Envi FX Review: “Automated Capital” trading financial fraud

Envi FX fails to provide company ownership and executive information on its website.

Envi FX fails to provide company ownership and executive information on its website.

Envi FX’s website domain (“envifx.com”), was first registered in 2020. The private registration was last updated on July 23rd, 2022.

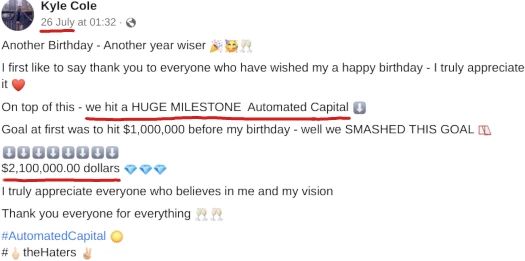

Update 3rd August 2022 – As referenced in the conclusion of this review, one half of the admin team behind Envi FX and Automated Capital goes by “Kyle”.

In the comments below, BehindMLM reader David has outed “Kyle” as Kyle Cole (aka Kyle Raymond Cole and Kyle Raymond):

As of July 26th, Cole (right) claims $2.1 million has been invested into Envi FX and Automated Capital. Within an hour of David outing Cole, Cole deleted the above FaceBook post.

As of July 26th, Cole (right) claims $2.1 million has been invested into Envi FX and Automated Capital. Within an hour of David outing Cole, Cole deleted the above FaceBook post.

As per Cole’s FaceBook account, he’s a “full time entrepreneur” based out of Cincinnati, Ohio.

I can’t confirm it’s the same individual but, back in January, BehindMLM had a “Kyle Cole” show up trying to understand the since collapsed Intelligence Prime Capital Ponzi scheme.

On LinkedIn Cole cites himself as the CEO and Financial Specialist of “Global Ambassadors LLC”.

On LinkedIn Cole cites himself as the CEO and Financial Specialist of “Global Ambassadors LLC”.

Whatever Global Ambassadors LLC was, its website is no longer functional.

A search of the Edgar database reveals Cole is not registered with the SEC. It is illegal to offer and promote unregistered securities in the US.

Cole’s Automated Capital partner in crime has yet to be identified. /end update

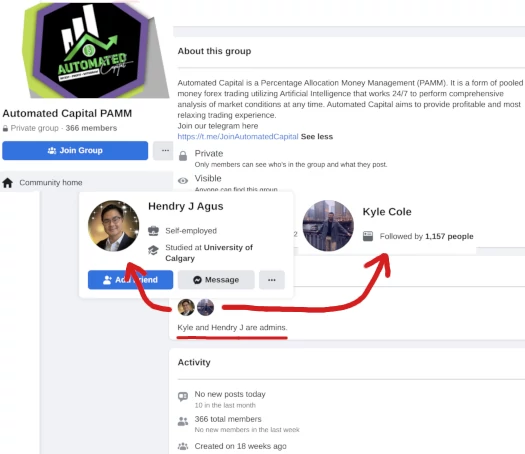

Update 3rd August 2022 #2 – I did some more digging around and believe Kyle Cole’s partner in crime is Hendry J Agus.

This is based on Cole and Agus being the sole two admins of Automated Capital’s official FaceBook group:

The group currently has 366 members and was created in March 2022.

Automated Capital is a Percentage Allocation Money Management (PAMM).

It is a form of pooled money forex trading utilizing Artificial Intelligence that works 24/7 to perform comprehensive analysis of market conditions at any time.

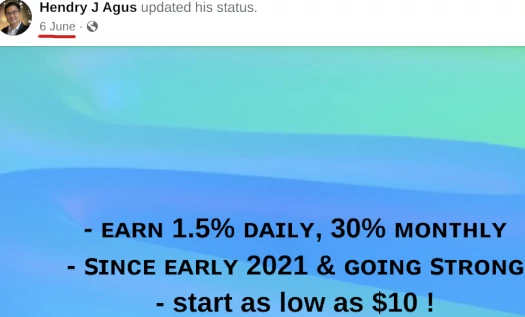

On his own FaceBook profile, Agus promotes Automated Capital as a “legit investment platform” generating “20 to 30% monthly”:

Agus represents he is based out of Alberta in Canada. Agus, like Cole, is not registered with the SEC or Canadian financial regulators.

