Kuailian Review: KUAI contract investment fraud

![]() Kuailian provides no information on its website about who owns or runs the company.

Kuailian provides no information on its website about who owns or runs the company.

In it’s marketing materials Kuailian represents it is based out of East Europe and Southeast Asia.

An incomplete corporate address in Georgia (the country) is provided on Kualian’s website.

Late last year Kuailian held an “international launch event in Barcelona, Spain.

The two main speakers at the event were these guys:

The guy on the left I’ve been able to identify as David Ruiz de Leon.

De Leon is Kuailian’s CEO and, according to his LinkedIn profile, is based out of Madrid, Spain.

This is where Kuailian is being operated from. Any ties to Georgia, East Europe or Southeast Asia appear non-existent (might be some shell companies).

Possibly due to language barriers, I was unable to put together an MLM history on de Leon.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Kuailian’s Products

Kuailian has no retailable products or services, with affiliates only able to market Kuailian affiliate membership itself.

Kuailian’s Compensation Plan

Kuailian affiliates invest in $100 KUAI positions, on the promise of daily returns paid for a thousand days.

Specific return rates aren’t provided, however Kuailian’s marketing material provides a 320% ROI example.

Investment in KUAI positions appears to be solicited via ethereum. It is assumed returns are thus also paid out in ethereum.

Kuailian Affiliate Ranks

There are fifteen affiliate ranks within Kauilian’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Starter – invest $200

- Advisor – invest $500 and generate $1000 in downline investment volume

- Manager – invest $700 and generate $2500 in downline investment volume ($100 on your first unilevel team level)

- Executive – invest $1000 and generate $5000 in downline investment volume ($200 on your first unilevel team level)

- Director – invest $1200 and generate $7500 in downline investment volume ($300 on your first unilevel team level)

- Regional Director – invest $1500 and generate $10,000 in downline investment volume ($500 on your first unilevel team level)

- National Director – invest $2000 and generate $25,000 in downline investment volume ($1200 on your first unilevel team level)

- International Director – invest $4000 and generate $50,000 in downline investment volume ($2500 on your first unilevel team level)

- Vice President – invest $7000 and generate $100,000 in downline investment volume ($5000 on your first unilevel team level)

- Senior Vice President – invest $12,000 and generate $500,000 in downline investment volume ($25,000 on your first unilevel team level)

- President – invest $20,000 and generate $1,000,000 in downline investment volume ($50,000 on your first unilevel team level)

- Shareholder – invest $30,000 and generate $2,500,000 in downline investment volume ($125,000 on your first unilevel team level)

- Main Shareholder – invest $45,000 and generate $5,000,000 in downline investment volume ($250,000 on your first unilevel team level)

- Ambassador – invest $70,000 and generate $10,000,000 in downline investment volume ($500,000 on your first unilevel team level)

- Global Ambassador – invest $100,000 and generate $12,500,000 in downline investment volume ($1,250,000 on your first unilevel team level)

Note that downline investment volume is counted only across the first ten levels of a unilevel team.

Referral Commissions

Kuailian pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Kuailian caps payable unilevel team levels at ten.

Referral commissions are paid as a percentage of funds invested across these ten levels as follows:

- level 1 (personally recruited affiliates) – 10%

- level 2 – 3%

level 3 – 2% - levels 4 to 7 – 1%

- level 8 – 0.5%

- levels 9 and 10 – 0.25%

Return Match

Kuailian pays out a match percentage of daily returns paid to unilevel team affiliates.

The Return Match is capped to the same ten levels as referral commissions:

- level 1 – 8%

- level 2 – 4%

- level 3 – 2%

- levels 4 to 8 – 1%

- levels 9 and 10 – 0.5%

Note that how many levels the Return Match is paid out on is determined by rank:

- Starter – earn the Return Match on one unilevel team level

- Advisor – earn the Return Match on four unilevel team levels

- Manager – earn the Return Match on six unilevel team levels

- Executive – earn the Return Match on seven unilevel team levels

- Director – earn the Return Match on eight unilevel team levels

- Regional Director – earn the Return Match on nine unilevel team levels

- National Director and higher – earn the Return Match on ten unilevel team levels

Ambassador Pools

Kuailian takes 1.5% of claimed company-wide generated profit and splits it across three Ambassador Pools.

- 40% is placed into the Ambassador Pool 1, split evenly between Main Shareholder ranked affiliates

- 35% is placed into the Ambassador Pool 2, split evenly between Ambassador ranked affiliates

- 25% is placed into the Ambassador Pool 3, split evenly between Global Ambassador ranked affiliates

Rank Achievement Bonus

Starting from the International Director rank, Kuailian rewards affiliates with the following Rank Achievement Bonuses:

- International Director – iPad

- Vice President – iPhone

- Senior Vice President – Macbook Pro

- President – Rolex watch

- Shareholder – “Leadership Trip”

Joining Kuailian

Kuailian affiliate membership is $50.95, payable in ethereum.

Conclusion

Kuailian represents it generates external revenue via cryptocurrency trading.

We combine automated cryptocurrency conversion systems with a machine learning tool that analyzes the market and identifies the Master Nodes that have the best return/risk ratio, executing them automatically.

Kuailian investment contracts are dressed up as “master nodes”. No matter what they call them though, Kuailian are pitching a passive returns investment opportunity.

This constitutes a securities offering.

Securities in Spain are regulated by the National Securities Market Commission (CNMV).

A search of CNMV’s register reveals Kuailian is not registered to offer securities in Spain. This means the company is operating illegally in its home country.

Seeing as Kuailian don’t appear to be registered with any financial regulators, the company also operates illegally worldwide.

Furthermore, Kuailian’s business model fails the Ponzi logic test.

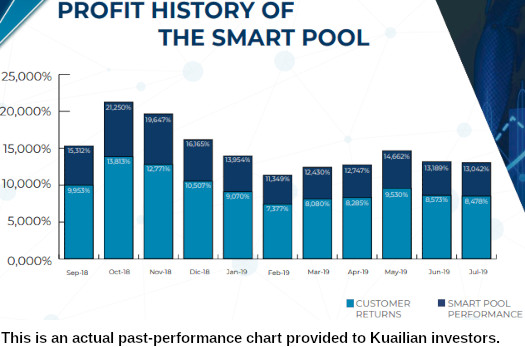

A graph in Kuailian’s marketing materials represents returns topping 20,000% a month being generated.

If David Ruiz de Leon had a bot capable of passively generating anywhere near 20,000% a month, what does he need your money for?

As it stands the only verifiable source of revenue entering Kuailian is new investment.

Using new investment to pay existing affiliate investors a daily return makes Kuailian a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment drops off so too will new investment.

This will starve Kuailian of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the the majority of investors lose money.

I think he’s only claiming 20% a month, which is still an absurd 792% compounded a year.

Their native Spanish is showing: they’re using a decimal comma rather than a decimal point, the practice in most languages other than English, and for some reason give the purported percentages to three decimal places of accuracy. That makes the graph fit with the ROI example in dollars given.

This is a mistake two categories of non-English speakers would never make when writing English: those dealing with money professionally (since there using a comma instead of a decimal point would be absolutely disastrous), and those with any technical knowledge about software (since all programming languages use a decimal point).

Two categories these people purport to fall into.

I don’t understand it anyway: if Ruiz is claiming the 800% a year, how does it fit into his earlier promise of 320% over 1000 days?

