DAO1 Review: Trading bot securities & commodities fraud

DAO1 fails to provide ownership or executive information on either of its websites.

DAO1 fails to provide ownership or executive information on either of its websites.

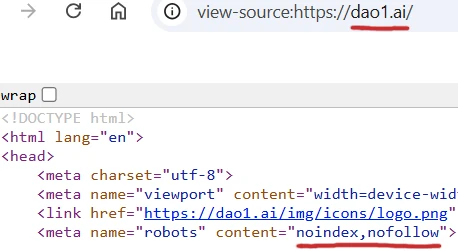

DAO1 operates from two known website domains:

- dao1.ai (main website) – privately registered on November 19th, 2024

- dao1.info (marketing funnel) – privately registered on December 11th, 2024

Of note is DAO1 hiding its primary .AI website from public search engine indexing:

This is a red flag, as it suggests DAO1 is attempting to avoid public and/or regulatory scrutiny. Irrespective of any other conduct, hiding a website is not something a legitimate MLM company would do.

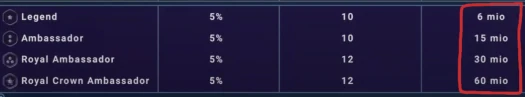

Also of note is the use of “mio” in DAO1’s official marketing material:

“Mio” is a German abbreviation for “million”. This suggests whoever is running DAO1 at the very least speaks German.

As per DAO1’s .AI website Privacy Policy;

The Site is hosted in the European Union and is intended for visitors located within the European Union.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

DAO1’s Products

DAO1 markets access to passive returns, derived through automated trading bots and an apertum token (APT) mining bot.

DAO1’s automated trading bots operate like any other trading bot. Investors place funds under control of the centrally operated bots on the expectation of a passive return.

Apertum token appears to be owned by whoever is running DAO1. Apertum token has its own website set up at “apertum.io”, privately registered on April 21st, 2023.

As per the marketing slide above, DAO1 markets APT mining as a “long term” income opportunity.

Access to DAO1’s trading bots and APT mining costs between 50 to 10,000 USDT annually:

- Lunar – 50 USDT, access to two trading bots and one APT mining bot

- Solar – 500 USDT, access to four trading bots and one APT mining bot

- Nebula – 2000 USDT, access to eight trading bots and one APT mining bot

- Nova – 5000 USDT, access to thirteen trading bots and one APT mining bot

- Galactic – 10,000 USDT, access to twenty-six trading bots and one APT mining bot

Note that until February 1st, 2025, DAO1 is giving affiliates who purchase a trading bot and APT mining membership a duplicate membership of equal value.

DAO1’s Compensation Plan

DAO1’s compensation plan pays on the sale of trading bot and APT mining access to retail customers and recruited affiliates.

DAO1 Affiliate Ranks

There are twelve affiliate ranks within DAO1’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Starter – recruit two affiliates and generate 15,000 USDT in downline trading bot and APT mining access fee volume

- Achiever – maintain two personally recruited affiliates and generate 30,000 USDT in downline trading bot and APT mining access fee volume

- Visionary – recruit four affiliates and generate 60,000 USDT in downline trading bot and APT mining access fee volume

- Challenger – maintain four personally recruited affiliates and generate 150,000 USDT in downline trading bot and APT mining access fee volume

- Builder – recruit six affiliates and generate 300,000 USDT in downline trading bot and APT mining access fee volume

- Leader – maintain six personally recruited affiliates and generate 600,000 USDT in downline trading bot and APT mining access fee volume

- Mentor – recruit eight affiliates and generate 1,500,000 USDT in downline trading bot and APT mining access fee volume

- Elite – maintain eight personally recruited affiliates and generate 3,000,000 USDT in downline trading bot and APT mining access fee volume

- Legend – recruit ten affiliates and generate 6,000,000 USDT in downline trading bot and APT mining access fee volume

- Ambassador – maintain ten personally recruited affiliates and generate 15,000,000 USDT in downline trading bot and APT mining access fee volume

- Royal Ambassador – recruit twelve affiliates and generate 30,000,000 USDT in downline trading bot and APT mining access fee volume

- Royal Crown Ambassador – maintain twelve personally recruited affiliates and generate 60,000,000 USDT in downline trading bot and APT mining access fee volume

Referral Commissions

DAO1 pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

DAO1 caps unilevel team levels at nine.

