E-Estate Review: Boris CEO MLM crypto Ponzi

E-Estate fails to provide verifiable ownership or executive information on its website.

E-Estate fails to provide verifiable ownership or executive information on its website.

E-Estate’s website domain (“e-estate.co”), was privately registered on September 9th, 2024.

While E-Estate does provide a list of corporate executives, none of them are real people:

Instead E-Estate’s co-founders, Brandon Stephenson and Mike Hamilton, appear to be robo-dubbed actors or AI-generated avatars.

For Brandon Stephenson, if we compare a September 6th E-Estate marketing video with one from April 9th, we find completely different AI-generated voices used.

I suspect this video evidence will disappear shortly after this review is published. I’ll leave an inline update here when that happens.

We can also observe the obvious use of AI in E-Estate marketing videos featuring serial promoters of MLM Ponzi schemes:

![]()

It’s also somewhat telling that E-Estate’s co-founders only feature in solo marketing videos. Surely by now they’d have made an appearance on these promoter videos?

To aid with deceiving consumers, E-Estate has created fictional digital footprints for its co-founders.

Brandon Stephenson only began posting on his FaceBook account on January 28th, 2024 – a few months after E-Estate’s website domain was created.

E-Estate represents “Brandon Stephenson” is founder of the Association of Real Digital Realtors.

The Association of Real Digital Realtors is set up on the website domain (“association-rdr.com”). The domain was first registered in 2020 but it’s private registration was only recently updated on March 31st, 2025.

Through the Wayback Machine we can see the Association of Real Digital Realtors’ domain was dormant until the current website was uploaded in or around February 2025.

The Association of Digital Realtor’s website PDFs (“terms and conditions” etc.), were created in December 2024.

This suggests the domain was acquired by the scammers running E-Estate sometime after E-Estate’s own website domain was registered a few months prior.

Despite only existing as a website for a few months, on its website the Association of Real Digital Realtor’s falsely represents it was created in 2020.

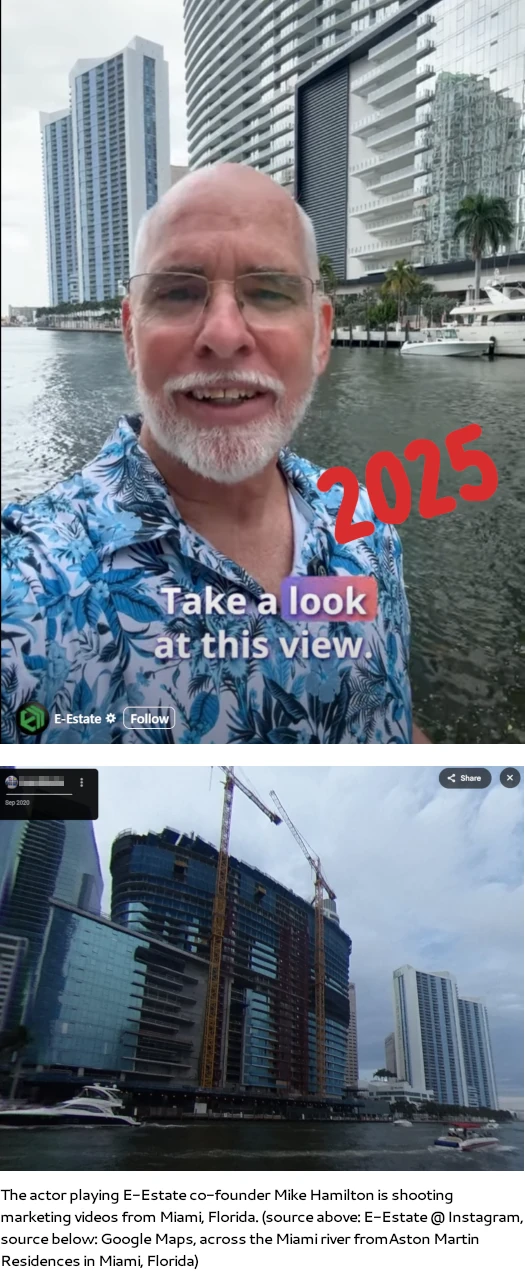

“Mike Hamilton” appears to be a US resident residing in Florida. Marketing videos shot by Hamilton on a cell phone are filmed with a horizontal reverse filter at the mouth of the Miami river:

Note the Aston Martin Residences are still under construction in the Google Maps section of the image above (circa 2020).