And doesn’t he calculate the 320% 1000 day ROI strangely in his “theoretical example”, without taking the daily ROI exponentiality into account?

Math doesn’t seem to be their strong point.

Hi Behind MLM,

We have reviewed your article about Kuailian APP OU and your information is incorrect, I leave some important points about the Kuailian project:

1. Kuailian does not make a return of 20,000% or 893% a year. Currently the benefits produced by the monthly Masternodes are between 6% to 8% monthly (Some cases 10% -12% or 5%, it is variable, or approximately 72% / Annual (Depends on the price of the tokens).

These benefits are based on the ROI of the masternodes, all benefits are paid daily to the users’ ETH wallet, there is no compound interest on the part of the company or an option to the users within the Kuailian customer area.

Kuailian is not an investment contract, it uses a Staking modality and at the end of the 1000-day contract it returns 65-80% of the collateral that is in the Masternodes pool to the users.

You cannot say that the Staking system is a fraud, there are coins with annual ROI and high volumes between 30% and 150% per year. (stakingrewards.com/asset/energi) Large exchanges such as Kraken or coinbase staking with very low risk currencies, Kuailian combines low risk and high risk currencies to give a better profit.

Kuailian has a pool monitoring and its own platform to change the rewards of the Masternodes to Bitcoin / Ethereum.

2. Kuailian is not a Trading / Arbitration / Forex platform.

3. Kuailian is registered in Estonia (Europe) and was previously in Georgia.

4. Kuailian has responded to the CNMV in Spain about its business model and seeks regulation for its product throughout Europe, is a member of the Ethereum Enterprise Alliance (Kuailian is looking for all legal means to regulate its product in Europe ).

If you investigate with expert cryptocurrency lawyers in Europe, you will know that staking is still in a gray area and has no regulation to this day.

That is why Coinbase or Kraken are not licensed for this, the maximum licenses in Europe are for the exchange of Crypto to Fiat Currency for example or custody services.

That is why the CNMV has not alerted about Kuailian, because Kuailian only wants to regulate in some area to guarantee the long-term stability of the project’s Ecosystem participants.

We ask that you please make the correction in your article about our project and if you do not have enough arguments please delete it. We wait for an answer from you.

Kuailian Team

Then you might want to update your own marketing material. Shoot us a comment when that’s done.

Affiliates invest and you pay them a daily return for 1000 days. That’s an investment contract. And a passive contract at that.

Passive investment contract + MLM = securities. You can call the investment contract “masternodes”, “staking”, “daily benefits” or whatever else you want, it’s still a securities offering.

There is no grey area when it comes to securities regulation, irrespective of the investment vehicle (ethereum in this case).

This is again from your own marketing material:

“Conversion” = trading.

Glad to hear the CNMV has been in touch. Hopefully they see through the waffle and take action soon.

Kuailian is also not registered to offer securities anywhere else in the world. Do you plan to address this or keep operating illegally?

hAy GuYs, KuAiLiAn IsN’t An InVeStMeNt CoNtRaCt!

Paging the CNMV to aisle three…

The page references in what follows are to a PDF with marketing slides called Product_compressed.pdf, available on the company website.

You offer us quite a few different claims about what returns you are producing. (I have left aside the fact that there appears to be a difference between the returns generated by what you call your “smart pool”, and what the customers get back. Since you do not make that difference in what I quote above, neither will I.)

(1)

In your comment, you state that your monthly returns are “between 6% to 8%”.

(2)

In the same sentence, you also claim that they’re between between 5% and 12%.

Which is it?

Perhaps you think of “between 6% to 8%” as an average, but an average is a single number, not a range. Such innumeracy is quite remarkable, especially for people selling securities (that that is what you’re doing is clearly established by p. 7).

(3)

You also claim an annual return of “approxumately 72%”. I do not see how this can be derived from either (1) or (2).

But assuming by “6% to 8%” you mean a monthly average of 7%, that’s a compound annual return of 125%. More than doubling your money in a year isn’t bad at all, but it gets even better.

(4)

On p. 10 you show a graph of claimed monthly returns between September 2018 and July 2019. Those show percentages between 11,349% and 21,250%.

Over those 11 months, the total is 163,747%, or an average of 14,886% a month. Since this is claimed to be a monthly return it can be compounded, but I won’t even bother to see what absurd annual number would give.

Why would I, when at such rates I can just invest 1000 euro this way, and already get back almost 150,000 at the end of the month?

Reinvest that for a second month, and I’ve got over 22 million, and after three months, I’ve got over 3 billion. (All that is of course assuming I didn’t make any typos entering the numbers on my calculator.)

(5)

Let’s be gentle, and assume you did indeed make the incredibly stupid mistake I think you made, and used a comma where you should have used a decimal point.

Correcting for your error, and wondering why the hell you give percentages to three significant decimal places, you show monthly returns between 11.3% and 21.3%, for an average of 14.9%. That would still produce an annual return of 428%.

(6)

On p. 11, you provide a “Theoretical Example” of a 1000 dollar investment. Now suddenly you’re generating returns daily, at a rate of 0.32% (of course you write it 0,32%) a day, which it is claimed makes a monthly return of 9.6%.

This is incorrect, if that return is realized on a daily basis, the money earned can be reinvested, and it would be a monthly return of 157%, or 9,842,039% per year.

Which of these incompatible sets of numbers, all based directly on your own material, is the closest to being correct? (That even the lowest of them doesn’t sound remotely plausible is a different matter.)

(1) What kind of registration do you have in Estonia?

(2) Explain how any kind of registration in Estonia is relevant to the approximately 99.983% of the world's population that doesn't live in Estonia.

If you were to break any of the rules your registration requires you to stick to, how would the Estonian regulatory authorities become aware of this, and what actions could they then undertake to put a stop to it?

I wonder about this especially because your company is registered in Georgia, and I somehow doubt that's within the reach of the long arm of Estonian law.

(Not that I think for one moment you are the kind of people who would even consider breaking any rules at all. Almost no people in the general field of MLM are, and especially not in crypto and securities related MLMs.

It's a field pretty much entirely inhabited by honest idealists, wishing to share the use of their magical money-making machines with their fellow man, instead of just profiting from them themselves. But it's only due diligence to consider the theoretical possibility.)

We have reviewed your comments and again we inform you that you act with utmost ignorance, have no proper knowledge about our product nor the technology behind it and are confusing it with fraudulent ponzi / pyramid systems, but we will be kind and help you to educate yourself in the area of POS technology. (Ozedit: Snip, see below)

It doesn’t matter what “technology” you use.

Recycling newly invested funds to pay existing investors = Ponzi scheme.

Those funds can be cryptocurrency, fiat or any other vehicle.

Not registering a passive investment opportunity with financial regulators = securities fraud.

You can set up a Ponzi scheme using whatever technology and terms you want, it’s still investment fraud.

When you’ve registered with financial regulators and provided them with audited accounting, feel free to let us know. Until then, best of luck with the scamming.

Why you have cut the message we left before and only left a first par #8t? That you don’t want people to see the truth? We have left a very extensive message (Ozedit: full of crypto shill bullshit. See below.)

The only truth that matters is Kuailian is offering a passive investment opportunity. Kuailien is not registered to offer securities in any jurisdiction. And that Kuailian thus illegally solicits investment the world over.

