ETHPlus Review: Smart-contract Ponzi with ETHP exit-scam

![]() EthPlus operates in the cryptocurrency MLM niche and appears to have launched a few months ago (official Facebook page was created in May 2020).

EthPlus operates in the cryptocurrency MLM niche and appears to have launched a few months ago (official Facebook page was created in May 2020).

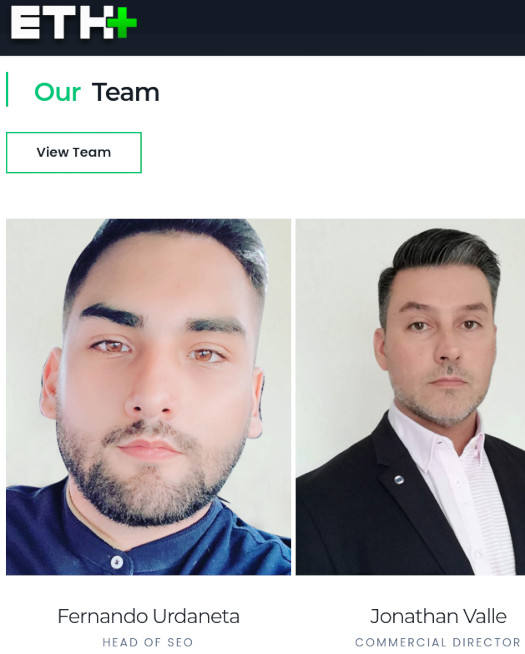

At the time of publication, EthPlus’ website details two executive members; Fernando Urdaneta (Head of SEO) and Jonathan Valle (Commercial Director).

Further research reveals Urdaneta appearing as EthPlus’ CEO in YouTube marketing videos:

Why Urdaneta is attempting to diminish his role within ETHPlus on the company’s website is unclear.

Given the lack of anyone else presented as being in a position of authority within EthPlus, Urdaneta (right) is assumed to be running the company.

Given the lack of anyone else presented as being in a position of authority within EthPlus, Urdaneta (right) is assumed to be running the company.

ETHPlus’ website domain (“ethplus.net”) was registered on April 10th, 2020. “OmegaSquad” is listed as the owner, through an incomplete address in Santo Domingo, Dominican Republic.

This syncs up with Fernando Urdaneta who, according to his Facebook profile, is originally from Venezeula but now lives in Santo Domingo.

Possibly due to language barriers, I was unable to put together an MLM history on Urdaneta.

Read on for a full review of EthPlus’ MLM opportunity.

EthPlus’ Products

EthPlus has no retailable products or services, with affiliates only able to market EthPlus affiliate membership itself.

ETHPlus’ Compensation Plan

ETHPlus affiliates sign up and pay a fee in ethereum. Commissions are generated from this fee, as well as deposits into advertised ethereum investment plans.

Recruitment Commissions

ETHPlus affiliates are charged 0.05 ETH when they sign up. This fee is split three levels upline (reverse unilevel).

In turn, ETHPlus affiliates earn 0.012 ETH from recruits under them down three levels of recruitment.

0.05 ETH ETHPlus affiliate membership fees are paid every 90 days recurring.

Matrix Investment

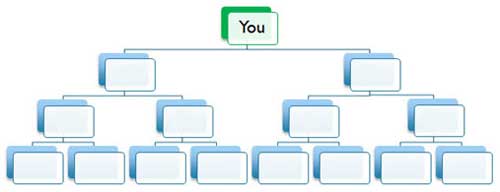

ETHPlus offers investment returns through a 2×17 matrix.

A 2×17 matrix places an ETHPlus affiliate at the top of a matrix, with two positions directly under them:

These two positions form the first level of the matrix. The second level of the matrix is generated by splitting these first two positions into another two positions each.

Levels three to seventeen of the matrix are generated in the same manner, with each new level housing twice as many positions as the previous level.

ETHPlus groups multiple matrix levels together under a single investment entry fee.