As an additional aside, you can clearly see the Mike Hamilton actor’s eyes reading a script in each video he features in.

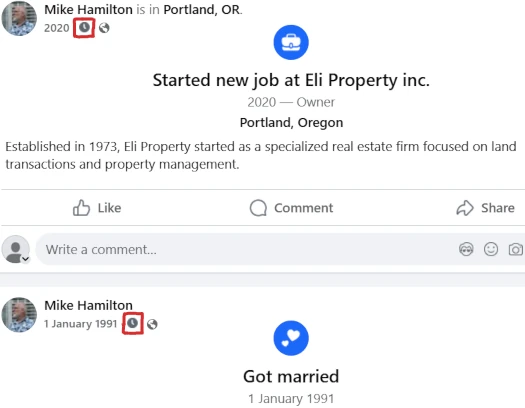

Like Stephenson, E-Estate created/purchased a FaceBook profile for Mike Hamilton in December 2024.

We can see the two posts before this date, have been retrospectively added (probably in December 2024), as denoted by the clock symbol on both posts:

E-Estate represents Hamilton is owner of “Eli Property Company, Inc.”. A website has been set up for Eli Property Company on the domain “eliproperty.com”.

The domain was first registered in 1998 but its private registration was last updated on September 6th, 2024. This is three days prior to E-Estate’s own domain being registered.

Again through the Wayback Machine, we can see the Eli Property domain was for sale until purchase in late 2024.

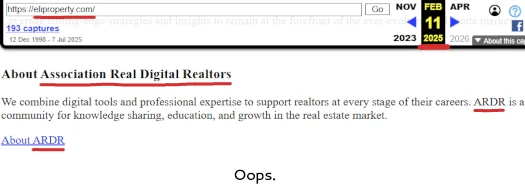

In February 2025 The WayBack Machine captured what appears to be a hosting error:

As above, E-Estate’s scammers appear to have mistakenly uploaded the Association of Real Digital Realtor website content to the Eli Property domain.

The current Eli Property website domain went live sometime between late February and April 4th, 2025.

The Eli Property website PDFs were created on the same date as the Association of Digital Realtor website PDFs, suggesting it was a batch job.

Despite again only existing for a few months as a website, the E-State scammers falsely represent Eli Property “started” in 1970. Eli Property’s first website was purportedly “launched” in 1993. This is patently false.

While the actor playing “Mike Hamilton” appears to be a Florida resident, Boris CEO schemes are typically run by eastern European scammers (Russia, Ukraine and/or Belarus).

This could tie in to the use of an AI robodub to mask the accent of the Brandon Stephenson actor. It would also explain why Stephenson and Hamilton don’t make a joint appearance in the same room in any of E-Estate’s marketing videos.

One final red flag with E-Estate is the representation it is based out of Panama.

While it’s unlikely E-Estate has any actual ties to Panama, it should still be noted the country is a scam-friendly jurisdiction with lax regulation.

We’ll go over E-Estate’s regulatory compliance failings in the conclusion of this review.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

E-Estate’s Products

E-Estate has no retailable products or services.

Promoters are only able to market E-Estate promoter membership itself.

E-Estate’s Compensation Plan

E-Estate promoters invest USD equivalents in cryptocurrency.

This is done on the promise of advertised passive returns, across five real estate themed investment tiers:

- Apartments – invest $117 or more and receive 0.41% to 0.61% a day

- Houses – invest $480 or more and receive 0.46% to 0.66% a day

- Villas – invest $3120 or more and receive 0.51% to 0.71% a day

- Tourism – invest $6740 or more and receive 0.56% to 0.76% a day

- Commercial – invest $10,270 or more and receive 0.61% to 0.81% a day

All E-Estate invest tiers expire after 18 months, after which 10% is promised annually.