I am absolutely not interested in “but muh crypto!” excuses.

I have provided evidence of Kuailian’s investment contracts. I have provided acknowledgement from Kuailien itself that it is soliciting investment.

If your only response to that is “masternodes!”, best of luck with the scamming.

Great work OZ.

Unfortunately this people target uneducated individuals and people thinking they can get rich that easy. If it was that easy everyone would do it.

Keep up the good work.

Thanks for the support!

Hello Oz, excuse me but you can’t make a review about kuailian and don’t mention a single word about blockchain, that’s all it is about! I recommend you to study that part and lots of the questions you ask here will be answer.

All the best.

Sure you can. Kuailian’s business model sees them committing securities fraud. That’s basically the entire opportunity.

But muh blockchain! is not an excuse or justification for securities fraud.

Masternodes are the new cloudmining, well 2018’s anyway.

Ironically, here

facebook.com/476857625784638/posts/welcome-to-the-kuailian-bank-blue-empire-crypto-pool-in-blockchain-30-masternode/1548295771974146/

they are listed one post above BitClub Network.

Apparently less than six months ago they were known as The Blue Empire.

That site’s offline but archived.

web.archive.org/web/20190514163028/https://theblueempire.com/

Miguel Tello? Javier Hermosilla?

Surely we’re getting close to the end of crypto buzz words scammers can dress up their Ponzi with now?

Not by along chalk mate 🙂

Next up I suggest will be schemes themed around DeFi, which will be a scammers challenge.

Here’s a primer (it’s clever stuff actually)

consensys.net/blog/news/2019-was-the-year-of-defi-and-why-2020-will-be-too/

Fuck me. *goes and smashes head against brick wall some more to crypto detox*

Nah, when it comes to pimps, logic has no bearing

HOWEVER they are playing to a smaller and rapidly decreasing number of “victims”

In fact, it’s hard to define most / many of the remainder as true “victims”

i think you should do better research concerning Kuailian, no doubt there are many scams around but Kuilian is not one of them.

Also there is no regulations up to this day regarding POS, (Ozedit: derail link removed)

Gotta love MLM crypto tards running around telling others to do better research, when they’ve done none themselves.

Add “POS” to the list of crypto buzz words that don’t matter.

MLM + passive investment = security. There is no exemption for cryptocurrency, masternodes, blockchain, POS or any other term you want to use.

Kuailian’s passive investment opportunity is the issue here, not the vehicle it’s offered through.

Hi OZ,

I also evaluate Kuailian as a fradulent ponzi scheme, since the is absolutely no transparancy.

They tell you you can see every transaction on their side, but you only see numbers and you can not follow a path to understand transactions which are way different in real cryptocurrency companies.

Not to mention that the “company” operates in Spain but does not pay tax in Spain, nor is registered in Spain nor has any Servers etc.

And they also do not talk about their technology. They try to sell you “masternodes” which is a cheap name for “commission payment”.

You will never see or know any programmer from “Kuailian” because they do not exist and this is all made up.

This is just so wrong on so many levels, but Spain is not the smartest country, that is why it is working so good.

Not to mention that some of the Kuailian guys was in a spanish ponzi scheme once, and seeing him doing it again is kinda funny.

Nevermind, I appreciate your work OZ, oppening people their eyes, because if you see, you can see a cryptocurrency, but if you use your vision, you can see a ponzi scheme company just like Bitconnect and BitClub, etc.

Keep it up, best regards, James

Hello,

This is an interesting read, however why did you cut off Kuailian responses?

I think it is only fair everyone gets the right to fully express themselves and for readers to be the judges.

This isn’t FaceBook, it’s a review. If Kuailien wants to respond they can, to the review.

If they want to carry on like pork chops about “POS technology” and other crypto bullshit, which has nothing to do with securities fraud, out come the snip snips.

Hi OZ,

I think this review will be incomplete without publishing kuailians responses as Pablo said. Let’s know all the shit kuailian has.

Let a man die before you bury him. Just publish their response and let’s help in the final judgement. Unless you want to be a judge in your own case against kuailian.

#publishkuailiansresponse

Kualian are free to respond to the issue of investment fraud. Waffling on about POS technology and the rest of it, none of which has anything to do with investment fraud, isn’t a response.

#waffle=spambin

@oz, thanks for re awakening our thoughts on the hurts of internet fraudsters.

I’ve been a victim of their nefarious activities, it was timely as I just got an invitation to attend a kuailian launch in my local.

Just wanted add a couple to make sure nobody still wonders if it’s worth throwing your money in there.

One of the previuos bussiness of Miguel Tello (one of the co-founders) was warned by the CNMV as a “chiringuito financiero”, which basically means that his business isn’t regulated and is probably a scam.

His company was named BLUEEMPIRE INC. He even still appears as the president inhis LinkedIN.

es.linkedin.com/in/migueltelloconsultornetworker

cnmv.es/portal/verDoc.axd?t=%7B37d919d1-13f6-42cb-9fcc-221588d9b391%7D

As many of you have already said they try to sell a product with a big benefit but arguing that it has none or very low risk.

This unfortunaly is convincing people especially the young, with low education or desperate ones. They never get into actually explaining the supposed technology they have, neither showed any prove of their servers, coders, or code.

Any relevant spanish media has talked about them expect for the digital version of “El Confidencial” where Kuailian payed an article to be published.

As a curiosity they even use bots in YT to dislike the videos that talk don’t recommend the site or say it’s a scam. Obviously little some content creators reccomend because they are already in and want people to use their refferal link.

They brag about being in the EEA which basically means nothing, except for that they pay an annual fee to that consortium and that they operate with ETH.

They also promised an audit from Deloitte but nothing real has been published (and probably will never be published).

Lastly say that this scam is actually working and even a friend of mine invited me to join, so thanks for making this report.

Hi everyone,

At first, thanks for creating this review and for the different comments.

I am interesting to participate to the topic and especially to get the opinion on the following points:

-Legislation

I understand it has been mentionned that Kuailian is an investment fraud due to the non compliance regarding regulation.

Nevertheless, it seems it is not that simple. Kuailian is offering a stacking service inside the POS environnement. And indeed, this kind of service is still a grey area and cannot be considered automatically for securities.

The main reason is linked to the fact that it could be argued that client’s motivation in engaging with the provider (in this case Kuailian) is based on the value of the underlying asset (in this case the crypto) and not the excepting return (in this case ROI). With this argument, staking is not a securities.

There is not a law or regulation so as it is has been mentionned, it is a grey area and the only interesting document I found is this one:

globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/12-the-potential-legal-implications-of-securing-proof-of-stake-based-networks

I am interested to heard your opinon about it but saying directly that Kuailian is an investment fraud seems to be a conclusion a bit too fast.

-Calculation of ROI

I am a bit surprised by everyone saying that a ROI of 5-10% monthly is not possible in this kind of field. In fact, you can check by yourself the ROI of the masternodes online: masternodes.online/

Some like EROS has a annual ROI of 2766% with of course a high risk in term of liquidity. And if you know how to install a masternodes and you have enough money to diversify the investments between masternodes, you can get by yourself a ROI even above 10% monthly with a good ratio risk/benefit.

So here as well, I don’t really understand the argument.

I don’t know if this entity, Kuailian is a scam or not. But in my opinion, your arguments are not correct. On a side note, I have seen in the comments you have deleted answer of this entity and I don’t think it is correct.

