MproLab Review: iNodes ruse MLM crypto Ponzi

![]() MproLab fails to provide ownership or executive information on its website.

MproLab fails to provide ownership or executive information on its website.

MproLab’s website domain (“mprolab.io”), was first registered in September 2022. The private registration was last updated on June 12th, 2023.

While there are no legally required disclosures on MproLab’s website, its YouTube channel provides names we can attach to the company.

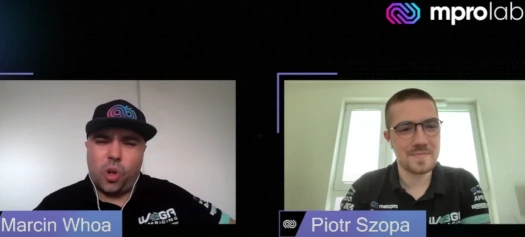

Marcin Whoa, Michal Bartczak and Piotr Szopa appear on MproLab “community lab” videos.

MproLab’s “community lab” videos began a month ago on March 11th.

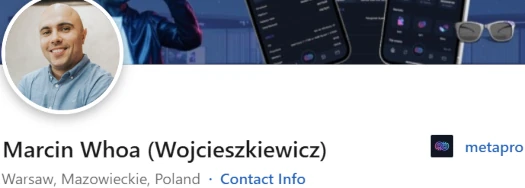

On his LinkedIn profile Marcin Whoa, aka Marcin Wojcieszkiewicz, cites himself as a resident of Poland.

Whoa also cites himself as co-founder and COO of MetaPro, which appears to be attached to MproLab. As far as I can tell, Whoa is a random crypto bro with no prior MLM experience.

Michal Bartczak and Piotr Szopa are also from Poland and attached to MetaPro as executives.

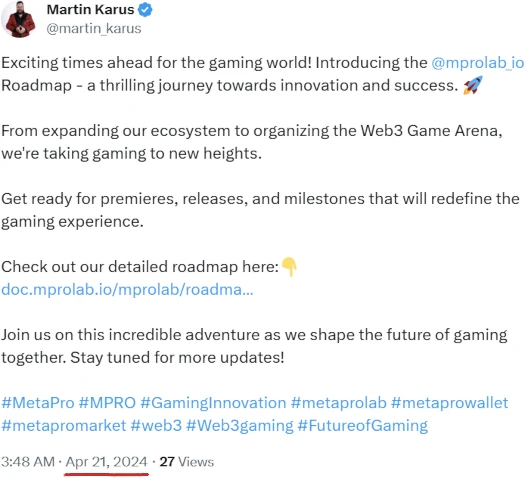

In researching the trio I also came across a fourth name, serial Ponzi fraudster Martin Karus.

Karus has been promoting MproLab and MetaPro on Twitter. He refers to both companies in the possessive, suggesting an ownership stake.

Karus (right), also originally from Europe, has since fled to Dubai.

Karus (right), also originally from Europe, has since fled to Dubai.

From Dubai Karus continues to defraud consumers through various MLM crypto Ponzi schemes.

The latest MLM crypto Ponzi Karus has been promoting is Xera, a combination of three collapsed Dubai MLM crypto Ponzi schemes.

Collapsed MLM crypto Ponzi schemes Karus himself launched in the past include TronCase and Monarch.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to MproLab, read on for a full review.

MproLab’s Products

MproLab has no retailable products or services.

Affiliates are only able to market MproLab affiliate membership itself.

MproLab’s Compensation Plan

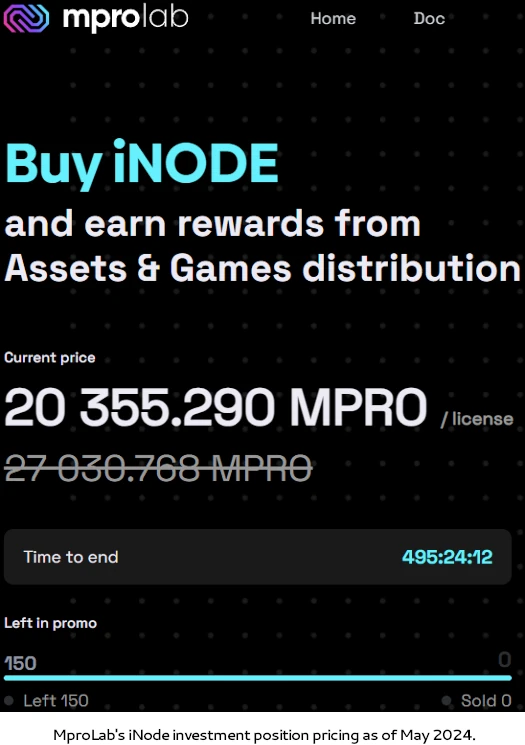

MproLab affiliates invest in iNode positions. This is done on the promise of a daily passive return.