Referral commissions are paid as a percentage of trading bot and APT mining access across these nine levels as follows:

- level 1 (personally recruited affiliates) – 20%

- level 2 – 7%

- levels 3 to 5 – 3%

- levels 6 and 7 – 2%

- levels 8 and 9 – 1%

Rank Pools

DAO1 takes 10% of company-wide fee volume and places it into smaller rank-specific pools:

- Starter ranked affiliates receive a share in a 20% pool

- Achiever ranked affiliates receive a share in a 10% pool

- Visionary ranked affiliates receive a share in a 10% pool

- Challenger ranked affiliates receive a share in a 10% pool

- Builder ranked affiliates receive a share in a 7.5% pool

- Leader ranked affiliates receive a share in a 7.5% pool

- Mentor ranked affiliates receive a share in a 7.5% pool

- Elite ranked affiliates receive a share in a 7.5% pool

- Legend ranked affiliates receive a share in a 5% pool

- Ambassador ranked affiliates receive a share in a 5% pool

- Royal Ambassador ranked affiliates receive a share in a 5% pool

- Royal Crown Ambassador ranked affiliates receive a share in a 5% pool

Rank Pools are distributed monthly to all qualifying affiliates.

It should be noted that until February 1st 2025, DAO1 is selling shares in the Starter rank pool:

- buy a 2000 USDT Nebula membership or sell 5000 USDT in trading bot and APT mining access and receive two Starter Rank Pool shares

- buy a 5000 USDT Nova membership or sell 12,000 USDT in trading bot and APT mining access and receive five Starter Rank Pool shares

- buy a 10,000 USDT Galactic membership or sell 25,000 USDT in trading bot and APT mining access and receive eleven Starter Rank Pool shares

Bought Starter Rank Pool shares must be requalified for every six months by meeting the 5000, 12,000 or 25,000 USDT trading bot and APT mining access fee requirement.

ROI Matching Bonus (?)

DAO1’s compensation documentation states affiliates can “earn passively on the trades of [their] downline”.

This isn’t clarified in the documentation but, specific percentages and downline levels aside, is otherwise self-explanatory.

Joining DAO1

DAO1 affiliate membership is 9 USDT a month.

DAO1 Conclusion

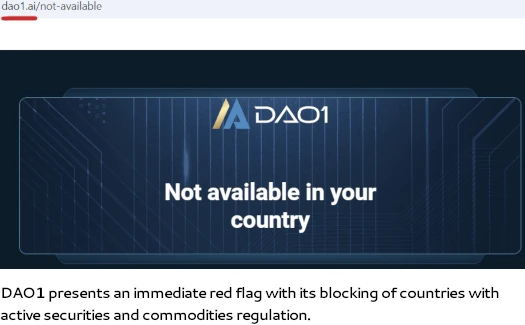

The first glaring red flag with DAO1 is it blocking visitors from the US:

To be clear, nothing DAO1 offers is outright illegal in the US. Passive returns through trading bots and crypto mining is legal, provided the offering company registers with the SEC and/or CFTC (depending on what is being offered).

The SEC and CFTC are among the most active regulators in the world. There’s a high probability DAO1’s filed financial reports would attract attention if the company isn’t doing what it claims to be.

Also note that audited financial reports filed with regulators, a legal requirement in any jurisdiction, is the only way consumers can verify DAO1 does what it claims.

Rather than operating legally, DAO1 commits both securities and commodities fraud. This lends itself to DAO1 targeting consumers in countries with less active regulators.

As it stands, the only verifiable source of revenue entering DAO1 is sourced from retail and affiliate investors. The use of these funds to pay ROI withdrawals would make DAO1 a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will membership fees and new investment.

This will starve DAO1 of ROI revenue, eventually prompting a collapse.