Anyway, I am interested to hear your opinion on my above points.

No, it really is. MLM + passive investment opportunity = security.

Securities are regulated the world over. Either you’re registered and providing audited financial reports, or you’re operating illegally.

As for return calculation, they are sourced from Kualian. If you have a problem with the advertised returns you’ll have to take it up with them.

Oz,

I understand you want to protect people and it is really great but in my opinion, in this case, the arguments are not correct.

Once again, I don’t want to talk about the company as I don’t know it. But staking in the POS market is not associated yet to a securities (and it is the same legislation for all compagnies).

Regarding the return calculation, I don’t understand your comment. You were saying in your review it is a Ponzi as such profitabily is impossible. And no it is not the case as such profitabily with masterNodes can easily be reached (of course with an associated risk, like all investments)

MLM + passive investment opportunity = securities. It doesn’t matter how the investment opportunity is set up.

Feel free to provide evidence of “POS market” or “staking” being exempt from securities law in the Securities and Exchange Act (1933).

Staking, POS Market and all the other crypto bullshit might not be securities in and of themselves. But when you offer a passive investment opportunity using them and attach an MLM opportunity, you’re now offering a security.

If that were the case everyone in crypto would be moonlambolulz status. And Kualian wouldn’t need to resort to offering unregistered securities.

Hypotheticals are pointless to discuss. Sure, it’s possible to double your money in bitcoin over a short period of time. That doesn’t mean every Ponzi scheme using bitcoin is all of a sudden legit.

The fact of the matter is unless Kualian registers its passive investment opportunity with financial regulators, you cannot state with certainty what they are doing with invested funds.

All we know for sure is is returns are being advertised and the only verifiable source of revenue entering Kualian is new investment.

I have provided evidence already : globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/12-the-potential-legal-implications-of-securing-proof-of-stake-based-networks

Regarding rentability, there is risk like always but of course it is possible.

Anyway, I don’t want to argue over night. I have just seen your blog is against mlm companies (which I can understand) so your conclusion is already done anyway

The SEC don’t regulate securities law using that website. They regulate securities as per the Securities and Exchange Act.

No regulator on the planet uses that website to regulate securities.

So again, I’m asking you to provide evidence from actual securities regulation exempting “staking”, “POS Market” or any other term you think negates securities law when it comes to MLM + passive investment opportunities being securities.

Not interested in arguing. Facts only.

Regarding your last point, you can easily check it on the blockchain if the revenue come from MasterNodes. You just need the adress and it is public.

If you really want to do the job perfectly, you should ask them the adress. If they refuse, yes you can start to make a conclusion. Otherwise, it can be checked.

But muh blockchain! is not a substitute for legally required audited financial reports.

Thank you for confirming Kualian’s passive investment opportunity is not exempt from securities regulation. You have a nice night now.

But yes anyway I get your point and this company should look for regulation.

I don’t think law is working this way : it should be written in the law otherwise it is authorized. That’s the reason why so many international companies are making crazy instruments for instance just because it has not been written in the law yet.

Or also the reason why for instance you can create new drugs not forbidden by law as it has not been written.

Anyway, yes for sure, nothing replaced audited financial reports and definitevely the company should increase transparency so I understand your point.

What you think doesn’t matter. We’ve covered plenty of cryptocurrency related schemes being regulated as per securities law.

That’s on top of the dozens of securities fraud cease and desists issued to MLM cryptocurrency companies too.

Securities law is well established around the world. MLM + passive investment opportunity = a security.

This was the case prior to cryptocurrency, is the case during cryptocurrency and will remain the case after cryptocurrency. \

Pretending securities law doesn’t apply because fraud is committed using cryptocurrency is folly.

When I say I think, it is a matter of speech.

Everything which is not forbidden is allowed is written in many constitution

There is nothing about cryptocurrency passive investment opportunities being exempt from securities law in the constitution of any country.

I think we’re done here.

Two observations:

(1) If someobody selling anything at all uses the words “grey area” to describe their product’s legal status: run fast, run far.

You can not only be certain it’s illegal, it’s probably an outright scam as well.

(2) There is nothing “grey area” at all about what Kuailian sells. You give them your money, they promise to pay a ridiculously high ROI on that money.

In their own words:

(from product_compressed_en.pdf, p. 12, retrieved from their website just now.)

That constitutes a security in every jurisdiction in the world. Through which activities they claim to generate that ROI (in their case something-something-masternodes) is completely immaterial.

They could be claiming they were making money from selling yurt timeshares in Mongolia, just to name something I am pretty sure isn’t explicitly mentioned in legislation in any country (except perhaps Mongolia), and it would make no difference.

I’d love to hear an explanation of whose money makes up those steady 10% or more.

It’s a zero-sum game, if some people are consistently making profits it means other people are consistently losing that same amount of money.

Who are these idiots, and why do they keep pouring their money into the pockets of the smart people owning these magical ‘masternodes’?

This is an area where the law in many countries is based on a rule that any product that isn’t explicitly allowed is banned.

Laws framed like that exist in a lot of other areas as well. Such as the selling of securities: all selling of securities is banned, unless you’ve got the required permits.

And no, that is not a violation of the fact that things can, by definition, only be illegal if there is a law saying so.

Really? The whole business model and website is about promising returns but people are not buying it for the returns?

That’s like saying people buy cars not because they want to drive them but because they want to possess something that has a volume knob.

Hi Oz,

Great work here, thank you for this analysis. A friend of mine got scammed today by Kuailian 🙁

keep going !

I grabbed some popcorn. Go on please.

Hi there, I’ve been researching Kuailian and came across your review. I have a question regarding the point you mentioned about ‘the lack of a product in Kuailian’s MLM scheme’.

Does the maternode not count as a product?

If each person invests a small portion of the funds used to buy the tokens that are necessary to create a masternode this would count as a product right?

Each maternode wthen verifies cryptocurrency transactions which produces more tokens that are then exchanged to BTC and returned to the investors based on their percentage stake in the initial funds necessary.

I understand and agree with you Oz that the lack of financial regulation is an issue, but does this maternode idea that i mentioned above not count as a product?

If it does, then it means that it passes the Ponzi Scheme test right?

This then means that the only thing Kuailian needs is financial regulation.

I’m asking from a completely unbiased POV, I just want to know if this is legit or not…

Two things:

1. the review states lack of a retailable product. Retail isn’t part of Kualian’s business model so this is true.

2. Selling unregistered securities isn’t a product, it’s securities fraud. That’s on top of wire fraud when you’re running a Ponzi scheme.

Really thanks for all your job Oz. Thanks to all this info I realized this is a scam. Keep working on it to unmask this ponzi scams.

Which crypto platform do you recommend me?

@Cryptoman

Glad you found the information useful but BehindMLM doesn’t provide personalized recommendations.

Hello ,i’m french … kuallian is now registered with an audit? (deloitte)

AFAIK Kualian is not registered with financial regulators anywhere in the world. They continue commit securities fraud.

Hi, I saw that Kuailian is applying for the “Payment Service Act” financial license from the Monetary Authority of Singapore. If Kuailian gets that license from the MAS, it will be regulated by one of the bests central banks in the world.

In that case, Kuailian should be a legal company offering a real product, right?

Does anybody know about the Payment Service Act license and its benefits? Does it ensure that Kuailian is trustworthy?

Thanks.

