Credit Star Funding Review: Borrow $250K to invest in Ponzi schemes

Credit Star Funding is owned and operated by CEO Riccardo Ferrari, who claims to be based out of California in the US.

Credit Star Funding is owned and operated by CEO Riccardo Ferrari, who claims to be based out of California in the US.

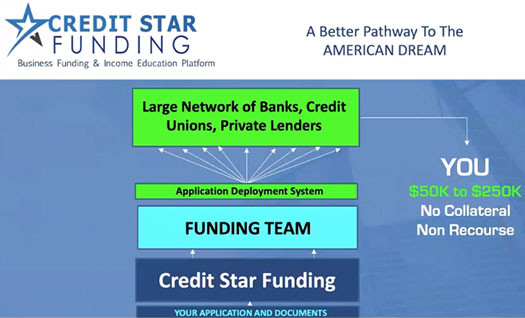

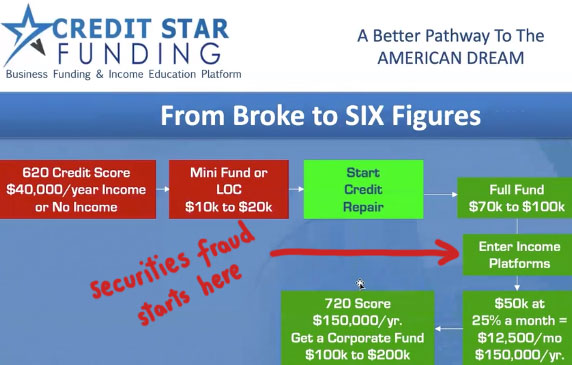

Credit Star Funding’s business model is simple; the company pitches a promise to get its affiliates funded.

Once funded, Credit Star Funding affiliates are expected to plough their loan into “non-collateral funding and Artificial Intelligence income systems.”

And by that Credit Star Funding is referring to Ponzi schemes. More on that later.

What’s important now is that Credit Star Funding appears to withhold the true nature of the loan is assists its affiliates with obtaining.

Or in other words, Credit Star Funding assists its affiliates with obtaining loans via deception – which is obviously illegal.

Illegal… but hardly surprising given Riccardo Ferrari’s past.

Illegal… but hardly surprising given Riccardo Ferrari’s past.

Prior to launching Credit Star Funding, Ferrari (right) was promoting the BitClub Network Ponzi scheme.

In late 2017 Richard Brooke cited Ferrari as an example of “outright lying, stupid illegal claims and cheeseball videos about how cool it is to be rich”.

At the time Ferrari boasted he was making $150,000 a week recruiting people into BitClub Network.

By early 2019 BitClub Network appeared to be on its last legs, prompting Ferrari to launch Credit Star Funding.

In a nutshell, Ferrari “helps” people obtain $50,000 to $250,000 loans through deception, and then instructs recipients of loans to invest that money into fraudulent investment schemes.

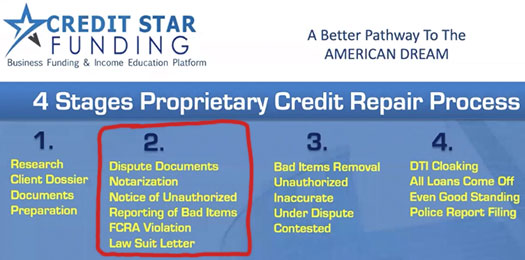

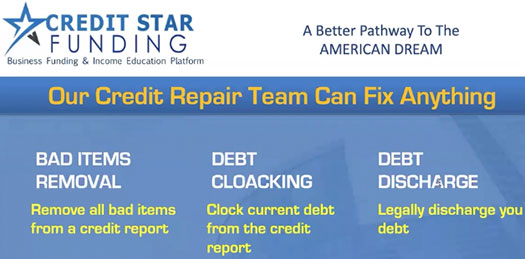

As per Credit Star Funding’s marketing material, specifically a presentation hosted by Ferrari himself roughly two weeks ago, if you have a garbage credit score then you need to repair it.