Of particular concern for consumer should be DAO1’s “limited liability” policy:

DAO1.ai is not liable for indirect, incidental, or consequential damages, including lost profits.

DAO1 has a few levers to pull when it inevitably collapses. Trading can be manipulated and APT can be dumped on investors as part of an exit-scam.

Regardless of how DAO1 collapses, the math behind Ponzi schemes guarantees the majority of participants lose money.

Update 6th January 2024 – DAO1 is confirmed to be part of the fifth reboot of GSPartners.

So DAO1 came to me as another GSB spinoff. I wasn’t able to independently confirm any concrete links so I left it out of the review.

That said DAO1 does present a very similar color scheme to Swiss Valorem Bank. Then there’s the use of German. And of course Billionico/Auratus promoters are now promoting DAO1, particularly in Australia.

Billionico and Auratus Gold both had the same “hide our website” index flags set.

In addition to “mio”, certain phrases used on DAO1’s website and marketing material are clearly not from native-English speakers.

E.g. (quoted verbatim);

Dennis Loos appears to be the face of DAO1 marketing. Loos is a former Ultima Ponzi promoter. He’s also an Austrian citizen who spends most of his time in Dubai (another possible link).

Leaving it there for now. Will update if anything else comes up.

GS Partners is a good call. They partnered with the Platincoin scammer Dennis Loos. German, but lived in Austria for a while.

Dream combo: Josip Heit, Dennis Loos, Dirc Zahlmann. That will be huge!

Probably the most damning evidence, Auratus Gold and DAO1 are running the same website template.

Auratus Gold (click to enlarge):

DAO1 (click to enlarge):

Note the identical formatting layout, app-755185d7.css filename and “const Ziggy” javascript.

Billionico of course has the same website template too:

view-source:billionico.com/login

DAO1 is being promoted by Lorien Cameron, Australian promoter of Auratus infamy. Thanks for posting this Oz! You’re a star.

Both sites use Laravel which is a PHP framework, and ziggy is a component for that. In a HTTP request you can get a json object with lots of app specific configurations, like formattedCurrencyNames, currencies and blockchainCurrencies which are identical on both websites.

Ziggy is also quite helpful in that it exposes all the laravel app routes without even being logged in…

Look at the template format and where the files are called, it’s copy and paste. One can of course dig deeper but at a base level the HTML calls are sufficient evidence.

But thanks for explaining where “Ziggy” fits in on a technical level.

DAO1 is being promoted by Dennis Loos and Benny Heimberger. In a video they tell that behind this project is Frank Schwarzkopf from crypto shifter.

Also, on the Apertum site they claim to be a subnet (like a subchain) of the Avalanche blockchain which would be a good thing if it were true (actual decentralisation, transparency, etc.)

But there’s no sign of it on the list of subnets (subnets.avax.network/subnets/) so either they haven’t deployed it yet, or they’re doing their own private centralised version to avoid decentralisation and transparency…

@Sascha

Benni Heimberger as a former OneCoin scammer in a video from August 19, 2016. Why was his full name abbreviated in this video?

postimg.cc/1gKZRmry

youtube.com/watch?v=h8zvz1SLOzI

The video was uploaded by former OneCoin scammer Matthias Jäger.

postimg.cc/t7Y8wtwq

Matthias Jäger has advertised OneCoin on two different YT channels.

youtube.com/@matthias0761 and

youtube.com/@matthiasjager1084

In the announcement of a business presentation on October 25, 2016, Benni Heimberger was named Top Leader.

postimg.cc/RN3dvgLF

doo.net/veranstaltung/6681/buchung

After OneCoin, Benni Heimberger, like other OneCoin scammers, switched to the EXW Wallet scam from Austria.

https://behindmlm.com/companies/exw-wallet-indictments-arrests-criminal-trial-in-austria/#comment-471381

Benni Heimberger (real name Benjamin Heimberger) has deleted all the videos on his YT channel. In a playlist, however, I found this video from March 13, 2020, which was not originally listed. He forgot to delete this video.

postimg.cc/rzbyP9yc

youtube.com/watch?v=lETYblayt1M&list=PLqGZfjO7BUrpqOAGMbuQ5RB8uqvbMoqzS&index=3

The Frank Schwarzkopf you mentioned is of course also a former OneCoin scammer with his own website (kryptomania.net), which no longer exists.