Agus represents he has been committing securities fraud since at least “early 2021”:

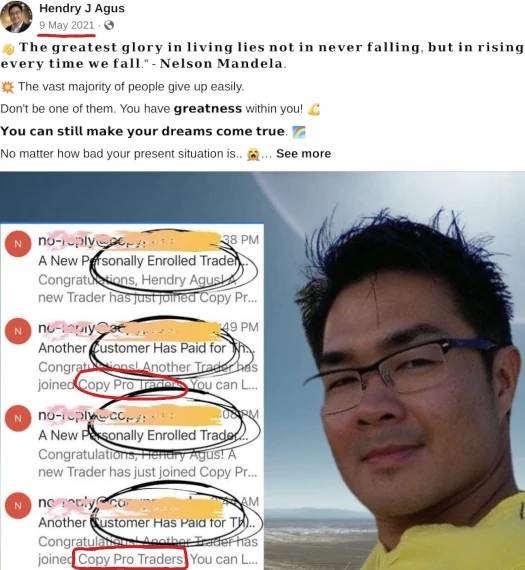

Prior to founding Automated Capital, Agus was promoting CopyProTraders,

CopyProTraders is another MLM opportunity committing securities fraud. As at the time of this update, CopyProTraders’ website was non-responsive.

Before CopyProTraders Agus promoted My Freedom 365, a Ponzi cycler.

In addition to scamming people through fraudulent investment schemes, Agus works as a “systems engineer”. He is also a former Primerica distributor. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Envi FX’s Products

Envi FX has no retailable products or services.

Affiliates are only able to market Envi FX affiliate membership itself.

Envi FX’s Compensation Plan

Envi FX affiliates invest cryptocurrency on the promise of passive returns.

Envi FX’s returns are dressed up as forex trading, with commissions paid on simulated trading volume by recruited affiliates.

Envi FX pays commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Envi FX caps payable unilevel team levels at five.

Commissions are paid per lot trade volume across these five levels as follows:

- level 1 (personally recruited affiliates) – $1.50 per lot

- levels 2 to 5 – 75 cents per lot

A lot is typically 100,000 units of the base currency being traded. How this factors into Envi FX’s simulated trading is unclear.

High Rise and Top Heavy ranked Envi FX affiliates receive higher commission rates:

- High Rise ranked affiliates earn $2 on level 1, $1 on level 2, 95 cents on level 3, 30 cents on level 4 and 25 cents on level 5

- Top Heavy ranked affiliates earn $2.50 on level 1, $1.50 on level 2 and 50 cents on level 3

Note that High Rise and Top Heavy rank qualification criteria is not provided.

Joining Envi FX

Envi FX affiliate membership appears to be free. No minimum investment amounts are specified.

Envi FX solicits investment in various cryptocurrencies.

Envi FX Conclusion

Envi FX’s website overloads visitors with trading information and options. This is an attempt to make the site look like a legitimate trading broker.

All anyone cares about is the passive investment opportunity, which Envi FX dresses up as Percentage Allocation Management Module (PAMM) accounts.

Your first red flag with Envi FX is you don’t know who’s running it. This is not how legitimate companies asking you for money operate.

Your second red flag with Envi FX is solicitation of investment in cryptocurrency to forex trade with.

Your third red flag is Envi FX committing securities fraud.

Envi FX affiliates invest crypto with anonymous randoms, do nothing and collect a daily ROI. Sound familiar?

Envi FX operates a passive investment opportunity. This requires it to be registered with financial regulators.

Envi FX provides no evidence it has registered with financial regulators and filed legally required audited financial reports.

Envi FX affiliates are provided simulated trading reports in their backoffice. This is not substitute for registration with financial regulators.

Rather than operate legally, Envi FX offers up the following pseudo-compliance:

This website is not directed at or intended to elicit citizens and/or residents of the USA.

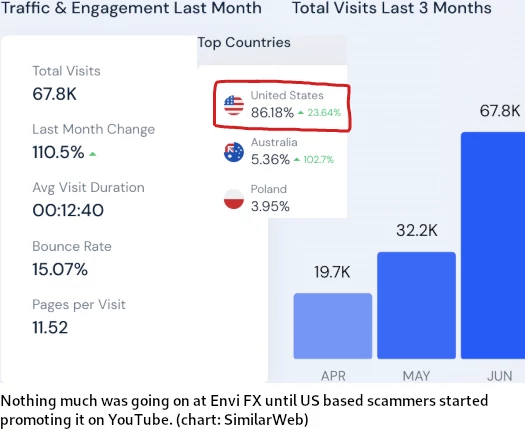

As we can see over at SimilarWeb, this is baloney:

86% of Envi FX’s website traffic originates from the US.

