MLC Review: Blood glucose monitor themed securities fraud

MLC fails to provide ownership or executive information on its website.

MLC fails to provide ownership or executive information on its website.

MLC’s website domain (“mlc.health”), was privately registered on September 29th, 2022.

If we open up MLC’s marketing presentation, we find the document is titled in Kazakh:

This suggests someone from and/or with ties to Kazakhstan is behind MLC.

Other possibilities where Kazakh is commonly spoken include China’s Xinjiang Uyghur Autonomous Region, Mongolia, Tajikistan, Turkmenistan, Uzbekistan, and Afghanistan.

MLC’s website also contains a vKontakte socail media link, suggesting ties to Russia (or at the very least Russian speakers).

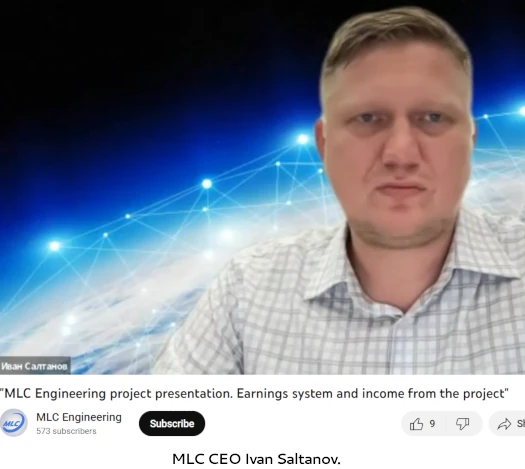

That brings us to MLC’s social media profiles, on which it’s revealed “Ivan Saltanov” is CEO of the company.

Saltanov, who speaks Russian, has been appearing in MLC marketing videos dating back to August 2022.

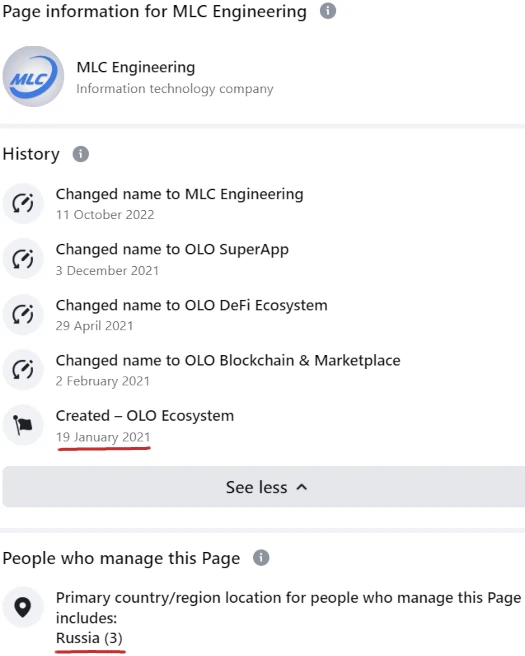

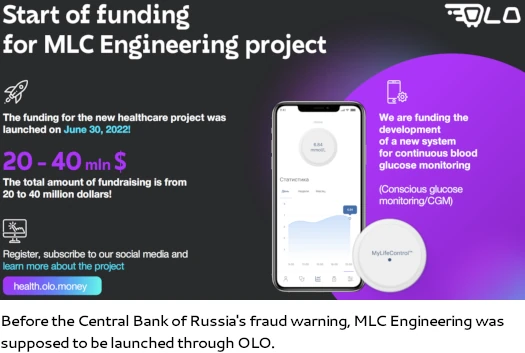

If you’re wondering how MLC’s social media profiles pre-date its current domain registration, that’s because MLC originally launched as MLC Engineering.

