for some reason COMS can be directly invested into, which makes no sense other than as a money spinner for MyCOM.

On the MLM side of things whether commissions are paid on MyCOM investment isn’t specified.

What we do know is MyCOM charges merchants fees, which funds the cashback (referred to as “shareback” because reasons).

Of this collected cashback fee from the merchant, MyCOM keeps 30% and pays

- 30% to the purchaser

- 1% to 4% to the referring MyCOM affiliate (based on how much they’re paying in fees)

- 4% to the MyCOM Pro Advisor assigned to the store

- 15% to “regional managers”

- 20% through a ten-level deep unilevel team

MyCOM intentionally hides this unilevel compensation structure. You won’t find it anywhere on the internet or in their marketing videos.

The reason I’ve seen cited for the deception is because MyCOM doesn’t want to be seen as an MLM company. They feel this will better position them to attract merchants (see screenshot above, that’s going swell).

Shady business practices aside, MyCOM’s Marketplace failed because it’s an outdated model.

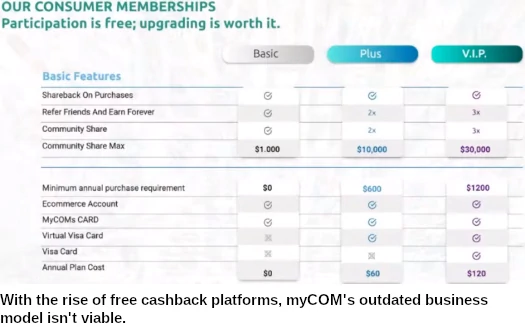

MyCOM charges customers for access based on a three-tier pricing model:

- Basic – no cost

- Plus – $60 annually

- VIP – $120 annually

The more you pay the more COM points you can earn.

Oh and as a potential customer, you have to be referred by an existing MyCOM affiliate.

That’s going up against the multitude of free apps and browser cashback/voucher extensions – all of which provide vastly superior coverage of available merchants.

No fees, no restrictive ecosystem to buy into, and some of them actually offer cashback.

That’s what MyCOM’s Marketplace business model is competing against. So it’s no wonder the concept failed.

This is the Achilles’ heel of every MLM ecommerce cashback platform. Fees have the be charged somewhere or there’s no commissions to pay out.

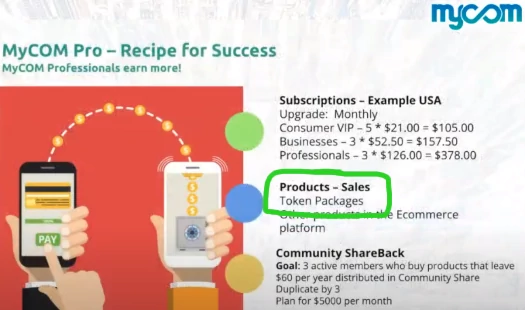

With respect to affiliate fees, MyCOM charges:

- Business Consultant – $360 annually

- Professional Rep – $600 annually

- MyPoint Pro – $900 annually

Again, how much you spend directly impacts earning potential.

MyCOM’s business fees are:

- Free – no cost, capped at $500 Shareback

- Plus – $100 annually, capped at $50,000 Shareback

- VIP – $300 annually, capped at $150,000 Shareback

Same story.

MyPoint membership is $900 annually or $75 a month. It appears to be a purely “upgrade your income potential” membership fee.

Whether commissions are paid out on the above membership fees is not disclosed. I’d assume so, otherwise what else is MyCOM doing with those fees?

Anyway now that we’ve established what MyCOM is and why it failed, let’s move onto the next phase of Tesora Financial: crypto shitcoins.

There are a ton of shell companies within Tesora Financial, only a few of which have been elaborated on.

The primary companies we’re going to reference are Bitcoin Trust, Tesora Trust, Tesora Custody and Tesora Exchange.

Tesora Financial’s primary shitcoin is Bitcoin Trust.