A search of the SEC’s Edgar database reveals Envi FX is not registered to offer securities in the US. They aren’t registered to offer securities anywhere on the planet.

Note that in addition Envi FX committing securities fraud, anyone promoting is also committing securities fraud. Promotion of unregistered securities is also illegal the world over.

Finally, by offering a forex trading investment opportunity to US residents, simulated or otherwise, Envi FX needs to be registered with the CFTC.

A search of the NFA register confirms Envi FX isn’t registered with the CFTC. This is a violation of the Commodities and Exchange Act.

While we don’t know who is running Envi FX, they’re running the scheme and communicating to investors via the “Automated Trading” Telegram group (an MLM company being run through Telegram is another red flag).

While we don’t know who is running Envi FX, they’re running the scheme and communicating to investors via the “Automated Trading” Telegram group (an MLM company being run through Telegram is another red flag).

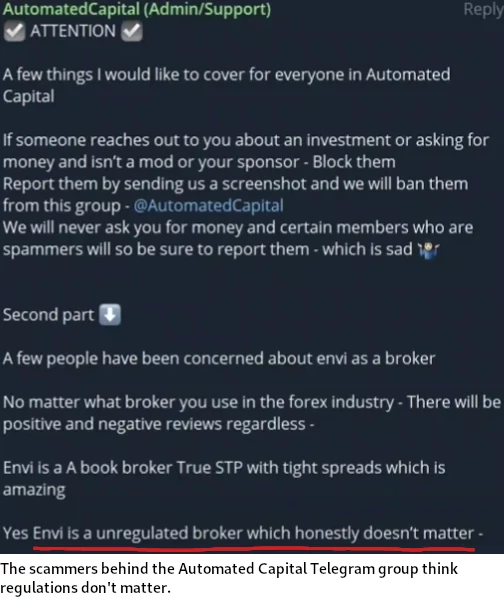

In a message posted to the Automated Trading Telegram group mid July, investors were told Envi FX committing financial fraud “doesn’t matter”.

The admin of Automated Trading refers to founders of the scheme as “Kyle and I”.

MLM companies commit financial fraud and operate illegally because they aren’t doing what they claim to be. With Envi FX, this would be forex trading to generate external ROI revenue.

If Envi FX isn’t trading, what are they doing?

They’re running a Ponzi scheme.

New crypto comes in and Envi FX uses it to pay early investor withdrawals. This is dressed up as trading, complete with simulated backoffice trading reports and lot commissions.

It’s all theater and is completely disconnected from Envi FX shuffling around invested crypto to pay returns.

As with all MLM Ponzi schemes, once Envi FX recruitment dries up so too will new investment.

This will starve Envi FX of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 5th August 2022 – Within 24 hours of this article being updated with company ownership information, the Automated Capital FaceBook group has been marked private.

Update 24th September 2022 – EnviFX and Automated are imploding. Over the last 48 hours investors have lost upwards of 70% in their trading accounts.

Hi, I have some funds in this. I am not saying its not a ponzi as after reading your article i’m really not sure.

But how do you explain the live trading information you can see on: myfxbook.com/members/KyleCole/automated-capital/9550857

they seem to be doing actual trading.

1. MyFXBook stats can be easily faked.

2. MyFXBook is not evidence of external revenue being used to pay withdrawals.

3. MyFXBook is not a substitute for registering with financial regulators and filing audited financial reports.

Looks like the Kyle who runs this is Kyle Cole. nolink:facebook.com/kyleraymondcole. He posted last week bragging that $2.1 million has been deposited so far.

Looks like he promoted Forex Entourage in 2016, but can’t see his posts between then and now to see what else he has been involved with.

Thanks for that. Managed to capture the evidence before Cole deleted it (~30 mins after you left your comment).

Silly Kyle, you can’t delete securities fraud.

And anyway, why would you have to delete boasting about millions invested if you were trading and everything was above board?

You know how this ends…

Did some more digging myself and looks like Hendry J Agus is the other half of Automated Capital.

Article updated to note Automated Capital FaceBook group has been marked private.

Silly Kyle, you can’t hide securities fraud.

I’m unrelated to the targets of your article, but I’ve been digging into your claims in your article and comments, and here’s what I’m finding:

CLAIM #1:

Really? Please provide a live link (not just a screenshot) of an account under the myfxbook.com/members domain, showing fake stats. Since this can be “easily done”, I don’t expect this will take you much time.