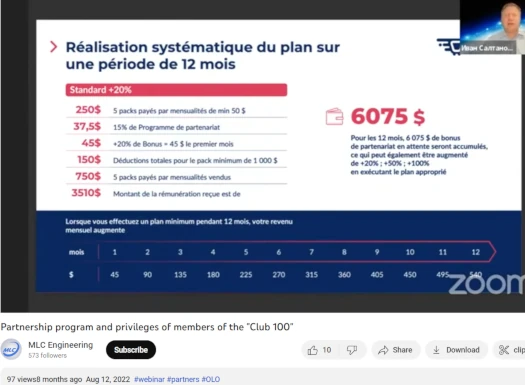

MLC has scrubbed its FaceBook page prior to 2022. There is one August 2022 French language video left on MLC’s YouTube channel, which suggests “OLO” was some “Club 100” investment scheme:

Partnership program and member privileges of “Club 100” TODAY, August 11 at 6:00 p.m. Moscow time (UTC+3), you will be able to tune in to an online webinar, during which Ivan SALTANOV, Founder and CEO from the company OLO, will tell you about the advantages of participating in the “Club 100” of the MLC Engineering project.

The original model was some “franchisee” nonsense. After which Olo was rebooted as Olo DeFi, a crypto app scheme built around “OLOb token”.

On August 3rd, 2022, the Central Bank of Russia issued a pyramid scheme fraud warning for Olo, Partner Club 100, MLC Engineering and OLO DeFi Ecosystem.

This appears to have prompted the rebranding to MLC Engineering and now just MLC.

Ivan Saltanov doesn’t exist outside of OLO’s and MLC’s marketing material. He’s a prime Boris CEO candidate but has featured in enough marketing videos to suggest otherwise.

It’s worth noting the exact same Kazakh document title was also used by EcoLine, a recently launched MLM Ponzi scheme.

I can’t definitively confirm but it’s likely the same scammers are behind OLO and MLC.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

MLC’s Products

MLC has no retailable products or services.

Affiliates are only able to market MLC affiliate membership itself.

MLC’s Compensation Plan

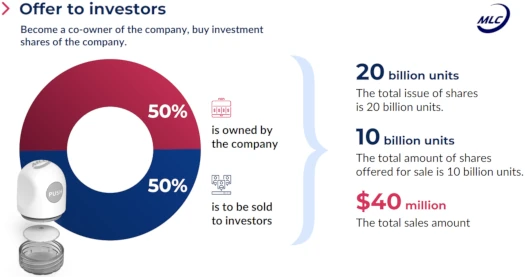

MLC affiliates invest in virtual shares at $0.001 each.

MLC represents shares will reach $1, allowing affiliates to cash out more then they invested.

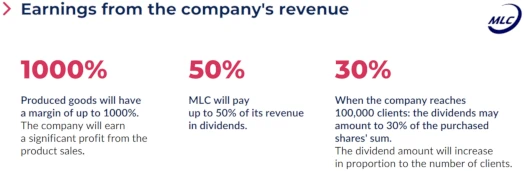

MLC affiliates are also promised 50% of the company’s revenue in dividends.

This revenue will generated from the purported sale of blood glucose monitors.

The MLM side of MLC pays on recruitment of affiliate investors.

MLC Affiliate Ranks

There are five affiliate ranks within MLC’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Partner – sign up as an MLC affiliate

- Specialist – invest at least $250, recruit two or more affiliates who’ve each invested at least $100, and generate at least $450 investment between your own investment and that of personally recruited affiliates

- Master – invest at least $500, recruit three or more affiliates who’ve each invested at least $200, and generate at least $2000 investment between your own investment and that of personally recruited affiliates

- Expert – invest at least $1500, recruit three Master or higher ranked affiliates, and generate at least $5000 investment between your own investment and that of personally recruited affiliates

- Professional – invest at least $5000, recruit three Expert or higher ranked affiliates, and generate at least $10,000 investment between your own investment and that of personally recruited affiliates

Referral Commissions

MLC pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

MLC caps payable unilevel team levels at twenty.