Naturally Credit Star Funding and Ferrari can’t wait to bend over backwards to get you out of debt.

So that nobody can accuse us of misrepresenting Credit Star Funding’s business model, I’ll be supplementing my own research with quotes from Ferrari himself (anything in a green box is Ferrari’s own words).

One of the reasons of our success is we have a patented software.

We are connected to large networks of banks. There are 6400 banks in America. Six to seven thousand banks.

But you cannot file an application with too many banks at the same time, because it’ll crash your credit score.

We can take your application and put it through, say um, maybe ten banks, fifteen, sometimes even twenty, until we find one, maybe two or three, that are willing to give you money. Right?

So that’s how we fund people that maybe can only qualify for $10,000.

We can get it out of five different banks. There’s the $50,000.

If you’re orange and higher tier, you can apply for a loan through Credit Star Funding, and then use that money to fix your credit score.

Once your credit is repaired you’re expected to get another loan, to pump into various investment schemes.

Here’s an example of Credit Star Funding’s provided loan terms and conditions:

To start the process, there is a $199 commitment fee charged to each client per application. It will be invoiced on the first unsecured loan or credit line if you are approved.

A loan generation fee of 22% will be invoiced to you after the loan is funded to you. This is considered a low fee for non-collateral, signature-only loans.

The interest rates are standard rates for non-collateral, non-recourse loans. May vary from 9% to 18% or higher depending on your credit conditions.

Alternatively if you get a green tier loan, you just jump straight into investment fraud.

Before we get into that though, here’s the MLM side of Credit Star Funding’s own business model.

Credit Star Funding offers referral commissions on recruited affiliate loans, paid down two levels of recruitment:

- 2.5% on loans obtained by personally recruited affiliates (level 1) and

- 1% on loans obtained by any affiliates your level 1 affiliates recruit (your level 2)

These commissions are paid out of the obtained loans which, if you remember, are obtained by obscuring the true nature of the loan to lenders.

Alright so you’ve obtained a $50,000 to $250,000 loan via deception, funded Credit Star Funding referral commissions out of the loan – what now?

Choose your vehicle and earn income!

Unfortunately the first “bitcoin arbitrate” option Credit Star Funding provides is not available.

According to Ferrari, whatever the scheme was it’s already pulled the “we got hacked” exit-scam.

This platform has made me and some of you uh, a lot of money.

Unfortunately (though) they ran into some security breaches.

The platform is on hold right now, we’re not gonna spend a lot of time on this.

The second “CTO Arbitrage” option Credit Star Funding provides is the Cloud Token Ponzi scheme.

Cloud Token sees affiliates invest funds on the promise of a passive return, purportedly generated via a trading bot.

Not being registered to offer securities anywhere on the planet, Cloud Token operates out of Malaysia illegally.

In addition to securities fraud, Cloud Token also provides no evidence external revenue (derived via bot trading or otherwise) is used to pay affiliate withdrawal requests.

Ferrari advertises a 10% monthly return on Cloud Token investment.

His incentive is a referral commission (Cloud Token’s own MLM compensation plan), paid on investment by anyone who joins Cloud Token through Credit Star Funding.

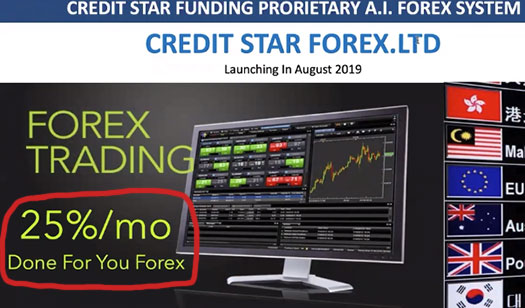

The third “credit star forex” option is an in house investment opportunity, through which Riccardo Ferrari advertises a 25% a month “done for you” return.

This is Credit Star Forex LTD. This is the actual name of a company that we have incorporated in a British Commonwealth country.

