I-InsureMe Review: Insurance + pass-up chain recruitment

I-InsureMe operates in the insurance MLM niche.

I-InsureMe operates in the insurance MLM niche.

The company is based out of Arizona in the US and headed up by owner and CEO Paul Langley.

The earliest business history I was able to find on Langley (right) was Clear Business Solutions.

The earliest business history I was able to find on Langley (right) was Clear Business Solutions.

I wasn’t able to pin down when it started but as per a Better Business Bureau listing, prior to 2005 Clear Business Solutions “offered a health care savings plan”.

As of March 2005, the company has ceased this type of business and now offers a service to close sales for coastal vacations business opportunities.

Coastal Vacations is your typical MLM travel niche recruitment opportunity.

According to Langley’s LinkedIn profile, he owned and operated Dedicated Financial Group from August 2006 to April 2014.

An official Dedicated Financial Group Facebook page describes the business as the “developer of the retirement rescue plan”.

An official Dedicated Financial Group Facebook page describes the business as the “developer of the retirement rescue plan”.

Those Facebook posts link to still-available email marketing copy, which reveals Dedicated Financial Group was a financial services MLM opportunity.

Considering Dedicated Financial Group ended in April 2014 and I-InsureMe was launched that same month, it appears I-InsureMe was a rebranding.

Read on for a full review of I-InsureMe’s MLM opportunity.

I-InsureMe’s Products

I-InsureMe markets property & casualty insurance, broken down to home, auto and/or business insurance policies.

Insurance policies are provided by Dickinson Insurance, an Idaho agency that pitches it self as “the insurance specialists”.

Through Dickinson Insurance, offered policies are available in Arizona, California, Colorado, Connecticut, Florida (no HO), Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Minnesota, Missouri, Montana, Nevada, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin, Wyoming.

These locations are taken directly from I-InsureMe’s website at the time of publication.

Seeing as pricing is policy dependent, I can’t provide any retail pricing examples.

I-InsureMe do however state that

70-80% of the time, a person can get better coverage, better pricing, or both on his/her home/auto/business insurance.

I-InsureMe’s Compensation Plan

I-InsureMe’s compensation plan combines recruitment and insurance policy commissions.

Affiliate Membership Tiers

I-InsureMe’s compensation documentation details three affiliate membership tiers:

- Representative – gets paid to refer insurance clients (no MLM)

- Affiliate – paid to recruit new Affiliates and Representative Affiliates

- Representative Affiliates – paid to refer insurance clients and recruit new Affiliates and Representative Affiliates

While policy volume generated by Representatives is paid out via I-InsureMe’s compensation plan, Representatives themselves can’t earn MLM commissions.

Affiliates earn both direct and passed up recruitment commissions.

Representatives earn direct, passed up and residual policy and recruitment commissions.

Insurance Referral Fees

Licensed Representatives and Representative Affiliates earn insurance referral fees.

Insurance referral fees are calculated annually but paid monthly.

- 1.02% is paid on the first $25,000 PV

- 5.04% is paid on $25,001 PV and higher volume

As per I-InsureMe’s compensation material, this equates to 0.085% or 0.42% a month respectively.

Note that when an unlicensed Representative or Representative Affiliate, insurance referral fees are passed up to the first upline Representative or Representative Affiliate.

When an unlicensed Representative or Representative Affiliate becomes licensed, they receive formerly passed up referral fees on their PV.

Recruitment Commissions

I-InsureMe pays commissions on IIM System commissions paid by Affiliates and Representative Affiliates.

A $25 per month commission is paid per Affiliate or Representative Affiliate recruited.

Note that recruitment commissions paid on the first two affiliates recruited are passed upline (to the affiliate who recruited you).

In turn, personally recruited affiliates must also pass up commissions generated by their first two recruits.

Representative Affiliates need only pass up one recruit, as their own IIM System fee payment counts as one pass up.

Residual Commissions

I-InsureMe pays residual commissions to Representative Affiliates via a unilevel compensation structure.

A unilevel compensation structure places a Representative Affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

I-InsureMe caps payable unilevel commissions at four levels.

Residual commissions are paid out based on IIM System fee payments, policy sales or total PV generated by unilevel team level affiliates.