As above, the Payment Services Act only covers “payment systems and payment service providers”. It has nothing to do with securities.

Also, at least as far as Alexa’s estimates go, Singapore is not a major source of of new investment for Kuailian. The company is primarily soliciting investment from Mexico, Spain and Venezuela.

Kuailian is not registered to offer securities anywhere. Applying for Singapore’s Payment Service Act doesn’t change that.

At best what it might do is help Kuailian launder invested funds through shell companies. Why else would a Euro MLM company scamming Spanish, Central and South American investors take an interest in Singapore?

I think in Spain there is no regulation for POS (Proof of Stake) software services.

Inside Kuailian’s back office, they claim that the Payment Service Act will give their POS software the regulation it needs.

As far as I know, POS software is not yet regulated in any country except Singapore, I think that is why Kuailian can’t get the license in Spain or other countries.

I recommend you a very interesting research called “An Overview of Blockchain Integration with Robotics and Artificial Intelligence” where it says that the POS technollogy adoption is still in its infancy. That is why there is almost no regulatory framework about POS.

By the way, Kuailain is half the way of getting that license (PS act). It will appear in the MAS website.

We could ask the MAS if that license grants any security for investors. But I think the MAS, as a central bank (Best Central Bank of 2019 award), won’t grant any licese to a company which operates a Ponzi scheme or pyramid scam. (you said that “the PS Act provides for regulatory certainty and consumer safeguards”), so the money is safe right?

I think that the company is soliciting investments from Spanish speaking countries because the founders are Spanish and can communicate better with them (they can persuade better to invest, as any other investment company does).

The company is based in Estonia because is one of the cheapest countries to register a company. (Spain for example, is a tax hell).

I don’t know if Kuailain is a Ponzi Scheme or not (only the founders of the company know that, see for example Bitconnect case), but considering the lack of regulation of their activity (only available at Singapore, as it seems) and the willingness to be “regulated”, we could infer that it is an honest company, but we can’t ensure that (many Ponzi companies and scams hide their intentions very well).

If you know of any other country which has regulation reagarding POS activity or Smart contract investments, please let me know, I am very interested in this topic. Thanks for reading!

As previously stated Kuailian’s passive investment opportunity is a securities offering.

Securities are already regulated the world over. And no country on the planet exempt cryptocurrency investment opportunities from securities regulation.

The Payment Service Act is smoke and mirrors.

Kuailian won’t register with securities regulators as is legally required, because that means getting audited and confirming it’s a Ponzi scheme.

Why not? All Kuailian has to do is create shell companies and not mention their securities fraud scheme.

Submit bullshit to MAS, get an irrelevant license and then use it as a marketing tool to solicit more investment.

That seems to be the play here.

Okey, lets accept that Kuailian is a Ponzi.

So, the MAS (Best Central Bank of 2019) is giving licenses to Ponzis scams. Am I correct right?

If that is true, (Ozedit: it’s not, see below. Derails removed.)

I will ask the MAS about Kuailian, the PS act and if it is legitimate to invest in a company with that license from other countries different than Singapore. I will be back with the answer if they reply to my mail.

And Oz, I think that stating that the PS Act is “smoke and mirrors” without doing an appropriate research is a little bit risky (Unless you have talked with the regulators about the issue of course.

I don’t know if you have talked with the MAS, but it seems you haven’t). Try to back up your opinions with data, not with methafors.

A Payment Services Act license doesn’t require examination of Kuailian’s investment opportunity.

They’ll file whatever bullshit with MAS and get a license. There won’t be any filed audited accounting, as per securities regulation.

In that sense MAS aren’t giving Ponzi schemes Payment Services Act licenses, at least not here. They’re acting on what is filed.

I can guarantee you anything Kuailian files with MAS isn’t going to disclose them fraudulently soliciting investment in an unregistered securities offering the world over.

Kuailian getting a Payment Services Act license is not approval of their business model by MAS. Yet you can bet that’s exactly how it’s going to be presented by Kuailian and its promoters.

The issue from day 1 with Kualian has been securities fraud. The Payment Services Act has nothing to do with securities.

Therefore with respect to Kuailian operating illegally or not and within that context only, the Payment Services Act is smoke and mirrors.

I have just sent an email to the MAS, exposing Kuailian case. I will update you with their reply (if they decide to reply, you know).

In the mean time I will deep into the PS act and look for what it grants in more detail.

If you have any new information, I will be happy to see it. Thanks for your interest in this case (I got many valuable insights).

That is just nonsense, and a typical pseudo-argument from people who think the ritual invocation of the magical word “blockchain” puts someone outside existing financial regulations.

A blockchain is just a particular type of database. Like any database, it can contain any kind of information.

Proof of stake is just one way some blockchain systems use to populate a blockchain with one particular kind of information, viz. little packets of data which are only meaningful within the database itself, referred to as tokens.

You can have tokens without “Proof of” anything, in fact I think that’s true of most of them (considering how many centrally-issued ERC-20 shittokens there are alone). It’s all a matter purely for IT specialists, not legislators, or financial regulators.

It is only when some people start assigning a real-world financial significance to tokens, i.e. start exchanging them for money, and also exchanging them among themselves on the understanding that they carry some ultimate value in money, that financial regulations become relevant.

But even that’s got nothing at all to do with Kualian. What they do is very simple. Kuailian takes your money, with the promise of returning it to you later with profit added. (According to their sales material, that money is denominated in US dollars.) That means they’re selling securities, and are therefore subject to all legislation and regulation regarding securities.

That Kuailian also has no discernible economic activity through which they could generate the promised, impossibly high, ROI, and can therefore be doing nothing else than shuffling money around between investors, i.e. is a Ponzi scheme, is really a separate matter. But it is the only reasonable explanation for why Kuailian doesn’t simply apply for a securities license in all the jurisdictions where it operates, which it could easily get it it wasn’t fraudulent.

(Actually, purely from their self-description it could even not be a Ponzi scheme: unless we have external evidence that some investors are actually getting their money with ROI back, they could simply be taking in all the money and keeping it. That would make it something only pretending to be a Ponzi.)

Just why you think a piece of Singapore legislation about payment service providers is in any way relevant to anything Kuailian does beats me.

They don’t even use any normal payment service, instead using Ethereum merely as a money transfer mechanism, for amounts expressed in US dollars, thus bypassing the banking system and all its safeguards against fraud.

If you can find anything from Kuailian showing they’re offering payment services in Singapore, I’m sure everyone here would love to hear about it.

Kuailian use their KUAI product (1 Kuai = 100$). But the KUAI is paid in ETHER for the amount equal to 100$. Kuailian does not operate with dollars, they only use it to make easier to understand for people buying their product. ( is easy to understand the cost of 100$ than X amount of Ether).

Additionaly, I heard that Kuailian is going to operate in Arbitrage systems and they expect to make physical investments too (like real estate).

You can purchase a participation and get the proportional return in exchange (I think that for this kind of new investments they will need additional licenses and regulation, we will see how they manage to get them).

I get it. They don’t operate in dollars. They just set their prices in dollars.

BTW, I think you’ve got the name of that cryptocurrency wrong. In their sales brochure, they call it “Ethereum”, not “Ether” – and I’m sure they, being the cryptocurrency experts they are, wouldn’t get such a thing wrong, would they?

