LoveBiome Review: Tahitian Noni autoship rebooted

LoveBiome fails to provide ownership or executive information on its website.

LoveBiome fails to provide ownership or executive information on its website.

LoveBiome’s website domain (“lovebiome.com”), was registered in September 2021. The private registration was last updated on September 20th, 2024.

Further research reveals Kelly Olsen cited as LoveBiome’s founder and CEO:

Why this isn’t disclosed on LoveBiome’s website is unclear. Especially considering Olsen is quoted in multiple LoveBiome website blog posts.

In one such post, dated June 22nd, 2022 and authored by Disraeli Rangel (?), Olson (right) explains why he “left retirement and started LoveBiome”.

In one such post, dated June 22nd, 2022 and authored by Disraeli Rangel (?), Olson (right) explains why he “left retirement and started LoveBiome”.

My story starts in August 2018, in Tokyo Japan.

After years of fighting to get our original Tahitian Noni brand and culture back on center stage, we held a convention in Tokyo that brought everyone back to the very best years of Morinda and Tahitian Noni International.

It was truly like going home. We had done it; we united our entire worldwide organization again with the story of Tahitian Noni.

Fast forward four months. In December 2018, I hosted a large group of our leaders in Tahiti. It was the perfect conclusion to our year. The spirit was so good, and everyone looked forward to a year of unity and growth.

It didn’t happen.

Arriving home in the Salt Lake City airport after that trip, I received a text message to meet my partner at his home immediately. I went. I arrived at 9 am.

It was there that I learned Morinda had been sold. I was an owner and partner, but the deal was done completely without my knowledge. I found out about it that morning.

I was in shock. The papers were prepared, and my partner put them in front of me with a pen and said, “sign them.”

One hour later I met the new CEO who had arranged the purchase of Morinda. Two hours after that, he gathered the managers of the company together to inform them. It all happened fast—like it had been rehearsed.

Morinda wasn’t sold for TNJ, our amazing workforce, Tahitian Noni, or our culture—all the things we were so proud of.

It was sold to become a platform to sell CBD products. The new management couldn’t have cared less about all those other things.

When the CBD idea flamed out, they continued to aggressively pursue the route of acquisitions and mergers with other companies.

You can see for yourself how that turned out. They took a profitable, united company—on the verge of a breakout year—and turned it into an unrecognizable mess. In just three years.

Following acquisition by NewAge in 2018, Tahitian Noni became “Noni by NewAge“.

The deal called for me to remain employed by the company for three years as a figurehead to help with the transition.

I had no role or responsibilities. I was there just to make people feel some continuity with the past. I hated every minute of it, but I felt I may be able to cushion the blow for our employees and distributors.

The three-year agreement lasted less than 18 months: I was asked to depart in March, 2020.

NewAge filed for Chapter 11 bankruptcy in 2022. The SEC sued former NewAge CEO Brent Willis for alleged fraud around the same time.

NewAge itself settled fraud allegations with the SEC and was sold off.

NewAge’s 2022 bankruptcy marked the end of Tahitian Noni. In 2023 NewAge rebranded as PartnerCo.

Kelly Olsen claims he founded LoveBiome “to try and keep the memories and culture of Morinda and Tahitian Noni alive” (Tahitian Noni rebranded as Morinda in 2012).

LoveBiome provides a corporate address in Utah on its website.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

LoveBiome’s Products

LoveBiome markets a range of nutritional supplements targeting microbiome health.

The Era of the Microbiome has created an explosion of scientific research and discovery, all of which points to the same truth: The microbiome is the center of health in the human body.

Today, microbiome health remains relatively unknown to consumers, even though governments, companies, researchers, and universities share a profound interest in microbiome health.

- P84 – “PhytoPower 1 and PhytoPower 2 [formulas] and 84 total ingredients carefully chosen for their positive impact on microbiome health”, retails at $225 for a pouch of 30 servings or $425 for 60 servings (marketed as “P84 Gold”)

- PhytoPower 1 – “contains essential whole foods, beneficial Targeted Probiotics, and powerful digestive enzymes to feed and diversify the gut microbiome”, retails at $120 for a pouch of 30 servings

- PhytoPower 2 – “contains specialized blends that were designed to help the body cleanse the microbiome of harmful toxins, and promote a healthy environment for beneficial bacteria to grow and flourish”, retails at $120 for a pouch of 30 servings

- PhytoPower – “combines fresh fruits and vegetables with essential prebiotics, probiotics and digestive super blends to create the ideal biotic environment in your gut”, retails at $95 for a box of 30 single-serve sachets

- PhytoPower B – “features one of the best and most impressive collections of carb-, starch-, and sugar-blocking ingredients on the planet”, retails at $50 for a pouch of 15 single-serve sachets

- PhytoPower X – “250mg of natural caffeine from guarana and yerba mate, adaptogens, and bioavailable vitamins and prebiotics”, retails at $55 for a pouch of 15 single-serve sachets

- PhytoPower I – “a daily beverage supplement designed to build and strengthen immune system defenses”, retails at $50 for a pouch of 15 single-serve sachets