And uh, this is the Jewel of the Nile as far as I’m concerned.

Ferrari had originally intended to solicit investment of $25,000 or more a pop, but he advises that plan has since been scrapped.

While obtaining loans via deception is illegal for what should be obvious reasons, the rest of Credit Star Funding’s business model is no better.

Neither Credit Star Funding or Riccardo Ferrari are registered with the SEC. This means that both parties are committing securities fraud via promotion of unregistered securities.

And while Ferrari regulatory liability extends only to promotion of Cloud Token, the Credit Star Forex 25% a month investment opportunity is in house.

That means Ferrari and anyone he’s working with will be legally liable should the SEC investigate and pursue a case against the company.

Obviously Credit Star Funding affiliates leave themselves liable should the promote the opportunity.

That’s on top of the financial risk when the Ponzi schemes Ferrari pushes through Credit Star Funding inevitably collapse.

Update 10th August 2019 – Within 24 hours of this article being published, Riccardo Ferrari deleted all of his recent Credit Star Funding videos from his Ferrari Media Vimeo channel.

This includes the Credit Star Funding marketing video referenced in this article.

They can’t even spell cloaking.

Credit Star Funding has customers and agents, not affiliates.

The funds received from a bank can be used for any purpose. People are not forced into any schemes at all.

You can call them whatever you want. MLM company participants are primarily referred to as affiliates or distributors.

I go with the former. You can go with agents, it doesn’t change Credit Star Funding’s multi-level business model.

How many banks are going to give you a $250,000 loan if you’re honest about wanting to use the funds to invest in cryptocurrency Ponzi schemes?

Obtaining loans via deception (lying to banks) is illegal.

You are a great guy Oz, saving the world.

As crypto bull run is Coming the More scams will be out there!

Scammers are the Bitcoin sellers, and They will sell u the bitcoins then They will steal from You and then You will Buy Back from then.

That’s how its works, scammers swindlers dark. Market owners have huge ammount of bitcoins, it will be sold to people Through Instutional investment platforms, After that btc will be just a history.

Article updated with news of Riccardo Ferrari removing all of his recent Credit Star Funding marketing videos.

Run away!

Quite a review. Your review looks more aggressive with lots of hate surrounding it.

I would have recommended you reach out to any of the Credit Star Funding independent Agents or possibly customers who have been funded to get their own stories so you can add that to your review.

You’re not good on reviews judging from the way you false information.

Who lies to US banks to get huge loans to people seeking loans? Are you saying that banks that deals with Credit Star Funding are stupid? For God sake, who lies to the US banks and keep getting loans for thousands of individuals and businesses? Maybe you missed that very point.

Folks with 620 fico score are now getting loans, how’s that possible? Credit Star Funding doesn’t force anyone to invest loans on any platform, it’s optional to invest on recommended platforms.

Your Loan is 100% yours, FYI: every recommended platform is not a Ponzi, there are lots of satisfied clients.

Bad review or not Credit Star Funding will still be helping individuals/businesses secure funds. Get that into your thick skull.

Anytime someone mentions “hate”, it’s because they don’t want to or can’t address facts.

Why? Credit Star Funding’s business model is not a secret: Lie to banks to get money to invest in Ponzi schemes.

Approaching scammers who have a direct financial interest in getting you to invest is the worst due-diligence you could do.

Credit Card Funding and the serial Ponzi scammer behind it. Wasn’t that made clear in the review?

Nope. I’m saying Credit Card Funding obtains loans for Ponzi investors by lying to banks about the nature of the loan.

Not Credit Star Funding, that’s for sure. The interest just isn’t there.

PS. If you’re going to pluck a random number out of thin air, at least make it believable.

Well of course the loan is yours, like Credit Star Funding area going to take any financial responsibility for it.

And I’m sure there’s a good amount of pyramid schemes and other scams mixed into the Ponzi schemes investors are being funneled into

Sure. Until the banks cotton on. Or regulators step in. Or recruitment collapses (seems pretty dead in the water already TBH).