They mention it on only two occasions, both times in a footnote. Those footnotes just make clear that the amounts they want are in dollars, and unaffected by the exchange rate of what they call “Ethereum” to the dollar. (And on p. 12, they accidentally mention “$100 in Bitcoin” as their price.)

I don’t doubt for a moment you’ve heard that.

Additionally, in their own brochure, I’ve read that since April 2019 they have signed “strategic alliances for the creation of a global brand and large-scale distribution”.

And since the fourth quarter of 2019, they have their own decentralized exchange (what is being exchanged for what on that exchange isn’t specified), issue payment cards (credit or debit isn’t specified), and are in some unspecified way present at “points of sale”.

We’re in the second quarter of 2020. Could you point us to some evidence for any of those things existing?

Whether Kualian operates in USD or not is irrelevant to it committing securities fraud.

There is no exemption for cryptocurrency in any country’s securities regulation.

Instead of promising new ruses to keep new investment flowing in, Kuailian should be addressing securities fraud. But they won’t, because Ponzi.

Ether is the token behind the Ethereum blockchain. Ether is the coin and Ethereum is the blockchain (I think Kuailian uses the word “Ethereum” instead of “Ether” to make it easier to understand).

They do not change the amount in dollars, but when you are purchasing the KUAIs, the amount of Ether changes depending on the the Ether/dollar exchange rate at that moment.

In their exchange company, you can purchase ethereum and bitcoin paying with dollars, euros, etc (only by money transfer yet). The exchange is managed by Crosschange International OU and it is named “Kuailian Bank” (That it is not a bank yet, it is just an exchange).

If you go to kuailian website you can find the data for Kuailian bank and its licenses (I think you can only access to Kuailian bank if you are registered in the Kuailian platform).

No country on the planet has an exemption for cryptocurrency with respect to securities law.

Feel free to provide evidence to the contrary. “But muh blockchain!” comments will be marked as spam.

Oz, I was explaining the difference between Ether and Ethereum to PassingBy user (to avoid misunderstandings). I don’t know why you deleted my previous post.

I know this is your blog, but you must understand that if you keep deleting harmless and clarifying information, I won’t keep posting. By deleting information, the blog could lose its credibility because it will be biased towards the exclusive information the administrator wants to show.

Unless what I say is incorrect or does anything to do with the subject in question, I think it should be respected and let other users to see what it is about.

Fair enough, I reinstated the comment.

I saw the first sentence and spam-binned it as a “crypto is above the law” comment. We’ve been getting a few of those lately and it becomes tiresome pointing out to crypto nerds that their funbux aren’t above the law.

I think that cryptocurrency and its products are in a grey area in terms of legislation. We need an international agreement to establish common standards and regulations.

Aaand as soon as I reply, there you go.

There is no grey area. Securities offered in cryptocurrency are not exempt from securities law in any country.

Nobody said anything about regulating cryptocurrency. This is as stupid as claiming USD Ponzi schemes are legal because the SEC doesn’t regulate USD.

MLM + passive investment opportunity = securities offering. End of story.

In this article “SEC chairman explains how it classifies cryptocurrencies as securities” they claim that (Ozedit: snip, see below)

Gonna stop you there. The issue is Kuailian’s passive investment opportunity, which is a securities offering.

The question of whether cryptocurrency itself is a security is offtopic and has nothing to do with Kuailian’s MLM opportunity.

Kauilain MLM opportunity is realted to a “digital asset”, the Kuai, Using a digital asset “Ether”. In my opinion, referring to criptocurrencies legislation is inderectly connected with the Kuai, then kuailian.

Btw, the second part of the post is related to the hability we have to criticize Kuilian’s MLM investment opportunity. I think only experts and regulators have the last word, and assuming for granted that Kuailian is an investment fraud, without a valid official opinion (from a regulator) backing it, is a mistake.

We could say “it could be a fraud” not “it is a fraud” because it has not been demonstrated yet officially by any court (presumption of harmlessness).

The issue is Kuailian’s passive investment opportunity, which is a securities offering.

The question of whether cryptocurrency itself is a security is offtopic and has nothing to do with Kuailian’s MLM opportunity.

Securities regulation already exists. Regulators have been having the last word on securities fraud in the US since 1933.

Today securities are regulated in practically every country. By offering unregistered securities, Kuailian continues to commit securities fraud the world over.

Presumption of innocence applies only within a criminal court, not in reality.

If I cut your head off that immediately makes me a murderer. You don’t have to wait until I’m convicted by a criminal court to call me a murderer.

Kauilian offers a passive investment scheme without registering with the relevant securities regulators, that means they are committing securities fraud.

The reason they are willing to commit securities fraud is because they are running a Ponzi scheme, another type of fraud.

If you are going to hand your money to scammers on the basis that they haven’t been convicted of being a scammer (yet), you are going to lose a lot of money.

It is no different from standing there while I cut your head off on the basis that I’ve never been convicted of murder, ergo I’m not a murderer, ergo I can’t be murdering you. That is literally your argument with “fraud” replacing “murder”.

I try to use legal framework way of thinking in both, reality and criminal court cases (if ever had one).

Why? because In Spain, accusing someone of being a fraud in social media, without the resolution of a court, is a criminal offense. (I saw that Kuailian legal team is acting against those Spanish speaking YouTubers and bloggers who accused them of fraud, scam, Ponzi, etc. Some of them have their videos, channels or articles removed from the web because of that).

That is why I say that the “correct” way of talking about kualian in this context is that “it could be a fraud” not “it is a fraud”.

I get your point Malthusian, I just try to apply the rationale I think is correct (I am not a dogmatic person). But, as I said previously, I am not an expert nor authority, so I could be wrong.

Anyway, I hope the best for those who have purchased kuailian products (there are 30.000 users up to date). Time will tell us the result, because if Kuailian is a Ponzi, time goes against them (specially those who invested lately).

Spain regulates securities the same as everywhere else in the world.

Kuailian is not registered with the CNMV and is committing securities fraud in Spain. There’s no “could be” about it.

Threatening people who point this out with legal action to shut them up doesn’t change the fact Kuailian is committing securities fraud.

Bollocks it is. You are probably thinking of criminal libel. Libel can be a criminal offence in some backwards European countries (in contrast to the US and the UK where libel is a civil wrong only).

However, even in countries where libel can be a criminal offence, truth is always an absolute defence.

Of course Kuailian’s legal team is threatening people telling the truth about their scheme, that’s what Kuailian pays them to do. Standard Ponzi tactics.

“It could be a fraud” is the wrong way to talk about it because that suggests it might not be.

@Cripto Avenger:

I am sure you have some corroboration for this last claim. For starters, the names of these “some of them” would be nice to have.

As to the claim that saying things about Kuailian it doesn’t like could possibly be a criminal offense: criminal offenses are a matter first for the police, and then the judicial authorities, not for any company’s “legal team”.

Prosecutions for defamation in Spain are extremely rare (as they are in other European countries which have such a criminal offense on the books). If one or more were to be launched for defamation of Kuailian, that would be a major, major news story.

Such a prosecution would also of course require those hypothetical Spanish prosecutors to be 100% certain that this obscure company, owned and run by persons unknown, currently claiming to be a shell company in Estonia (I can’t be bothered to look up whether that shell incorporation exists for real, since it’s meaningless regardless), but clearly not based there, and without so much as a genuine office address, a phone number, an email address, or a bank account number (at least none of those things can be easily found on their website), in Spain or anywhere else, isn’t a fraud.

