MetaHub Finance Review: MEN token staking Ponzi

MetaHub Finance operates in the cryptocurrency MLM niche.

MetaHub Finance operates in the cryptocurrency MLM niche.

MetaHub Finance represents it is operated through AuraLink Labs Pte Ltd, a Singapore registered company.

The address associated with MetaHub Finance is shared by over one hundred companies. This strongly suggests AuraLink Labs is a shell company.

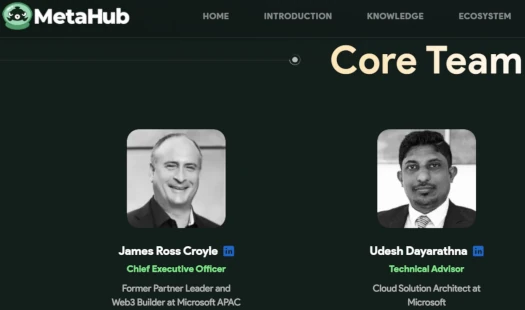

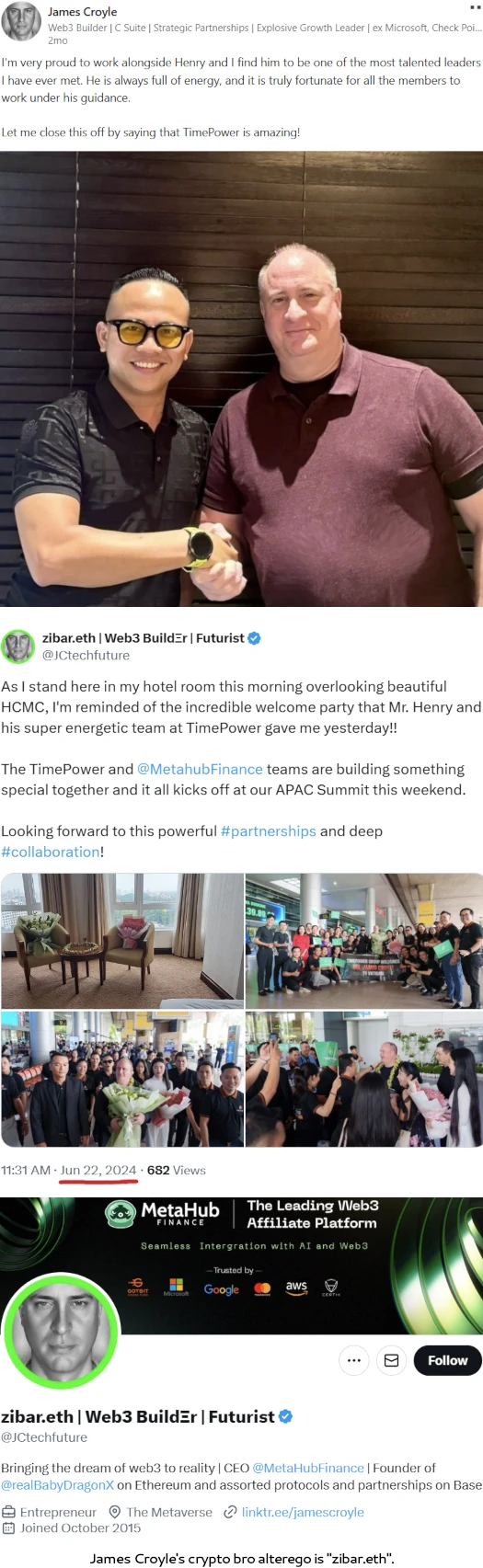

Heading up MetaHub Finance is CEO James Ross Croyle.

On LinkedIn Croyle represents himself with an AI-generated avatar and represents he is based out of Singapore.

Croyle, represented to be from the US, does appear to be a Singapore resident since at least 2011.

Croyle appears to have been legitimately working in the tech field till around 2021. Sometime after Croyle got into crypto related fraud.