Referral commissions are paid as a percentage of funds invested across these twenty levels based on rank:

- Partners earn 15% on level 1 (personally recruited affiliates), 4% on level 2, 2% on level 3 and 1% on level 4

- Specialists earn 15% on level 1, 5% on level 2, 4% on level 3, 2% on level 4 and 1% on level 5

- Masters earn 15% on level 1, 7% on level 2, 5% on level 3, 3% on level 4, 2% on level 5, 1% on level 6 and 0.5% on level 7

- Experts earn 15% on level 1, 7% on level 2, 5% on level 3, 4% on level 4, 3% on level 5, 1% on level 6 and 0.5% on levels 7 to 9

- Professionals earn 16% on level 1, 7% on level 2, 5% on level 3, 4% on level 4, 3% on level 5, 1% on level 6, 0.5% on levels 7 to 9 and 0.3% on levels 10 to 20

Joining MLC

MLC affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $100 investment.

MLC Conclusion

Before we get into MLC’s MLM opportunity, I want to note the appropriation of existing company names.

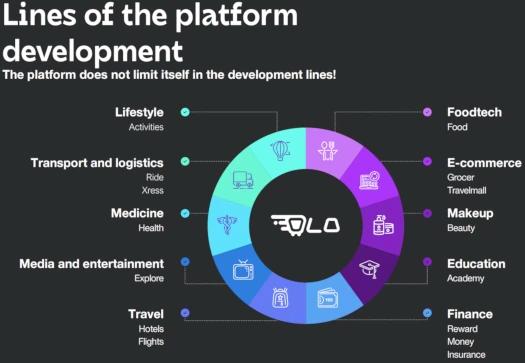

Olo is an app delivery company. OLO the Russian pyramid scheme just took that idea and expanded it (note that none of this actually ever existed):

MLC Engineering was an electrical consulting firm based out of Oregon. As per its website, MLC Engineering shut down in 2022.

One same-named company I could write off as coincidental. Two seems intentional.

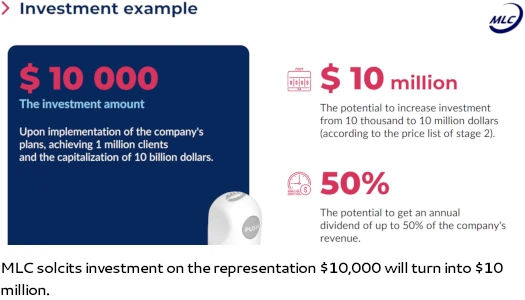

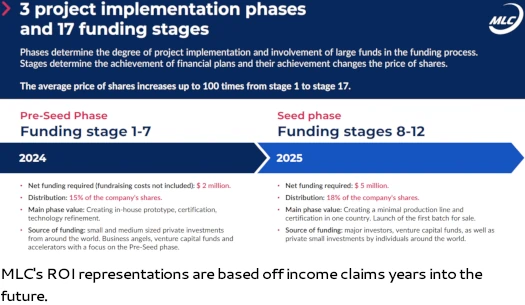

MLC’s blood glucose monitoring ruse sees the company represent investors will generate $10 million from an initial $10,000 investment.

This is based on marketing projections and promises, none of which hold any water.

If we look at the history of the MLC, we have some franchisee nonsense attached to marketing projections and promises. Then it was a brief crypto scam, and now it’s blood glucose monitors.

There’s a pattern of soliciting investment and never delivering. That’s because the real business is pyramid recruitment.

As far as its MLM business goes, MLC is soliciting investment and paying commissions on recruitment of affiliate investors. Nothing is marketed or sold to retail customers, making MLC a pyramid scheme.

The investment side, even though its not paying anything out, constitutes securities fraud.

MLC cannot sell shares in its company, virtual or otherwise, without registering with financial regulators.

MLC provides no evidence it has registered with financial regulators in any jurisdiction.

Instead of acknowledging its Russian roots MLC represents shell company ties to St. Lucia, a tax haven in the Caribbean.

Registering a shell company, in a tax haven or elsewhere, does not equate to registration with financial regulators.

As with all MLM pyramid schemes, once affiliate recruitment dries up so too will commissions. This will eventually lead to MLC collapsing.

The math behind MLM pyramid schemes guarantees that when they collapse, the majority of participants lose money.

This SCAM has arrived in Vietnam now. A bunch of Skyway scammers are behind it.