- level 1 (personally recruited affiliates) – unlicensed Representative Affiliates earn the standard recruitment commission rate ($25 a month), licensed Representative Affiliates earn 0.24% of generated PV if it is higher

- levels 2 to 4 – $10 paid on the first policy of affiliates on these levels, or 0.24% of their total PV paid at 0.02% a month

I-InsureMe’s compensation material suggest that, excluding the $25 a month first-level commission, residual commissions are tracked but not paid until a license is acquired.

Note that on level 1, if the $25 recruitment commission is the standard “recruitment commission” detailed above.

That is to say the $25 commission on level 1 isn’t paid out a twice (both as a recruitment commission and residual commission).

Joining I-InsureMe

I-InsureMe MLM affiliate pricing is as follows:

- Affiliate – $50 a month

- Representative Affiliate – $149 a month

I-InsureMe’s Terms and Conditions states these fees are non-refundable.

Note that the above fees are waived as per the following conditions:

- Affiliate fees are waived when a Representative Affiliate sells their first insurance policy

- 50% of the IIM System Fee is waived when a Representative or Representative Affiliate refers $12,500 PV

- 100% of the IIM System Fee is waived when a Representative or Representative Affiliate refers $25,000 PV

For reference, I-InsureMe’s non-MLM membership (Representative) costs $99 a month.

Conclusion

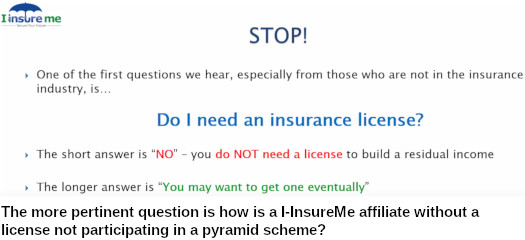

I-Insurance Me’s MLM opportunity contains two distinct business models, both tied to chain recruitment.

The first is the affiliate side of the business. You sign up, pay a membership fee and get paid to recruit others who do the same.

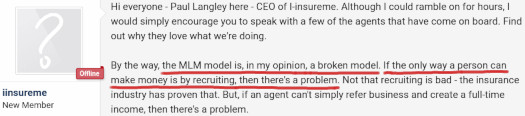

An insurance license isn’t required to participate, and CEO Paul Langley describes this component of I-InsureMe’s compensation plan as “fantastic”.

Nothing is being marketed or sold to retail customers, meaning that from a regulatory standpoint this is a blatant pyramid scheme.

The insurance side of I-InsureMe presents itself as retail-centric. This is done by emphasizing insurance being compulsory (i.e. everyone in the target market needs and will be paying for it).

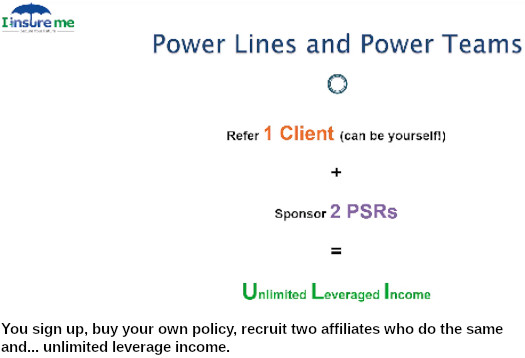

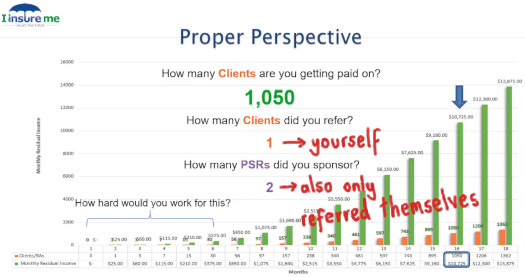

Analysis of I-InsureMe’s own marketing material however suggests the policy component is also rooted in chain-recruitment.

There are no retail client qualifiers in I-InsureMe’s compensation plan. Affiliates are able to sign up, get a policy and focus on recruiting others who do the same.

This is in fact the only insurance income example provided in I-Insure Me’s compensation material, narrated by Paul Langley;

You can earn $10 a month on the first policy that each Representative refers on levels 2 through 4.

And whose policy is that likely to be?

It is most likely to be the Representative’s own home and auto policy.

A big deal is made about insurance being compulsory, which makes it sound like this would be an ideal retail focused opportunity.