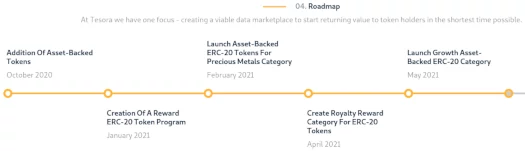

Based on the company’s roadmap, Bitcoin Trust (BCT) is an ERC-20 shitcoin.

ERC-20 shitcoins can be set up in five minutes or so on the ethereum blockchain, at little to no cost.

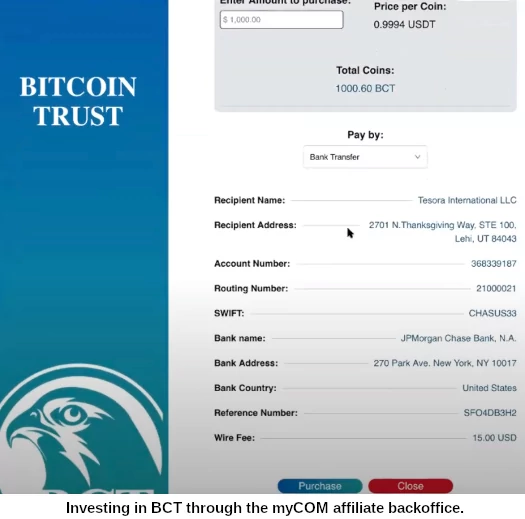

MyCOM affiliates invest directly into BCT through their backoffice.

As per the above example from Jaime Villagomez’s backoffice, Tesora Financial sells BCT to affiliates for 0.9994 USDT each.

The primary reason for BCT investment, as per Tesora Financial’s own marketing, is the implication that affiliate investors will eventually be able to withdraw more than they invested.

Due to aforementioned secrecy, I wasn’t able to ascertain whether commissions are paid on BCT investment.

Once invested in, BCT is parked with the company. In exchange for doing this, Tesora Financial rewards affiliate investors with more BTC. Internal value goes up, and thus affiliates cash out more than they invested.

In other words BCT is your typical MLM crypto passive investment scheme.

Built into this a shitcoin factory (why stop at one shitcoin), purportedly attached to themed smart-contracts.

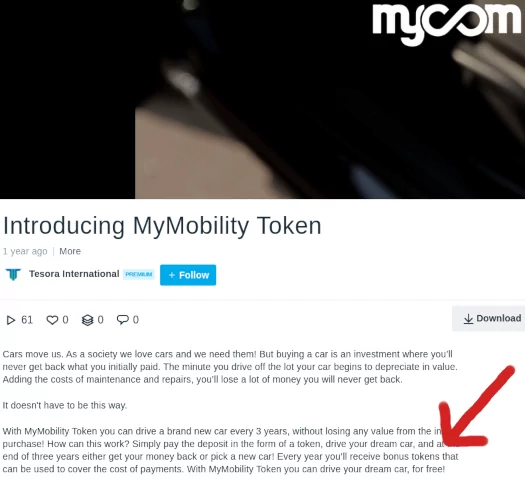

One of these shit tokens is “mobility token”:

In a mobility token promo video uploaded in August 2020, My ECOM pitches “you can drive you dream car, for free”.

The idea is affiliates invest in mobility tokens, get more mobility tokens as a return, cash out other people’s money and that money is used to pay off the car loan.

The mobility token scheme has a place on Tesora Financial’s website under “AutoMobility”.

There you find a link to another website, “automobility.it”.

As far as I can tell, Auto Mobility is an independent Italian business that predated MyCOM.

Naturally there’s nothing about a mobility token on Auto Mobility’s website.

The only reference I found was one post on Auto Mobility’s official Facebook page, dated August 2020.

Seems kind of odd Auto Mobility isn’t advertising free cars all over its website.

Other themed shit tokens Tesora Financial pushes is a business startup (power start) and real estate (power house). Same nonsense, invest in tokens, park tokens, get more tokens, cash out – free everything.