The MLM side of E-Estate pays on recruitment of promoter investors.

E-Estate Promoter Ranks

There are ten promoter ranks within E-Estate’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Rank 1 – generate $500 in downline investment volume

- Rank 2 – generate $3000 in downline investment volume

- Rank 3 – generate $10,000 in downline investment volume

- Rank 4 – generate $25,000 in downline investment volume

- Rank 5 – generate $50,000 in downline investment volume

- Rank 6 – generate $100,000 in downline investment volume

- Rank 7 – generate $200,000 in downline investment volume

- Rank 8 – generate $400,000 in downline investment volume

- Rank 9 – generate $700,000 in downline investment volume

- Rank 10 – generate $1,000,000 in downline investment volume

Referral Commissions

E-Estate pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

E-Estate caps payable unilevel team levels at five.

Referral commissions are paid as a percentage of cryptocurrency invested across these five levels as follows:

- level 1 (personally recruited promoters) – 6%

- levels 2 to 5 – 2%

- levels 6 to 8 – 1%

ROI Match

E-Estate pays a ROI Match using the same unilevel team referral commissions are paid out with (see “referral commissions” above):

- level 1 – 5% match

- levels 2 and 3 – 2% match

- levels 4 and 5 – 1% match

Revenue Share

The revenue share component of E-Estate doesn’t make much sense. The Revenue Share is stated to be a “percentage from your clients’ investment volumes”.

This sounds like referral commissions, which we’ve already covered. We’ve also covered E-Estate’s ROI Match, so I’m unclear on what exactly revenue share pays out on.

Nonetheless, here are the revenue share percentages from E-Estate’s compensation plan:

- personal investment – 100%

- level 1 – 80%

- level 2 – 40%

- level 3 – 20%

- level 4 – 10%

- levels 5 to 8 – 5%

Rank Achievement Bonus

E-Estate rewards promoters who qualify at Level 1 and higher with the following one-time Rank Achievement Bonuses:

- qualify at Rank 1 and receive 100 e-tokens

- qualify at Rank 2 and receive 150 e-tokens plus $30

- qualify at Rank 3 and receive 250 e-tokens plus $100

- qualify at Rank 4 and receive 500 e-tokens plus $250

- qualify at Rank 5 and receive 750 e-tokens plus $500

- qualify at Rank 6 and receive 1000 e-tokens plus $1000

- qualify at Rank 7 and receive 2000 e-tokens plus $2000

- qualify at Rank 8 and receive 3000 e-tokens plus $3000

- qualify at Rank 9 and receive 4000 e-tokens plus $4000

- qualify at Rank 10 and receive 10,000 e-tokens plus $10,000

E-tokens is an internal currency system that is worthless outside of E-Estate itself.

Joining E-Estate

E-Estate promoter membership is free.

Full participation in the attached income opportunity requires a minimum $117 investment.

E-Estate solicits investment in various cryptocurrencies.

E-Estate Conclusion

E-Estate is a simple MLM crypto Ponzi scheme.

New investors are recruited on the promise of a daily return. That money is stolen by earlier investors, with recruiters paid out as per E-Estate’s pyramid recruitment compensation plan.

E-Estate’s marketing ruse is “tokenized real-estate”.

The premise taken at face value makes no sense. If E-Estate already had infinity real estate properties, it makes no financial sense to sell micro ownership stakes to randoms over the internet.

Furthermore owning a real estate property in and of itself isn’t generating up to 0.81% a day. So we have a secondary ruse wherein E-Estate’s fictional real estate properties are being somehow monetized to generate ROI revenue.

Again, if this is the case why is E-Estate soliciting investment from randoms over the internet?

On the regulatory front we have E-Estate committing securities fraud, wire fraud and likely some form of money laundering too.

In offering a passive returns investment scheme to consumers, E-Estate is required to register with financial regulators.

In Panama this would be the Superintendency of the Securities Market. As previously pointed out, while still legally required, Panama has lax regulation of MLM related securities fraud.