- levels 1 to 9 – invest 0.17 ETH and receive 0.01 ETH from anyone placed under you across levels 1 to 9 (1022 positions)

- level 10 – invest 0.35 ETH and receive 0.02 ETH from anyone placed under you in level 10 (1024 positions)

- level 11 – invest 0.8 ETH and receive 0.05 ETH from anyone placed under you in level 11 (2048 positions)

- level 12 – invest 1.6 ETH and receive 0.1 ETH from anyone placed under you in level 12 (4096 positions)

- level 13 – invest 2.5 ETH and receive 2.5 ETH from anyone placed under you in level 13 (8192 positions)

- level 14 – invest 3.5 ETH and receive 3.5 ETH from anyone placed under you in level 14 (16,384 positions)

- level 15 – invest 6.6 ETH and receive 0.4 ETH from anyone placed under you in level 15 (32,768 positions)

- level 16 – invest 15.2 ETH and receive 0.8 ETH from anyone placed under you in level 16 (65,534 positions)

- level 17 – invest 24.5 ETH and receive 1.6 ETH from anyone placed under you in level 17 (131,070 positions)

Positions in the matrix are filled when directly or indirectly recruited affiliates purchase positions.

Note that matrix levels up to 13 are recurring 30 day investments. Reinvestment is required in order to continue earning.

Investment across levels 14 and onward are one-time.

Investment Referral Commissions

ETHPlus pays a referral commission when personally recruited affiliates purchase matrix level positions as follows:

- personally recruit an affiliate who invests in a level 1 to 9 position and receive 0.04 ETH

- personally recruit an affiliate who invests in a level 10 position and receive 0.09 ETH

- personally recruit an affiliate who invests in a level 11 position and receive 0.15 ETH

- personally recruit an affiliate who invests in a level 12 position and receive 0.24 ETH

- personally recruit an affiliate who invests in a level 13 position and receive 0.34 ETH

- personally recruit an affiliate who invests in a level 14 position and receive 0.42 ETH

- personally recruit an affiliate who invests in a level 15 position and receive 0.51 ETH

- personally recruit an affiliate who invests in a level 16 position and receive 0.7 ETH

- personally recruit an affiliate who invests in a level 17 position and receive 1.26 ETH

Joining ETHPlus

ETHPlus affiliate membership is 0.05 ETH every 90 days recurring.

Full participation in the attached income opportunity costs 55.22 ETH, subject to 30-day reinvestment at the lower tiers.

Conclusion

ETHPlus is the latest smart contract Ponzi entry I’m aware of.

The contract itself is a cookie-cutter matrix-based Ponzi scheme, through which early ETHPlus affiliate investors steal the money of those who join after them.

Consequently, expect the usual amount of “BUH MY BLOCKCHAIN!” marketing nonsense, and pretentious insistence that the laws of math don’t apply to cryptocurrency scams.

Consequently, expect the usual amount of “BUH MY BLOCKCHAIN!” marketing nonsense, and pretentious insistence that the laws of math don’t apply to cryptocurrency scams.

As with any MLM Ponzi scheme, once affiliate recruitment slows down so too will new investment.

Being a matrix-based Ponzi, this will manifest itself by way of affiliate matrices stalling. Once enough matrices have stalled company-wide, ETHPlus will collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of investors lose money.

Being an MLM crypto Ponzi, Fernando Urdaneta and friends have to have an exit-scam.

ETHPlus’ exit-scam of choice appears to be the publicly traded shitcoin.

In late June ETHPlus began touting ETHP, a publicly traded ERC-20 shitcoin.

ERC-20 token coins can be set up in 5 minutes and cost practically nothing to run.

When the time comes to stop paying out actual ethereum, expect ETHPlus to start dumping worthless ETHP onto affiliates.

As previously stated, ETHP costs Fernando Urdaneta little to nothing to generate on demand.

As ETHPlus initially spreads, ETHP’s public value will deceptively rise. This is due to the offloading of ETHP onto new investors at inflated prices.

Since June 2020, ETHP public trading value has climbed to $24. While that might sound impressive, bear in mind there’s little to no external trading volume.

When ETHPlus inevitably collapses, its website and Urdaneta will disappear.

This will leave ETHPlus affiliates bagholding a worthless shitcoin, whose public value thus dumps to $0.

Thank you so much for your honest review. You’ve saved me from investing on many ponzies. I don’t know how to thank!

ETHP had a big dump yesterday in the late evening (UK time). Price went down from US$26 to $5.

But seems some investors still have confidence in the token as it bounced back and has consolidated around $20.

It’s pretty easy for insiders to artificially pump up the value of thinly traded shitcoins.

There was another one recently (I forget which) that was pumped up a bit every weekend, only to droop back again during each week.

Eventually the scammers took a runner and the value collapsed for good. Do not be fooled; the price rise is just insider market manipulation. Only the insiders get to win.

shohan Bowala thought this was real. Undercover promoter… caught again.