Tesora Trust is a secret passive investment opportunity. It has a place on myCOM’s website but the company is intentionally opaque about specifics:

“Holding assets” sounds like another avenue to park tokens, get more tokens and cash out through.

The linked website domain, “tesora.io”, naturally doesn’t work.

Tesora Custody is a passive bitcoin investment opportunity, accessible through myCOM.

Deposit your bitcoin into Tesora Custody and earn more coins!

There is no sense in holding your bitcoins without trading, place them on deposit, and make them work for you!

Sounds like your typical crypto trading Ponzi scheme ruse.

Finally we have “Mining Farm by Tesora Group”, another passive investment opportunity.

Mining Farm by Tesora Group allows through Tesora tokens [sic] for community members to participate without having to manage the technology.

This is the only reference to a “tesora token” I came across.

By offering multiple passive investment opportunities through their MLM opportunity or otherwise, Tesora Financial Group and Jaime Villagomez have created and are promoting multiple securities offerings.

With all of this going down in the US, this means myCOM and Tesora Financial Group need to register their securities offerings with the SEC.

Neither MyCOM, Tesora Financial Group, any of the known shell companies or Jamie Villagomez are registered with the SEC.

And now you know why this is all kept secret and quietly marketed behind closed doors.

To recap;

- myCOM is a failed ecommerce platform MLM company that hides the fact its an MLM company;

- parent company Tesora Financial Group has jumped on the crypto bandwagon, launching several passive investment schemes;

- neither myCOM or Tesora Financial Group are registered with the SEC, meaning the company is committing securities fraud and operating illegally.

You know the drill. This won’t end well.

As CEO of MyCOM Global I’d like to thank BehindMLM for their consideration and explain how their review does not paint a fair nor accurate picture of our company.

There are inaccuracies I would like to clarify and many misunderstandings and assumptions that must be corrected.

First, the claim “Failed” e-commerce and marketplace is incorrect. MyCOM is in pre-launch phase and is currently preparing for an official launch in early 2022 in various countries and is currently adding new vendors and dozens of products daily.

At the time of BehindMLM review, we had not yet launched the ecommerce platform except to vendors to add products.

Secondly, MyCOM Global is not a crypto company. MyCOM is a marketplace that has a program of sharing back its earnings with its community of buyers and sellers through a unique loyalty program.

Our goal is to enhance economic activity for small and medium businesses and support entrepreneurs and innovators by helping identify products that could be marketed to our community.

MyCOM allows vendors to set the margin they want to share back with the company which it then shares with its active members.

The credit distributed are loyalty points we call COMs. They are not crypto, they are buying credits that can be redeemed with any affiliated vendor.

As to redirect the shoppers to spend with the businesses in the, we do not payout cash but awards COMs credits to the shoppers.

An example of this is the retailer Kohl’s in the USA that gives loyalty credits as “Kohl’s cash” that must be redeemed within Kohl’s.

Because we are not paying out cash we have named these credits COMs and call it Shareback instead of Cashback.

This represents the cash value of what you can redeem on your next purchase within our marketplace either within our ecommerce or with affiliated businesses that use our payment App to transact.

Vendors get these credits paid to them but get cashed out in fiat currency at their full value minus the amount they share and the credit card transaction fee that is charged by the processing banks.

Vendors can set their own prices and margins or “Shareback” as we call it for the community which we distribute to affiliates in our system.

We are not an MLM but more like a buying club. We borrow the idea of popular wholesale clubs like Sam’s and Costco that charge memberships.

In short, these clubs are big discounters and make a small margin to cover operations and make their money by selling memberships to take advantage of their offers.

There are some differences however, MyCOM allows members to join for free but offers upgrades for increased benefits.

Again, this is not too different than Amazon Prime or upgraded memberships offered at these clubs. But instead of being physical warehouses where consumers shop, we have created a system for small and medium businesses throughout the world to attract consumers that are affiliated with our community.

In essence, MyCOM is engaged in providing a loyalty and marketing program for businesses to enable them to compete against the larger businesses that threaten small businesses survival.