- PhytoPower W – “delivers the most powerful combination of targeted probiotics and a unique blend of prebiotic soluble fiber that feeds friendly bacteria”, retails at $50 for a pouch of 15 single-serve sachets

- PhytoPower T – “designed to help the body burn excess fat through targeted microbiome support”, retails at $55 for a pouch of 15 single-serve sachets

- PhytoPower C – “delivers calming chemical compounds through nature’s best calming ingredients”, retails at $50 for a pouch of 15 single-serve sachets

- PhytoPower E – “a healthy, natural way to help stimulate your body and promote healthy energy harvesting”, retails at $50 for a pouch of 15 single-serve sachets

- Next Hydration – “fuels your microbiome with four crucial electrolytes and a proprietary prebiotic blend”, retails at $50 for a pouch of 15 single-serve sachets

- Next Balance – “uses the most potent superfruits found in nature to strengthen, nourish, and diversify your gut microbiome”, retails at $65 for a 750 ml bottle (25 servings)

- Next Detox – “created with three distinct and unique superfood blends which work together to flood the body with antioxidants and help safely remove harmful toxins and prevent further oxidative stress in the body”, retails at $65 for a 750 ml bottle (25 servings)

PhytoPower variants (excluding P84, PhytoPower 1, PhytoPower 2 and PhytoPower X), are available in a bundle pack retailing at $375.

It should be noted that while LoveBiome provides claimed product research on their website, none of the provided research equates to peer-reviewed studies specifically pertaining to LoveBiome’s supplements.

LoveBiome’s Compensation Plan

LoveBiome’s compensation plan pays on the sale products to retail customers and recruited affiliates.

LoveBiome Affiliate Ranks

There are six affiliate ranks within LoveBiome’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Member – sign up as a LoveBiome affiliate and generate 60 PV and GV a month

- Merchant – maintain 60 PV a month, recruit and maintain three Members and generate and maintain 1040 GV a month (min 130 GV from a recruitment leg)

- Builder – generate and maintain 130 PV a month, maintain three Members or higher and generate and maintain 5200 GV a month (min 780 from a recruitment leg)

- Leader – maintain 130 PV a month, maintain three Members or higher and generate and maintain 26,000 GV a month (min 3250 from a recruitment leg)

- Star Performer – maintain 130 PV a month, recruit and maintain four Members and generate and maintain 52,000 GV a month (min 6500 GV from a recruitment leg)

- Elite Performer – maintain 130 PV a month, recruit and maintain five Members and generate and maintain 78,000 GV a month (min 7800 GV from a recruitment leg)

PV stands for “Personal Volume”. PV is sales volume generated via retail sales and a LoveBiome affiliate’s own orders.

GV stands for “Group Volume”. GV is PV generated by an affiliate and their downline (capped at six levels of recruitment).

Direct Product Commissions

LoveBiome pays a commission on the sale of products purchased by directly referred retail customers and recruited affiliates:

- a 5% direct product commission is paid on non-autoship orders

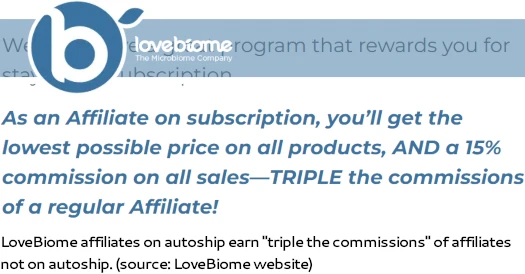

- a 10% direct product commission is paid on autoship orders

Autoship is offered as a monthly order subscription service in exchange for a small discount.

Note LoveBiome’s compensation plan states “subscription must be over $130 points per month to qualify for discount”. Free shipping is also offered on autoship orders over $300.

Pay-to-Play Commission Bonus

LoveBiome’s compensation plan details a 5% commission on “sales from front-line members”. In other words, a 5% commission on product sales made by personally recruited affiliates.

The bonus is available to LoveBiome affiliates who “commit to the Daily 3 System”.

The Daily 3 System is presented as a “budget friendly” bundle of LoveBiome supplements:

The implication appears to be LoveBiome affiliates on a Daily 3 System monthly autoship qualify for the 5% commission bonus.

Residual Commissions

LoveBiome pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

LoveBiome caps unilevel team levels at six. Referral commissions are paid a percentage of sales volume generated across these six levels based on rank:

- Members earn 10% or 15% (bonus) on level 1 (personally recruited affiliates), 5% on level 2 and 2% on levels 3 to 5

- Merchants earn 10% or 15% (bonus) on level 1, 10% on level 2, 3% on level 3 and 2% on levels 4 and 5

- Builders earn 10% or 15% (bonus) on level 1, 10% on level 2, 4% on level 3 and 3% on levels 4 to 6

- Leaders earn 10% or 15% (bonus) on level 1, 10% on level 2, 5% on level 3 and 4% on levels 4 to 6

- Star Performers and Elite Performers earn 10% or 15% (bonus) on level 1, 10% on level 2 and 5% on levels 3 to 6

Leadership Bonus

The Leadership Bonus is a percentage bonus on residual commissions earned on level 6 of the unilevel team:

- Leaders earn a 1% Leadership Bonus

- Star Performers earn a 5% Leadership Bonus

- Elite Performers earn a 10% Leadership Bonus

Note there doesn’t appear to be any qualification for the Leadership Bonus other than rank. This leaves me wondering why the Leadership Bonus wasn’t just tacked onto residual commission rates for level 6.