Something tells me your source of information for this is exactly the same as the one which made you write this (comment #55):

So we have a completely irrelevant act (unless the name of that act is deliberately misleading), in a completely irrelevant country (to anyone in the world except the small number living in Singapore), and being “half way” to some kind of unclear license there. That proves Kuailian isn’t a fraud and a Ponzi scheme. Brilliant.

Why do you keep on referring to them in the third person? The fact that you know what is being posted in the Kuailian back office (and repeat it unquestioningly, as if anything Kuailian claims to its customers is established fact) means you must either be a Kuailian customer, or work for them.

So in future, please correctly use “we” to either refer to Kuailian investors if you’re one of them, or to the Kuailian scammers, if you’re one of them.

I know about kuailian backoffice and staff like that because many YouTubers (Jacinto Ribas, Criptoshark News, Jose Torvisco) are Kauilian users and share their backoffice (staking regulation road map, for example) in their videos. (The problem for you is that the videos are in Spanish, so unless you speak Spanish, you are not going to understand what they say).

There is a youtube channel called Money Revolution that has made interviews to Kuailian staff (in Spanish too). (Passingby said that kauilian is managed by unknown people, but in fact the heads of the company are very visible: David Ruiz de Leon, Miguel Tello, Javier Hermosilla). De Leon, for example, shows in its Linkedln that he is director at Kuailian app.

Cinterfor.net removed an article from their website because it was calling kuailian a scam literally (that is why I told you the importance off differentiating between “it is a fraud” and “could be a fraud”). Cinterfor.net now has an article defending Kuailian.

Other YouTubers (SS Conexión, Lamafiasiberiana) are against Kauilian activities and show, for example, how easy it is to apply for the “Enterprise Ethereum Alliance”. Also there are articles like “¿Kuailian estafa?, todo lo que se sabe” that are against kuailian, but they don’t accusse them directly (They use the “it could be a scam” technique, to avoid problems).

I try to use data from supporters and detractors of Kuailian to make my own judgment. All the data that I showed comes from this sources and more (but I can’t post them all because I could not remember the exact names of all the sources. Only the most relevant ones).

Extra: In Spain, The criminal offense about accussing someone to be a fraud without proof ratified by a judge is reflected in the “Código Penal, Libro II, Título XI, Artículos 205-216. (In English: Penal Code, Book II, Title XI, Articles 205-216). (This is for Passingby user who asked me about corroboration).

It is normal for people to accuse Ponzi schemes of being Ponzi schemes and then back down when threatened.

1) Legal threats are scary.

2) Ponzi schemes have a big pool of other people’s money to fund expensive lawyers.

3) If a Ponzi scheme takes you to court, you will have to pay all your own costs even if you win. The chance of a Ponzi scheme paying a costs order is minimal.

4) Most people have nothing to gain and everything to lose from standing up to a Ponzi scheme’s legal threats.

So when a Ponzi scheme starts making legal threats, most amateurs (bloggers, YouTubers etc) will back down.

However, reality doesn’t care whether or not people are willing to stand up for it in court.

The reality is that Kuailian is offering a passive investment scheme, and has no authority to run or market its passive investment scheme in any country, which means it is committing securities fraud.

The reason it prefers to operate illegally is because its returns of 20% (or whatever) per month do not exist and it is a Ponzi scheme.

You don’t need to waste your time accumulating data from supporters and detractors in an effort to persuade yourself that Kuailian is real and will get you rich quick. The fact that Kuailian is not registered with securities regulators and is operating illegally can be trivially verified.

If someone is running a legitimate investment scheme than to say “it could be a scam” is still defamatory.

Hello, I’m french,

I was about to invest in kuailian until I find your blog, which is very interesting and I thank you for your great work. I also red ALL the comments.

I’m not a blockchain expert but I’m wondering, if the investments they receive by users is really invested into the masternodes, these masternodes really secure transactions of blocks, and the rewards earned by the securisation of these blocks are returned to the investors, isn’t it verifiable in the blockchain ? And if it is verified, would it make it disqualified from a Ponzi Scheme?

I understand that Kualian isn’t registered by financial regulators and therefore is operating illegally, but I’m only talking about the Ponzi scheme.

Moreover, I found onm any websites that kualian is registered in the FSA which is the financial regulator in Estonia with the number : 14909553.

Regards,

Sure, the crypto side of generating your return is “verifiable on the blockchain”.

Nobody is withdrawing “masternodes” though. What is the source of actual funds you are withdrawing?

That’s not an Estonian FSA number, that’s their E-äriregister number.

It’s the body with whom you register a limited company, not the financial regulator. It’s the equivalent of the UK’s Companies House, not the equivalent of the FCA or the SEC.

Registering a limited company is not a licence to operate a collective investment scheme. Registering a company in Estonia is cheap as chips and literally anybody can do it.

Classic “look, we’ve got an incorporation certificate (that cost us two tokens off a packet of breakfast cereal)” scam.

Estonia has even lower requirements for registering a limited company than the UK (which is virtually none at all). If your company is registered in Estonia and you are not actually Estonian it is a scam.

THX for the answer,

“If your company is registered in Estonia and you are not actually Estonian it is a scam” Why ? I mean, if its cheaper, i’d it as well.

“Nobody is withdrawing “masternodes” though. What is the source of actual funds you are withdrawing?” Well, that’s what I’d like to know. Do you think we can’t verify this ?

Sure. Kuailian only has one verifiable source of revenue, new investment.

2+2=4

Then now can you prove this? Or is it just what you think.

You can prove it yourself. Name one other verifiable source of revenue that Kuailian has.

I’ll save you some time, there isn’t one.

I’m Spanish and one of my best friends has been scammed by these people, even though I advise him about them.

One of his colleagues has already recovered his investment (due to the referral system) and that convinced him. I hope he can get back as much money as possible (let’s see how longer this last).

On every forum I look about kuailian I see somebody from their team (like the kuailian avenger from this one) defending them.

You don’t need to be so smart to suspect when reading what they say. The same with all the YouTube content created adhoc (a lot of new videos every day, in Spanish, all of them using all those void terms).

At the end people without less knowledge about how crypto works thinks this can be the next bitcoin and they take advantage of their ignorance.

Regarding Spanish law, I’m not an expert but I’m pretty sure this is just a threat and they can do nothing (spanish law says that you need to know that what you are telling is not truth, which is not the case). There is also a lot of content preventing from this scam, but little compared to the tons of promotional content they create every day.

Also, spanish authorities cannot do anything about them, apart from warn people like the CNMV already did.

Hope this ends soon so they cannot scam more people.

How your friend was scammed ? He lost money ?

Hello guys,

First I d’like to thank you for all these insights. I was on the verge to invest in Kuailian when I saw you blog.

Since all these comments have been made and all this talk about scam, a last question remains for me: “Has anyone tried to contact the authorities about what you know?” It is very nice from you to have all these opinions, but till nobody speaks up, we are all as guilty as Kuailian by doing nothing.

One of the poster said he sent a mail to MSA, after reading all the available posts I have not seen any response from Singapore, do you guys have any news?

Thank you for the enlighting of my night and thanks for reading, I ll be waiting for your responses.

Cheers, Take care!

Nobody is responsible for Kuailian committing securities fraud other than those running Kualian.