Our Shareback formula does incentivize invitations and sharing as typical of many businesses that incentivize referrals and provide rebates to attract sales or new customers.

We want members to invite others to increase the communities buying power and businesses to share a generous discount for our members.

We also want members to find other resources and services from our platform. For example, Tesora Financial supports some of our payment system and Tesora Exchange supports those customers that approved to participate.

We are negotiating with many more service providers to sell to or provide services to both the consumer and businesses in our community.

Eventually, we will offer banking, travel, entertainment, health solutions for our community members to benefit depending upon country.

We do have a program for licensed professional and independent sales reps that want to work with us. We contract with them to help find businesses and support them through their journey to success.

We also provide them opportunities to sell products for commissions.

As these sales reps earn traditional commissions from the sale of some products. They also earn COMs as a commission when a businesses they registered or are assigned to support, sell through our payment system.

They as contracted sales reps, can convert their COMs credits to fiat just like businesses can.

We keep consumers using COMs because this is a loyalty program and we redirect sales back to the vendors that are sharing their margin with the community.

We also incentivize businesses to invite their customers to participate as they can earn back some additional COMs credit wherever their affiliates shop.

Our program also offers what we call Community Share for active members to benefit from transactions that happen in our community.

How we share is not defined as it can be done many different ways depending upon what the company wants to give and what works best to generate a perpetual economy that brings more shopping credits and discounts to the community.

But the spirit of it is to enhance community and turn platform users into stakeholders in the success of MyCOM and its affiliated businesses.

All these credits called COMs that are paid to shoppers are then redirected back to the businesses in our eco-system creating a perpetual win-win system.

MyCOM’s founders are entrepreneurs and come from varied backgrounds including marketing, manufacturing, distribution, private equity, and banking.

We do not come from the MLM industry although some of us as have some exposure to this industry.

We believe that direct marketing is good for some but there has always been challenges with many companies growing and failing due to their exponential growth and lack of inventory to support the opportunities. We do not depend on any one product that is overpriced to have margin to payout, but instead connects third party businesses and sells their products at the standard prices but with a rebate called “Shareback”.

MyCOM has business agreements with sister companies and other independent entities that offer some of its services to its community.

Part of MyCOM’s infrastructure is supported by regulated financial entities and include a licensed crypto exchange out of Estonia, licensed payment institutions out of UK and soon other countries, regulated asset management out of Switzerland and others.

Any supporting services that are required to operate or offer to our members are offered by contract to the MyCOM Platform and follow strict regulations.

For example, Tesora OU, a licensed exchange handles token and crypto transactions for MyCOM community members.

If there are any “financial” products that are sold, they are limited to the jurisdictional governing laws and are only offered by licensed financial advisors.

The author of the review mentions that MyCOM is not registered with the SEC and that is correct.

MyCOM does not offer or sell any products that require SEC oversight to investors in the USA and as such does not need to be registered.

If and when it chooses to do so, it will undoubtedly follow the same strategy of “partnership” by a licensed institution as required by law.

Although MyCOM doesn’t itself do Crypto it believes that Crypto can be a helpful way to make purchases and transactions globally and particularly in less sophisticated markets where buyers don’t have bank accounts or credit/debit cards to participate in a marketplace.

Many of these people however, do have crypto wallets and have become increasingly a normal and safer way to pay or get paid.

As such MyCOM, has been preparing the way to accept some crypto payments such as Bitcoin, Ethereum, stable coins, and BitcoinTrust. We have adopted BCT or BitcoinTrust as a favored coin because it follows our philosophy of being inclusive for the little guy and overall being an improvement upon Bitcoin.

It is way less expensive to transact with less than a fraction of a % fee as to opposed to much higher fees incurred with a Bitcoin or Ethereum transaction.

It is way faster handling most operations as fast as a credit card transaction. It is inclusive and allows its owners to mine on their computer and earn without having to be a techie.

