MSIM Review: Stolen identity “click a button” app Ponzi

MSIM fails to provide ownership or executive information on its website.

MSIM’s website domain (“1ms.top”), was registered with bogus details on April 21st, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

MSIM’s Products

MSIM has no retailable products or services.

Affiliates are only able to market MSIM affiliate membership itself.

MSIM’s Compensation Plan

MSIM affiliates invest tether (USDT). This is done on the promise of advertised returns:

- VIP-1 – invest 10 USDT and receive 8% to 10% a day

- VIP-2 – invest 200 USDT and receive 12.99% to 15% a day

- VIP-3 – invest 2000 USDT and receive 20.4% to 22% a day

- VIP-4 – invest 6000 USDT and receive 28% to 30% a day

- VIP-5 – invest 15,000 USDT and receive 36.6% to 39% a day

- VIP-6 – invest 50,000 USDT and receive 46.2% to 52.5% a day

- VIP-7 – invest 100,000 USDT and receive 64% to 76% a day

MSIM pays referral commissions down three levels of recruitment (unilevel):

Commission ranges are specified to be 21% to 9% but aren’t disclosed per level.

Joining MSIM

MSIM affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 10 USDT investment.

MSIM Conclusion

MSIM is yet another “click a button” app Ponzi scheme.

MSIM misappropriates the name and branding of Morgan Stanley, an American multinational investment bank:

Needless to say MSIM has nothing to do with Morgan Stanley.

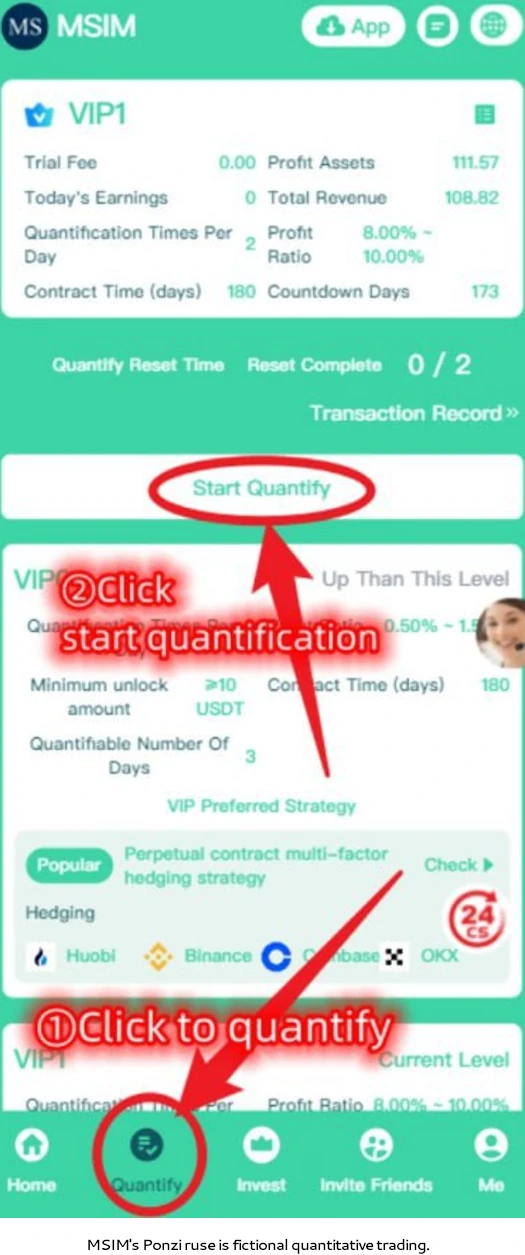

MSIM’s Ponzi ruse is “quantitative trading”.

The presented ruse is MSIM affiliates log in and click a button (the more invested the more the button needs to be clicked).

Clicking the button purportedly generates revenue via quantitative trading, which for some reason MSIM shares a percentage of with affiliate investors.

If that makes no sense it’s because it doesn’t. Randoms clicking a button in an app doesn’t trigger quantitative trading.

In reality clicking a button inside MSIM does nothing. All MSIM does is recycle newly invested funds to pay earlier investors.

Examples of already collapsed “click a button” app Ponzis using the stolen identity ruse are VIP Oxy, Watts USDT and Iran Mall. Quantitative trading ruse examples include GSTAIQ, Dusery and edX AI.

Including MSIM, BehindMLM has thus far documented over a hundred “click a button” app Ponzis. Most of them last a few weeks to a few months before collapsing.

“Click a button” app Ponzis disappear by disabling both their websites and app. This tends to happen without notice, leaving the majority of investors with a loss (inevitable Ponzi math).

The same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.