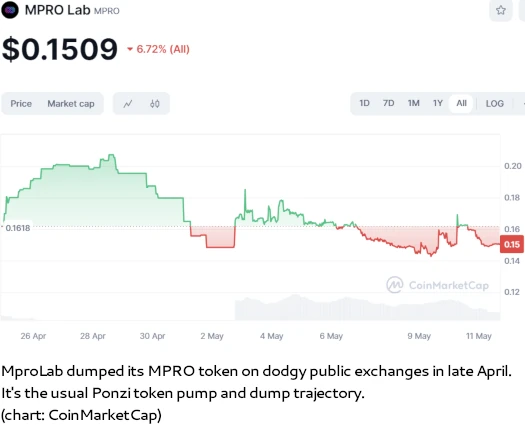

iNode positions and daily returns are paid in MPRO, a token MproLab created.

As of May 2024 an iNode investment position costs ~27,015.869 MPRO, however discounts appear frequently available on MproLab’s website.

The full iNode investment amount also seems to fluctuate, in line with MPRO tokens declining public value.

MproLab pays referral commissions on iNode positions invested in down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 8%

- level 2 – 4%

- level 3 – 3%

Joining MproLab

MproLab affiliate membership is free.

Full participation in the attached income opportunity requires purchase of MPRO and investment into an iNode position.

MproLab Conclusion

MproLab is a simple MLM crypto Ponzi scheme.

New affiliates sign up, acquire MPRO (which MproLab sells them), and then invests MPRO into iNode investment positions.

MproLab pays a daily return to each investor in MPRO, which it generates on demand.

MPRO itself is an ERC-20 shit token.

These tokens can be created in a few minutes at little to no cost.

Cashing out MPRO returns is possible for as long as MproLab allows withdrawals.

As to where that money comes from;

As an iNODE provider, you contribute to the stability and efficiency of the Metapro protocol. In return for your services, you receive MPRO as compensation

MproLab has no verifiable source of external revenue, which is of course a problem.

On the regulatory front MproLab’s iNodes investment scheme satisfies all prongs of the Howey Test.

MproLab affiliates invest with the company (a common enterprise), “with the reasonable expectation of profits” (see quoted MproLab marketing spiel above), “derived from the efforts of others” (returns are purportedly generated and paid out by MproLab).

MproLab fails to provide evidence it has registered its securities offering with regulators in any jurisdiction.

As of April 2024, SimilarWeb tracked top sources of traffic to MproLab’s website as Sweden (44%), Hungary (12%), India (7%), Finland (7%) and the Netherlands (5%).

Each of these countries has a regulated financial market and by failing to register to offer securities, MproLab illegally solicits investment in each country.

Instead of registering its securities offering with financial regulators and operating legally, MproLab pretends its iNode investment scheme isn’t an investment scheme.

Here’s a relevant YouTube video from the SEC addressing companies pretending their investment schemes aren’t investment schemes.

While the SEC regulates securities fraud in the US, securities law is materially the same in each country with a regulated financial market; either you’re registered or you’re operating illegally.

As it stands, the only verified source of revenue entering MproLab is new investment. Using new investment to fund MPRO withdrawals would make MproLab a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve MproLab of MPRO withdrawal revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Karus is not from Poland, he is from Estonia. The Fact you make this mistake says a lot about your research

Thanks for catching that. I ran a search on the surname Karus and it originates from Poland. Still I wasn’t 100% sure and was supposed to put “Europe” there.

As for research, Karus is still a serial scammer and MproLab is still a Ponzi scheme.

Karus guy always promoting some scams. Now he promoting frogbar.

Maybe you want to check out my youtube OZ. I been standing up to Karus for a while now. I made some videos on him And also on Marcin.

I got proof they scammed. They stolen my funds. Presale I have 32 nodes which only 10 work and 22 are visible the others dissapeared.

I have cloned their contract and relaunched it as SCAMPRO. With in the contract code on top sayin MPRO IS A SCAM.

MARCIN SOMETHING IS A SCAMMER. MARTIN KARUS IS A SCAMMER. #PTCPAT has proof.

I quit with working with them and posting youtube over a year ago after all i worked with was continuesly turning to shit

Now i just fight for justice and changing how the world of online income works…

With no loyalty friendship and all the backstabbing.

I got many files you mentioned before like martin karus saying he is the CO-owner of Troncase. I have fought with them as i have proof of liquidity stealing with Coinswap by Marcin and martin.

I am fighting very hard to make everything right i ever did. They have not.

For MPRO i have multiple contracts of them with shady coding.

Where they can mind 50% of everything all the people node and send it to their “Treasury” The same way martin and Marcin stile liquidity form CSS multiple times.

I was suppose to get an angel investment. I have all documented.

They said it was not possible and called me sick in the head a scammer a liar. And i kept saying i have proof please no war fix it make it right.

They did not shit happened i went throug their code and now i am making multiple videos of their scamcoding.

i can also mail you details.

Sorry to hear you personally had to lose money before you accepted you were investing in and promoting Ponzi schemes.

There are probably parts of Karus’ scamming that haven’t been covered on BehindMLM but as far as the MLM side of it goes I think we’ve documented most of it over the years.

Yeaah it took me some years to realize all i was always told all was building was fake hope and dreams.

Will never talk my part in promoting shit online right. Made me change my ways when i realized.

We live and learn keep rising my man i love your site.