Inprexia Review: Bitcoin based adcredit cycler Ponzi scheme

There is no information on the Inprexia website indicating who owns or runs the business.

There is no information on the Inprexia website indicating who owns or runs the business.

The Inprexia website domain (“inprexia.com”) was privately registered on October 11th, 2016.

The official Inprexia Facebook group has one admin, an account bearing the name “Axiantor Inprexia”. This account lists its location as Lisbon, Portugal.

This account was created only recently on January 14th, 2017.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

The Inprexia Product Line

Inprexia has no retailable products or services, with affiliates only able to market Inprexia affiliate membership itself.

Once signed up, Inprexia affiliates purchase cycler positions to participate in the attached MLM opportunity.

Bundled with each cycler position are adcredits, which can be used to display advertising on the Inprexia website.

The Inprexia Compensation Plan

Inprexia affiliates purchase 0.001 BTC cycler positions on the promise of a 0.0014 BTC ROI.

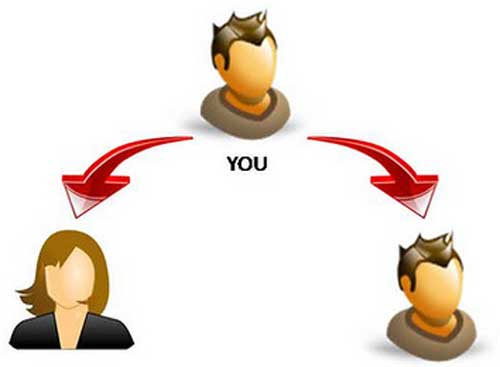

This ROI is paid out via a 2×1 matrix, requiring two positions to be filled for each ROI paid out:

Referral commissions are paid on cycler position purchases by recruited affiliates down two levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 35%

- level 2 – 5%

Advertising Commissions

If an Inprexia affiliate purchases advertising outside of the MLM opportunity, the company pays 7% on level 1 and 1% on level 2 (same unilevel as cycler referral commissions).

Joining Inprexia

Inprexia affiliate membership is free.

Participation in the attached MLM opportunity requires the bulk purchase of cycler commissions as follows:

- Earner – 0.005 BTC (five cycler positions)

- Super – 0.01 BTC (ten cycler positions)

- Pro – 0.015 BTC (fifteen cycler positions)

Conclusion

Despite offering advertising services outside their MLM compensation plan, Inprexia still operate as a closed-loop Ponzi scheme.

Even if Inprexia advertising was offered at a retail level, legitimate advertisers aren’t interested in advertising on Ponzi websites.

The Ponzi nature of Inprexia is evident in the cycler ROI offered. Inprexia themselves bill this as a 140% ROI:

The ROI is funded by subsequent affiliate investment, with two 0.001 BTC investments required to pay a 0.0014 BTC ROI.

Again, Inprexia confirm this in their own FAQ:

No refunds will be made, because all revenues are already shared with all active members and commissions paid to your referring sponsor.

Revenues are 100% derived from affiliates and recycling new affiliate funds to pay off existing affiliates is Ponzi fraud.

Despite the fraudulent nature of the business, Inprexia insist they are legal:

Is Inprexia a hyip, ponzi, pyramid scheme, or illegal?

A. No, Inprexia is not an investment site, nor is it illegal in any way, shape, or form.

Last year the SEC reaffirmed that adding adcredits to a Ponzi scheme does nothing to legitimize the business.

Once affiliate recruitment dies down Inprexia’s cycler will stall, prompting a collapse.

Same as any other Ponzi scheme, a collapse at any given time will see most Inprexia affiliates lose money.

I’ve been following your reviews as I find them a well done research. But in this case I have to say that it was very badly researched. You didn’t talk about all the revenues generated by the advertising services. You only describe what you need in order to call it a ponzi. And the 140% it’s not fixed. Is an up to 140%.

I expect you to do a better job next time.

Everbody loves BehindMLM until we review their particular scam…

That’s because there are none. The only verifiable source of revenue entring Inprexia is affiliate investment.

And I quote…

These are the advertising services:

Login ads

Banner ads

Surf slots

Text ads

Once again you didn’t done your research well. Start by reading FAQ and how it works pages. Looks like you have no intentions of reviewing but a need to call programs ponzis.

This is still 100% affiliate money. And in adcredit Ponzi schemes only a fraction of what is invested in ad packs.

I think you need to do some research chief, the adcredit Ponzi model has been a scam for years.

100% of those advertising services revenues contribute to the up to 140% ROI. And it’s all advertisers money. One of the treat advantages is that you can use those up to 140% to rebuy advertisement and keep adding it to the pool.

Well there’s nothing like signing up and check things yourself and then make the a proper and correct review.

Advertisers in closed-loop Ponzi schemes are affiliates.

Inprexia is an adcredit Ponzi scheme, the review is correct.

There are pure advertisers.

It’s said that you keep stating ideas with checking the truth.

Well I rest my case. It seems you are not discussing inprexia at all.

Legitimate advertisers aren’t interested in advertising on Ponzi websites.

These are all tired arguments from adcredit Ponzis over the years.

closed loop ‘advertising’ is not advertising. period. as proven by the fact you have to lure in suckers with you tube videos and spamming facebook.