BehindMLM reports on the MLM industry, we’re not an advocacy group. What our readers do or don’t do is up to them.

The MAS told me that they haven’t granted any license to Kuailian yet (they do not know what kuailian is). In one of my previous posts I wrote that “Kuailian was half-way of getting the license”, but I was wrong.

It seems they were half- way of their roadmap before applying for the license (Kuailian has not applied for the license yet, that is why the MAS has no data about them, sorry for my mistake).

The MAS just sent me the link to summit a request to the Singapore Police Department if I had evidence that kuailian is running any criminal activity in Singapore soil.

Thanks for being honest. You’ll find Ponzi schemes avoid regulators at all costs, for obvious reasons.

This is why I come down hard on any MLM company that opts to operate illegally (not registering their securities offering in this case).

It’s also why roadmaps and such are pointless. When it comes to securities either you’ve registered and provided financial reports, or you’re operating illegally.

I went through all the post. Thanks to all for sharing your valuable knowledge. I wanted to join kuailian. You saved my money.

Hi, I was about to invest in Kuailian when i found this blog, may i ask one question that i am kind of confused about..

Here you state that the only revenue kuailian produce is new investment funds which is then used to pay profits to the previous investors and so on..

But, do the masternode fees not generate an income stream? Are you also saying, they have no AI trading bots that take advantage of arbitrage like their marketing literature states?

Of course, if they are paying new investors with previous investors money it is for sure a scam but if the revenue from masternodes is real and that is the source of income, then the only concern is the lack of regulation yes?

Feel free to provide legally required audited financial reports confirming external revenue.

The only reason Kualian wouldn’t provide these reports and opt to operate illegally is if there was no external revenue.

Any updates on kuailian?

Nope. Kualian is still the same unregistered securities Ponzi scheme it’s been since launch.

Hello! ive invested around 2500$usd 40 days ago and Ive received a ROI of 5.2647% for 1,300$usd on low risk licences and 12.9991% on 1,200$usd without the referral program, this is just with my investment.

I had 10,000usd that i decided to invest in new high risk business models and from all 4 investments I’ve made this is the only one that has this kind of ROI, and also i was very skeptical about criptocurrencies at all.

Im not being supportive of the company or anything, I’m not into referrals, its too much hassle for me. This numbers are only from my investment and i can share all the payments and everything.

Congratulations, you’re today’s winner of our pointless cookie award.

I appreciate your in-depth research but Ponzis are supposed to collapse quickly, aren’t they?

Kuailian has been operating for almost two years and growing its ecosystem day after day. Your review is from January, maybe it’s time to update it and take a look at things from the inside instead of pontificating.

I know some people involved in this project: if they fail it’s because startups may fail (actually, 9 out 10 do), not because it’s a scam.

TomPonzi:

Mein Gott. Let’s not insult everyone’s intelligence on here.

Fine if you are a paid ponzi shill or just have no shame that you are proud to make money off of others loss.

Kuailian has been a scam from day 1 and how long it lasts is just irrelevant and saying that makes you look (even more) stupid.

For example: The Madoff ponzi lasted decades.

Did it fail “because startups may fail” ?

@Tom

Ponzi schemes collapse when they run out of new investment. How long that takes is irrelevant.

Madoff went near two decades.

Sure, here’s your update:

Kualian is still committing securities fraud and running a Ponzi scheme.

Fine, guys, you win.

I’ll talk to you when Kuailian becomes the new Madoff scandal. Meanwhile, enjoy your life.

(Belated reply)

No you wouldn’t, because genuine business owners don’t want everyone to think they are running a scam.

Genuine businesses incorporate in their own country. If they can’t afford it they bootstrap and manage without limited liability until they are big enough to justify the cost / raise the necessary capital.

If an Estonian company is trying to sell you something and you are not Estonian, it is a scam until proven otherwise.

You will find people saying “buh-but Estonia liberalised their company registry to attract tech entrepreneurs, I read an article on Medium”.

99% of entrepreneurs who have an Estonian company are crypto scammers.

Nobody else registers in Estonia to save a few bob. Registering a limited company in your own country is certain to be less onerous than explaining to every customer, lender and bank why your company is registered in Estonia despite neither you nor they being Estonian.

Okay guys, i really read everything that you wrote and all the responses. Its good to have many opinions on where you gonna invest your money. All the inseciurities are good to be written but i gonna tell you my experience.

I invest in KUAILIAN a typical amount and i also invited some affiliates with also typical amount and we getting payed everyday as they promise. I get ETH everyday in my ETH wallet.

So now, you have a person that tried it in real life and it still pay me everyday.Sometimes the solution is to give 100 $ and wait to find if its a scam or not.

If you dont play the game with real money you will always try to find some other experts like the author of the article to give you advise TO SOMETHING THAT HE DIDNT EVEN TRY IN REALITY. There`s no so responsible.

And im not here to say KUAILIAN is the best or something like this but when i invest my money somewhere and the company kept all the promises is not fair to talk about it and you dont even invest 100$ to find out what happen guys.

And something else very important to think about it.

In the past i saw lots of scams and i also be scammed one time but i never see the company to stand here in a site like this and want to tell people what they really do!

If it was a scam or just a typical ponzi company you think that they would be in your site to change people`s opinion or just keep do they scamm? I said that from experience.

I really want to discuss it.

Thank you.

And? Ponzi schemes pay out as long as scammers such as yourself are able to recruit new investors.

No. A Ponzi scheme is a Ponzi scheme because of its business model. You don’t need to invest in a Ponzi scheme to identify one.

I.e. so long as you’re stealing money from people you couldn’t give a fuck if Kualian is a Ponzi scheme or not.

At least be honest and own your thievery. No need for paragraphs of waffle excuses.

Why you called it Ponzi scheme?

You can start invest without being an affiliate! And also you can register without someone’s else suggestion.

Kualian is a Ponzi scheme because new investment is used to pay returns.

Whether you can invest outside of the MLM opportunity is neither here nor there.

How can you be 100% sure about that? Masternode pools make sense to me.

Just curious, maybe you have insider information. I’m here to find out.

Because legitimate investment companies don’t opt to commit securities fraud.

The only time we see this in MLM is when a company isn’t doing what they say they are.

If you want to make claims about MasterNodes, pony up the legally required audited financial reports confirming external revenue is being used to pay Kualian withdrawal requests.

“Masternodes” isn’t some magical fountain of money. The only source of revenue entering Kualian is new investment.

One of the top leaders seems to be this guy. That explains enough when you know what het did in GetEasy one of the biggest scams before the coin scams took off.

google.com/amp/s/geteasyteam.wordpress.com/2015/01/14/matthieu-denys-matt-la-menace-matt-le-bananeur-diamant-vereux/amp/

I know top leaders and founders and that guy is not one of them. Please check your sources and don’t spread fake news.

hi Oz i am a scam from Kuailian .. they brought me friends of 30 years .. today 2nd october 2021 the ponzi pyramid has collapsed.

Thanks for the heads up. I had someone email me about this (in Italian) earlier today and I briefly looked into it.

Still working through the news today, will take a closer look when it comes up.

I wish I had read your posts … they closed a day suddenly after lawsuits started in Spain … the only exit options are to take 50% of the amount invested 10 months ago or continue for 18 months in which they return in installments the amount invested. .

I doubt to get back my 50% and lose the rest .. I think there are no more $ … well I can trust friends .. scammers .. not friends.