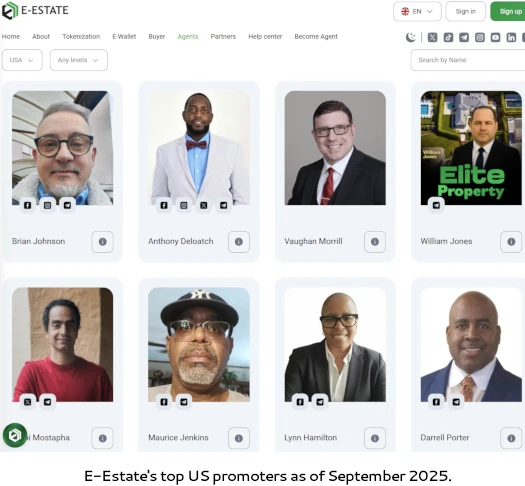

What we can hone in on is one of E-Estate’s co-founders being a Florida resident and E-Estate’s feature of multiple US resident promoters on its website:

For reference, left to right, top to bottom we have:

- Brian Johnson – Rank 7, claimed downline of 356 investors, defrauded consumers out of $329,455 **note appears to be a bogus profile, fake social media accounts created around March 2025**

- Anthony Deloatch – Rank 4, claimed downline of 200 investors, defrauded consumers out of $44,822, based out of North Carolina

- Vaughan Charles Morrill – Rank 3, claimed downline of 36 investors, defrauded consumers out of $8,837, US national and twice convicted felon, last known to be based out of the Philippines

- William Jones – Rank 3, claimed downline of 3 investors, defrauded consumers out of $24,660 **could be a fake profile, only Telegram account provided**

- Sami Mostapha – Rank 3, claimed downline of 4 investors, defrauded consumers out of $479 **could be a fake profile, no digital footprint**

- Maurice Jenkins – Rank 3, claimed downline of 130 investors, defrauded consumers out of $33,975, based out of Miami, Florida

- Lynn Hamilton – Rank 3, claimed downline of 49 investors, defrauded consumers out of $11,209, based out of New York

- Darrel Porter – Rank 2, claimed downline of 15 investors, defrauded consumers out of $4353, based out of Texas

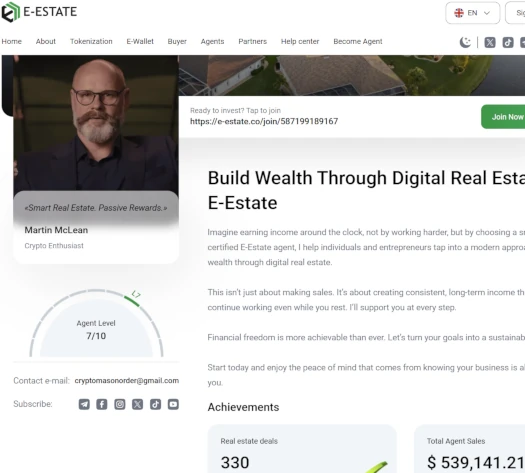

Another promoter I’m making an additional note of is “Martin McLean”, aka “Crypto Mason”.

McLean is represented to be from the UK but has an eastern European accent. McLean’s social media profiles were also only created in or around April 2025.

Getting back to E-Estate’s US activity, an MLM passive returns investment scheme constitutes a securities offering. This requires E-Estate to register with the SEC.

A search of the SEC’s Edgar database reveals neither E-Estate, it’s fictional executives or US resident promoters are registered.

Offering and/or promoting unregistered securities to US residents constitutes securities fraud. Additional wire fraud and money laundering charges may also apply if the DOJ gets involved.

As it stands, the only verifiable revenue entering E-Estate is new investment.

Using new investment to pay ROI withdrawals would make E-Estate a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve E-State of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.

So many names involved in this Scam I’m gonna have a field day I’m creating my own blog about them this one’s going to be good the main face that I want to go after is “Anthony Deloatch” the great thing about it if you look at the agents they list them all by first name and last name makes it easy to associate all the other multilevel marketing bottom feeders together.

Thanks for sharing this information to prevent someone from making a mistake.

Great reporting!