Hi,

Any more updates on CSF?

Thank you.

Not on my end.

This is bullshit. Do you guys have at one once of honesty in you?

(Ozedit: offtopic derails removed)

The money is released by banks, not us. Why are these haters take time to post this stuff?

All these reviews are false. I dont even have an MLM plan.

Our income platform are SEC compliant. I hire SEC attorneys and I can prove it.

These sites make up information and never update anything.

My company is Free, we dont even charge for the back office.

Riccardo Ferrari

(Ozedit: attempt to take discussion offsite removed)

Under false pretenses, which is fraud.

Paying commissions more than one level deep = MLM.

SEC attorneys aren’t for hire. They work for the SEC.

And how an you be “SEC compliant” when Credit Star Forex or any of the scams you’re funneling victims into aren’t registered with the SEC?

This is false review is full of wrong information and a copy of the same review of some other sick people online. They just copy the same review to drive traffic to their own shams. (Ozedit: angry man rant removed, see below)

^^ I can confirm the above is bullshit. I personally research and put together every BehindMLM review from scratch.

Lying to banks, lying about reviews… a disturbing pattern is forming.

Ah, Credit Star Funding website traffic plunged mid October. No wonder you’re pissed.

Anyway, not my problem your Ponzi funnel is failing. Go have your little angry man rant somewhere else kthx.

(Ozedit: derails removed)

Get this straight:

1. No one can lie to banks! If they see the right credit and income they lend money. Period.

2. They check Credit Karma or IdentotyIQ so we cannot feed them “false” information like you claim. They want tax returns, pay stubs and bank login. No one can fool a bank. You claiming that we deceive the banks take 100% of your credibility down the drain. There is no deception. The only deception are the words you write.

3. People can do what they want with their money. We never obligate anyone to invest money in programs we promote. I say it over and over in my videos. I dont really care. I make enough money from my own investments.

4. Yes I hire SEC attorneys. Search google for crying sake. SEC attorney means attorney who specialize in SEC laws. Of course these are not people that work for the SEC.

Everyone knows that but you They simply handle financial and investoment matters. of course you know this. You are being deceving about it.

5. The Forex Platform I use is a legittimate SEC compliant platform which is non commissionable and restricted to a small number of US citizens as the law provides. All the customers are happy with it.

6. The reason I erased some of the videos is not becuase of your article, is because my program changed. I made better videos.

In fact I launched a brand new processing system this month, which I consider the best in the lending industry.

7. You opened a fake CFS account to spy on my program. You are violating the non confidentiality agreement that comes in the program.

You are also committing copywrite infringement by using the word Credit Star Funding to do false reviews, drive traffic to your site and sell your ponzies using illegitimate internet traffic. You are breaking the law with defamation and false statements.

(Ozedit: more derails removed)

You walk into a bank and tell them you want a loan to join Riccardo Ferrari in Cloud Token and similar Ponzi schemes.

Doesn’t matter how much income you make or what your credit score is, you’re not getting that loan.

You and I know very well you’re not putting “investment in Ponzi scams” down on loan applications. That’s where the deception takes place.

The rest of the loan application is irrelevant.

Yet you promoted BitClub Network (securities fraud Ponzi scheme), and at the time of publication you were promoting Cloud Token (another securities fraud Ponzi scheme).

Either you have the worse securities attorneys in the US or you’re full of shit. Probably full of shit, seeing as there’s no such thing as “SEC laws”.

Cool. Give us the name then. It’ll only take me two seconds to run a search on Edgar and confirm.

Mmmhmmm. *winkwink, nudgenudge*

Can confirm this never happened.

Can’t violate an agreement I never signed.

The review is accurate, that’s why you’re pissed. As for copyright infringement; Fair Use, look it up.

Geez, the lies don’t stop with this one. Happy New Year!

Hello,

What is the truth regarding CSF?

Read the review.