In reality the insurance industry is highly competitive, hence why a third-party is tasked with closing sales and providing the actual insurance policies.

In Langley’s own words, I-InsureMe’s “target audience” is “people who pay for home and auto and want to build residual income”.

This alone differentiates I-InsureMe from a retail-centric opportunity. And again, in Langley’s own words, brings affiliate recruitment to the forefront of the policy side of the business;

Everyone focuses on referring one client, probably themselves, and sponsoring just two PSRs (personally sponsored Representatives), who want to do the same.

This isn’t as blatant as the membership fee commission pyramid scheme, but is still a 100% internal consumption model. The FTC has spelled out MLM companies without significant retail sales are pyramid schemes.

I haven’t even gone into insurance licensing requirements, without which all an I-InsureMe affiliate can earn is recruitment commissions.

Another aspect of I-InsureMe I want to touch on is income claims.

Going back to Dedicated Financial Group, here’s how Langley pitched it;

This is literally the “tip of the iceberg”, as there will be some people making $250,000 per MONTH with this.

That was circa 2013. And seeing as, at least as far as I can tell, I-InsureMe was simply a rebranding of Dedicated Financial Group, surely after seven years there’s at least a handful of affiliates making $250 a month?

And of course that’d be on a majority of retail policies across their entire downline?

With respect to I-InsureMe, Langley touts “$10,000+ monthly residual income … in as little as 1-2 years working part-time”.

So again how many I-InsureMe affiliates are there currently? And how many of them that have been with the company for 1-2 years are banking $10,000+ a month?

If I was considering I-InsureMe as an income opportunity, these are the first two questions I’d be asking my potential downline.

Next I’d be asking how many retail policies they’ve sold, and how many of those are still active – weighed against affiliates in their downline who took out one policy for themselves.

What you want to see is a majority swing towards retail policies. Which, for reasons explained above, I’m doubtful you’ll find.

Not withstanding if Langley is misrepresenting potential income for I-InsureMe affiliates, that would be an FTC Act violation.

Given the compensation plan and pretty obvious marketing, I’m confident I-InsureMe in fact has not generated and retained retail policy sales in significant numbers. At least not when weighed against the number of active affiliate policy purchases.

As previously stated, if that’s the case this would make I-InsureMe a pyramid scheme.

There is no defending or justifying the chain-recruitment commissions paid on affiliate membership fees.

The above is from a 2015 Insurance Forums thread. Langley isn’t wrong in his identification of a pyramid scheme. The problem is he hasn’t acknowledged merely having a retail option isn’t enough.

Retail sales need to actually be made and they need to be your primary generator of commissionable sales revenue company-wide.

Update 9th March 2022 – The Clear Business Solutions Better Business Bureau listing cited in this review has been deleted.

I did have a link to the listing but as such have removed it.

Decent overview. He has since updated his company and has added discount cell phone service for $17.50 a month, Identity Theft Protection, and health insurance… he has made his model even harder and more convoluted.

I get what he’s trying to do, but there is very little incentive for actual product only production when you’re only getting a 1.5% – 3.25% commission on each of these services as a product only residual… the money is in the “iInsureMe system” making the $25 a month for recruiting.

Why would someone spend so much hassle getting people in this just for pennies?

If he made this a 2 x 10 forced matrix, that would make a lot more sense for such little commissions. But he wont because he can’t afford that.

It’s hard enough getting people to switch home and auto companies with the double premium payment due each year (or when you switch home & auto companies) when people renew their home & auto insurance.

Even if one only focused on auto insurance, you’re making about $2.70 per retail customer on average (about $1000 a year of premium, and this is at the top of the comp plan making 3.25%).

So about $1.89 after taxes per customer… So I can make a decent living after about 5000 personal retail customers… no thanks.

With the FTC really pushing for retail only as the majority, and the fact that saving people 70-80% on home and auto has a LOT of potential, its very disappointing to see that potential wasted. I had high hopes for this opportunity.

I also found out from someone, even if they became their own customer and then quit the business, you – the sponsor, don’t even get to keep the residual from them STAYIN ON THE BOOKS AS A CUSTOMER! Paul’s agency keeps that.

We know business opportunities have a high drop out rate! Why can’t they keep that residual? They brought in the customer. Disappointing.