The current websites of this serial fraudster are ingsw.de/wp/ and freiherr-von-schwarzkopf.de.

In the past, Frank Schwarzkopf has also advertised the GlamJet scam.

postimg.cc/d7HmMfS4 and postimg.cc/GHK4Syfj

Frank Schwarzkopf also privately registered the domain bcitmedia.com on November 20, 2023 and updated it on November 19, 2024.

postimg.cc/YjRHgfZM

As is usual with serial fraudsters, Frank Schwarzkopf hides behind addresses in Dubai and New Mexico on bcitmedia.com without giving his name.

postimg.cc/qgyrRHXh

bcitmedia.com/contact/

Dennis Loos links to redotpay.com in Hong Kong on Instagram. The domain was privately registered on May 24, 2023.

postimg.cc/xJF202ZF

An affiliate program is also offered on the website.

postimg.cc/wtgyNXBY

redotpay.com/affiliates/

Several domains were registered in connection with redotpay.

redotpay.net – registered on May 11, 2023, but no website exists.

redotpay.org – registered on January 15, 2024 and updated on April 14, 2024.

This was an information page for customers in mainland China.

web.archive.org/web/20240315151802/https://redotpay.org/

redotpay.info – registered on January 4, 2024. This is the Japanese version of redotpay.

redotpay.us – registered on June 7, 2024.

The terms and conditions of redotpay.com name a company in Hong Kong.

postimg.cc/r0Vvx8sg

redotpay.com/terms

RedotPay on Instagram with 1,503 followers and 32 posts since December 17, 2024. Hong Kong is mentioned as the location.

postimg.cc/LqtG7JGm

instagram.com/redotpay/

Dennis Loos on Instagram with 494,000 followers.The account has existed since March 2016 and lists the UAE as its location.

postimg.cc/wtvrjwGb

instagram.com/loos_dennis/

Neil De Waal, the GSP promoter who was arrested last year is promoting this in South Africa. More tears incoming.

Warning from NZ:

fma.govt.nz/library/unregistered-businesses/dao1/

Thanks for the heads up!

And dont forget the Promoter Jennifer Renzi, one of their “Promo queens”, which also promote many mlm scams… At last bitonite… And Flow (but dont know it already scamed}…. Fabio menner is also a Promoter.

Martene Wallace posted on Instagram a grinning selfie with the caption “a project we have been a part of the vision for many years came to life”.

This points to the Australian vanlife influencers having played a major part in concocting this ponzi.

DAO1, Apertum and Auratus.gold video featuring some of Martene Wallace’s “experts” in Web3, decentralised systems and a #protrader.

Featuring –

Ed & Leah Smith @ram_n_oz

Trae & Chentelle @seekingthesunoz

Jessica Sol @jessicasol_

Emma Savage @iamemmasavage

Kyle Power @kyle_power_official

VIDEO: youtube.com/watch?v=7DIBEGyCzFU

Serial scammer Josip Heit should know that the term One Ecosystem is already used by the OneCoin scammers! 😀

postimg.cc/bsST9Fvh

youtu.be/7DIBEGyCzFU?t=100

I’m sure he does know. Josip and accomplices are targetting vulnerable people who will miss his red flags indicating that it’s a scam. Another video dropped today showing how silly it is.

Connecting Metamask to DAO1 is so broken

VIDEO – (Ozedit: link removed)

Ooops sorry. Hopefully this one will work.

youtube.com/watch?v=ZS74mvUAcQE

VIDEO of Australian “Coaches” – Not a financial adviser financial advice!

Featuring serial scam promoters

Jessica Sol aka Jessica Schembri @jessicasol_

Amy Sayle aka Amy Jessica (Jones) @_wildtribe_

Miss Chloe Maxwell @misschloemaxwell

youtube.com/watch?v=YtsNG3Fq-Iw

VIDEO: Is it all just smoke and mirrors?