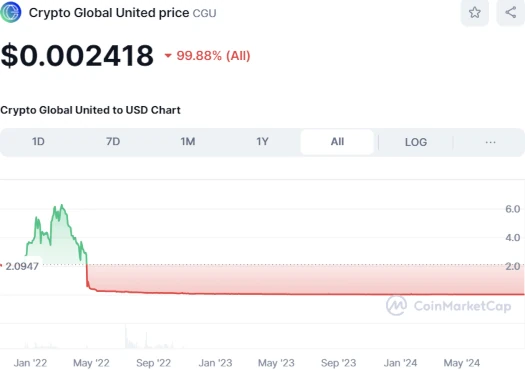

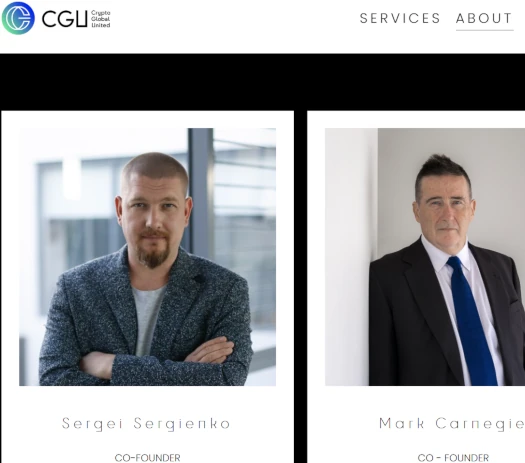

Crypto Global United is/was a crypto Ponzi scheme that launched in 2021. In 2022 Crypto Global United launched its CGU token, which its “staking” model Ponzi is built around.

CGU launched with the typical crypto Ponzi pump and dump trajectory:

Crypto Global United represents it is based out of Singapore, which is odd seeing as its co-founders aren’t.

Sergei Sergienko is a Russian born crypto bro living in Australia.

Mark Carnegie is an Australian crypto bro who describes himself as a “fucking narcissist”. In 2022 Carnegie was living in Singapore.

There’s enough similarities between CGU and MetaHub Finance to suggest the same people might be running both companies. Based on what’s known though, I can’t say for certain.

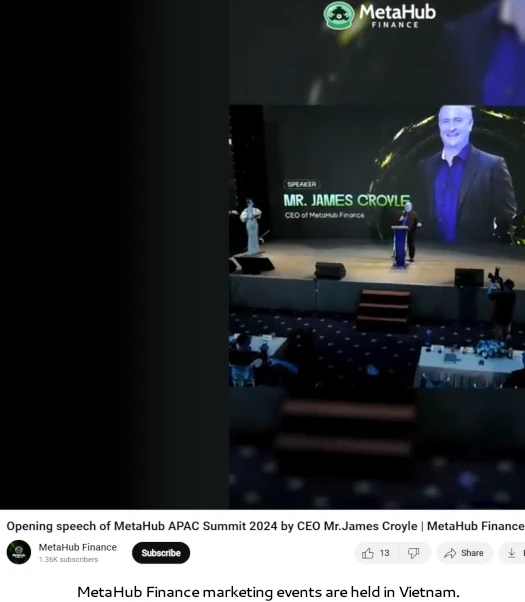

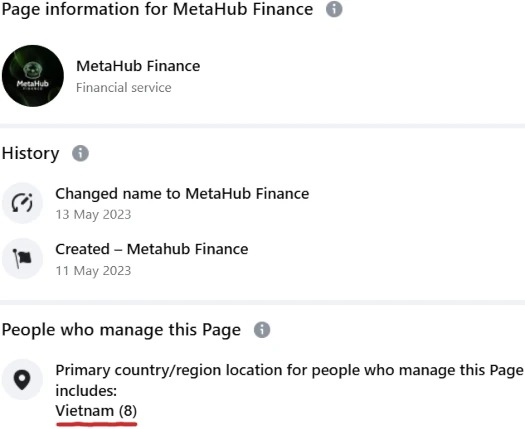

Getting back to MetaHub Finance, while the company represents it is based out of Singapore, MetaHub Finance has held at least two marketing events in Vietnam.

MetaHub Finance’s official FaceBook page is also managed from Vietnam.

Both Singapore and Vietnam are hubs for Chinese organized crime interests. It’s also possible Vietnamese scammers are running MetaHub Finance through a Singapore shell company.

What is unlikely is Ross Croyle is founded and is running MetaHub Finance himself.

Read on for a full review of MetaHub Finance’s MLM opportunity.

MetaHub Finance’s Products

MetaHub Finance has no retailable products or services.

Affiliates are only able to market MetaHub Finance affiliate membership itself.

MetaHub Finance’s Compensation Plan

MetaHub Finance affiliates invest in 100 USDT NFT investment positions.

Each NFT investment position converts to 500 MEN.