CLAIM #2:

Again, since you appear to be an expert on how MyFXBook works, please explain how a live PAMM account with a $6 million investment balance with over $1 million in withdrawals is NOT evidence that the invested money wasn’t used for those withdrawals.

CLAIM #3:

No one is claiming that it is. EnviFX and Automated Capital make endless warnings about the high risk nature of Forex trading, and further warn investors not to invest money they can’t lose.

CLAIM #3:

How is it a violation of this act? Per the US SEC,

Further, since EnviFX provides their address as one in the nation of St. Vincent and the Grenadines, a quick search through the Financial Services Agency website (svgfsa.com) for the country of St. Vincent and the Grenadines, confirms that EnviFX is registered there.

A quick look through the same website confirms

The website further states

The website also states:

Since EnviFX is open about the fact that they are unregulated (as you show above), since they make their off-shore address public on their website, and since they continually warn investors that their investments are at high risk, what is it exactly that they are doing that you are claiming is illegal?

I would agree that forex trading is risky (they admit this), but I fail to see any illegal activities. Enlighten me.

https://behindmlm.com/mlm-reviews/intelligence-prime-capital-review-boris-ceo-ponzi-scheme/#comment-448183

I feel like this is self-explanatory? You’re asking me to prove a negative.

Without legally required audited financial reports, you can’t tie the source of withdrawal funds to trading.

There’s only one reason a company would hide this information and not operate legally: The source of withdrawal funds isn’t from trading, at least not wholly.

We’ve seen this time and time again with every MLM forex scheme busted by the CFTC.

Yet here we are.

If you’re running an MLM company claiming to generate revenue via forex trades and soliciting investment from US residents, you need to be registered with the CFTC through the NFA. There are no exceptions to this.

Admitting you are operating illegally doesn’t legalize illegal conduct.

Kyle Cole deleting an incriminating FaceBook post and marking the Automated Capital FaceBook group private within hours of evidence being collected on here, isn’t conduct of a legitimate company.

It’s a pointless after-the-fact attempt to hide now documented ongoing illegal conduct.

This isn’t a live link of myfxbook.com, (Ozedit: you asked for a link on FXBook fraud, you got one. Ignoring the fact that it’s easy to fake FXBook doesn’t make it go away)

Not true at all. After Dodd-Frank, it now costs TENS OF MILLIONS of dollars (Ozedit: lies removed)

And I proved to you that that is NOT the case. Straight from the SEC and the Commodities Exchange Act itself: (Ozedit: derails removed, see any CFTC MLM forex fraud case)

Just so you’re aware, the so-called “incriminating” post announcing $2.1 million raised is publicly available in the Telegram group (Ozedit: doesn’t change the fact incriminating evidence was deleted.)

Bottomline, your entire argument is: (Ozedit: derails removed)

Disingenuous Ponzi scammers are the worst.

1. You asked for info on MyFXBook fraud, you got it. From another MLM company pulling the same scam no less.

2. Ponzi scams don’t leave up their MyFXBook bullshit when they collapse. For obvious reasons.

3. NFA membership fees are here:

nfa.futures.org/registration-membership/dues-revenue-structure.html

Registering with the NFA costs a few thousand dollars.

And anyway, regardless of how much it costs, “waaah it costs too much” is not an excuse to operate legally.

And you are still full of crap.

This is from the complaint of a recently busted MLM forex scam, EminiFX:

And this is from the associated press-release:

cftc.gov/PressRoom/PressReleases/8527-22

MLM + forex trading = register with the CFTC or illegal.

was deleted within 30 minutes of it being made public here. End of story.

EnviFX/Automated Capital is operating illegally, is not registered with financial regulators and is a scam.

This is not the place to peddle uninformed bullshit in an attempt to defend fraudulent conduct.

No, this is the place to call someone guilty when you have zero evidence. (Ozedit: spambinned for failing to address facts in #10)

MLM + securities fraud + commodities fraud = Ponzi scheme.

See you when EnviFX/Automated Capital inevitably collapses, or the CFTC shuts it down.

No, I preemptively don’t know how yOu CaN gEt YoUr MoNeY bAcK.

I can confirm that Kyle and I USED to be friends. I even started to work alongside him as a trader when he was running a PAMM called SuperbangPAMM on the Vantage FX platform.