Furthermore, it is green as opposed to the energy hog that is Bitcoin. The author should investigate this technology further as their comments are technologically incorrect.

MyCOM or its sales reps do sell cryptocurrency. Any crypto tokens are sold by Tesora Exchange or other utility tokens are offered by authorized and licensed sales reps of the Tesora Financial Group and is limited to countries governed by their financial license. Although the token contracts are not securities, they are still presented by authorized advisors.

As is obvious, the author of this review is generally pessimistic and pre-judgement towards many MLM’s or crypto products.

We agree that there have historically been companies that have taken advantage of many and that there is a need to protect people.

As such, MyCOM has invested many years and setup platform and program that has been created legally and regulatorily sound from the start with consultation with lawyers and regulators.

For that reason, we have connected the financial companies to our platform as service providers and will continue to do so wherever needed.

The businesses that provide products and services to the platform are independent and provide non-exclusive services to MyCOM.

We invite the author of this review to contact us to get further clarification from us directly so as to not have to make assumptions or struggle to find accurate information.

As you will see, MyCOM has spent considerable attention to working within regulatory scope for the long-term benefit of the community its serves.

In the future, we will enjoy many more partnerships with banks, manufacturers, innovators, health care solutions providers and discover additional ways to lift the economies of entrepreneurs as they help lift their local economies with employment and innovation.

(Ozedit: attempt to take discussion offsite removed)

Hi Jaime, welcome to BehindMLM.

Mate cut the crap. MyCOM launched four years ago in 2017. Prior to you rebooting it as a crypto scheme it was dead.

Dead business = failed business.

MyCOM sells tokens packages (CryptoCOMS, Bitcoin Trust, “mobility token” or whatever you call them). That makes it an MLM crypto company.

That’s nice. What about “cryptoCOMS” and selling token packages? Evidence of this provided via screenshot in the review.

No you don’t, because neither Costco or Sam’s Club has an MLM compensation plan.

MyCOM has an MLM compensation plan very much making it an MLM company.

You set up a premise, waffled on and then demolished said premise with one sentence. As you acknowledge, COM tokens can be cashed out.

Your selling a token or tokens Jaime, attached to a scheme through which affiliate investors invest in said token(s), get more tokens passively and then cash out.

That’s a securities offering, offered through MyCOM (see MyCOM marketing slide featuring Tesora Financial investment pitch).

Registering shell companies offshore doesn’t change the fact that you and MyCOM are based in the US.

If you’re not registered with the SEC, you’re committing securities fraud.

Because you created and own it. Owning the shitcoin you commit securities fraud through = maximum profits.

Again cut the crap. You own all the companies. It’s all you.

You can’t pseudo-compliance securities fraud through offshore shell companies.

Why? Nailed it the first time.

Failed ecommerce platform transitions to shitcoin securities fraud. Crypto bro running the show thinks he’s above regulation because *winkwink* “independent” offshore shell companies.

The reason I’m “generally pessimistic and pre-judgement towards many MLM’s or crypto products” is because every MLM crypto company I’ve reviewed over the past 8-9 years is operating fraudulently.

MyCOM and your Tesora shell companies are no exception.

BEWARE!!!

as a former mycom employee I can corroborate that all the statements here writer are mostly true.

I “worked” for them for about 2 years, and I never saw any project fulfilled, thera a lot more projects that we think are the baits for naive investors to put money with the promise of a long term return that they never see.

One of the worst thing about these people is that they belong to the Mormon church, they claim to be religious and maintain a facade of goodwill doing, but behind that, I am pretty sure that they use the church money to keep the fraud going for some time to then restart all over again, not only robbing the investors, but also the team of people they hire for a period of time

up to this date, Jaime Villagomez, Marco pedrazzolli, Michele Giacomele and Carlos Urdaneta, owe their few employees left, 3 month worth of salaries and they are not answering their calls and questions.

beware of these people, they are mean persons only wanting the money and then leaving everyone hanging, there NONE profit from ANY of their projects, they are all a scam!