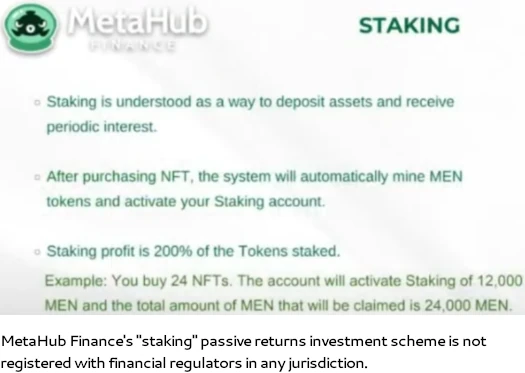

Once acquired, MEN is then staked with MetaHub Finance on the promise of a passive 200% ROI.

The ROI is paid in MEN, which must be converted into something else to cash out within MetaHub Finance.

The MLM side of MetaHub Finance pays on recruitment of affiliate investors.

Referral Commissions

MetaHub Finance pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

MetaHub Finance caps payable unilevel team levels twenty.

Referral commissions are paid as a percentage of MEN tokens staked across these twenty levels as follows:

- levels 1 and 2 – 20%

- level 3 – 10%

- levels 4 and 5 – 5%

- levels 6 to 20 – 2%

Joining MetaHub Finance

MetaHub Finance affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 100 USDT investment.

MetaHub Finance Conclusion

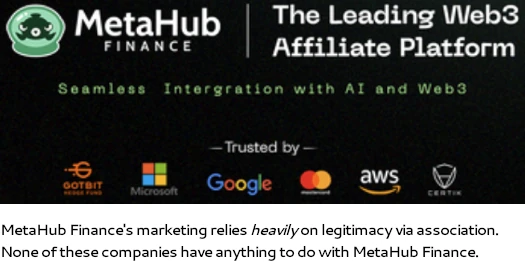

MetaHub Finance presents itself as a typical MLM crypto staking model Ponzi scheme.

MetaHub Finance affiliates invest tether and receive worthless MEN tokens. MEN is then parked with MetaHub Finance, who pay a 200% ROI from MEN tokens they generate on demand.

Cashing out MEN is possible as long as MetaHub Finance allows it, and/or until MEN is dumped on dodgy public exchanges (after which it’s a race to $0).

With nothing marketed and sold to retail customers, the MLM side of MetaHub Finance operates as a pyramid scheme.

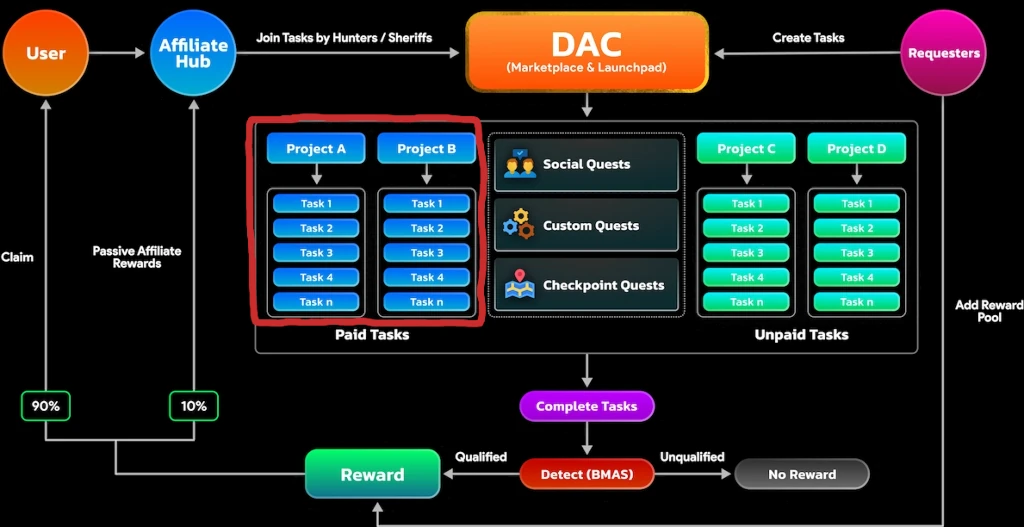

I also want to note there appears to be a “task-based Ponzi” inside MetaHub Finance (click to enlarge):

Task Ponzis see investors promised returns on completion of meaningless tasks. There could be an investment required here, or if MEN is the ROI, MetaHub Finance would again just be generating the tokens out of thin air.

The same withdrawal constraints as in MetaHub Finance’s staking Ponzi scheme would then apply.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve MetaHub Finance of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 23rd May 2025 – MetaHub Finance collapsed in late 2024. The scam was rebooted as MetaHub Global, which has also collapsed.

The third MetaHub Finance reboot recently launched as DAC Platform.