It was going ok for about 2 months and then all hell broke loose. First the “other traders, did the group dirty.” Then it was just Kyle and I trading.

Then Kyle took absolutely ludicrous positions which cost the PAMM dearly and led to MASSIVE losses. When I confronted him about it he rather abruptly stopped talking to me and would not respond to any messages whatsoever.

Do not trust whatever he has his name attached to. You will absolutely lose ultimately any money you put in that you aren’t able to withdraw.

And Kyle, if you by chance happen to come across this. Be a better human. Stop conning people and most certainly stop trading.

bUt AuToMaTeD cApItAl DiD 9.98% yEsTeRdAy! Sounds like the inevitable blow up is going to be epic.

Haha yup. Like I said any money you can get out, do it. Cause you’ll lose everything else.

@BigBert

Would you be willing to give an inside look into the operations of that previous failed PAMM?

1. Were legitimate trades actually taking place?

2. Were any fake trades added to the ledger?

3. Was any manipulation done to what was reported to myfxbook?

4. Were newly invested funds used to attempt to hedge/save previous bad trades?

5. Was the PAMM in any way being run as a ponzi scheme?

Hey David,

Not a problem at all.

1. Yes legitimate trades were taking place. We would use a trade copy software so that the trades from my account were copied into the pamm as well. Later on Kyle said he would give me the login details of the pamm due to “technical issues” of my trades not being copied.

2. To my knowledge, no. I could see my trades being copied over just fine.

3. Again, not to my knowledge. Over time garbage trades started happening from Kyle’s end.

4. All the time. This is what led to Kyle taking really idiotic position sizes especially in gold.

5. At first no. Towards the end when he ghosted me I always suspected. The reason for initially no is because people would just deposit through Vantage FX platform. Later on crypto deposits were allowed so I speculate that he might have given a wrong wallet address to people but I don’t have any direct evidence of this..

If anyone would like to see the conversations I had with him feel free to hit me up on telegram or Facebook.

@RobertTyrer – Telegram

Rob Tyrer – Facebook

@BigBert

Thanks for all of that!

This time around, they seem to constanting be touting software and algorithms that are responsible for the trades.

Do you think they’re still trading manually and that this is a front, or that they’ve switched to using bots?

Any idea from your history with Kyle which bots they might be utilizing?

It sounds like he doesn’t have any actual trading credentials that justify him managing this amount of money. But would also be crazy if he’s just hooking the PAMM up to some commercially available software.

No problem.

My best guess would be that they’re using bots UNLESS he’s actually found consistent, profitable traders but my opinion is that this is unlikely.

I would bet bots are being used either that are commercially available or he’s developed some custom bot (which I hope to dear baby Jesus aren’t based on his trading style).

I’m glad I found this as I was considering starting with AC. Thanks for taking the time to post!

The accounts are in the weeds at the moment, not good for anyone that joined recently.

Update:

I want to clarify a couple things.

1. I was also placing bad trades at the time which contributed to the lost money as well.

2. Since posting in here I have finally got in touch Kyle and we’ve made up.

3. I’m looking at joining Automated Capital to get some first hand experience. This will be with money that I can afford to lose.

–>

Ruh-roh…

I hope by “made up” you don’t mean Kyle paid you off with money he’s misappropriated through Automated Capital.

@Robert

That is certainly a sudden flip, especially on a day that it looks like the trading account is 21% in drawdown based on the myfxbook.

What did he say that suddenly made you 180 into thinking he’s a capable trader qualified to manage millions of dollars safely?

Haha no. Absolutely zero money was paid to me, offered to me or even talked about.

When we were speaking he said he doesn’t have time to trade himself and instead has partnered with a couple developers to build a custom software to do the trading.

What piqued my interest is how he was describing how the software operates. For someone such as myself who has bought many bots before, suffice it to say that his software is intriguing enough for me to take a chance again.

I approach this with 1. Money I can literally afford to lose and 2. Cautious optimism. Time will tell where this leads…

Thanks for at least confirming that much.

Not on the regulatory front. Securities fraud is illegal.

per Rory Singh, who does scam reviews on YouTube, Hendry J Agus is now attempting to distance himself from Automated Capital – removing Facebook posts, saying he isn’t involved, etc.

The trading actually seems to be going good at the moment (for now..), so wonder what caused his sudden decision to eject.

Still fully expect this to crash either way, but does he know something the members don’t?

Can’t say for sure but it could be as simple as Agus cashing out and hoping he escapes a securities fraud lawsuit if the SEC comes knocking.