I’ve separated the bonus percentages from the base level-six residual commission rates (as per LoveBiome’s compensation documentation) just in case I’m missing something.

Dynamic Compression Bonus

Dynamic Compression typically compensates for non-active downlines. That is in order to maximize commissions and bonus, non-active downlines are “compressed” out in favor of still active downlines deeper in the recruitment lineage.

LoveBiome take an unspecified amount of dynamic compression volume and place it into a bonus pool:

All dynamically compressed volume from the entire organization, across all lines, is accumulated into one bonus pool where our most committed leaders will obtain a share.

I’m not 100% on what the compressed volume is (only counted when compression occurs? counted when compression doesn’t occur?), but here are the bonus pool rates:

- Leaders earn a share in a 16% Dynamic Compression Bonus pool

- Star Performers earn a share in a 24% Dynamic Compression Bonus pool

- Elite Performers earn a share in a 60% Dynamic Compression Bonus pool

Infinity Bonus

LoveBiome sets aside 3% of company-wide sales volume and places it into an Infinity Bonus pool.

- Star Performers receive a share in 25% of the pool

- Elite Performers receive a share in 75% of the pool

Go Rewards

LoveBiome’s compensation plan details “Go Rewards”. Go Rewards comprise of “amazing trips, once-in-a-lifetime experiences and

recognition badges”.

Further specifics are not provided.

Income Bonus Champion

LoveBiome’s top weekly income earners from “each region” receive a $100 bonus.

LoveCash Bonus

LoveBiome affiliates who refer three retail customers and recruit three affiliates who also refer three retail customers each, qualify for a $150 LoveCash Bonus.

Rank Achievement Bonus

LoveBiome rewards affiliates for qualifying a Builder for two non-consecutive months (i.e. first and third month), receive a $500 bonus.

LoveBiome pays an additional bonus based on Builder GV production:

- generate 9600 GV a month as a Builder and receive a $500 bonus

- generate 14,400 GV a month as a Builder and receive a $750 bonus

- generate 19,200 GV a month as a Builder and receive a $1000 bonus

For higher ranks:

- qualify at Leader for two non-consecutive months = $2500 bonus

- qualify at Star Performer for two non-consecutive months = $5000 bonus

- qualify at Elite Performer for two non-consecutive months = $10,000 bonus

Joining LoveBiome

LoveBiome affiliate membership costs $25 annually.

LoveBiome Conclusion

LoveBiome’s product line confused me at first. How many variants of essentially the same base-supplement do they need?

After thinking about it for a bit, I appreciated LoveBiome sticking to a niche and covering all possible bases.

We often see MLM companies offer a flagship product with a bunch of “me too” products. This dilutes the focus, resulting in a generic bland offering.

The bottled post-mix was also a decent enough nod to Tahitian Noni’s and Morinda’s flagship juice offering.

As to whether LoveBiome’s products having retail viability, probiotic and prebiotic supplements are pretty common. Do your homework and price-compare.

One potential drawback of such a focused product range is you’re really relying on singular use-case overlap. Either your target customer needs a digestive supplement or they don’t. If they don’t, as a LoveBiome affiliate you don’t have anything else to pitch.

Personally my take on gut biome is if you’re eating properly you don’t need digestive supplements. Your individual circumstance might be different.

Moving on to LoveBiome’s compensation plan, pay to play autoship is a concern.

There are no explicit purchase requirements but LoveBiome markets maximum income potential as requiring autoship. This lends itself to LoveBiome operating as an autoship recruitment scheme.

That is you sign up as a LoveBiome affiliate, go on autoship (which qualifies you for commissions), and then recruit others who do the same. Recruited affiliate autoship generates commissions, with you earning more the more recruited autoship affiliates you have under you.

At the expense of retail sales, this is otherwise known as your classic product-based pyramid scheme.

Unfortunately I can’t say I’m surprised given Kelly Olsen’s MLM history. Autoship recruitment was an issue in Tahitian Noni, Morinda and Noni by NewAge.

The quick fix is requiring monthly PV to be retail sales. I’ll leave it up to you to figure out why that hasn’t been implemented.

The good news is confirming autoship recruitment in LoveBiome is easy. Ask your potential upline how they’re meeting their monthly PV requirement.

It’s more than likely to be on their own autoship. And if that’s the case with no consistent monthly retail sales volume equivalent, that LoveBiome affiliate is running their business as a pyramid scheme.

Approach with caution.

Update 4th September 2025 – LoveBiome was acquired by LifeVantage in September 2025.

Oz.. you’re going to need a new review. Our company, LifeVantage, just announced the purchase of Lovebiome. Everything will become ONE formally on November 1st.

Confirmed, thanks for the update. BehindMLM last reviewed Lifevantage back in 2019 so I’ll queue it up for a review update. Hopefully that’s before November but either way I’ll make a note of the LoveBiome acquisition.