Featuring:

Dennis Loos @loos_dennis

Lorien Cameron @loriencameron

Britt Ridell @brittyriddell

Jessica Sol aka Jessica Schembri @jessicasol_

youtube.com/watch?v=_0HYldAhqS8&ab_channel=SpookyChicken

Dear Sir,

Thank you so much for the article it helped me a lot I knew already but this article covered me to the fullest. Thank u.

VIDEO – Apertum – the not a real blockchain blockchain

youtube.com/watch?v=iA2z2F5TIu8&ab_channel=SpookyChicken

Featuring: Michelle Birch facebook.com/michelle.birch1

Incl

Bruce Hughes

Josip Heit

Dirc Zahlmann

Alex Bodi

VIDEO CLIP: Martene Wallace victim shaming.

Spooky Chicken recorded and posted this clip of a zoom session advertised as a GSPro call. Martene Wallace publicly abused a victim for asking a question about GSPro.

Featuring: Martene Wallace and Bruce Hughes in what was actually a training session about DAO1.

bsky.app/profile/spookychicken.bsky.social/post/3lixtz3xngk2b

VIDEO: The Metric of Success

youtube.com/watch?v=LHApUKJl7tg&ab_channel=SpookyChicken

Featuring:

Sarah Vella @the.mother.hustle

Hayley Battese @the.sunnyside.up

Martene Wallace @martenewallace

Amy Deane @the_reel_amy

Amy Sayle aka Amy Jessica @_wildtribe_

Ed and Leah Smith @ram_n_oz

Dennis Loos @loos_dennis

Lorien Cameron @loriencameron

Moneysmart.gov.au

Nice work Spooky Chicken.

DAO1 to list on centralized European P2B Exchange according to DAO1 Telegram channel.

VIDEO: The way of the IBO

youtube.com/watch?v=qPxN3NeLPd4&ab_channel=SpookyChicken

Alex Bodi, Josip Heit, Dirc Zahlmann

Featuring Slaves and Vultures

Andrew Hawkes @andrewhawkesonline

Martene Wallace @martenewallace

Lorien Cameron @loriencameron

Nicole Robertson @women_to_wealth

Ed Smith @ram_n_oz

Mike Pope @_roaminfree

Jessica Schembri @jessicasol_

Hayley Battese @the.sunnyside.up

Amy Sayle @_wildtribe_

Chloe Maxwell @misschloemaxwell

Bruce Hughes @brucehughes_official

Therese Kerr @theresekerr

Ed and Leah Smith @ram_n_oz

Loriens imaginary pen.

Warren Black @globalwealthclub_

Nicole Robertson @women_to_wealth

Special thanks to Spooky Chicken for the research and work involved in creating the informative ScamLife VanLife series.

Apertum and DAO1 received a Cease and Desist (C&D) order from the Texas SSB on 20 March 2025 in ENF-25-CDO-1889, naming Josip Heit, Dirc Zahlmann, Bruce Hughes, and Dennis Loos by name as well.

Note that the Texas SSB is going after Josip Heit again, as they recently stepped out of the current settlement due to… ehh, misrepresentations of some facts (the Texas SSB had accounts they controlled submitted into the settlement and GSPartners made false claims about these).

Going through it now, article up soon.

Looking at the price of Apertum on p2pb2b marketplace, it had a short lived spike and it is just continuously dropping now. I can’t see this lasting much longer.

I see the APTM wash trading bots have been adjusted from ~$3.3 million to ~$14.3 million over the last 24 hours.

Very organic. Very authentic. Much trading.

Darn it, I have fallen for this, and given my money away. $1k AUD investment and so far barely 5 APT for a whopping return of <$10 bucks.

I suppose it is a long game, but reading here I'm almost certain I've done my dough – doh!

GS Partners victims are being funneled into DAO1 on Thursday!

Notorious Australian DAO1 ponzi scheme promoter Lorien Cameron has now moved to Dubai to join Josip Heit, Bruce Hughes, Dennis Loos, and Dirc Zahlmann. Martene and Nathan Wallace to move next?