Automated Capital has now a $25,000 smallest investment. Looks a little weird. If it was a real trading platform in good order then would they not keep accepting the smaller investments?

IF IT WAS A PONZI SCHEME then this would be a logical step to increase the base investment, to pay every one out. Now it could be a Hybrid scheme PONZI + BOT + TRADING — who knows.

Also, with AI trading the “Traders” take on a different role, they have to take up the trades that the AI messed up, and a lot of people claiming AI actually have just a “BOT” running.

True AI is very very very expensive. Just having BOTS is very true if the MT4/MT5 platform is in use, that platform started “BOTS” or automatic trading for the general public.The Tandy Radio Shack, Z80 [microprocessor] Computer was the first to auto control the Gold Market.

Also the jobs of “Lawyers” is at risk from AI. Contract/ Law documents make up a fair percentage of the work, a recent test claimed that a “Law AI” went over a large contract and found 91% of the errors. It took 3 lawyers three days to finish and found 83% of the errors, it took the AI 1 hour.

That is the difference between AI Trading and Algorithm Trading.

The benefit of legally required audited financial reports is consumers don’t have to guess.

If an MLM company offering a passive investment scheme isn’t registered with financial regulators, they’re not doing what they claim to be.

hi terry, This automated capital has 3 or 4 tired investments[Gold, Platinum, Diamond etc]. Each one has a different fee structure and minimum investment requirement.

What you are referring to as 25000 minimum I think is one such tier.

Update:

This is now a complete shit show, the accounts are in meltdown with large losses.

Paging Robert Tyrer to aisle 3…

And this is why you never, EVER invest more than you’re comfortable losing.

Yeah that’s great and all but can you confirm the losses?

Presently hovering around 30% loss.

Thanks for the transparency. Will continue to monitor.

They made tons of GBP/USD trades a few days ago thinking USD would go up when the Fed announced an interest rate hike.

The opposite happened and the whole fund is being throttled.

Looks like an epic collapse. The Myfxbook is a sea of red, with anyone that joined recently down ~70%. Fund overall has lost ~$5 million, not counting what Kyle has taken as management and performance fees.

I think this is a good reminder why securities laws exist in the first place. So that random people aren’t allowed to trade millions of dollars of other people’s money with no clue what they’re doing.

Automated Capital used the buzz word “Equity Protector”, making it sound like something special their system had that would protect from loss.

Really all it did was close trades (locking in losses) when drawdown got too large.

Clearly not revolutionary and not anything that could protect against a string of bad trades, as drawdown would just be hit again.

These systems that urge people to not pay attention to their equity and only focus on their balance are preying on people that don’t understand that equity is what really matters.

Closing out small winning trades for “profit” while letting lovers ride until they cause massive damage isn’t profiting.

For anyone reading: If the sum of your open trades + closed trades is negative, then you’re down money. Simple.

Don’t think this falls into the normal ponzi scheme category, but definitely falls into people being dumb enough to trust no-name traders who are doomed to fail with their money.

Putting an article together. Will be out soon.

Thanks for this review because I was almost going to join this scam.

There are so many scams out there. Is there anything legit regarding working from home??

Anything you can legitimately do for money remains legitimate if able to be done from home.

Any further developments on this?I am told the fund /trading has not ceased.

At 20% to 30% a month since early to mid 2022 and then the first major blowup in Sep 2022, if there’s no Automated Capital bajillionaires by now then you have your answer.

If your still looking for Kyle an his shady ways look on fb he’s been dumping big earnings into fb streamers like Spartacus.

I’ve seen seen 5k to 6k in one stream today he dumped 495k stars to equivalently equal close to 5,000$ on a streamer named gloryjean. all on fb and he does these dumps daily.

I joined 6 months ago via EnviFX and i ended up being $1300 down so I pulled out as I thought they wasn’t that good losing me $1300.

I found them on TG and watched it for a while before I committed but wishing I hadn’t after the loss I took.

It’s now Sunday the 26th of March and I still watch their TG as I have never been 100% sure about if they were actually trading or not. But after reading this article I’ve come to the conclusion that they are nothing more than a scam.

That and a comment I saw in their TG which made me think WOW no way did they just say that. It was like they wasn’t bothered that they lost money like a oh well that’s fortex trading for you.

Anyway they’re still going strong it seems I hope people stop putting there money into it as I don’t think there is any website that does trading of any kind that is 100% legit out there. None.